As filed with the Securities and Exchange Commission on November 5, 2014

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form S-11

FOR

REGISTRATION

UNDER

THE SECURITIES ACT OF 1933

OF SECURITIES OF CERTAIN REAL ESTATE COMPANIES

GLADSTONE

LAND CORPORATION

(Exact Name of Registrant as Specified in its Governing Instruments)

1521 Westbranch Drive, Suite 100

McLean, Virginia 22102

(703) 287-5800

(Address, Including Zip Code, and Telephone Number, including Area Code, of Registrant’s Principal Executive Offices)

David Gladstone

Chairman, Chief Executive Officer and President

Gladstone Land Corporation

1521 Westbranch Drive, Suite 100

McLean, Virginia 22102

(703) 287-5800

(703) 287-5801 (facsimile)

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

Copies to:

|

| Lori B. Morgan, Esq.

Bass, Berry & Sims PLC

150 Third Avenue South, Suite 2800

Nashville, Tennessee 32701

Telephone: (615) 742-6280

Facsimile: (615) 742-2780 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the Securities being registered on this Form are to be offered on a

delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and

list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act

registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act

registration statement number of the earlier effective registration statement for the same offering. ¨

If delivery of the prospectus is expected to be made pursuant to Rule 434, check the following

box. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check

one):

|

|

|

|

|

|

|

| Large accelerated filer |

|

¨ |

|

Accelerated filer |

|

¨ |

|

|

|

|

| Non-accelerated filer |

|

x (Do not check if a smaller reporting company) |

|

Smaller reporting company |

|

¨ |

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

| |

| Title of Each Class of

Securities to be Registered |

|

Proposed

Maximum Aggregate

Offering Price (1)(2) |

|

Amount of

Registration Fee (1)(2) |

| Common Stock, $0.001 par value per share |

|

$35,000,000 |

|

$4,067 |

| |

| |

| (1) |

Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(o) under the Securities Act, as amended. |

| (2) |

Includes shares the underwriters have the option to purchase to cover allotments, if any. |

The Registrant hereby amends

this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in

accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell

these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the

offer or sale is not permitted.

SUBJECT TO COMPLETION DATED NOVEMBER 5, 2014

PRELIMINARY PROSPECTUS

Shares of

Common Stock

We are an externally-managed real estate company formed to engage in the business of owning and leasing farmland located in major agricultural markets

throughout the United States. We are offering shares of common stock, par value $0.001 per share, in this offering. Our common stock is traded on the

NASDAQ Global Select Market under the symbol “LAND.” The closing price of our common stock on November 4, 2014, was $11.41 per share.

We

believe that we qualify, and have elected to be taxed as, a real estate investment trust, or REIT, for federal income tax purposes. To assist us in complying with certain federal income tax requirements applicable to REITs, among other purposes, our

charter contains certain restrictions relating to the ownership and transfer of our capital stock, including an ownership limit of 3.3% in value or number of shares, whichever is more restrictive, of the outstanding shares of our common stock by any

person.

We are an “emerging growth company” under applicable federal securities laws, and, as such, we are subject to reduced public company reporting

requirements. Investing in shares of our common stock involves substantial risks that are described in the “Risk Factors” section beginning on page 14 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the

adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

|

|

|

|

|

|

|

|

|

| |

|

Per

Share |

|

|

Total |

|

| Public Offering Price |

|

$ |

|

|

|

$ |

|

|

| Underwriting Discount (1) |

|

$ |

|

|

|

$ |

|

|

| Proceeds, before expenses, to us |

|

$ |

|

|

|

$ |

|

|

| (1) |

See “Underwriting” for information concerning certain expense reimbursement to the underwriters. |

We

have granted the underwriters an option to purchase up to additional shares of common stock from us at the public offering price, less the underwriting

discount, within 30 days from the date of this prospectus to cover over-allotments, if any. If the underwriters exercise this option in full, the total public offering amount will be $ , the total

underwriting discounts and commissions payable by us will be $ and our total proceeds, before expenses, will be $ .

