UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2012

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE TRANSITION PERIOD FROM TO

COMMISSION FILE NUMBER: 001-35795

GLADSTONE LAND CORPORATION

(Exact name of registrant as specified in its charter)

| MARYLAND | 54-1892552 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

1521 WESTBRANCH DRIVE, SUITE 200

MCLEAN, VIRGINIA 22102

(Address of principal executive offices)

(703) 287-5800

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| (Title of Each Class) |

(Name of Each Exchange on which Registered) | |

| Common Stock, $0.001 par value per share | NASDAQ Global Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ¨ NO x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES ¨ NO x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES ¨ NO x

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES ¨ NO ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| (Check one): | ||||||

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). YES ¨ NO x.

At June 29, 2012, the last business day of the registrant’s most recently completed second fiscal quarter, there was no public market for the registrant’s common stock. The Registrant’s common stock began trading on the NASDAQ Global Market on January 29, 2013. Based on the closing price of $15.25 of the registrant’s common stock on the NASDAQ Global Market on March 15, 2013, the aggregate market value of its shares held by non-affiliates was $57,470,601. For the purposes of calculating this amount only, all directors and executive officers of the registrant have been deemed to be affiliates.

The number of shares of the registrant’s Common Stock, $0.001 par value per share, outstanding as of March 27, 2013, was 6,530,264.

GLADSTONE LAND CORPORATION

FORM 10-K FOR THE YEAR ENDED

DECEMBER 31, 2012

FORWARD-LOOKING STATEMENTS

Our disclosure and analysis in this Annual Report on Form 10-K, or Form 10-K, and the documents that are incorporated by reference herein, contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. Forward-looking statements provide our current expectations or forecasts of future events and are not statements of historical fact. These forward-looking statements include information about possible or assumed future results of our business, future events, financial condition or performance, expectations, competitive environment, availability of resources, regulation, liquidity, results of operations, strategies, plans and objectives. These forward-looking statements include, without limitation, statements concerning projections, predictions, expectations, estimates, or forecasts as to our business, financial and operational results, and future economic performance, as well as statements of management’s goals and objectives and other similar expressions concerning matters that are not historical facts. When we use the words “may,” “should,” “could,” “would,” “predicts,” “potential,” “continue,” “expects,” “anticipates,” “future,” “intends,” “plans,” “believes,” “estimates” or similar expressions or their negatives, as well as statements in future tense, we intend to identify forward-looking statements. You should not place undue reliance on these forward-looking statements. Statements regarding the following subjects are forward-looking by their nature:

| • | our business strategy; |

| • | our ability to implement our business plan, including our ability to expand geographically and expand beyond row crops; |

| • | pending transactions; |

| • | our projected operating results; |

| • | our ability to obtain future financing arrangements; |

| • | estimates relating to our future distributions; |

| • | estimates regarding potential rental rate increases; |

| • | our understanding of our competition and our ability to compete effectively; |

| • | market and industry trends; |

| • | estimates of future operating expenses, including payments to our Adviser (as defined herein) under the terms of our Advisory Agreement (as defined herein); |

| • | our compliance with tax laws, including our intention to elect or qualify as a real estate investment trust, or REIT, for federal income tax purposes; and |

| • | use of proceeds of our Line of Credit (as defined herein), mortgage notes payable, initial public offering, or IPO, future stock offerings and other future capital resources, if any. |

Forward-looking statements involve inherent uncertainty and may ultimately prove to be incorrect or false. You are cautioned to not place undue reliance on forward-looking statements. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of various factors, including, but not limited to:

| • | the factors referenced in this Form 10-K, including those set forth in “Item 1A. Risk Factors;” |

| • | general volatility of the capital markets and the market price of our common stock; |

| • | failure to qualify as a real estate investment trust, or REIT, and risks of changes in laws that affect REITs; |

| • | risks associated with negotiation and consummation of pending and future transactions; |

| • | changes in our business strategy; |

| • | the adequacy of our cash reserves and working capital; |

| • | our failure to successfully integrate and operate acquired properties and operations; |

| • | defaults upon or non-renewal of leases by tenants; |

| • | decreased rental rates or increased vacancy rates; |

| • | the degree and nature of our competition, which is not limited to other real estate investment companies; |

| • | availability, terms and deployment of capital, including the ability to maintain and borrow under our Line of Credit, arrange for long-term mortgages on our properties and raise equity capital; |

| • | our Adviser’s ability to identify, hire and retain highly-qualified personnel in the future; |

| • | changes in our industry or the general economy; |

| • | changes in real estate and zoning laws and increases in real property tax rates; |

| • | changes in governmental regulations, tax rates and similar matters; |

| • | environmental liabilities for certain of our properties and uncertainties and risks related to natural disasters; and |

| • | the loss of any of our key officers, such as Mr. David Gladstone, our chairman and chief executive officer or Mr. Terry Lee Brubaker, our vice chairman and chief operating officer. |

This list of risks and uncertainties, however, is only a summary of some of the most important factors to us and is not intended to be exhaustive. You should carefully review the risks set forth herein under the caption “Item 1A. Risk Factors.” New factors may also emerge from time to time that could materially and adversely affect us. Except as otherwise may be required by law, we undertake no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or actual operating results.

| ITEM 1. | BUSINESS |

Corporate Overview

Gladstone Land Corporation (which we refer to as “we,” “us” or the “Company”) is a real estate company that was originally incorporated in California in 1997, was re-incorporated in Delaware in 2004 and re-incorporated under the General Corporation laws of the State of Maryland on March 24, 2011. We were primarily formed to invest in farmland located in major agricultural markets throughout the United States. On January 29, 2013, our shares of common stock began trading on the NASDAQ Global Market under the symbol “LAND” upon the pricing of our IPO.

Prior to 2004, we engaged in the owning and leasing of farmland, as well as an agricultural operating business whereby we engaged in the farming, contract growing, packaging, marketing and distribution of fresh berries, including commission selling and contract cooling services to independent berry growers. In 2004, we sold our agricultural operating business, and since 2004, our operations have consisted solely of leasing our farms to independent tenant farmers and larger, corporate tenant farmers. Our farmland is predominantly concentrated in locations where tenants are able to grow annual row crops such as berries, lettuce and other row crops, which are planted and harvested annually or more frequently. We have not purchased land to grow grains but may in the future. In the future we may acquire land with fruit or nut trees, bushes, wine berries and wine grapes. We may also acquire property related to farming, such as storage facilities utilized for cooling crops, freezer buildings, facilities used for storage and assembling boxes, known as box barns, silos, storage facilities, green houses, processing plants, packaging buildings and distribution centers. As of March 25, 2013, we owned twelve farms, leased to eight separate tenants, including two cooler buildings and one box barn, which is a facility used for storage and

2

assembly of boxes for shipping produce. Five of these farms are located in or near Watsonville, California, one is near Oxnard, California, five are near Plant City, Florida, and one is near Wimauma, Florida. We also lease a small parcel on our farm near Oxnard, or our West Gonzales Farm, to an oil company. We do not currently intend to enter the business of growing, packing or marketing farmed products. However, if we do so in the future we expect that it would be through a taxable REIT subsidiary, or TRS.

