UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE QUARTERLY PERIOD ENDED MARCH 31, 2014

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE TRANSITION PERIOD FROM TO

COMMISSION FILE NUMBER: 001-35795

GLADSTONE LAND CORPORATION

(Exact name of registrant as specified in its charter)

| MARYLAND | 54-1892552 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 1521 WESTBRANCH DRIVE, SUITE 100 MCLEAN, VIRGINIA |

22102 | |

| (Address of principal executive offices) | (Zip Code) | |

(703) 287-5800

(Registrant’s telephone number, including area code)

Not Applicable

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. YES x NO ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES x NO ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

(Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES ¨ NO x.

The number of shares of the registrant’s Common Stock, $0.001 par value per share, outstanding as of May 5, 2014, was 6,530,264.

GLADSTONE LAND CORPORATION

FORM 10-Q FOR THE QUARTER ENDED

MARCH 31, 2014

2

PART I – FINANCIAL INFORMATION

GLADSTONE LAND CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

| March 31, 2014 |

December 31, 2013 |

|||||||

| ASSETS |

||||||||

| Real estate, at cost |

$ | 79,121,324 | $ | 78,478,053 | ||||

| Less: accumulated depreciation |

(3,426,433 | ) | (3,166,870 | ) | ||||

|

|

|

|

|

|||||

| Total real estate, net |

75,694,891 | 75,311,183 | ||||||

| Lease intangibles, net |

284,570 | 311,064 | ||||||

| Cash and cash equivalents |

13,546,471 | 16,271,282 | ||||||

| Restricted cash |

781 | 41 | ||||||

| Short-term investments |

680,611 | 680,443 | ||||||

| Deferred financing costs, net |

557,522 | 309,933 | ||||||

| Deferred offering costs |

122,968 | — | ||||||

| Other assets |

735,824 | 789,518 | ||||||

|

|

|

|

|

|||||

| TOTAL ASSETS |

$ | 91,623,638 | $ | 93,673,464 | ||||

|

|

|

|

|

|||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY |

||||||||

| LIABILITIES |

||||||||

| Mortgage note payable |

$ | 41,331,998 | $ | 43,054,165 | ||||

| Borrowings under line of credit |

100,000 | 100,000 | ||||||

| Accounts payable and accrued expenses |

1,035,079 | 1,097,270 | ||||||

| Due to related parties(1) |

309,871 | 160,719 | ||||||

| Other liabilities |

901,504 | 749,318 | ||||||

|

|

|

|

|

|||||

| TOTAL LIABILITIES |

43,678,452 | 45,161,472 | ||||||

|

|

|

|

|

|||||

| Commitments and contingencies(2) |

||||||||

| STOCKHOLDERS’ EQUITY |

||||||||

| Common stock, $0.001 par value; 20,000,000 shares authorized; 6,530,264 shares issued and outstanding at both March 31, 2014, and December 31, 2013 |

6,530 | 6,530 | ||||||

| Additional paid in capital |

51,326,262 | 51,326,262 | ||||||

| Distributions in excess of earnings |

(3,387,606 | ) | (2,820,800 | ) | ||||

|

|

|

|

|

|||||

| TOTAL STOCKHOLDERS’ EQUITY |

47,945,186 | 48,511,992 | ||||||

|

|

|

|

|

|||||

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY |

$ | 91,623,638 | $ | 93,673,464 | ||||

|

|

|

|

|

|||||

| (1) | Refer to Note 4, “Related-Party Transactions,” for additional information |

| (2) | Refer to Note 8, “Commitments and Contingencies,” for additional information |

The accompanying notes are an integral part of these condensed consolidated financial statements.

3

GLADSTONE LAND CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(UNAUDITED)

| For the Three Months Ended March 31, | ||||||||

| 2014 | 2013 | |||||||

| OPERATING REVENUES: |

||||||||

| Rental revenues |

$ | 1,495,636 | $ | 914,583 | ||||

|

|

|

|

|

|||||

| Total operating revenues |

1,495,636 | 914,583 | ||||||

|

|

|

|

|

|||||

| OPERATING EXPENSES: |

||||||||

| Depreciation and amortization |

288,031 | 160,036 | ||||||

| Management fee(1) |

240,964 | 59,164 | ||||||

| Incentive fee(1) |

— | 41,037 | ||||||

| Administration fee(1) |

66,158 | 38,332 | ||||||

| Professional fees |

178,987 | 85,392 | ||||||

| Acquisition-related expenses |

43,412 | 16,871 | ||||||

| Property operating expenses |

65,585 | 18,495 | ||||||

| General and administrative expenses |

217,315 | 118,778 | ||||||

|

|

|

|

|

|||||

| Total operating expenses |

1,100,452 | 538,105 | ||||||

|

|

|

|

|

|||||

| OPERATING INCOME |

395,184 | 376,478 | ||||||

|

|

|

|

|

|||||

| OTHER INCOME (EXPENSE): |

||||||||

| Interest income |

5,648 | 10,627 | ||||||

| Other income |

749 | — | ||||||

| Interest expense |

(374,040 | ) | (280,400 | ) | ||||

|

|

|

|

|

|||||

| Total other expense |

(367,643 | ) | (269,773 | ) | ||||

|

|

|

|

|

|||||

| Net income before income taxes |

27,541 | 106,705 | ||||||

|

|

|

|

|

|||||

| Income tax provision |

(6,623 | ) | (59,189 | ) | ||||

|

|

|

|

|

|||||

| NET INCOME |

$ | 20,918 | $ | 47,516 | ||||

|

|

|

|

|

|||||

| EARNINGS PER COMMON SHARE: |

||||||||

| Basic and diluted |

$ | 0.00 | $ | 0.01 | ||||

|

|

|

|

|

|||||

| Distributions per common share |

$ | 0.09 | $ | 0.08 | ||||

|

|

|

|

|

|||||

| WEIGHTED AVERAGE SHARES OF COMMON STOCK OUTSTANDING—basic and diluted |

6,530,264 | 5,249,898 | ||||||

|

|

|

|

|

|||||

| (1) | Refer to Note 4, “Related-Party Transactions,” for additional information |

The accompanying notes are an integral part of these condensed consolidated financial statements.

4

GLADSTONE LAND CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

| For the Three Months Ended March 31, | ||||||||

| 2014 | 2013 | |||||||

| CASH FLOWS FROM OPERATING ACTIVITIES: |

||||||||

| Net income |

$ | 20,918 | $ | 47,516 | ||||

| Adjustments to reconcile net income to net cash provided by (used in) operating activities: |