The underwriters expect to deliver the shares of common stock on or about , 2014.

The date of this prospectus is , 2014

GLADSTONE LAND CORPORATION

TABLE OF CONTENTS

You should rely only upon the information contained and incorporated by reference in this prospectus and any free writing

prospectus provided or approved by us. We have not, and the underwriters have not, authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely upon it.

We are not, and the underwriters are not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the

time of delivery of this prospectus or of any sale of shares of our common stock. You should assume that the information appearing in the documents incorporated by reference in this prospectus is accurate only as of the respective dates of those

documents or another date specified therein. Our business, financial condition and prospectus may have changed since such dates.

PROSPECTUS SUMMARY

This summary highlights the material information in this prospectus. Because it is a summary, it may not contain all the information that you should

consider before investing in our common stock. To fully understand this offering, you should carefully read this entire prospectus, including the more detailed information set forth under the caption “Risk Factors,” the historical and pro

forma financial statements, including the related notes thereto, incorporated by reference into or appearing elsewhere in this prospectus, and any free writing prospectus provided or approved by us, and the information incorporated by reference in

this prospectus, before investing in our common stock. Unless otherwise expressly stated or the context otherwise requires, all information presented in this prospectus assumes that the underwriters’ over-allotment option to purchase additional

shares is not exercised.

Unless the context otherwise requires or indicates, each reference in this prospectus to (i) “we,”

“our,” “us” and the “Company” means Gladstone Land Corporation, a Maryland corporation, and its consolidated subsidiaries, (ii) “Operating Partnership” means Gladstone Land Limited Partnership, a

wholly-owned subsidiary of the Company and a Delaware limited partnership, (iii) “Adviser” means Gladstone Management Corporation, the external adviser of the Company and a Delaware corporation, and (iv) “Administrator”

means Gladstone Administration, LLC, the external administrator to the Company and a Delaware limited liability company.

Gladstone Land

Corporation

We are an externally-managed real estate company formed to engage in the business of owning and leasing farmland located in major

agricultural markets throughout the United States. Our farmland is predominantly concentrated in locations where tenants are able to grow annual row crops such as berries, lettuce and melons, among others, which are planted and harvested annually or

more frequently. We may also acquire property related to farming, such as storage facilities utilized for cooling crops, processing plants, packaging buildings and distribution centers. We completed our initial public offering on January 28, 2013

with 1,630 acres on twelve farms, leased to six separate corporate and independent farmer tenants, in California and Florida. At that time, we also owned two storage facilities utilized for cooling crops (“coolers”) and a facility utilized

for storage and assembly of boxes for shipping (“box barn”). As of the date of this prospectus, we own 8,039 acres on 32 farms: 14 in California, 9 in Florida, 4 in Michigan, 4 in Oregon and 1 in Arizona. We also own three coolers and a

box barn.

As of September 30, 2014, these properties are leased to 25 separate tenants that are either corporate or independent farmers. We also

lease a small parcel on our 653-acre farm near Oxnard, California, or West Gonzales, to an oil company. While our farmland has predominantly been concentrated in locations where tenants are able to grow annual row crops, during 2013 and continuing

in 2014, we began to diversify the variety of crops grown on our properties, and now own several farms with more permanent crops, such as blueberries, as well as one farm that grows grains, such as corn and beans. While our focus remains on annual

row crops, in the future, we may acquire additional land farmed for fruit or nut trees, bushes, wine berries and wine grapes, as well as land to grow grains. We may also acquire more property related to farming such as coolers, freezer buildings,

box barns, silos, storage facilities, green houses, processing plants, packaging buildings and distribution centers. We may also acquire more property related to farming, such as coolers, freezer buildings, box barns, silos, storage facilities,

green houses, processing plants, packaging buildings and distribution centers.