To a lesser extent, we may provide senior secured first lien mortgages to farmers for the purchase of farmland and properties related to farming. We expect that any mortgages we make would be secured by farming properties that have a successful history of crop production and profitable farming operations and that, over time, such mortgages would not exceed 5.0% of the fair value of our total assets. As of March 25, 2013, we did not hold any mortgages, and we have not currently identified any properties for which to make loans secured by mortgages.

We intend to conduct our business through an Umbrella Partnership Real Estate Investment Trust, or UPREIT, structure in which our properties and the mortgage loans we make will be held directly or indirectly by Gladstone Land Limited Partnership, which we refer to as our Operating Partnership. We are the manager and 100% owner of Gladstone Land Partners, LLC, which we refer to as Land Partners, which is the sole general partner of our Operating Partnership, and we currently hold, directly and indirectly through Land Partners, 100% of its outstanding limited partnership units, or Units. In the future, we may offer an equity ownership in our Operating Partnership by issuing Units to farmland owners from time to time in consideration for acquiring their farms, such as through a partnership or a limited liability company. Holders of Units in our Operating Partnership will be entitled to redeem these units for cash or, at our election, shares of our common stock on a one-for-one basis at any time after holding the Units for one year. Farmland owners who exchange their farms for Units may be able to do so in a tax-free exchange under U.S. federal income tax laws.

We intend to elect to be taxed as a real estate investment trust, or REIT, under federal tax laws beginning with our taxable year ending either December 31, 2013, or December 31, 2014. Because we must distribute our accumulated non-REIT earnings and profits by December 31 of the year for which we first elect REIT status, it is possible that our distributions may not be sufficient to satisfy this requirement by December 31, 2013, in which case we would likely not elect to be taxed as a REIT until the taxable year ending December 31, 2014.

As long as we qualify as a REIT, we generally will not be subject to U.S. federal income tax if we distribute at least 90% of our taxable income to our stockholders. We have elected for Gladstone Land Advisers, Inc., a wholly-owned subsidiary of our Operating Partnership, to be taxed as a taxable REIT subsidiary, or TRS. We may own or manage our assets and engage in other activities through Gladstone Land Advisors or another TRS we form or acquire when we deem it necessary or advisable. The taxable income generated by any TRS will be subject to regular corporate income tax. Currently, we do not have any operations in our TRS.

Our business and real estate portfolio investments are managed by our Adviser, which is a registered investment adviser with the Securities and Exchange Commission, or SEC. Our Adviser is owned and controlled by David Gladstone, our chief executive officer, president, chairman of our Board of Directors and our largest stockholder.

Our Investment Objectives and Our Strategy

Our principal business objective is to maximize stockholder returns through a combination of: (1) monthly cash distributions to our stockholders, (2) sustainable long-term growth in cash flows from increased rents, which we hope to pass on to stockholders in the form of increased distributions, (3) appreciation of our land, and (4) capital gains derived from the sale of our properties. Our primary strategy to achieve our business objective is to invest in and diversify our current portfolio of net leased farmland and properties related to farming operations. This strategy includes the following components:

| • | Owning Farms and Farm-Related Real Estate for Income. We own and intend to acquire farmland and lease it to corporate and independent farmers, including sellers who desire to continue farming the land after we acquire the property from them. We expect to hold acquired properties for many years and to generate stable and increasing rental income from leasing these properties. |

3

| • | Owning Farms and Farm-Related Real Estate for Appreciation. We intend to lease acquired properties over the long term. However, from time to time we may elect to sell one or more properties if we believe it to be in the best interests of our stockholders. Potential purchasers may include real estate developers desiring to develop the property or financial purchasers seeking to acquire property for investment purposes. Accordingly, we will seek to acquire properties that we believe have potential for long-term appreciation in value. |

| • | Expanding our Operations beyond California and Florida. While our properties are currently located exclusively in California and Florida, we expect that we will acquire properties in other farming locations. We believe the Southeast and Mid-Atlantic parts of the United States, such as Georgia, North Carolina and New Jersey, offer attractive locations for expansion. We also expect to seek farmland acquisitions in the Midwest and may also expand into other areas in the United States. |

| • | Expanding our Operations beyond Row Crops in Produce and Berries. Currently, the tenants who farm our properties grow only row crops dedicated to produce, such as lettuce and tomatoes, and berries, such as strawberries and raspberries. In the future, we will seek to expand into other crops, such as wheat, rice and corn, and into tree and vine crops, such as nuts and fruits. |

| • | Using Leverage. To make more investments than would otherwise be possible, we intend to borrow through loans secured by long-term mortgages on our properties, and we may also borrow funds on a short-term basis or incur other indebtedness. |

| • | Owning Mortgages on Farms and Farm-Related Real Estate. In circumstances where our purchase of farms and farm-related properties is not feasible, we may provide the owner of the property with a mortgage loan secured by the property along with an option to sell the property to us in the future at a predetermined price. We do not expect that, over time, our mortgages held will exceed 5.0% of the fair value of our total assets. |

| • | Joint Ventures. Some of our investments may be made through joint ventures that would permit us to own interests in large properties without restricting the diversity of our portfolio. |

We expect that most of our future tenants will be medium-sized independent farming operations or large corporate farming operations that are unrelated to us. We intend to lease our properties under triple-net leases, an arrangement under which the tenant maintains the property while paying us rent plus taxes, maintenance and insurance. We are actively seeking and evaluating other farm properties to potentially purchase with the net proceeds received from our IPO which closed in January 2013, although we have not yet entered into binding purchase agreements to acquire any properties. All potential acquisitions will be subject to due diligence investigations, and there can be no assurance that we will be successful in identifying or acquiring any properties in the future.

Our Investment Process

Types of Investments

We expect that substantially all of our investments will be in income-producing agricultural real property and, to a lesser extent, mortgages on agricultural real estate. We expect that the vast majority of our leases will be structured as triple-net leases. If we make mortgage loans, we expect the ratio of loan amount to value of the real estate to be greater than for conventional mortgage loans on farms and the interest rate to be higher than those for conventional loans. Investments will not be restricted as to geographical areas, but currently, all of our properties are located in California and Florida.

We anticipate that we will make substantially all of our investments through our Operating Partnership. Our Operating Partnership may acquire interests in real property in exchange for the issuance of: common shares, Operating Units or cash or through a combination of the three. Units issued by our Operating Partnership will be redeemable for cash or, at our election, shares of our common stock on a one-for-one basis at any time after holding the Units for one year. However, we currently, and may in the future, hold some or all of our interests in real properties through one or more wholly-owned subsidiaries, each classified as a qualified REIT subsidiary.