||||||||

| Depreciation and amortization |

288,031 | 160,036 | ||||||

| Amortization of deferred financing fees |

7,975 | 7,404 | ||||||

| Amortization of deferred rent assets and liabilities, net |

(19,894 | ) | (29,061 | ) | ||||

| Changes in operating assets and liabilities: |

||||||||

| Other assets |

53,526 | (2,425,907 | ) | |||||

| Accounts payable, accrued expenses, and due to related parties |

(128,877 | ) | (425,439 | ) | ||||

| Other liabilities |

172,080 | 103,883 | ||||||

|

|

|

|

|

|||||

| Net cash provided by (used in) operating activities |

393,759 | (2,561,568 | ) | |||||

| CASH FLOWS FROM INVESTING ACTIVITIES: |

||||||||

| Capital expenditures on exisiting real estate |

(503,299 | ) | — | |||||

| Increase in restricted cash |

(740 | ) | — | |||||

| Purchase of U.S. Treasuries |

— | (19,996,767 | ) | |||||

| Deposits on future acquisitions |

(50,000 | ) | (50,000 | ) | ||||

| Deposits refunded |

50,000 | — | ||||||

|

|

|

|

|

|||||

| Net cash used in investing activities |

(504,039 | ) | (20,046,767 | ) | ||||

| CASH FLOWS FROM FINANCING ACTIVITIES: |

||||||||

| Proceeds from issuance of equity |

— | 56,703,960 | ||||||

| Offering costs |

(84,140 | ) | (4,130,898 | ) | ||||

| Repayments on mortgage note payable |

(1,722,167 | ) | (1,228,715 | ) | ||||

| Financing fees |

(220,500 | ) | (12,230 | ) | ||||

| Distributions paid |

(587,724 | ) | (522,421 | ) | ||||

|

|

|

|

|

|||||

| Net cash (used in) provided by financing activities |

(2,614,531 | ) | 50,809,696 | |||||

|

|

|

|

|

|||||

| NET (DECREASE) INCREASE IN CASH AND CASH EQUIVALENTS |

(2,724,811 | ) | 28,201,361 | |||||

| CASH AND CASH EQUIVALENTS AT BEGINNING OF PERIOD |

16,271,282 | 873,474 | ||||||

|

|

|

|

|

|||||

| CASH AND CASH EQUIVALENTS AT END OF PERIOD |

$ | 13,546,471 | $ | 29,074,835 | ||||

|

|

|

|

|

|||||

| NON-CASH OPERATING, INVESTING AND FINANCING INFORMATION: |

||||||||

| Additions to real estate included in accounts payable and accrued expenses |

$ | 141,946 | $ | — | ||||

|

|

|

|

|

|||||

| Offering costs included in accounts payable and accrued expenses |

38,828 | 237,021 | ||||||

|

|

|

|

|

|||||

| Financing fees included in accounts payable and accrued expenses |

35,064 | — | ||||||

|

|

|

|

|

|||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

5

GLADSTONE LAND CORPORATION AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

NOTE 1. BUSINESS AND ORGANIZATION

Business

Gladstone Land Corporation (the “Company,” “we,” “us” or “our”) was re-incorporated in Maryland on March 24, 2011, having been previously re-incorporated in Delaware on May 25, 2004, and having been originally incorporated in California on June 14, 1997. We are primarily in the business of owning and leasing farmland. Subject to certain restrictions and limitations, and pursuant to contractual agreements, our business is managed by Gladstone Management Corporation (the “Adviser”), a Delaware corporation, and administrative services are provided to us by Gladstone Administration, LLC (the “Administrator”), a Delaware limited liability company.

Organization

We conduct substantially all of our operations through a subsidiary, Gladstone Land Limited Partnership (the “Operating Partnership”), a Delaware limited partnership. As we currently own, directly or indirectly, all of the general and limited partnership interests of the Operating Partnership, the financial position and results of operations of the Operating Partnership are consolidated with those of the Company.

Gladstone Land Partners, LLC (“Land Partners”), a Delaware limited liability company and a subsidiary of ours, was organized to engage in any lawful act or activity for which a limited liability company may be organized in Delaware. Land Partners is the general partner of the Operating Partnership and has the power to make and perform all contracts and to engage in all activities necessary in carrying out the purposes of the Company, as well as all other powers available to it as a limited liability company. As we currently own all of the membership interests of Land Partners, the financial position and results of operations of Land Partners are consolidated with those of the Company.

Gladstone Land Advisers, Inc. (“Land Advisers”), a Delaware corporation and a subsidiary of ours, was created to collect any non-qualifying income related to our real estate portfolio. We have elected for Land Advisers to be taxed as a taxable REIT subsidiary (“TRS”). It is currently anticipated that this income will predominately consist of fees we receive related to the leasing of real estate. We may also provide ancillary services to farmers through this subsidiary, though there have been no such fees earned to date. Since we currently own 100% of the voting securities of Land Advisers, the financial position and results of operations of Land Advisers are consolidated with those of the Company.

All subsequent references in this report to the “Company,” “we,” “us” and “our” refer, collectively, to Gladstone Land Corporation, the Operating Partnership and the Company’s and the Operating Partnership’s subsidiaries, unless the context otherwise requires or where otherwise indicated.

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Interim Financial Information

Our interim financial statements are prepared in accordance with accounting principles generally accepted in the United States of America (the “U.S.”) (“GAAP”) for interim financial information and pursuant to the requirements for reporting on Form 10-Q in accordance with Article 10 of Regulation S-X. Accordingly, certain disclosures accompanying annual financial statements prepared in accordance with GAAP are omitted. In the opinion of our management, all adjustments, consisting solely of normal recurring accruals, necessary for the fair presentation of financial statements for the interim period have been included. The results of the interim period reported herein are not indicative of the results to be expected for the full year. The interim financial statements and accompanying notes should be read in conjunction with the financial statements and notes thereto included in our Form 10-K for the year ended December 31, 2013, as filed with the Securities and Exchange Commission on February 24, 2014.

6

Out-of-Period Adjustment

During the three months ended September 30, 2013, and the three months ended December 31, 2013, we recorded adjustments to our income tax provision and to other assets that were related to our 2011 and 2012 provision reconciliation. As a result of the correction of these errors, we understated net income by $30,800 for the both three and nine months ended September 30, 2013, and by $9,638 and $40,438 for the three months and year ended December 31, 2013, respectively. We concluded that these adjustments were not material to the 2011, 2012 or 2013 results of operations; as such, these adjustments were recorded during 2013, with no impact on the three months ended March 31, 2013.

Use of Estimates

The preparation of financial statements in accordance with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting periods. Actual results could materially differ from those estimates.

Real Estate and Lease Intangibles

Our investments in real estate consist of farmland and improvements made to the farmland, consisting of buildings; irrigation and drain systems; coolers, which are storage facilities used for cooling crops; box barns, which are facilities used for storing and assembling boxes; and horticulture acquired in connection with the land purchase, which currently consists of blueberry bushes and lemon trees. We record investments in real estate at cost and capitalize improvements and replacements when they extend the useful life or improve the efficiency of the asset. We expense costs of repairs and maintenance as such costs are incurred. We compute depreciation using the straight-line method over the shorter of the estimated useful life or 39 years for buildings and improvements, the shorter of the estimated useful life or 25 years for horticulture acquired in connection with the purchase of farmland, 5 to 7 years for equipment and fixtures and the shorter of the useful life or the remaining lease term for leasehold interests.

Certain of our acquisitions involve sale-leaseback transactions with newly-originated leases, which we account for as asset acquisitions under Accounting Standards Codification (“ASC”) 360, “Property, Plant and Equipment.” In the case of an asset acquisition, we will capitalize the transaction costs incurred in connection with the acquisition. Other of our acquisitions involve the acquisition of farmland that is already being operated as rental property and has a lease in place that we assume at the time of acquisition, which we will generally consider to be a business combination under ASC 805, “Business Combinations.” When an acquisition is considered a business combination, ASC 805 requires that the purchase price of real estate be allocated to the tangible assets acquired and liabilities assumed, consisting of land, buildings, improvements, horticulture and long-term debt; and identifiable intangible assets and liabilities, typically the value of above-market and below-market leases, in-place leases, unamortized lease origination costs and tenant relationships, based in each case on their fair values. ASC 805 also requires that all expenses related to the acquisition be expensed as incurred, rather than capitalized into the cost of the acquisition.

Whether our acquisitions are treated as an asset acquisition under ASC 360 or a business combination under ASC 805, the fair value of the purchase price is allocated among the assets acquired and any liabilities assumed. Management’s estimates of fair value are made using methods similar to those used by independent appraisers, such as a sales comparison approach, a cost approach, and an income capitalization approach (utilizing a discounted cash flow analysis). Factors considered by management in its analysis include an estimate of carrying costs during hypothetical, expected lease-up periods, taking into consideration current market conditions and costs to execute similar leases. We also consider information obtained about each property as a result of our pre-acquisition due diligence, marketing and leasing activities in estimating the fair value of the tangible and intangible assets acquired and liabilities assumed. In estimating carrying costs, management also includes real estate taxes, insurance and other operating expenses and estimates of lost rental income at market rates during the hypothetical, expected lease-up periods, which typically range from 3 to 12 months, depending on specific local market conditions. Management also estimates costs to execute similar leases, including leasing commissions, legal and other related expenses, to the extent that such costs are not already incurred in connection with a new lease origination as part of the transaction.

We allocate purchase price to the fair value of the tangible assets and liabilities of an acquired property by valuing the property as if it were vacant. The “as-if-vacant” value is allocated to land, buildings, improvements and horticulture, based on management’s determination of the fair values of these assets. Real estate depreciation expense on these tangible assets was $259,563 and $135,055 for the three months ended March 31, 2014 and 2013, respectively.