1

The table below sets forth information regarding our current portfolio of properties as of the date of this

prospectus:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Property Name |

|

Location |

|

Date

Acquired |

|

Number

of

Farms |

|

|

Total

Acres |

|

|

Farmable

Acres |

|

|

Net Cost

Basis(1) |

|

|

Current

Fair

Value |

|

| San Andreas |

|

Watsonville, CA |

|

6/16/1997 |

|

|

1 |

|

|

|

307 |

|

|

|

238 |

|

|

$ |

4,836,147 |

|

|

$ |

10,700,000 |

(2) |

| West Gonzales |

|

Oxnard, CA |

|

9/15/1998 |

|

|

1 |

|

|

|

653 |

|

|

|

502 |

|

|

|

12,241,930 |

|

|

|

49,900,000 |

(2) |

| West Beach |

|

Watsonville, CA |

|

1/3/2011 |

|

|

3 |

|

|

|

196 |

|

|

|

195 |

|

|

|

8,406,970 |

|

|

|

9,150,000 |

(2) |

| Dalton Lane |

|

Watsonville, CA |

|

7/7/2011 |

|

|

1 |

|

|

|

72 |

|

|

|

70 |

|

|

|

2,706,126 |

|

|

|

2,959,000 |

(4) |

| Keysville Road |

|

Plant City, FL |

|

10/26/2011 |

|

|

2 |

|

|

|

59 |

|

|

|

50 |

|

|

|

1,230,757 |

|

|

|

1,498,000 |

(4) |

| Colding Loop |

|

Wimauma, FL |

|

8/9/2012 |

|

|

1 |

|

|

|

219 |

|

|

|

181 |

|

|

|

3,924,951 |

|

|

|

4,300,000 |

(2) |

| Trapnell Road |

|

Plant City, FL |

|

9/12/2012 |

|

|

3 |

|

|

|

124 |

|

|

|

110 |

|

|

|

4,146,807 |

|

|

|

4,806,500 |

(2) |

| 38th Avenue |

|

Covert, MI |

|

4/5/2013 |

|

|

1 |

|

|

|

119 |

|

|

|

89 |

|

|

|

1,451,684 |

|

|

|

1,411,000 |

(4) |

| Sequoia Street |

|

Brooks, OR |

|

5/31/2013 |

|

|

1 |

|

|

|

218 |

|

|

|

206 |

|

|

|

3,156,674 |

|

|

|

3,135,000 |

(4) |

| Natividad Road |

|

Salinas, CA |

|

10/21/2013 |

|

|

1 |

|

|

|

166 |

|

|

|

166 |

|

|

|

7,417,364 |

|

|

|

7,607,000 |

(4) |

| 20th Avenue |

|

South Haven, MI |

|

11/5/2013 |

|

|

3 |

|

|

|

151 |

|

|

|

94 |

|

|

|

1,901,569 |

|

|

|

1,985,000 |

(3) |

| Broadway Road |

|

Moorpark, CA |

|

12/16/2013 |

|

|

1 |

|

|

|

60 |

|

|

|

60 |

|

|

|

2,957,471 |

|

|

|

3,000,000 |

(3) |

| Oregon Trail |

|

Echo, OR |

|

12/27/2013 |

|

|

1 |

|

|

|

1,895 |

|

|

|

1,640 |

|

|

|

14,011,872 |

|

|

|

13,855,000 |

(3) |

| East Shelton |

|

Willcox, AZ |

|

12/27/2013 |

|

|

1 |

|

|

|

1,761 |

|

|

|

1,320 |

|

|

|

7,798,747 |

|

|

|

7,900,000 |

(2) |

| Collins Road |

|

Clatskanie, OR |

|

5/30/2014 |

|

|

2 |

|

|

|

200 |

|

|

|

157 |

|

|

|

2,560,286 |

|

|

|

2,591,333 |

(3) |

| Spring Valley |

|

Watsonville, CA |

|

6/13/2014 |

|

|

1 |

|

|

|

145 |

|

|

|

110 |

|

|

|

5,914,002 |

|

|

|

5,900,000 |

(3) |

| McIntosh Road |

|

Dover, FL |

|

6/20/2014 |

|

|

2 |

|

|

|

94 |

|

|

|

78 |

|

|

|

2,560,062 |

|

|

|

2,666,000 |

(3) |

| Naumann Road |

|

Oxnard, CA |

|

7/23/2014 |

|

|

1 |

|

|

|

68 |

|

|

|

64 |

|

|

|

6,879,182 |

|

|

|

6,888,500 |

(3) |

| Sycamore Road |

|

Arvin, CA |

|

7/25/2014 |

|

|

1 |

|

|

|

326 |

|

|

|

322 |

|

|

|

5,954,079 |

|

|

|

5,800,000 |

(3) |

| Wauchula Road |

|