4

Property Acquisitions and Net Leasing

We anticipate that many of the farms we purchase will be acquired from farmers or agricultural companies and that they or an independent farmer will simultaneously lease the properties back from us. These transactions will provide the tenants with an alternative to other financing sources, such as borrowing, mortgaging real property, or selling securities. We anticipate that some of our transactions will be in conjunction with acquisitions, recapitalizations or other corporate transactions affecting our tenants. We also expect that many of the farms we acquire will be purchased from owners that do not farm the property but rather lease the property to tenant farmers. In situations such as these, we intend to have a lease in place prior to or simultaneously with acquiring the property. For a discussion of the risks associated with leasing property to leveraged tenants, see “Risk Factors — Risks Relating to our Business and Operations – Some of our tenants may be unable to pay rent, which could adversely affect our cash available to make distributions to our stockholders or otherwise impair the value of your investment.”

We intend to own primarily single-tenant, agricultural real property. Generally, we will lease properties to tenants that our Adviser deems creditworthy under leases that will be full-recourse obligations of our tenants or their affiliates. We will generally seek to enter into short-term leases with terms of two to five years, which we believe is customary within many farmland communities, including those in California and Florida. While we expect that we will renew most of these leases at the end of their terms, we believe that this strategy will also permit us to increase rental rates. However, there can be no assurance that this strategy will result in increasing rents upon renewal, and it may result in decreasing rents.

We believe that most of the farmland that we are interested in purchasing can be rented at annual rental rates ranging from 4% to 6% of the properties’ market values. However, there can be no assurance that we will be able to achieve this level of rental rates. Since rental contracts in the farming business for annual row crops are customarily short-term agreements, rental rates are renegotiated regularly to market rates. However, if we invest in land with longer term plants such as trees, bushes and vines, we would expect leases on these types of properties to be longer.

All of our leases will be approved by our Adviser’s investment committee. Our Board of Directors has adopted a policy that we will not make an investment in any individual property with a cost in excess of 20% of our total assets at the time of investment. However, our Board of Directors may amend or waive this policy at any time.

Underwriting Criteria and Due Diligence Process

Selecting the Property

We consider selecting the right properties to purchase or finance as the most important aspect of our business. Buying quality farmland that can be used for many different crops and that is located in desirable locations is essential to our success.

Our management team works with real estate contacts in agricultural markets throughout the United States to assess available properties and farming areas. We believe that our management team is experienced in selecting valuable farmland and will use this expertise to identify promising properties. The following is a list of important factors in our selection of farmland:

| • | Water availability. Availability of water is essential to farming. We will seek to purchase properties with ample access to water through an operating water well on it or rights to use a well or other source that is located nearby. However, we may consider properties that rely on rainfall for water if the tenant on that property mitigates the drought risk by purchasing drought insurance. Typically the leases on properties that rely on rainfall would be longer-term in nature. |

| • | Soil composition. In addition to water, for farming efforts to be successful the soil must be suitable for growing crops. We will not buy or finance any real property that does not have soil conditions that we believe are favorable for growing the crop farmed on the property, except to the extent that a portion of an otherwise suitable property, while not favorable for growing the crop farmed on the property, may be utilized to build coolers, which are storage facilities utilized for cooling crops, freezer buildings, packing houses, silos, facilities used for storage and assembling boxes, known as box barns, storage facilities, green houses, or other property used in the farming business. |

| • | Location. Farming also requires optimal climate and growing seasons. Initially we intend to purchase properties that are located in California and in Florida in order to take advantage of climate conditions that are needed to grow fresh produce crops. We may purchase properties that are located in close proximity to our current farmland in California and Florida to take advantage of that proximity. We also expect to expand throughout the United States in locations with productive farmland and financially sound farming tenants. |

5

| • | Price. We intend to purchase and finance properties that we believe are a good value and that we will be able to profitably rent for farming over the long term. Generally, the closer that a property is located to urban developments, the higher the value of the property. As a result, properties that are currently located in close proximity to urban developments are likely to be too expensive to justify farming over an extended period of time, and, therefore, we are unlikely to invest in such properties. |

Our Adviser will perform a due diligence review with respect to each potential property. Such review will include an evaluation of the physical condition of a property and an environmental site assessment to determine potential environmental liabilities associated with a property prior to its acquisition. One of the criteria that we look for is whether mineral rights to such property, which constitute a separate estate from the surface rights to the property, have been sold to a third party. We generally seek to invest in properties where mineral rights have not been sold to third parties; however, in cases where access to mineral rights would not affect the surface farming operations, we may enter into a lease agreement for the extraction of minerals or other subterranean resources, as we have done in the West Gonzales Farm property. We may seek to acquire mineral rights in connection with the acquisition of future properties to the extent such mineral rights have been sold off and the investment acquisition of such rights is considered to be favorable after our due diligence review. Despite the conduct of these reviews, there can be no assurance that hazardous substances or waste, as determined under present or future federal or state laws or regulations, will not be discovered on the property after we acquire it. See “Risk Factors — Risks Relating to our Business and Operations – Potential liability for environmental matters could adversely affect our financial condition.”

Our Adviser will also physically inspect each property and the real estate surrounding it in order to estimate its value. Our Adviser’s due diligence will be primarily focused on valuing each property independently of its rental value to particular tenants to whom we plan to rent. The real estate valuations our Adviser performs will consider one or more of the following items:

| • | The comparable value of similar real estate in the same general area of the prospective property. In this regard, comparable property is hard to define since each piece of real estate has its own distinct characteristics. But to the extent possible, comparable property in the area that has sold or is for sale will be used to determine if the price being paid for the property is reasonable. |

| • | The comparable real estate rental rates for similar properties in the same area of the prospective property. |

| • | Alternative uses for the property to determine if there is another use for the property that would give it higher value, including potential future conversion to urban or suburban uses such as commercial or residential development. |

| • | The assessed value as determined by the local real estate taxing authority. |

In addition, our Adviser may supplement its valuation estimate with an independent real estate appraisal in connection with each investment that it considers. These appraisals may take into consideration, among other things, the terms and conditions of the particular lease transaction, the quality of the tenant’s credit and the conditions of the credit markets at the time the lease transaction is negotiated. The actual sale price of a property, if sold by us, may be greater or less than its appraised value. When appropriate, our Adviser may engage experts to undertake some or all of the due diligence efforts described above.