We record above-market and below-market in-place lease values for acquired properties based on the present value (using an interest rate that reflects the risks associated with the leases acquired) of the difference between (i) the contractual amounts to be paid pursuant to the in-place leases and (ii) management’s estimate of fair market lease rates for the corresponding in-place leases, measured over a period equal to the remaining, non-cancelable term of the lease. When determining the non-cancelable term of the lease, we evaluate if fixed-rate renewal options, if any, should be included.

7

In connection with our 2013 and 2012 acquisitions, we allocated $161,547 and $98,808, respectively, of the purchase price to below-market lease values. Prior to 2012, all acquired leases were determined to be at market. The fair value of capitalized below-market leases, included as part of Other liabilities in the accompanying Condensed Consolidated Balance Sheets, are amortized into rental income on a straight-line basis over the remaining, non-cancelable terms of the respective leases. Total amortization related to below-market lease values recorded for the three months ended March 31, 2014 and 2013 was $19,984 and $29,061, respectively.

The total amount of the remaining intangible assets acquired, which consists of in-place lease values, unamortized lease origination costs and tenant relationship intangible values, are allocated based on management’s evaluation of the specific characteristics of each tenant’s lease and our overall relationship with that respective tenant. Characteristics to be considered by management in allocating these values include the nature and extent of our existing business relationships with the tenant, prospects for developing additional business with the tenant, the tenant’s credit quality and our expectations of lease renewals (including those existing under the terms of the lease agreement), among other factors.

The value of in-place leases and unamortized lease origination costs are amortized to expense on a straight-line basis over the remaining terms of the respective leases, which currently range from 1 to 15 years. The value of customer relationship intangibles, which is the benefit to us resulting from the likelihood of an existing tenant renewing its lease at the existing property or entering a lease at a different property owned by us, are amortized to expense over the remaining lease term and any anticipated renewal periods in the respective leases. Should a tenant terminate its lease, the unamortized portion of the above-market and below-market lease values, in-place lease values, lease origination costs and tenant relationship intangibles will be immediately charged to the related income or expense.

Total amortization expense related to these intangible assets, in aggregate, was $28,468 and $24,981 for the three months ended March 31, 2014 and 2013, respectively.

Impairment of Real Estate Assets

We account for the impairment of real estate, including intangible assets, in accordance with ASC 360-10-35, “Property, Plant, and Equipment,” which requires us to periodically review the carrying value of each property to determine whether circumstances indicate impairment of the carrying value of the investment exists or if depreciation periods should be modified. If circumstances support the possibility of impairment, we prepare a projection of the undiscounted future cash flows, without interest charges, of the specific property and determine whether the carrying value of the investment in such property is recoverable. In performing the analysis, we consider such factors as the tenants’ payment history and financial condition, the likelihood of lease renewal, agricultural and business conditions in the regions in which our farms are located and whether there are indications that the fair value of the real estate has decreased. If the carrying amount is more than the aggregate undiscounted future cash flows, we would recognize an impairment loss to the extent the carrying amount exceeds the estimated fair value of the property.

We evaluate our entire property portfolio each quarter for any impairment indicators and perform an impairment analysis on those select properties that have an indication of impairment. We concluded that none of our properties were impaired as of March 31, 2014, and will continue to monitor our portfolio for any indicators of impairment. There have been no impairments recognized on real estate assets since our inception.

Restricted Cash

Restricted cash as of March 31, 2014, and December 31, 2013, consisted solely of accrued interest owed on funds held in escrow related to the acquisition of a property in December 2013.

Short-term Investments

We consider short-term investments to consist of any highly-liquid securities that have an original maturity of less than one year but greater than three months at the time of purchase. As of March 31, 2014, and December 31, 2013, short-term investments consisted of approximately $0.7 million held in a certificate of deposit (“CD”). The CD originally matured on September 6, 2013; however, upon maturity, the balance was rolled into a new, 12-month CD with a maturity date of September 6, 2014. Due to the short-term nature of the CD, the amortized cost of the security was deemed to approximate its fair value as of both March 31, 2014 and December 31, 2013. During the three months ended March 31, 2013, we also held

8

$20.0 million of short-term U.S. Treasury Bills that matured on June 27, 2013, and were subsequently invested in a money-market deposit account. As of both March 31, 2014, and December 31, 2013, our short-term investments were classified as held-to-maturity and were recorded at their amortized cost on the Condensed Consolidated Balance Sheets. Total income earned on these short-term investments is included in Interest income on the accompanying Condensed Consolidated Statements of Operations and totaled $168 and $1,787 for the three months ended March 31, 2014 and 2013, respectively.

Deferred Financing Costs

Deferred financing costs consist of costs incurred to obtain financing, including legal fees, origination fees and administrative fees. These costs are deferred and amortized over the term of the related financing using the straight-line method due to the revolving nature of the financing instrument. Upon early extinguishment of any borrowings, the unamortized portion of the related deferred financing costs will be immediately charged to expense. Total amortization expense related to deferred financing costs is included in Interest expense on the accompanying Condensed Consolidated Statements of Operations. Accumulated amortization of deferred financing costs was $72,123 and $64,148 as of March 31, 2014, and December 31, 2013, respectively. During the three months ended March 31, 2014, we incurred $255,564 of additional financing fees in connection with our negotiations regarding a new mortgage loan and credit facility with Metropolitan Life Insurance Company (“MetLife”)

Deferred Offering Costs

We account for deferred offering costs in accordance with SEC Staff Accounting Bulletin (“SAB”), Topic 5.A, which states that incremental costs directly attributable to a proposed or actual offering of securities may properly be deferred and charged against the gross proceeds of the offering. Accordingly, we record costs incurred related to public offerings of equity securities on our Condensed Consolidated Balance Sheet and pro-ratably apply these amounts to the proceeds of equity as stock is issued. The deferred offering costs on our Condensed Consolidated Balance Sheet as of March 31, 2014, are related to the filing and preparation of a registration statement on Form S-3, which was declared effective by the U.S. Securities and Exchange Commission (the “SEC”) on April 2, 2014.

Other Assets

Other assets consist primarily of income taxes receivable, deferred rent, prepaid expenses, deposits on potential real estate acquisitions and other miscellaneous receivables.

Revenue Recognition

Rental revenue includes rents that each tenant pays in accordance with the terms of its respective lease, reported evenly over the non-cancelable term of the lease. Some of our leases contain rental increases at specified intervals; we recognize such revenues on a straight-line basis. Deferred rent receivable, included in Other assets on the accompanying Condensed Consolidated Balance Sheets, includes the cumulative difference between rental revenue, as recorded on a straight-line basis, and rents received from the tenants in accordance with the lease terms. Capitalized above-market leases and capitalized below-market leases are included in Other assets and Other liabilities, respectively, on the accompanying Condensed Consolidated Balance Sheets, the value of which is amortized into rental income over the life of the respective leases. In addition, we determine, in our judgment, to what extent the deferred rent receivable applicable to each specific tenant is collectable. We periodically review deferred rent receivable, as it relates to straight-line rents, and take into consideration the tenant’s payment history, the financial condition of the tenant, business conditions of the industry in which the tenant operates and economic and agricultural conditions in the geographic area in which the property is located. In the event that the collectability of deferred rent with respect to any given tenant is in doubt, we record an allowance for uncollectable accounts or record a direct write-off of the specific rent receivable. No such reserves or direct write-offs have been recorded to date.

Income Taxes

We believe that we have completed all significant actions necessary to convert to a real estate investment trust (“REIT”), effective January 1, 2013, including the distribution of all accumulated earnings and profits from prior years. Therefore, beginning with our taxable year ended December 31, 2013, we intend to elect to be taxed as a REIT for federal income tax purposes. As a REIT, we generally will not be subject to federal income taxes on amounts that we distribute to our

9

stockholders (except income from any foreclosure property), provided that, on an annual basis, we distribute at least 90% of our REIT taxable income (determined without regard to the deduction for dividends paid and excluding net capital gains) to our stockholders and meet certain other conditions. To the extent that we satisfy the annual distribution requirement but distribute less than 100% of our taxable income, we will be subject to an excise tax on our undistributed taxable income. For all tax years prior to 2013, our net income was taxed at regular corporate tax rates for both federal and state purposes.