Duette, FL |

|

9/29/2014 |

|

|

1 |

|

|

|

808 |

|

|

|

590 |

|

|

|

13,888,500 |

|

|

|

13,765,000 |

(3) |

| Santa Clara Avenue |

|

Oxnard, CA |

|

10/29/2014 |

|

|

2 |

|

|

|

333 |

|

|

|

332 |

|

|

|

24,592,000 |

|

|

|

24,592,000 |

(3) |

| Dufau Road |

|

Oxnard, CA |

|

11/4/2014 |

|

|

1 |

|

|

|

65 |

|

|

|

64 |

|

|

|

6,125,600 |

|

|

|

6,125,600 |

(3) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

32 |

|

|

|

8,039 |

|

|

|

6,638 |

|

|

$ |

144,662,780 |

|

|

$ |

190,534,933 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) |

Consists of the initial acquisition price (including the costs allocated to both tangible and intangible assets), plus subsequent improvements and other capitalized costs associated with the properties, and

adjusted for depreciation and amortization accumulated through September 30, 2014. As Santa Clara Avenue and Dufau Road were acquired subsequent to September 30, 2014, the net cost basis and current fair value were both included as the

purchase price. |

| (2) |

Represents values based on third-party appraisals performed between January 2014 and October 2014. |

| (3) |

Valued at the purchase price paid. |

| (4) |

Represents values as determined by an internal valuation process. |

2

We generally lease our properties under triple-net leases, an arrangement under which the tenant pays rent

to us and maintains the property while paying the related taxes, maintenance and insurance costs. We may also elect to sell farmland at certain times, such as when the land could be developed by others for urban or suburban uses. We do not currently

intend to enter the business of growing, packing or marketing farmed products; however, if we do so in the future, we expect that we would conduct such business through a taxable REIT subsidiary, or TRS.

To a lesser extent, we may, without the consent of stockholders, provide senior secured first lien mortgage loans to farmers for the purchase of farmland and

farm-related properties. We expect that any mortgage loans we make would be secured by farming properties that have a successful history of crop production and profitable farming operations and that, over time, such mortgages would not exceed 5.0%

of the fair value of our total assets. Currently, we do not hold any mortgages, and we have not identified any properties for which to make loans secured by mortgages.

Our business is managed by our external adviser, Gladstone Management Corporation, or our Adviser, which is an affiliated registered investment adviser under

the Investment Advisers Act of 1940, or the Advisers Act. Our Adviser is responsible for managing our business on a daily basis and for identifying and making acquisitions and dispositions that it believes satisfies our investment criteria.

Administrative services are provided to us by Gladstone Administration, LLC, or our Administrator, also an affiliate of ours and our Adviser. Our Adviser and our Administrator are owned and controlled by David Gladstone, our chief executive officer,

president, chairman of our board of directors and our largest stockholder.