Underwriting the Tenant, Due Diligence Process and Negotiating Lease Provisions

In addition to property selection, underwriting the tenant that will lease the property will also be an important aspect of many of our investments. Our Adviser will evaluate the creditworthiness of the tenant and assess its ability to generate sufficient cash flow from its agricultural operations to make payments to us pursuant to our lease. Because our tenants are in the farming industry, their cash flows may fluctuate according to season. The following is a list of criteria that our Adviser may consider when evaluating potential tenants for our properties, although all criteria may not be present for each lease:

| • | Experience. We believe that experience is the most significant characteristic when determining the creditworthiness of a tenant. Therefore, we will seek to rent our properties to farmers that have an extensive track record of farming their particular crops successfully. |

6

| • | Financial Strength. We will seek to rent to farmers that have financial resources to invest in planting and harvesting their crops. We will generally require annual financial statements of the tenant to evaluate the financial capability of the tenant and its ability to perform its obligations under the lease. |

| • | Adherence to Quality Standards. We intend to lease our properties to those farmers that are committed to farming in a manner that will generate high-quality crops. We intend to identify such commitment through their track records of selling produce into established distribution chains and outlets. |

| • | Lease Provisions that Enhance and Protect Value. When appropriate, our Adviser attempts to include provisions in our leases that require our consent to specified tenant activity or require the tenant to satisfy specific operating tests. These provisions may include, for example, operational or financial covenants of the tenant, as well as indemnification of us by the tenant against environmental and other contingent liabilities. We believe that these provisions serve to protect our investments from changes in the operating and financial characteristics of a tenant that may impact its ability to satisfy its obligations to us or that could reduce the value of our properties. Our Adviser generally also seeks covenants requiring tenants to receive our consent prior to any change in control of the tenant. |

| • | Credit Enhancement. Our Adviser may also seek to enhance the likelihood of a tenant’s lease obligations being satisfied through a cross-default with other tenant obligations, a letter of credit or a guaranty of lease obligations from each tenant’s corporate affiliates, if any. We believe that this type of credit enhancement, if obtained, provides us with additional financial security. These same enhancements may apply to mortgage loans. |

| • | Diversification. Our Adviser will attempt to diversify our portfolio to avoid dependence on any one particular tenant or geographic location. By diversifying our portfolio, our Adviser intends to reduce the adverse effect on our portfolio of a single underperforming investment or a downturn in any particular geographic region. Many of the areas in which we purchase or finance properties are likely to have their own microclimates and will not be similarly affected by weather or other natural occurrences at the same time. For example, we currently lease land in California as far south as Oxnard and as far north as Watsonville, which are over 400 miles apart, each of which has distinct weather and other characteristics. In addition to the California coast, we own properties in central Florida. Over time, we expect to expand our geographic focus to other areas of the Southeast, Midwest and the Mid-Atlantic. We will also attempt to diversify our portfolio by expanding our current operations, which consist of row crops dedicated to produce and berries, into other crop types such as wheat, rice and corn and also tree, bush and vine crops, such as nuts and fruits. |

While our Adviser will select tenants it believes to be creditworthy, tenants will not be required to meet any minimum rating established by an independent credit rating agency. Our Adviser’s standards for determining whether a particular tenant is creditworthy will vary in accordance with a variety of factors relating to specific prospective tenants. The creditworthiness of a tenant will be determined on a tenant-by-tenant and case-by-case basis. Therefore, general standards for creditworthiness cannot be applied. We monitor the creditworthiness of our tenants on an ongoing basis by conducting site visits of the properties to ensure farming operations are taking place as expected and to assess the general maintenance of the properties.

Mortgage Loans

Borrower Selection

Our value-oriented investment philosophy is primarily focused on maximizing yield relative to risk. Upon identifying a potential mortgage opportunity, our Adviser will perform an initial screen to determine whether pursuing intensive due diligence is merited. As part of this process, we have identified several criteria we believe are important in evaluating and investing in prospective borrowers. These criteria provide general guidelines for our investment decisions. However, each prospective borrower may not meet all of these criteria:

| • | Positive cash flow. Our investment philosophy begins with a credit analysis. We intend to generally focus on borrowers to which we can lend at relatively low multiples of operating cash flow and that are profitable at the time of investment on an operating cash flow basis. Although we will obtain liens on the underlying real estate and other collateral, we are primarily focused on the predictability of future cash flow from their operations. |

7

| • | Seasoned management with significant equity ownership. Strong, committed management teams are important to the success of any farm, and we intend to invest in farm businesses where strong management teams are already in place with a history of successful crop production and profitable farming operations. |

| • | Strong competitive position. We seek to lend to farm businesses that have developed competitive advantages and defensible market positions within their respective markets and are well-positioned to capitalize on growth opportunities. |

| • | Exit strategy. We seek to lend to farm businesses that we believe will generate consistent cash flow to repay our loans and reinvest in their respective businesses. We expect such internally generated cash flow in these farms to be a key means by which we exit from our loans. |

Mortgage Loan Terms

We expect that most of the mortgage loans we make will contain some or all of the following terms and conditions:

| • | Loan to value. We will consider the appraised value of each property when we consider a mortgage on that property. Our goal is to loan an amount that is no more than 75% of the appraised value of the real estate. However, there may be circumstances in which we may increase the percentage, such as for land that we would like to own or for a borrower that is well-capitalized. |

| • | Cash flow coverage. We expect most borrowers to have a farming operation that has and is expected to continue to have substantial cash flow from its operations. We will seek to have cash flow generated by the businesses to be at least 1.2 times the amount of the mortgage payments. However, there may be circumstances in which we may lower that ratio below 1.2, such as for land we would like to own and for borrowers that have cash flow from other operations. |

| • | Term. In general, we expect to make mortgage loans of three to five years that will be interest-only, with the entire principal amount due at the end of the term. |

| • | Guarantees. In general we do not expect the owner of the property to personally guarantee the mortgage. However, we do expect the owner to pledge any assets or crops planted on the property as collateral for the loan. |

Property Review

We expect to perform a standard review of the property that will be collateral for the mortgage, including many of the following:

| • | an independent appraisal; |

| • | land record searches for possible restrictions; |

| • | water samples and availability; |

| • | soil samples; |

| • | environmental analysis; |

| • | zoning analysis; |

| • | crop yields; |

| • | possible future uses of the property; and |

| • | government regulation impacting the property including taxes and restrictions. |

8

Underwriting the Borrower

We view underwriting a borrower in the same way as underwriting a tenant, with criteria similar to those for tenants described above. We believe that, for assessing credit risk, a borrower and tenant are functionally the same, as they each are operating a farm business and will owe us money, either as rent or as interest and principal on a loan.

Other Investments

From time to time, we may purchase cooling buildings, freezer buildings, packing houses, facilities used for storage and assembling boxes, known as box barns, silos, storage facilities, green houses and similar improved property to rent to independent farmers in connection with the services provided to independent farmers. We may also build these types of buildings on property that we purchase if there is sufficient business to make this worthwhile. We do not expect these to be a material portion of the land and buildings that we purchase.

Temporary Investments

There can be no assurance as to when our capital may be fully invested in real properties or mortgages. Pending investment in real properties or mortgages, we intend to invest our cash on hand, including the net proceeds of the IPO, in permitted temporary investments, which include short-term U.S. Government securities, bank certificates of deposit and other short-term liquid investments. We also may invest in securities that qualify as “real estate assets” and produce qualifying income under the REIT provisions of the Internal Revenue Code of 1986, as amended, or the Code.

If at any time the character of our investments would cause us to be deemed an “investment company,” as defined in the Investment Company Act of 1940, we will take the necessary action to ensure that we are not deemed to be an “investment company.” Our Adviser will continually review our investment activity and the composition of our portfolio to ensure that we do not come within the application of the Investment Company Act. Our working capital and other reserves will be invested in permitted temporary investments. Our Adviser will evaluate the relative risks and rates of return, our cash needs and other appropriate considerations when making short-term investments on our behalf. The rates of return of permitted temporary investments may be less than or greater than would be obtainable from real estate investments.