In connection with intercompany transfers of the farmland now held by San Andreas Road Watsonville, LLC (“San Andreas”), a wholly-owned subsidiary of ours, in 2002 and again in 2004 and of the farmland currently held by West Gonzales Road Oxnard, LLC (“West Gonzales”), a wholly-owned subsidiary of ours, in 2002, we created deferred intercompany gains that are taxable for both federal and state income tax purposes upon the occurrence of certain triggering events. These deferred intercompany gains are generally equal to the excess of the fair market value of the property over the tax basis of the property (determined as of the time that the deferred intercompany gain was created) and are deferred indefinitely until a triggering event occurs (such as REIT conversion), generally when the transferee or the transferor leaves the consolidated group, as defined by the relevant tax law, or the property is sold to a third party. In the case of a transfer of built-in gain property between members of a consolidated group, there are deferred intercompany gains to the transferring entity, and the receiving entity’s tax basis is the fair market value at the date of transfer. Thus, a deferred tax liability is created related to the deferred intercompany gain to the transferring entity, and an offsetting deferred tax asset is created representing the basis difference from the new tax basis of the receiving entity. As a result, the deferred tax assets and liabilities offset one another and there is no net impact to us. In accordance with ASC 740 and ASC 810, no tax impact is recognized in the condensed consolidated financial statements as a result of transfers of assets between members of a consolidated group.

As a result of the transfers mentioned above, the related federal and state deferred tax assets and liabilities each totaled approximately $2.2 million as of December 31, 2013. With respect to the federal portion of approximately $2.1 million, this amount will become payable as of the effective date of our REIT election, and, as a REIT, we will no longer be able to obtain the benefit of the related deferred tax asset. As such, in March 2013, we made a tax prepayment of $2.1 million in the form of a cash bond submitted to the Internal Revenue Service (“IRS”) to cover this amount once it becomes due. Since we believe that we have completed all significant actions necessary to qualify as a REIT and intend to make an election to be treated as a REIT effective as of January 1, 2013, we reversed the $2.1 million deferred tax asset through our income tax provision during the year ended December 31, 2013. The REIT election does not have the same impact on the state tax amount of approximately $0.1 million, and, therefore, this amount will continue to be deferred.

At the time of transfer of San Andreas in February 2004 from SC Land, Inc. (“SC Land”), a deferred intercompany stock account (“DISA”) was created at the state income tax level. The DISA is calculated based upon the fair market value of the property at the time of distribution, resulting in a tax liability of approximately $98,000. SC Land was formally liquidated in June 2010; however, we have concluded that SC Land was de facto liquidated in May 2009, when it transferred its remaining existing assets to the parent company, since the business operations of SC Land were effectively terminated as of that date. The California state income taxes of $98,000 related to the DISA became payable at the time of the de facto liquidation in May 2009 and are being remitted by us in equal installments over a five-year period, the final installment of which will be made in 2014.

We transferred West Gonzales from SC Land into the parent company in May 2009. As stated in the paragraph above, we have concluded that SC Land was de facto liquidated in May 2009, and, as a result, we will not be subject to a tax on the transfer similar to that discussed in the paragraphs above related to the 2002 and 2004 transfers.

10

A reconciliation between the U.S. statutory federal income tax rate and our effective income tax rate for the three months ended March 31, 2014 and 2013 is provided in the following table:

| Three Months Ended March 31, 2014 |

Three Months Ended March 31, 2013 |

|||||||

| U.S. statutory federal income tax rate |

0.0 | % | 34.0 | % | ||||

| State taxes, net of U.S. federal income tax benefit |

0.0 | % | 21.4 | % | ||||

| Other adjustments(1) |

24.0 | % | 0.1 | % | ||||

|

|

|

|

|

|||||

| Effective tax rate |

24.0 | % | 55.5 | % | ||||

|

|

|

|

|

|||||

| (1) | Adjustments made to the 2014 income tax provision relate to the remaining DISA owed to the state of California, as a result of the land transfers from prior years, mentioned above. |

The provision for income taxes included in our Condensed Consolidated Financial Statements for both 2014 and 2013 were all current.

Also, beginning with our tax year ended December 31, 2013, we intend for Land Advisers to be treated as a TRS and to be subject to federal and state income taxes. Though Land Advisers has had no activity to date, we would account for any future income taxes in accordance with the provisions of ASC 740, “Income Taxes.” Under ASC 740-10-25, we account for income taxes using the asset and liability method, under which deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases.

Comprehensive Income

For the three months ended March 31, 2014 and 2013, comprehensive income equaled net income; therefore, a separate statement of comprehensive income is not included in the accompanying Condensed Consolidated Financial Statements.

Recently Issued Accounting Guidance

The Financial Accounting Standards Board (the “FASB”) issued Accounting Standards Update No. 2014-08, “Presentation of Financial Statements (Topic 205) and Property, Plant, and Equipment (Topic 360): Reporting Discontinued Operations and Disclosures of Disposals of Components of an Entity.” Under this revised guidance, only disposals representing a strategic shift in operations, such as a disposal of a major geographic area, a major line of business or a major equity method investment, will be presented as discontinued operations. As an emerging growth company, the standard is effective for us with respect to (a) all disposals (or classifications as held for sale) of components of an entity that occur within annual periods beginning on or after December 15, 2014, and interim periods within annual periods beginning on or after December 15, 2015, and (b) all activities that, upon acquisition, are classified as held for sale that occur within annual periods beginning on or after December 15, 2014, and interim periods within annual periods beginning on or after December 15, 2015. We currently anticipate that this standard will not have a significant impact on our financial position, results of operations or cash flows.

11

NOTE 3. REAL ESTATE AND INTANGIBLE ASSETS

All of our properties are wholly-owned on a fee-simple basis. The following table provides certain summary information about our 21 farms as of March 31, 2014:

| Number | Lease | |||||||||||||||||||||||||||||||

| Date | of | Total | Farmable | Expiration | Net Cost | |||||||||||||||||||||||||||

| Property Name |

Location | Acquired | Farms | Acres | Acres | Date | Basis(1) | Encumbrances | ||||||||||||||||||||||||

| San Andreas |

Watsonville, CA | 6/16/1997 | 1 | 307 | 237 | 12/31/2014 | $ | 4,855,100 | $ | 100,000 | (2) | |||||||||||||||||||||

| West Gonzales |

Oxnard, CA | 9/15/1998 | 1 | 653 | 502 | 6/30/2020 | 12,339,049 | 26,784,299 | ||||||||||||||||||||||||

| West Beach |

Watsonville, CA | 1/3/2011 | 3 | 196 | 195 | 12/31/2023 | 8,383,970 | 4,997,773 | ||||||||||||||||||||||||

| Dalton Lane |

Watsonville, CA | 7/7/2011 | 1 | 72 | 70 | 10/31/2015 | 2,718,326 | 1,648,264 | ||||||||||||||||||||||||

| Keysville Road |

Plant City, FL | 10/26/2011 | 2 | 59 | 50 | 7/1/2016 | 1,230,758 | 880,644 | ||||||||||||||||||||||||

| Colding Loop |

Wimauma, FL | 8/9/2012 | 1 | 219 | 181 | 6/14/2018 | 3,980,623 | 2,089,764 | ||||||||||||||||||||||||

| Trapnell Road |

Plant City, FL | 9/12/2012 | 3 | 124 | 110 | 6/30/2017 | 4,227,983 | 2,317,577 | ||||||||||||||||||||||||

| 38th Avenue |

Covert, MI | 4/5/2013 | 1 | 119 | 89 | 4/4/2020 | 1,343,135 | 788,813 | ||||||||||||||||||||||||

| Sequoia Street |

Brooks, OR | 5/31/2013 | 1 | 218 | 206 | 5/31/2028 | 3,176,000 | 1,824,864 | ||||||||||||||||||||||||