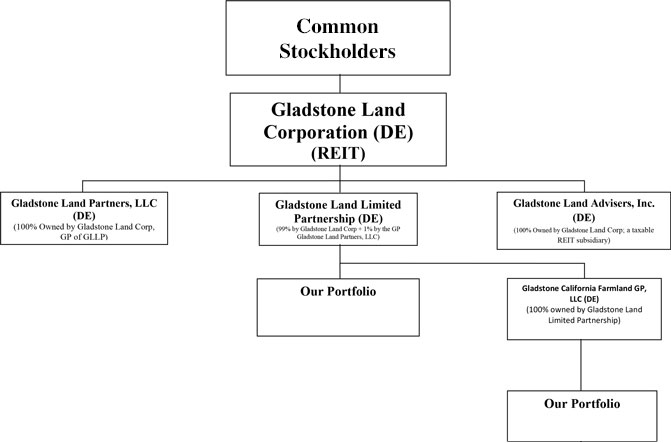

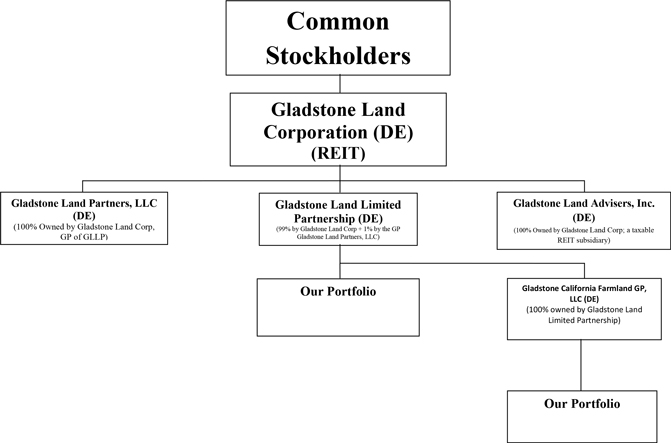

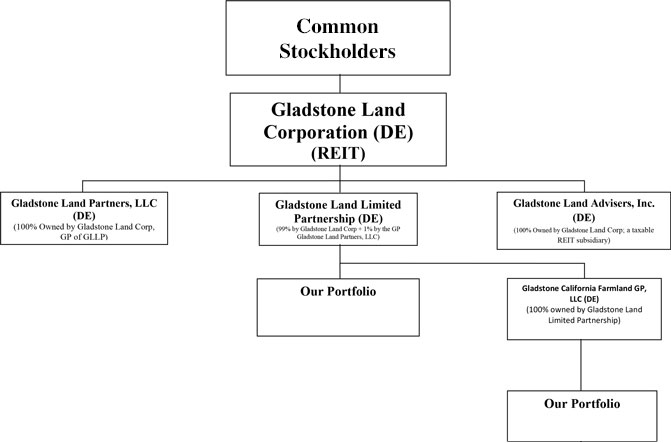

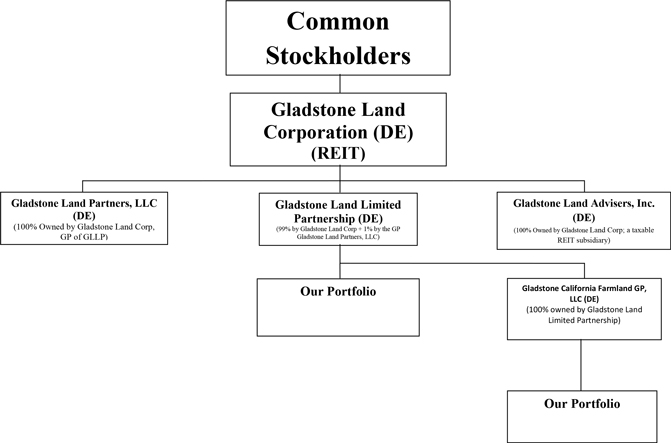

We conduct our business through an Umbrella Partnership Real Estate Investment

Trust, or UPREIT, structure in which our properties and the mortgage loans we make will be held directly or indirectly by Gladstone Land Limited Partnership, our Operating Partnership. We are the manager and 100% owner of Gladstone Land Partners,

LLC, or Land Partners, which is the sole general partner of our Operating Partnership, and we currently hold, directly and indirectly through Land Partners, 100% of its outstanding limited partnership units, or Units. In the future, we may offer

equity ownership in our Operating Partnership by issuing Units to farmland owners from time to time in consideration for acquiring their farms. Holders of Units in our Operating Partnership will be entitled to redeem these units for cash or, at our

election, shares of our common stock on a one-for-one basis at any time after holding the Units for one year. Farmland owners who exchange their farms for Units may be able to do so in a tax-deferred exchange under U.S. federal income tax laws.