Joint Ventures

We may enter into joint ventures, partnerships and other mutual arrangements with real estate developers, property owners and others for the purpose of obtaining an equity interest in a property in accordance with our investment policies. Many REITs have used joint ventures as sources of capital during periods where debt or equity capital was either unavailable or not available on favorable terms. Joint venture investments could permit us to own interests in large properties without unduly restricting the diversity of our portfolio. We will not enter into a joint venture to make an investment that we would not otherwise be permitted to make on our own. We expect that in any joint venture the cost of structuring joint investments would be shared ratably by us and the other participating investors.

Use of Leverage

Our strategy is to use borrowings as a financing mechanism in amounts that we believe will maximize the return to our stockholders. We generally expect to enter into borrowing arrangements directly or indirectly through our Operating Partnership. We will seek to structure all borrowings as non-recourse loans; however, this may not be possible. The use of non-recourse financing allows us to limit our exposure to the amount of equity invested in the properties pledged as collateral for our borrowings. Non-recourse financing generally restricts a lender’s claim on the assets of the borrower and, as a result, the lender generally may look only to the property securing the debt for satisfaction of the debt. We believe that this financing strategy, to the extent available, will protect our other assets. However, we can provide no assurance that non-recourse financing will be available on terms favorable to us, if at all, and there may be circumstances where lenders have recourse to our other assets. There is no limitation on the amount we may borrow against any single investment property. Neither our charter nor our bylaws impose any limitation on our borrowing.

9

We believe that, by operating on a leveraged basis, we will have more funds available and, therefore, will be able to make more investments than would otherwise be possible. We believe that this will result in a more diversified portfolio. Our Adviser will use its best efforts to obtain financing on the most favorable terms available to us.

We anticipate that prospective lenders may also seek to include in loans to us provisions whereby the termination or replacement of our Adviser would result in an event of default or an event requiring the immediate repayment of the full outstanding balance of the loan. We will generally seek to avoid the inclusion of these provisions and will attempt to negotiate loan terms that allow us to replace or terminate our Adviser if the action is approved by our Board of Directors. The replacement or termination of our Adviser may, however, require the prior consent of a lender.

We may refinance properties during the term of a loan when, in the opinion of our Adviser, a decline in interest rates makes it advisable to prepay an existing mortgage loan, when an existing mortgage loan matures or if an attractive investment becomes available and the proceeds from the refinancing can be used to make such investment. The benefits of the refinancing may include an increase in cash flow resulting from reduced debt service requirements, an increase in distributions to stockholders from proceeds of the refinancing, if any, or an increase in property ownership if some refinancing proceeds are reinvested in real estate.

Other Investment Policies

Working Capital Reserves

We may establish a working capital reserve in an amount that we anticipate to be sufficient to satisfy our liquidity requirements. Our liquidity could be adversely affected by unanticipated costs, greater-than-anticipated operating expenses or cash shortfalls in funding our distributions. To the extent that the working capital reserve is insufficient to satisfy our cash requirements, additional funds may be produced from cash generated from operations or through short-term borrowings. In addition, subject to limitations described in this Form 10-K, we may incur indebtedness in connection with:

| • | the acquisition of any property; |

| • | the refinancing of the debt upon any property; or |

| • | the leveraging of any previously unleveraged property. |

For additional information regarding our borrowing strategy, see “Our Investment Process — Use of Leverage.”

Holding Period For and Sale of Investments; Reinvestment of Sale Proceeds

We intend to hold each property we acquire for an extended period until it can be sold for conversion into urban or suburban uses, such as residential or commercial development. However, circumstances might arise which could result in the earlier sale of some properties. We may sell a property before the end of its expected holding period if in the judgment of our Adviser the sale of the property is in the best interest of our stockholders. The determination of whether a particular property should be sold or otherwise disposed of will be made after consideration of several relevant factors, including prevailing economic conditions, with a view to achieving maximum capital appreciation. No assurance can be given that the foregoing objective will be realized. The selling price of a property which is subject to a net lease will be determined in large part by the amount of rent payable under the lease and the creditworthiness of the tenant. In connection with our sales of properties we may lend the purchaser all or a portion of the purchase price. In these instances, our taxable income may exceed the cash received in the sale, which could cause us to delay required distributions to our stockholders.

The terms of any sale will be dictated by custom in the area in which the property being sold is located and the then-prevailing economic conditions. A decision to provide financing to any purchaser would be made only after an investigation into and consideration of the same factors regarding the purchaser, such as creditworthiness and likelihood of future financial stability, as are undertaken when we consider a net lease transaction. We may continually reinvest the proceeds of property sales in investments that either we or our Adviser believe will satisfy our investment policies.

10

Investment Limitations

There are numerous limitations on the manner in which we may invest our funds. We have adopted a policy that without the permission of our Board of Directors, we will not:

| • | invest 20% or more of our total assets in a particular property or mortgage at the time of investment; |

| • | invest in real property owned by our Adviser, any of its affiliates or any business in which our Adviser or any of its affiliates have invested; |

| • | invest in commodities or commodity futures contracts, with this limitation not being applicable to futures contracts when used solely for the purpose of hedging in connection with our ordinary business of investing in properties and making mortgage loans; |

| • | invest in contracts for the sale of real estate unless the contract is in recordable form and is appropriately recorded in the chain of title; |

| • | issue equity securities on a deferred payment basis or other similar arrangement; |

| • | grant warrants or options to purchase shares of our stock to our Adviser or its affiliates; |

| • | engage in trading, as compared with investment activities, or engage in the business of underwriting, or the agency distribution of, securities issued by other persons; |

| • | invest more than 5% of the value of our assets in the securities of any one issuer if the investment would cause us to fail to qualify as a REIT; |

| • | invest in securities representing more than 10% of the outstanding securities (by vote or value) of any one issuer if the investment would cause us to fail to qualify as a REIT; |

| • | acquire securities in any company holding investments or engaging in activities prohibited in the foregoing clauses; or |

| • | make or invest in mortgage loans that are subordinate to any mortgage or equity interest of any of our affiliates. |

Future Revisions in Policies and Strategies

Our independent directors will review our investment policies at least annually to determine that the policies we are following are in the best interest of our stockholders. The methods of implementing our investment policies also may vary as new investment techniques are developed. The methods of implementing our investment procedures, objectives and policies, except as otherwise provided in our bylaws or articles of incorporation, may be altered by a majority of our directors, including a majority of our independent directors, without the approval of our stockholders, to the extent that our Board of Directors determines that such modification is in the best interest of the stockholders.

Conflict of Interest Policy

We have adopted policies to reduce potential conflicts of interest. In addition, our directors are subject to certain provisions of Maryland law that are designed to minimize conflicts. However, we cannot assure you that these policies or provisions of law will reduce or eliminate the influence of these conflicts.