| Natividad Road |

Salinas, CA | 10/21/2013 | 1 | 166 | 166 | 10/31/2024 | 7,456,086 | — | ||||||||||||||||||||||||

| 20th Avenue |

South Haven, MI | 11/5/2013 | 3 | 151 | 94 | 11/4/2018 | 1,994,669 | — | ||||||||||||||||||||||||

| Broadway Road |

Moorpark, CA | 12/16/2013 | 1 | 60 | 60 | 12/15/2023 | 3,001,717 | — | ||||||||||||||||||||||||

| Oregon Trail |

Echo, OR | 12/27/2013 | 1 | 1,895 | 1,640 | 12/31/2023 | 14,049,596 | — | ||||||||||||||||||||||||

| East Shelton |

Willcox, AZ | 12/27/2013 | 1 | 1,761 | 1,320 | 2/29/2024 | 7,222,449 | — | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

| 21 | 6,000 | 4,920 | $ | 75,979,461 | $ | 41,431,998 | ||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

| (1) | Consists of the initial acquisition price (including the costs allocated to both tangible and intangible assets), plus subsequent improvements and other capitalized costs associated with the properties, and adjusted for depreciation and amortization accumulated through March 31, 2014. |

| (2) | Represents borrowings outstanding on our line of credit as of March 31, 2014, under which San Andreas is pledgd as collateral. |

Real Estate

The following table sets forth the components of our investments in tangible real estate assets as of March 31, 2014, and December 31, 2013:

| March 31, 2014 | December 31, 2013 | |||||||

| Real estate: |

||||||||

| Land and land improvements |

$ | 63,993,859 | $ | 63,944,307 | ||||

| Buildings and improvements |

2,193,604 | 2,193,255 | ||||||

| Coolers |

5,388,051 | 5,293,796 | ||||||

| Irrigation system |

6,506,836 | 6,007,845 | ||||||

| Horticulture |

1,038,974 | 1,038,850 | ||||||

|

|

|

|

|

|||||

| Real estate, gross |

79,121,324 | 78,478,053 | ||||||

| Accumulated depreciation |

(3,426,433 | ) | (3,166,870 | ) | ||||

|

|

|

|

|

|||||

| Real estate, net |

$ | 75,694,891 | $ | 75,311,183 | ||||

|

|

|

|

|

|||||

Existing Real Estate Activity

On January 20, 2014, we completed the work for the expansion and upgrade of the cooling facility on Trapnell Road, for which we agreed to incur the costs, up to a maximum of $450,000. We expended a total of $446,108 in connection with this project, and, in accordance with the lease amendment executed on October 21, 2013, we will earn additional rental income on the costs incurred related to this project at an initial annual rate of 8.5%, with prescribed rental escalations provided for in the lease.

12

On March 27, 2014, we executed a lease with a new tenant to occupy West Beach that commences on November 1, 2014, as the lease term with the current tenants on the property will expire on October 31, 2014. The new lease term is for nine years, through December 31, 2023, and provides for prescribed rent escalations over its life, with minimum annualized GAAP straight-line rental income of $540,469, representing a 21% increase over that of the current lease.

Intangible Assets

The following table summarizes the carrying value of intangible assets and the accumulated amortization for each intangible asset class as of March 31, 2014, and December 31, 2013:

| March 31, 2014 | December 31, 2013 | |||||||||||||||

| Lease Intangibles |

Accumulated Amortization |

Lease Intangibles |

Accumulated Amortization |

|||||||||||||

| In-place leases |

$ | 397,728 | $ | (260,098 | ) | $ | 397,728 | $ | (241,697 | ) | ||||||

| Leasing commissions |

148,532 | (42,409 | ) | 146,558 | (34,727 | ) | ||||||||||

| Customer relationships |

93,187 | (52,370 | ) | 93,187 | (49,985 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| $ | 639,447 | $ | (354,877 | ) | $ | 637,473 | $ | (326,409 | ) | |||||||

|

|

|

|

|

|

|

|

|

|||||||||

The aggregate amortization expense for the remainder of 2014 and each of the five succeeding fiscal years and thereafter is as follows:

| Period |

Estimated Amortization Expense |

|||||||

| For the remaining nine months ending December 31: |

2014 | $ | 85,423 | |||||

| For the fiscal years ending December 31: |

2015 | 100,920 | ||||||

| 2016 | 34,948 | |||||||

| 2017 | 23,869 | |||||||

| 2018 | 10,110 | |||||||

| 2019 | 7,150 | |||||||

| Thereafter | 22,150 | |||||||

|

|

|

|||||||

| $ | 284,570 | |||||||

|

|

|

|||||||

Lease Expirations

The following table summarizes the lease expirations by year for our properties with leases in place as of March 31, 2014:

| Year |

Number of Expiring Leases |

Expiring Leased Acreage |

% of Total Acreage |

Rental Revenue for the Three Months Ended March 31, 2014 |

% of Total Rental Revenue |

|||||||||||||||

| 2014(1) |

2 | 307 | 5.1 | % | $ | 115,574 | 7.7 | % | ||||||||||||

| 2015 |

1 | 72 | 1.2 | % | 35,625 | 2.4 | % | |||||||||||||

| 2016 |

1 | 59 | 1.0 | % | 17,084 | 1.1 | % | |||||||||||||

| 2017 |

1 | 124 | 2.1 | % | 68,548 | 4.6 | % | |||||||||||||

| 2018 |

2 | 370 | 6.1 | % | 63,789 | 4.3 | % | |||||||||||||

| 2019 |

0 | 0 | 0.0 | % | — | 0.0 | % | |||||||||||||

| Thereafter |

8 | 5,068 | 84.5 | % | 1,195,016 | 79.9 | % | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Totals |

15 | 6,000 | 100.0 | % | $ | 1,495,636 | 100.0 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (1) | Includes a surface area lease on a portion of one property leased to an oil company that is renewed on a year-to-year basis. |

13

Future Lease Payments

Future operating lease payments from tenants under all non-cancelable leases, excluding tenant reimbursement of expenses, for the remainder of 2014 and each of the five succeeding fiscal years and thereafter as of March 31, 2014, are as follows:

| Period |

Tenant Lease Payments |

|||||||

| For the remaining nine months ending December 31: |

2014 | $ | 4,474,612 | |||||

| For the fiscal years ending December 31: |

2015 | 5,425,610 | ||||||

| 2016 | 5,362,569 | |||||||

| 2017 | 5,265,339 | |||||||

| 2018 | 4,935,315 | |||||||

| 2019 | 4,928,252 | |||||||

| Thereafter | 12,053,723 | |||||||

|

|

|

|||||||

| $ | 42,445,420 | |||||||

|

|

|

|||||||

In accordance with the lease terms, substantially all operating expenses are required to be paid by the tenant; however, we would be required to pay real estate property taxes on the respective parcels of land in the event the tenants fail to pay them. The aggregate annual real estate property taxes for all parcels of land owned by us as of March 31, 2014, are approximately $447,000.