The Operating Partnership is the sole member of our subsidiary, Gladstone Land Advisers, Inc., or Land Advisers, which has elected to be a TRS. We may own or

manage our assets and engage in other activities through Land Advisors or another TRS we form or acquire when we deem it necessary or advisable. The taxable income generated by any TRS will be subject to regular corporate income tax. Currently, we

do not conduct any operations through a TRS.

Our Objectives and Our Strategy

Our principal business objective is to maximize stockholder returns through a combination of: (1) monthly cash distributions to our stockholders;

(2) sustainable long-term growth in cash flows from increased rents, which we hope to pass on to stockholders in the form of increased distributions; (3) appreciation of our land; and (4) capital gains derived from the sale of our

properties. Our primary strategy to achieve our business objective is to invest in a diversified portfolio of triple-net leased farmland and properties related to farming operations. We are actively seeking and evaluating other farm properties for

potential purchase, and we currently have one property under a signed purchase and sale agreement for a proposed purchase price amount of $3.8 million. All potential acquisitions will be subject to due diligence investigations, and there can be no

assurance that we will be successful in identifying or acquiring any properties in the future. This strategy includes the following components:

| |

• |

|

Owning Farms and Farm-Related Real Estate for Income. We own and intend to acquire farmland and lease it to corporate and independent farmers, including sellers who desire to continue farming the land after we

acquire the property from them. We expect to hold acquired properties for many years and to generate stable and increasing rental income from leasing these properties. |

| |

• |

|

Owning Farms and Farm-Related Real Estate for Appreciation. We intend to lease acquired properties over the long term. However, from time to time we may sell one or more properties if we believe it to be in the

best interests of our stockholders. Potential purchasers may include real estate developers desiring to develop the property or financial purchasers seeking to acquire property for investment purposes. Accordingly, we will seek to acquire properties

that we believe have potential for long-term appreciation in value. |

3

| |

• |

|

Continue Expanding our Operations Geographically. While our properties are currently located in five states across the U.S., we expect that we will acquire properties in other farming locations in the

future. We believe the Southeast and Mid-Atlantic regions of the United States, specifically, states such as Georgia, North Carolina and New Jersey, offer attractive locations for expansion. We also expect to seek farmland acquisitions in the

Midwest and may also expand into other areas in the United States. |

| |

• |

|

Continue Expanding our Crop Varieties. Currently, the majority of tenants who farm our properties grow row crops dedicated to produce, such as lettuce and tomatoes, and berries, such as strawberries and

raspberries. While we have begun expanding into longer-term crops, such as blueberries, as well as into grains, in the future, we will seek to continue expanding into other crops, such as wheat, rice and corn, and into tree and vine crops, such as

nuts and fruits. |

| |

• |

|

Using Leverage. To make more investments than would otherwise be possible, we intend to continue to borrow through loans secured by long-term mortgages on our properties, and we may also borrow funds on a

short-term basis or incur other indebtedness. |

| |

• |

|

Owning Mortgages on Farms and Farm-Related Real Estate. In circumstances where our purchase of farms and farm-related properties is not feasible, we may provide the owner of the property with a mortgage loan

secured by the property along with an option to sell the property to us in the future at a predetermined price. We do not expect that, over time, our mortgages held will exceed 5.0% of the fair value of our total assets. |

| |

• |

|

Joint Ventures. Some of our investments may be made through joint ventures that would permit us to own interests in large properties without restricting the diversity of our portfolio. |