We have adopted a policy that, without the approval of a majority of our independent directors, we will not:

| • | acquire from or sell to any of our officers, directors or our Adviser’s or Gladstone Administration, LLC’s, or our Administrator’s, employees, or any entity in which any of our officers, directors or such employees has an interest of more than 5%, any assets or other property; |

11

| • | borrow from any of our directors, officers or our Adviser’s or Administrator’s employees, or any entity in which any of our officers, directors or such employees has an interest of more than 5%; or |

| • | engage in any other transaction with any of our directors, officers or our Adviser’s or Administrator’s employees, or any entity in which any of our directors, officers or such employees has an interest of more than 5%. |

Consistent with the provisions of the Sarbanes-Oxley Act of 2002, we will not extend credit, or arrange for the extension of credit, to any of our directors and officers. Under the Maryland General Corporation Law, or the MGCL, a contract or other transaction between us and one of our directors or officers or any other entity in which one of our directors or officers is also a director or officer or has a material financial interest is not void or voidable solely on the grounds of the common directorship or interest, the fact that the director or officer was present at the meeting at which the contract or transaction was approved or the fact that the director’s vote was counted in favor of the contract or transaction if:

| • | the material facts relating to the common directorship or interest and as to the transaction are disclosed to our Board of Directors or a committee of our Board, and our Board or the committee in good faith authorizes the contract or transaction by the affirmative vote of a majority of the directors not interested in the contract or transaction, even if the disinterested directors do not constitute a quorum of the Board or committee; |

| • | the fact of the common directorship or interest is disclosed to our stockholders entitled to vote on the contract or transaction, and the contract or transaction is approved or ratified by a majority of the votes cast by the stockholders entitled to vote on the matter, other than shares owned of record or beneficially by the interested director or corporation or entity; or |

| • | the contract or transaction is fair and reasonable to us as of the time authorized, approved or ratified by the Board of Directors, a committee or the stockholders. |

Our policy also prohibits us from purchasing any real property from, or co-investing in any real property with, our Adviser, any of its affiliates or any business in which our Adviser or any of its subsidiaries have invested. If we decide to change this policy on co-investments with our Adviser or its affiliates, we will seek approval of our independent directors.

Code of Ethics

The Company and its affiliates, Gladstone Capital Corporation, Gladstone Investment Corporation, Gladstone Commercial Corporation, Gladstone Management Corporation, Gladstone Administration, LLC, and Gladstone Securities, LLC, have adopted a code of ethics and business conduct applicable to all personnel of such companies that complies with the guidelines set forth in Item 406 of Regulation S-K of the Securities Act of 1933. This code, among other things, establishes procedures for personal investments, restricts certain transactions by such personnel and requires the reporting of certain transactions and holdings by such personnel. A copy of this code is available for review, free of charge, at our website at www.GladstoneLand.com. We intend to provide any required disclosure of any amendments to or waivers of the provisions of this code by posting information regarding any such amendment or waiver to our website within four days of its effectiveness.

Our Adviser and Administrator

Gladstone Management Corporation

Our business is managed by our Adviser, Gladstone Management Corporation, which was incorporated in 2002. The officers, directors and employees of our Adviser have significant experience in making investments in and lending to small and medium-sized businesses and investing in real estate and making mortgage loans. We entered into an Advisory Agreement with our Adviser, or the Advisory Agreement, under which our Adviser will be responsible for managing our assets and liabilities, for operating our business on a day-to-day basis and for identifying, evaluating, negotiating and consummating investment transactions consistent with our investment policies as determined by our Board of Directors from time to time.

12

David Gladstone (our chairman, chief executive officer, president and largest stockholder), is also the chairman, chief executive officer and the indirect, sole stockholder of our Adviser. Terry Lee Brubaker (our vice chairman and chief operating officer) serves as vice chairman and chief operating officer of our Adviser.

Our Adviser will maintain an investment committee that will screen our investments. This investment committee is currently comprised of Messrs. Gladstone and Brubaker. We believe that our Adviser’s investment committee review process will give us a unique competitive advantage over other investors in agricultural real estate because of the substantial experience and perspective that the members of our Adviser’s investment committee possess in evaluating the blend of corporate credit, real estate and lease terms that combine to provide an acceptable risk for investment.

Our Adviser’s board of directors has empowered its investment committee to authorize and approve our investments, subject to the terms of the Advisory Agreement. Before we acquire any property, the transaction will be reviewed by our Adviser’s investment committee to ensure that, in its view, the proposed transaction satisfies our investment criteria and is within our investment policies. Approval by our Adviser’s investment committee will generally be the final step in the property acquisition approval process, although the separate approval of our Board of Directors will be required in certain circumstances described below.

Our Adviser is headquartered in McLean, Virginia, a suburb of Washington D.C., and also has offices in several other states.

Gladstone Administration, LLC

The holding company which owns our Adviser also has a 100% interest in our Administrator, which employs our chief financial officer and treasurer, chief compliance officer, internal counsel and their respective staffs. Our Administrator provides administrative services to us and our affiliates, including Gladstone Capital, Gladstone Investment and Gladstone Commercial. The services performed by our Administrator include the managing of financial reporting, accounting for our properties, stockholder reporting, treasury functions, compliance function, legal services and similar services.

David Gladstone (our chairman, chief executive officer, president and largest stockholder) is the indirect sole stockholder of our Administrator and serves as its chairman, chief executive officer and president. Terry Lee Brubaker (our vice chairman and chief operating officer) serves as chief operating officer of our Administrator and is vice chairman of the board of managers of our Administrator.

Amended Advisory Agreement

Adviser Duties and Authority under the Amended Advisory Agreement

Under the terms of the Amended Advisory Agreement, our Adviser is required to use its best efforts to present to us investment opportunities consistent with our investment policies and objectives as adopted by our Board of Directors. In performing its duties, our Adviser, either directly or indirectly by engaging an affiliate:

| • | finds, evaluates, presents and recommends to us a continuing series of real estate investment opportunities consistent with our investment policies and objectives; |

| • | provides advice to us and acts on our behalf with respect to the negotiation, acquisition, financing, refinancing, holding, leasing and disposition of real estate investments; |

| • | enters into contracts to purchase real estate on our behalf in compliance with our investment procedures, objectives and policies, subject to approval of our Board of Directors, where required; |

| • | takes the actions and obtains the services necessary to effect the negotiation, acquisition, financing, refinancing holding, leasing and disposition of real estate investments; and |

| • | provides day-to-day management of our real estate activities and other administrative services. |

13

It is expected that each investment that we make will be approved or ratified by our Board of Directors. Our Board of Directors has authorized our Adviser to make investments in any property on our behalf without the prior approval of our Board if the following conditions are satisfied:

| • | our Adviser has determined that the total cost of the property does not exceed its determined value; and |

| • | our Adviser has provided us with a representation that the property, in conjunction with our other investments and proposed investments, is reasonably expected to fulfill our investment objectives and policies as established by our Board of Directors then in effect. |

The actual terms and conditions of transactions involving investments in properties shall be determined in the sole discretion of our Adviser, subject at all times to compliance with the foregoing requirements. Some types of transactions, however, will require the prior approval of our Board of Directors, including a majority of our independent directors, including, but not limited to, the following:

| • | any acquisition which at the time of investment would have a cost exceeding 20% of our total assets; and |

| • | transactions that involve conflicts of interest with our Adviser (other than reimbursement of expenses in accordance with the Advisory Agreement). |

Our Adviser and Administrator also engage in other business ventures and, as a result, their resources are not dedicated exclusively to our business. For example, our Adviser and Administrator also serve as the external adviser and administrator, respectively, to Gladstone Capital Corporation and Gladstone Investment Corporation, both publicly traded business development companies affiliated with us, and Gladstone Commercial Corporation, a publicly traded real estate company. However, under the Amended Advisory Agreement, our Adviser is required to devote sufficient resources to the administration of our affairs to discharge its obligations under the agreement. The Advisory Agreement is not assignable or transferable by either us or our Adviser without the consent of the other party, except that our Adviser may assign the Advisory Agreement to an affiliate for whom our Adviser agrees to guarantee its obligations to us. Either we or our Adviser may assign or transfer the Advisory Agreement to a successor entity.