Portfolio Diversification and Concentrations

Diversification

The following table summarizes the geographic locations of our properties with leases in place as of March 31, 2014 and 2013:

| As of and For the Three Months Ended March 31, 2014 | As of and For the Three Months Ended March 31, 2013 | |||||||||||||||||||||||||||||||||||||||

| State |

Number of Farms |

Total Acres |

% of Total Acres |

Rental Revenue |

% of Total Rental Revenue |

Number of Farms |

Total Acres |

% of Total Acres |

Rental Revenue |

% of Total Rental Revenue |

||||||||||||||||||||||||||||||

| California |

8 | 1,454 | 24.2 | % | $ | 1,013,612 | 67.8 | % | 6 | 1,228 | 75.3 | % | $ | 795,541 | 87.0 | % | ||||||||||||||||||||||||

| Oregon |

2 | 2,113 | 35.2 | % | 238,025 | 15.9 | % | 0 | 0 | 0.0 | % | — | 0.0 | % | ||||||||||||||||||||||||||

| Florida |

6 | 402 | 6.7 | % | 116,982 | 7.8 | % | 6 | 402 | 24.7 | % | 119,042 | 13.0 | % | ||||||||||||||||||||||||||

| Arizona |

1 | 1,761 | 29.4 | % | 72,757 | 4.9 | % | 0 | 0 | 0.0 | % | — | 0.0 | % | ||||||||||||||||||||||||||

| Michigan |

4 | 270 | 4.5 | % | 54,260 | 3.6 | % | 0 | 0 | 0.0 | % | — | 0.0 | % | ||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| 21 | 6,000 | 100.0 | % | $ | 1,495,636 | 100.0 | % | 12 | 1,630 | 100.0 | % | $ | 914,583 | 100.0 | % | |||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

Concentrations

Credit Risk

Two of our farms are leased to a single tenant, Dole Food Company (“Dole”). As of March 31, 2014, 960 acres were leased to Dole, representing 16.0% of the total acreage we owned. Furthermore, these farms accounted for approximately $0.7 million, or 47.2%, of the rental income recorded during the three months ended March 31, 2014. Rental income from Dole accounted for 70.8% of the total rental income recorded during the three months ended March 31, 2013. If Dole fails to make rental payments or elects to terminate any of its leases, and the land cannot be re-leased on satisfactory terms, there would be a material adverse effect on our financial performance and ability to continue operations. No other individual tenant represented greater than 20.0% of the total rental income recorded during the three months ended March 31, 2014 or 2013.

14

Geographic Risk

8 of our 21 farms owned as of March 31, 2014, are located in California. As of March 31, 2014, our farmland in California accounted for 1,454 acres, or 24.2% of the total acreage we owned. Furthermore, these farms accounted for approximately $1.0 million, or 67.8%, of the rental income recorded during the three months ended March 31, 2014. Rental income from our farms in California accounted for 87.0 % of the total rental income recorded by us during the three months ended March 31, 2013. Our other farms, located in Arizona, Florida, Michigan and Oregon, were purchased between October 2011 and December 2013. Though we seek to continue to further diversify geographically, should an unexpected natural disaster occur where our properties are located, there could be a material adverse effect on our financial performance and ability to continue operations.

NOTE 4. RELATED-PARTY TRANSACTIONS

We are externally managed pursuant to contractual arrangements with our Adviser and our Administrator, which collectively employ all of our personnel and pay their salaries, benefits and general expenses directly. We had an advisory agreement with our Adviser that was in effect through January 31, 2013 (the “Prior Advisory Agreement”), which we and our Adviser amended, effective February 1, 2013 (the “Amended Advisory Agreement”). We also had an administration agreement with our Administrator that was in effect through January 31, 2013 (the “Prior Administration Agreement”), which we and our Administrator amended, effective February 1, 2013 (the “Amended Administration Agreement”). The management and administrative services and fees under both of these agreements are described below.

Prior Advisory and Administration Agreements

Prior Advisory Agreement

We entered into the Prior Advisory Agreement with our Adviser in 2004, pursuant to which the Adviser was responsible for managing us on a day-to-day basis and for identifying, evaluating, negotiating and consummating investment transactions consistent with our criteria. In exchange for such services, we paid the Adviser a management advisory fee, which consisted of the reimbursement of certain expenses of the Adviser. We reimbursed our Adviser for our pro-rata share of our Adviser’s payroll and related benefit expenses on an employee-by-employee basis, based on the percentage of each employee’s time devoted to our matters in relation to the time such employees devoted to all affiliated funds, collectively, advised by our Adviser. We also reimbursed the Adviser for general overhead expenses multiplied by the ratio of hours worked by the Adviser’s employees on Company matters to the total hours worked by the Adviser’s employees. We compensated our Adviser through reimbursement of our portion of the Adviser’s payroll, benefits and general overhead expenses. This reimbursement was generally subject to a combined annual management advisory fee limitation of 2.0% of our average invested assets for the year, with certain exceptions. Reimbursement for overhead expenses was only required up to the point that reimbursed overhead expenses and payroll and benefits expenses, on a combined basis, equaled 2.0% of our average invested assets for the year, and general overhead expenses were required to be reimbursed only if the amount of payroll and benefits reimbursed to the Adviser was less than 2.0% of our average invested assets for the year. However, payroll and benefits expenses were required to be reimbursed by us to the extent that they exceed the overall 2.0% annual management advisory fee limitation. To the extent that overhead expenses payable or reimbursable by us exceeded this limit and our independent directors determined that the excess expenses were justified based on unusual and nonrecurring factors which they deemed sufficient, we were permitted to reimburse the Adviser in future years for the full amount of the excess expenses, or any portion thereof, but only to the extent that the reimbursement would not have caused our overhead expense reimbursements to exceed the 2.0% limitation in any one year. The management advisory fee under the Prior Advisory Agreement never exceeded the annual cap.

Prior Administration Agreement

We entered into the Prior Administration Agreement with our Administrator, effective January 1, 2010, as amended on June 1, 2011, pursuant to which we paid for our allocable portion of our Administrator’s overhead expenses in performing its obligations to us, including, but not limited to, rent and the salaries and benefits of our chief financial officer and treasurer, chief compliance officer, internal counsel and secretary and their respective staffs. We compensated our Administrator through reimbursement of our portion of the Administrator’s payroll, benefits and general overhead expenses.

15

Amended and Restated Advisory and Administration Agreements

On February 1, 2013, we entered into each of the Amended Advisory Agreement and the Amended Administration Agreement.

Amended Advisory Agreement

Base Management Fee

Under the terms of our Amended Advisory Agreement that went into effect on February 1, 2013, we pay an annual base management fee equal to a percentage of our adjusted stockholders’ equity, which is defined as our total stockholders’ equity at the end of each quarter less the recorded value of any preferred stock we may issue and, for 2013 only, any uninvested cash proceeds from the IPO. For 2013, the base management fee was set at 1.0% of our adjusted stockholders’ equity; however, beginning in 2014, the base management fee equals 2.0% of our adjusted stockholders’ equity, which no longer excludes the uninvested cash proceeds from the IPO.

Incentive Fee

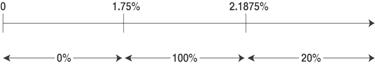

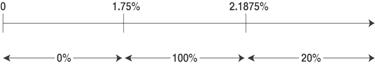

Under the terms of our Amended Advisory Agreement, we also pay an additional quarterly incentive fee based on funds from operations (“FFO”). For purposes of calculating the incentive fee, our FFO, before giving effect to any incentive fee (our “Pre-Incentive Fee FFO”) will include any realized capital gains or losses, less any distributions paid on our preferred stock, but will not include any unrealized capital gains or losses. The incentive fee will reward our Adviser if our Pre-Incentive Fee FFO for a particular calendar quarter exceeds a hurdle rate of 1.75% (7% annualized) of our total stockholders’ equity at the end of the quarter. Our Adviser will receive 100% of the amount of the Pre-Incentive Fee FFO for the quarter that exceeds the hurdle rate but is less than 2.1875% of our total stockholders’ equity at the end of the quarter (8.75% annualized), and 20% of the amount of our Pre-Incentive Fee FFO that exceeds 2.1875% for the quarter.

For the three months ended March 31, 2013, we paid an incentive fee to our Adviser of $41,037; however, during the three months ended June 30, 2013, our Adviser issued a one-time, irrevocable waiver equal to the full amount of the incentive fee paid for the three months ended March 31, 2013, and such fee was credited to us during the three months ended June 30, 2013. There was no incentive fee earned by our Adviser for the three months ended March 31, 2014, as our Pre-Incentive Fee FFO did not exceed the hurdle rate.

Amended Administration Agreement

Under the terms of the Amended Administration Agreement that went into effect on February 1, 2013, we pay separately for our allocable portion of the Administrator’s overhead expenses in performing its obligations, including rent and our allocable portion of the salaries and benefits expenses of our chief financial officer and treasurer, chief accounting officer, chief compliance officer, internal counsel and secretary and their respective staffs. Unlike the Prior Administration Agreement, which provided that our allocable portion of these expenses be based on the percentage of time that our Administrator’s personnel devoted to our affairs, under the Amended Administration Agreement, our allocable portion of these expenses is generally derived by multiplying the Administrator’s total allocable expenses by the percentage of our total assets at the beginning of each quarter in comparison to the total assets of all companies for whom our Administrator provides services.