Our Competitive Strengths

We believe that the following

strengths differentiate us from our competitors:

| |

• |

|

Innovative Business Strategy: First public company formed primarily to own and lease farmland with the goal of providing investors with steady income and capital appreciation, as well as a hedge against

inflation. |

| |

• |

|

Experienced Management Team: We are managed by an investment advisor registered with the SEC with over $1.5 billion of assets currently under management. Our management team has a successful track record of

underwriting agricultural real estate and conducting extensive due diligence on the management teams, cash flows, financial statements and risk ratings of our respective tenants. In addition, our chief executive officer has unique industry knowledge

as a former owner of Coastal Berry Company (from 1997-2004) — one of the largest integrated berry and vegetable growers, marketers, and shippers in California. |

| |

• |

|

Focused Business Model: Our business model seeks to foster investment opportunities that are generated from our strategic relationships with agricultural real estate brokers and corporate and independent farmers.

|

| |

• |

|

Attractive Market Opportunities: We believe that attractive investment opportunities currently exist that will allow us to capitalize on investing in farmland that has demonstrated relatively steady appreciation

in value and increases in rental rates with relatively low volatility. |

| |

• |

|

Conservative Dual Underwriting Strategy: When underwriting a tenant’s farming operations and the real estate it occupies, we focus on the cash flow of the tenant and management of the farming operations as

well as the intrinsic value of the property, including evaluation of access to water and other attributes. |

| |

• |

|

Proven Ability to Execute Business Model: Since our initial public offering, or IPO, in January 2013, we have invested $106.6 million into the acquisition of 20 new farms, and an additional $3.0 million

has been invested in the form of capital improvements on existing farms. |

| |

• |

|

Distribution Stability: Since our IPO in January 2013, we have made 21 consecutive monthly distributions on our common stock. We currently pay monthly distributions (declared quarterly) to holders of shares of

our common stock at the current rate of $0.03 per share. |

4

Our Investment Pipeline

Our pipeline currently consists of one property under a signed purchase and sale agreement for a proposed purchase price amount of $3.8 million, and we have

submitted indications of interest for nine properties for an aggregate amount of approximately $73.0 million. We also have several other properties that are still in their initial review stages.

Agricultural Leases

We anticipate that most of our

agricultural leases for properties growing row crops will continue to have initial terms ranging from 3 to 10 years, often with options to extend the lease further, and will be payable semi-annually, at a fixed rate, with one-half due at the

beginning of the year and the other half due later in the year. We anticipate that most of our agricultural leases for properties growing long-term plants, such as trees, bushes and vines, will have longer-term leases with similar payment terms.

Leases generally are on a triple-net basis, which means that, generally, the tenant is required to pay taxes, insurance (including drought insurance for properties that depend upon rain water for irrigation), water costs, maintenance and other

operating costs. Leases with longer terms, such as for five or more years, generally contain provisions, often referred to as escalation clauses, that provide for annual increases in the amounts payable by the tenants. The escalation clause may be a

fixed amount each year, or it may be variable based on standard cost of living figures. In addition, some long-term leases may require a regular survey of comparable land rents, with an adjustment to reflect the current rents. We have not and do not

expect to enter into leases that include variable rent based on the success of the harvest each year. Our current leases are generally on a triple-net basis with original lease terms ranging from 1 to 15 years.

5

We monitor our tenants’ credit quality on an ongoing basis by, among other things, conducting site

visits of the properties to ensure farming operations are taking place and to assess the general maintenance of the properties. To date, no changes to credit quality of our tenants have been identified and all tenants continue to pay pursuant to the

terms of their respective leases.

Agricultural Lease Expirations

Farm leases are often short-term in nature, so in any given year, we may have multiple leases up for renewal or extension. We had two agricultural leases that

were originally due to expire in 2014, one on 196 acres of farmland, which we refer to as West Beach, and one on 307 acres of farmland, which we refer to as San Andreas, both near Watsonville, California. However, during the nine months ended

September 30, 2014, we were able to re-lease both properties prior to the expiration of their leases and without any downtime. The two properties were re-leased for periods of 9 and 6 years, respectively, at rental rates representing an average

increase in minimum annualized straight-lined rental income of 26.0% over the previous leases. In aggregate, these properties accounted for approximately 6.6% of the total acreage owned as of September 30, 2014, and 14.1% and 14.5% of the total

rental income recorded for the three and nine months ended September 30, 2014, respectively.