Compensation of our Adviser under the Amended Advisory Agreement

We and our Advisor amended the Advisory Agreement on February 1, 2013. A summary of the compensation under the Amended Advisory Agreement is below.

Base Management Fee

Under the terms of our Amended Advisory Agreement, we will pay an annual base management fee in 2013 equal to 1.0% of our adjusted stockholders’ equity, which is equal to our total stockholders’ equity at the end of each quarter less the recorded value of any preferred stock we may issue and any uninvested cash proceeds from the IPO, and an additional quarterly incentive fee, which is described below, based on funds from operations, or FFO. Beginning in 2014, we will pay an annual base management fee equal to 2.0% of our adjusted stockholders’ equity at the end of each quarter, which will no longer exclude the uninvested cash proceeds from the IPO.

Incentive Fee

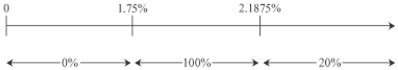

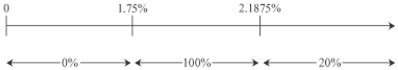

For purposes of calculating the incentive fee, FFO means net income, excluding gains (or losses) from debt restructuring and the sale of real property, plus depreciation and amortization on real estate assets and after adjustments for unconsolidated partnerships and joint ventures. The incentive fee would reward our Adviser if our quarterly FFO, before giving effect to any incentive fee, or pre-incentive fee FFO, exceeds 1.75%, or the hurdle rate, of total stockholders’ equity, less the recorded value of any preferred stock. We will pay our Adviser an incentive fee with respect to our pre-incentive fee FFO quarterly as follows:

| • | no incentive fee in any calendar quarter in which our pre-incentive fee FFO does not exceed the hurdle rate of 1.75% of our adjusted stockholders’ equity as of the end of that quarter; |

14

| • | 100% of the amount of the pre-incentive fee FFO that exceeds the hurdle rate, but is less than 2.1875%, of our adjusted stockholders’ equity as of the end of any calendar quarter (which would be an 8.75% annualized return); and |

| • | 20% of the amount of our pre-incentive fee FFO that exceeds 2.1875% of our adjusted stockholders’ equity as of the end of any calendar quarter (which would be an 8.75% annualized return). |

Quarterly Incentive Fee Based on FFO

Pre-incentive fee FFO

(expressed as a percentage of adjusted stockholders’ equity)

Percentage of pre-incentive fee FFO allocated to incentive fee

Amended Administration Agreement

We and our Administrator amended the Administration Agreement on February 1, 2013.

Under the Amended Administration Agreement, we will pay separately for our allocable portion of the Administrator’s overhead expenses in performing its obligations, including rent and our allocable portion of the salaries and benefits expenses of its employees, including, but not limited to, our chief financial officer and treasurer, chief compliance officer, internal counsel and their respective staffs.

Our allocable portion of these overhead expenses will be derived by multiplying our Administrator’s total allocable expenses by the percentage of our total assets at the beginning of each quarter in comparison to the total assets of all companies for whom our Administrator provides services under similar agreements.

Employees

We do not currently have any employees and do not expect to have any employees in the foreseeable future. Currently, services necessary for our business are provided by individuals who are employees of our Adviser and our Administrator pursuant to the terms of the Advisory Agreement and the Administration Agreement, respectively. Each of our executive officers is an employee or officer, or both, of our Adviser or our Administrator. No employee of our Adviser or our Administrator will dedicate all of his or her time to us. However, we expect that approximately 10% of the full-time employees of our Adviser and our Administrator will spend substantial time on our matters during calendar year 2013. To the extent that we acquire more investments, we anticipate that the number of employees of our Adviser and our Administrator who devote time to our matters will increase and the number of our Adviser’s employees working out of local offices, if any, where we buy land will also increase.

As of December 31, 2012, our Adviser and our Administrator, collectively, had 56 full-time employees. A breakdown thereof is summarized by functional area in the table below:

| Number of Individuals |

Functional Area | |

| 10 |

Executive Management | |

| 34 |

Investment Management, Portfolio Management and Due Diligence | |

| 12 |

Administration, Accounting, Compliance, Human Resources, Legal and Treasury |

15

Competition

Competition to our efforts to acquire farmland can come from many different entities. Developers, municipalities, individual farmers, agriculture corporations, institutional investors and others compete for farmland acreage. Investment firms that we might compete directly against could include agricultural investment firms such as Hancock Agricultural Investment Group, or Hancock, Prudential Agricultural Investments, or Prudential, and UBS Agrivest LLC, or UBS Agrivest. These firms engage in the acquisition, asset management, valuation and disposition of farmland properties. In addition to competition for direct investment in farmland we also expect to compete for mortgages with many local and national banks such as Rabobank, N.A., Bank of America, N.A., Wells Fargo Foothill, Inc., and others.

Environmental Matters

As an owner of real estate, we will be subject to various federal, state and local environmental laws, regulations and ordinances and also could be liable to third parties resulting from environmental contamination or noncompliance at our properties. Environmental laws often impose liability without regard to whether the owner or operator knew of or was responsible for the presence of the contaminants. The costs of any required investigation or cleanup of these substances could be substantial. The liability is generally not limited under such laws and could exceed the property’s value and the aggregate assets of the liable party. The presence of contamination or the failure to remediate contamination at our properties also may expose us to third-party liability for personal injury or property damage or adversely affect our ability to or lease the real property or to borrow using the real estate as collateral. These and other risks related to environmental matters are described in more detail in “Item 1A. Risk Factors.”

Tenants

We rent our properties to both independent and corporate farmers. Two of our eight current leases, representing approximately 76.3% of our rental revenue for the year ended December 31, 2012, are with Dole Food Company, or Dole, under leases expiring in 2013 and 2014. We expect that our tenant base will become more diversified in the future as we acquire more farmland.