16

The following table summarizes the management fees, incentive fees and associated credits and the administration fees reflected in our accompanying Condensed Consolidated Statements of Operations:

| For the Three Months Ended March 31, | ||||||||

| 2014 | 2013 | |||||||

| Management Fee: |

||||||||

| Allocated payroll and benefits |

$ | — | $ | 38,668 | ||||

| Allocated overhead expenses |

— | 7,538 | ||||||

|

|

|

|

|

|||||

| Prior management advisory fee(1) |

— | 46,206 | ||||||

| Amended base management fee(2) |

240,964 | 12,958 | ||||||

|

|

|

|

|

|||||

| Total management fee(3) |

$ | 240,964 | $ | 59,164 | ||||

|

|

|

|

|

|||||

| Incentive Fee: |

||||||||

| Incentive Fee(3)(4) |

$ | — | $ | 41,037 | ||||

|

|

|

|

|

|||||

| Net incentive fee |

$ | — | $ | 41,037 | ||||

|

|

|

|

|

|||||

| Administration Fee: |

||||||||

| Allocated payroll and benefits |

$ | — | $ | 14,034 | ||||

| Allocated overhead expenses |

— | 4,498 | ||||||

|

|

|

|

|

|||||

| Prior administration fee(1) |

— | 18,532 | ||||||

| Amended administration fee(2) |

66,158 | 19,800 | ||||||

|

|

|

|

|

|||||

| Total administration fee(3) |

$ | 66,158 | $ | 38,332 | ||||

|

|

|

|

|

|||||

| (1) | Pursuant to the Prior Advisory and Administration Agreements, respectively, as defined and described in further detail above, both of which were terminated on January 31, 2013. |

| (2) | Pursuant to the Amended Advisory and Administration Agreements, respectively, as defined and described in further detail above, both of which became effective on February 1, 2013. |

| (3) | Reflected as a line item on our accompanying Condensed Consolidated Statements of Operations. |

| (4) | An incentive fee of $41,037 was paid to our Adviser for the three months ended March 31, 2013; however, during the three months ended June 30, 2013, our Adviser issued a one-time, irrevocable waiver equal to the full amount of the incentive fee due and payable to the Adviser for the three months ended March 31, 2013. |

17

Related Party Fees Due

Amounts due to related parties on our accompanying Condensed Consolidated Balance Sheets were as follows:

| As of March 31, 2014 |

As of December 31, 2013 |

|||||||

| Management fee due to Adviser |

$ | 240,964 | $ | 91,823 | ||||

| Other due to Adviser(1) |

2,130 | 9,834 | ||||||

|

|

|

|

|

|||||

| Total due to Adviser |

243,094 | 101,657 | ||||||

|

|

|

|

|

|||||

| Administration fee due to Administrator |

66,158 | 59,062 | ||||||

| Other due to Administrator(1) |

619 | — | ||||||

|

|

|

|

|

|||||

| Total due to Administrator |

66,777 | 59,062 | ||||||

|

|

|

|

|

|||||

| Total due to related parties(2) |

$ | 309,871 | $ | 160,719 | ||||

|

|

|

|

|

|||||

| (1) | Other fees due to related parties primarily relate to miscellaneous general and administrative expenses paid by our Adviser or Administrator on our behalf. |

| (2) | Reflected as a line item on our accompanying Consolidated Balance Sheets. |

NOTE 5. BORROWINGS

Our borrowings as of March 31, 2014, and December 31, 2013, are summarized below:

| As of March 31, 2014 | As of December 31, 2013 | |||||||||||||||||||||||||||||||||||||

| Issuer |

Type of |

Date of Issuance |

Initial Commitment |

Maturity Date |

Principal Outstanding |

Stated Interest Rate |

Remaining Availability |

Principal Outstanding |

Stated Interest Rate |

Remaining Availability |

||||||||||||||||||||||||||||

| MetLife |

Mortgage Note Payable | 12/30/2010 | $ | 45,200,000 | 1/5/2026 | $ | 41,331,998 | 3.50 | % | $ | — | $ | 43,054,165 | 3.50 | % | $ | — | |||||||||||||||||||||

| MetLife |

Line of Credit | 5/31/2012 | 4,785,000 | 4/5/2017 | 100,000 | 3.25 | % | 4,685,000 | 100,000 | 3.25 | % | 4,685,000 | ||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

| Totals: | $ | 41,431,998 | $ | 4,685,000 | $ | 43,154,165 | $ | 4,685,000 | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

The weighted-average effective interest rate charged on all of our borrowings, excluding the impact of deferred financing costs, was 3.5% and 3.6% for the three months ended March 31, 2014 and 2013, respectively.

Mortgage Note Payable

On December 30, 2010, we executed a loan agreement with MetLife in an amount not to exceed $45.2 million, pursuant to a long-term note payable. The note currently accrues interest at a rate of 3.50% per year. The interest rate was subject to adjustment on January 5, 2014, and remained unchanged at 3.50%. The interest rate will be subject to further adjustment on January 5, 2017, and every three years thereafter to then-current market rates. The note is scheduled to mature on January 5, 2026, and we may not repay the note prior to maturity, except on one of the interest rate adjustment dates. We also incur a commitment fee of 0.20% on any undrawn amounts. As of March 31, 2014, there is no remaining balance available under the mortgage loan.

The fair value of our mortgage note payable outstanding as of March 31, 2014, was approximately $41.8 million, as compared to a carrying value of $41.3 million. The fair value of the mortgage note payable was valued using Level 3 inputs under the hierarchy established by ASC 820, “Fair Value Measurements and Disclosures,” and is calculated based on a discounted cash flow analysis, using interest rates based on management’s estimates of market interest rates on long-term debt with comparable terms.

18

Scheduled principal payments of the mortgage note payable for the remainder of 2014 and each of the five succeeding fiscal years and thereafter are as follows:

| Period |

Scheduled Principal Payments |

|||||||

| For the remaining nine months ending December 31: |

2014 | $ | — | |||||

| For the fiscal years ending December 31: |

2015 | 1,653,280 | ||||||

| 2016 | 1,587,149 | |||||||

| 2017 | 1,523,663 | |||||||

| 2018 | 1,462,716 | |||||||

| 2019 | 1,404,208 | |||||||

| Thereafter | 33,700,982 | |||||||

|

|

|

|||||||

| $ | 41,331,998 | |||||||

|

|

|

|||||||

As of March 31, 2014, the following properties have been pledged as collateral under this mortgage note payable: West Gonzales, West Beach, Dalton Lane, Keysville Road, Colding Loop, Trapnell Road, 38th Avenue and Sequoia Street.

Line of Credit

In May 2012, we obtained a $4.8 million revolving line of credit with MetLife that matures on April 5, 2017 (the “Credit Facility”). Our obligations under the Credit Facility are collateralized by a mortgage on San Andreas. The interest rate charged on the advances under the Credit Facility is equal to the three-month London Interbank Offered Rate (“LIBOR”) in effect at the beginning of each calendar quarter plus 3.00%, with a minimum annualized rate of 3.25%. We may use advances under the Credit Facility for both general corporate purposes and the acquisition of new properties.

As of both March 31, 2014, and December 31, 2013, there was $0.1 million outstanding under the Credit Facility, which is the minimum balance required, and approximately $4.7 million of availability from which we may draw. Due to the revolving nature of a line of credit, the carrying value of our Credit Facility of $0.1 million as of both March 31, 2014, and December 31, 2013, is deemed to approximate fair value.

NOTE 6. STOCKHOLDERS’ EQUITY

The following table summarizes the changes in our stockholders’ equity for the three months ended March 31, 2014:

| Common Stock | Distributions in Excess of Earnings |

Total Stockholders’ Equity |

||||||||||||||||||

| Number of Shares |

Par Value | Additional Paid-in Capital |

||||||||||||||||||

| Balance at December 31, 2013 |

6,530,264 | $ | 6,530 | $ | 51,326,262 | $ | (2,820,800 | ) | $ | 48,511,992 | ||||||||||

| Net income |

— | — | — | 20,918 | 20,918 | |||||||||||||||

| Distributions |

— | — | — | (587,724 | ) | (587,724 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Balance at March 31, 2014 |

6,530,264 | $ | 6,530 | $ | 51,326,262 | $ | (3,387,606 | ) | $ | 47,945,186 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

2013 Initial Public Offering

On January 28, 2013, we priced our initial public offering (“IPO”) of 3,333,334 shares of our common stock at a public offering price of $15.00 per share, which closed on January 31, 2013. Including the underwriters’ option to cover over-allotments, which was exercised on February 19, 2013, we issued a total of 3,780,264 shares, resulting in gross proceeds of $56.7 million and net proceeds, after deducting underwriting discounts and offering expenses borne by us, of approximately $51.3 million. As of March 31, 2014, $37.9 million of these proceeds have been invested in new property acquisitions, and an additional $1.7 million has been expended or accrued for capital improvements on existing properties. In addition, as of March 31, 2014, $10.3 million has been used to pay distributions to our stockholders, and a portion was used for other general corporate purposes. As of March 31, 2014, there were no significant uninvested proceeds remaining from our IPO.

19

Distributions

Our Board of Directors declared and paid the following monthly distributions to common stockholders during the three months ended March 31, 2014 and 2013:

| For the Three Months Ended March 31, |

Distributions per Common Share |

|||

| 2014 |

$ | 0.09 | ||

| 2013 |

0.08 | |||

A portion of the distributions paid during the three months ended March 31, 2013, related to the $9.6 million of accumulated earnings and profits from prior years we had to pay out by the end of the year for which we elect to be taxed as a REIT, as explained further below. We will provide information related to the federal income tax characterization of our 2014 distributions in an IRS Form 1099-DIV, which will be issued to our stockholders in January 2015.

Registration Statement

We filed a registration statement on Form S-3 (File No. 333-194539) with the SEC on March 13, 2014, which the SEC declared effective on April 2, 2014. The registration statement permits us to issue up to an aggregate of $300.0 million in securities, consisting of common stock, senior common stock, preferred stock, subscription rights, debt securities and warrants to purchase common stock, including through a combined offering of two or more of such securities.

REIT Election and Accumulated Earnings and Profits

We intend to elect to be taxed as a REIT for federal income tax purposes for the year ended December 31, 2013, which election will be made when we file our 2013 federal income tax return later this year. To qualify as a REIT for 2013, we were required to distribute our non-REIT accumulated earnings and profits by December 31, 2013. We believe that our non-REIT accumulated earnings and profits were approximately $9.6 million as of December 31, 2013, before taking into account any stockholder distributions during 2013. By paying out $9.7 million in distributions to stockholders during 2013, we believe that we have fully distributed all accumulated earnings and profits from prior years.

The amount of accumulated earnings and profits of $9.6 million from prior years included approximately $4.0 million of earnings and profits associated with deferred intercompany gains, described elsewhere in this Form 10-Q, that, upon our expected REIT election later this year, we will recognize effective as of December 31, 2012, for federal income tax purposes. Accordingly, the resulting federal income tax from such gain recognition will be due at the time of our expected REIT election later this year.

NOTE 7. EARNINGS PER SHARE OF COMMON STOCK

The following table sets forth the computation of basic and diluted earnings per common share for the three months ended March 31, 2014 and 2013. Earnings per share is computed using the weighted average number of shares outstanding during the respective periods.

| For the Three Months Ended March 31, | ||||||||

| 2014 | 2013 | |||||||

| Net income |

$ | 20,918 | $ | 47,516 | ||||

| Weighted average shares of common stock outstanding - basic and diluted |

6,530,264 | 5,249,898 | ||||||

|

|

|

|

|

|||||

| Basic and diluted earnings per common share |

$ | 0.00 | $ | 0.01 | ||||

|

|

|

|

|

|||||

NOTE 8. COMMITMENTS AND CONTINGENCIES

In connection with the execution of a new lease on Colding Loop in May 2013, we were required to install new wells and irrigation equipment on 121 of the 181 total farmable acres on the property. The installation of the new wells and irrigation equipment on these acres was completed in January 2014 at a total cost of $616,071. In addition, if the tenant notifies us of their intention to fully utilize the remaining 60 acres of the property, we will be required to install new irrigation equipment to cover the additional 60 acres, which is estimated to cost approximately $83,000.

20

Coinciding with the extension of the lease on West Beach, we entered into an agreement with the tenants on the farm to provide oversight on certain capital improvements that will serve to protect the property against future flooding. The cost of these improvements, which we expect to be between $200,000 and $250,000, will be borne by us and will take place over the next year. In addition, under the terms of the agreement with our tenants, we are required to pay them $46,000 for their oversight role, to be paid in two equal installments over the course of the next year. These capital improvements are currently underway, and, as of March 31, 2014, we have expended or accrued approximately $55,000 related to these improvements.

NOTE 9. SUBSEQUENT EVENTS

Distributions

On April 8, 2014, our Board of Directors declared the following monthly cash distributions to common stockholders:

| Record Date |

Payment Date | Distribution per Common Share |

||||||

| April 21, 2014 |

April 30, 2014 | $ | 0.03 | |||||

| May 20, 2014 |

May 30, 2014 | 0.03 | ||||||

| June 19, 2014 |

June 30, 2014 | 0.03 | ||||||

|

|

|

|||||||

| Total: | $ | 0.09 | ||||||

|

|

|

|||||||

21

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

All statements contained herein, other than historical facts, may constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These statements may relate to, among other things, future events or our future performance or financial condition. In some cases, you can identify forward-looking statements by terminology such as “may,” “might,” “believe,” “will,” “provided,” “anticipate,” “future,” “could,” “growth,” “plan,” “intend,” “expect,” “should,” “would,” “if,” “seek,” “possible,” “potential,” “likely” or the negative of such terms or comparable terminology. These forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our business, financial condition, liquidity, results of operations, funds from operations or prospects to be materially different from any future business, financial condition, liquidity, results of operations, funds from operations or prospects expressed or implied by such forward-looking statements and include, but are not limited to:

| • | Changes in our industry, interest rates or the general economy; |

| • | Natural disasters or climactic changes impacting the regions in which our tenants operate; |

| • | The degree and nature of our competition; |

| • | Changes in our business strategy; and |

| • | Loss of our key personnel. |

For further information about these and other factors that could affect our future results, please see the captions titled “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2013. We caution readers not to place undue reliance on any such forward-looking statements, which are made pursuant to the Private Securities Litigation Reform Act of 1995 and, as such, speak only as of the date made. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, after the date of this Quarterly Report on Form 10-Q, except as required by law.

All references to “we,” “our,” “us” and the “Company” in this Quarterly Report mean Gladstone Land Corporation and its consolidated subsidiaries, except where it is made clear that the term refers only to Gladstone Land Corporation.

OVERVIEW

General

We are an externally-managed real estate company that currently owns 21 farms: 8 in California, 6 in Florida, 4 in Michigan, 2 in Oregon and 1 in Arizona. These farms are currently leased to 16 separate tenants that are either corporate or independent farmers. We intend to acquire more farmland in these and other states in our regions of focus that is or will be leased to farmers, and we expect that most of our future tenants will be medium-sized independent farming operations or large corporate farming operations that are unrelated to us. We may also acquire property related to farming, such as cooling facilities, freezer buildings, packing houses, box barns, silos, storage facilities, green houses, processing plants, packing buildings and distribution centers. We generally lease our properties under triple-net leases, an arrangement under which the tenant maintains the property while paying the related taxes, maintenance and insurance costs, as well as rent to us. We may also elect to sell farmland at certain times, such as when the land could be developed by others for urban or suburban uses.

To a lesser extent, we may provide senior secured first-lien mortgages to farmers for the purchase of farmland and farm-related properties. We expect that any mortgages we make would be secured by farming properties that have been in operation for over five years with a history of crop production and profitable farming operations. We have not currently identified any properties for which to make loans secured by properties.