Available Information

Copies of our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy statements and amendments, if any, to those reports filed or furnished with the Securities and Exchange Commission, or the SEC, pursuant to Section 13(a) or 15(d) of the Securities Exchange Act are available free of charge through our website at www.GladstoneLand.com. A request for any of these reports may also be submitted to us by sending a written request addressed to Investor Relations, Gladstone Land Corporation, 1521 Westbranch Drive, Suite 200, McLean, VA 22102, or by calling our toll-free investor relations line at 1-866-366-5745. The public may read and copy materials that we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. Information on the operation of the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330. The SEC also maintains a website that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC at www.sec.gov.

16

| ITEM 1A. | RISK FACTORS |

An investment in our securities involves a number of significant risks and other factors relating to our structure and investment objectives. As a result, we cannot assure you that we will achieve our investment objectives. You should consider carefully the following information before making an investment in our securities.

Risks Relating to our Business and Operations

Two of our current properties are leased to the same tenant, Dole, and if Dole is no longer able to make rental payments or chooses to terminate its leases prior to or upon their expiration, it would have a material adverse effect on our financial performance and our ability to make distributions to our stockholders.

Two of our eight current leases, representing approximately 76.3% of our rental revenue for the year ended December 31, 2012, are with Dole under leases expiring in 2013 and 2014. If Dole fails to make rental payments or elects to terminate its leases prior to or upon their expiration, and we cannot re-lease the land on satisfactory terms, or if Dole were to experience financial problems or declare bankruptcy, it would have a material adverse effect on our financial performance and our ability to make dividend payments to our stockholders.

Our real estate portfolio will be concentrated in a limited number of properties, which subjects us to an increased risk of significant loss if any property declines in value or if we are unable to lease a property.

We estimate that we will purchase approximately 10 to 15 properties with the net proceeds from our IPO and borrowings under our existing credit facilities. To the extent we are able to leverage our investment acquisitions with borrowed funds, we will acquire additional properties with the net proceeds of borrowings. One consequence of a limited number of investments is that the aggregate returns we realize may be substantially adversely affected by the unfavorable performance of a small number of leases or a significant decline in the value of any single property. In addition, while we do not intend to invest 20% or more of our total assets in a particular property at the time of investment, it is possible that, as the values of our properties change, one property may comprise in excess of 20% of the value of our total assets. Lack of diversification will increase the potential that a single underperforming investment could have a material adverse effect on our cash flows and the price we could realize from the sale of our properties. Since our current real estate profile is concentrated entirely in California and Florida, we are also currently subject to the any adverse change in the political or regulatory climate in those states or specific counties where our properties are located that could adversely affect our real estate portfolio and our ability to lease properties.

We may not be successful in identifying and consummating suitable acquisitions that meet our investment criteria, which may impede our growth and negatively affect our results of operations.

We own a total of twelve farm properties in California and Florida that are leased to eight separate independent and corporate farmers. We are actively seeking and evaluating other farm properties to potentially purchase with the net proceeds from our IPO, but there is no guarantee that we will be able to invest the proceeds. We expect that most of our future tenants will be independent farming operations, about which there is generally little or no publicly available operating and financial information. As a result, we will rely on our Adviser to perform due diligence investigations of these tenants, their operations and their prospects. We may not learn all of the material information we need to know regarding these businesses through our investigations. As a result, it is possible that we could lease properties to tenants or make mortgage loans to borrowers that ultimately are unable to pay rent or interest to us, which could adversely impact the amount available for distributions.

We are subject to many of the business risks and uncertainties associated with any new business enterprise. Our failure to operate successfully or profitably or to accomplish our investment objectives could have a material adverse effect on our ability to generate cash flow to make distributions to our stockholders, and the value of an investment in our common stock may decline substantially or be reduced to zero.

17

We expect to lease most of our properties to medium-sized independent farming operations and agricultural businesses, which may have limited financial and personnel resources and, therefore, may be less stable than larger companies, which could impact our ability to generate rental revenue.

We expect to lease most of our properties to medium-sized farming operations and related agricultural businesses, which will expose us to a number of unique risks related to these entities. For example, medium-sized agricultural businesses are more likely than larger farming operations to have difficulty making lease payments when they experience adverse events. They also tend to experience significant fluctuations in their operating results and to be more vulnerable to competitors’ actions and market conditions, as well as general economic downturns. In addition, our target tenants may face intense competition, including competition from companies with greater financial resources, which could lead to price pressure on crops that could lower our tenants’ income.

Furthermore, the success of a medium-sized business may also depend on the management talents and efforts of one or a small group of persons. The death, disability or resignation of one or more of these persons could have a material adverse impact on our tenant and, in turn, on us.

Our Adviser has broad authority to make acquisitions and dispositions of properties and there can be no assurance that we will be able to enter into definitive agreements to purchase properties, complete acquisitions or dispose of properties on favorable terms. Investors will not be afforded the opportunity to evaluate the economic merits of our investments or the terms of any dispositions of properties.

Our Adviser will have broad authority to make acquisitions of properties that it may identify in the future and broad authority to make dispositions of properties. There can be no assurance that our Adviser will be able to identify or negotiate acceptable terms for the acquisition or dispositions of properties or that we will be able to acquire or dispose of such properties on favorable terms. Factors that could cause us not to purchase one or more properties that initially meet our investment criteria include our potential inability to agree to definitive purchase terms with the prospective sellers, and our discovery of problems with the properties in our due diligence investigations. Factors that could cause us to be unable to dispose of a property on favorable terms include market conditions and competition. Any significant delay in identifying and making investments that fit into our investment criteria or in disposing investments during suitable market conditions would have a material adverse effect on our ability to generate cash flow and make distributions to our stockholders.

Our cash available for distribution to stockholders may not be sufficient to pay anticipated distributions, nor can we assure you of our ability to make distributions in the future, and we may need to borrow in order to make such distributions or may not be able to make such distributions at all.

To remain competitive with alternative investments, our distribution rate may exceed our cash available for distribution, including cash generated from operations. In the event this happens, we intend to fund the difference out of any excess cash on hand or from borrowings under our revolving credit facility. If we do not have sufficient cash available for distribution generated by our assets to pay the annual distribution set by our Board of Directors, or if cash available for distribution decreases in future periods, the market price of our common stock could decrease.

All distributions will be made at the discretion of our Board of Directors and will depend on our earnings, our financial condition, whether or not we have qualified as a REIT, and other factors as our Board of Directors may deem relevant from time to time. We may not be able to make distributions in the future. In addition, some of our distributions may include a return of capital. To the extent that our Board of Directors approves distributions in excess of our then current and accumulated earnings and profits, these excess distributions would generally be considered a return of capital for federal income tax purposes to the extent of your adjusted tax basis in your shares. A return of capital is not taxable, but it has the effect of reducing your adjusted tax basis in your investment. To the extent that distributions exceed the adjusted tax basis of your shares, such excess will be treated for tax purposes as a gain from the sale or exchange of your shares. If we borrow to fund distributions, our future interest costs would increase, thereby reducing our earnings and cash available for distribution from what they otherwise would have been.

Some of our tenants may be unable to pay rent, which could adversely affect our cash available to make distributions to our stockholders or otherwise impair the value of your investment.