We have one agricultural lease due to expire in 2015,

on 72 acres of farmland near Watsonville, California, which we refer to as Dalton Lane. We recently began negotiations regarding a lease renewal on this property, and we anticipate being able to renew the lease prior to its expiration on

October 31, 2015. In addition, given that the property is in the same region as the two new leases we recently executed, on West Beach and San Andreas, we expect to be able to renew the lease at a higher rental rate, compared to that of the

existing lease. However, there can be no assurance that we will be able to renew the lease at a rate favorable to us, if at all, or be able to find a replacement tenant for the lease, if necessary.

In addition, we also have a surface area lease with an oil company on eight acres of West Gonzales that is renewed on an annual basis and continues for so

long as the tenant continues to use its oil rights. Under the terms of the lease, the amount of rent owed increases on an annual basis commensurate with the rental increases per the agricultural lease in place on West Gonzales. This lease accounted

for approximately 0.4% and 0.5% of the rental income recorded during the three and nine months ended September 30, 2014.

Risk Factors

You should carefully consider the matters discussed in the “Risk Factors” section of this prospectus beginning on page 17 prior to deciding to

invest in our common stock. Some of the risks include:

| |

• |

|

Our real estate portfolio is concentrated in a limited number of properties, which subjects us to an increased risk of significant loss if any property declines in value or if we are unable to lease a property. As of

September 30, 2014, we own 29 farms, leased to 25 separate tenants. We are actively seeking and evaluating other farm properties to potentially purchase with the net proceeds we will receive from this offering, although we have not yet entered

into binding agreements to acquire these properties, and there is no guarantee that we will be able to acquire any of them. As a result, investors will be unable to evaluate the manner in which the net proceeds are invested and the economic merits

of projects prior to investment. |

| |

• |

|

As of September 30, 2014, one tenant, Dole Food Company, or Dole, is responsible for approximately 36% of our annualized generally accepted accounting principles in the U.S., or GAAP, straight-line rental revenue;

if Dole fails to make rental payments or elects to terminate its leases with us, it would have a material adverse effect on our financial performance and our ability to make distributions to our stockholders. |

| |

• |

|

We use leverage through borrowings under mortgage loans on our properties, and potentially other indebtedness, which will result in risks, including restrictions on additional borrowings and payment of distributions and

risk of loss of property securing a loan upon foreclosure. |

| |

• |

|

We may fail to maintain our qualification as a REIT for federal income tax purposes. We would then be subject to corporate level taxation and we would not be required to pay any distributions to our stockholders.

|

| |

• |

|

The Company is considered an “emerging growth company” and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make our common stock less attractive to

investors. |

6

| |

• |

|

There was no active public market for our common stock prior to the IPO and the market price and trading volume of our common stock has been volatile at times following the IPO and may continue to be so following this

offering, which may adversely impact the market for shares of our common stock and make it difficult to sell your shares. |

| |

• |

|

We have paid, may continue to pay, or may in the future pay distributions from offering proceeds, borrowings or the sale of assets to the extent our cash flow from operations or earnings are not sufficient to fund

declared distributions. Rates of distribution to you will not necessarily be indicative of our operating results. If we make distributions from sources other than our cash flows from operations or earnings, we will have fewer funds available for the

acquisition of properties and your overall return may be reduced. |

| |

• |

|

We currently lease many of our properties to medium-sized independent farming operations and agricultural businesses, which may have limited financial and personnel resources and, therefore, may be less stable than

larger companies, which could impact our ability to generate rental revenue. |

| |

• |

|

We are dependent upon our key management personnel for our future success, particularly David Gladstone and Terry Lee Brubaker. |

| |

• |

|

Conflicts of interest exist between us, our Adviser, its officers and directors and their affiliates, which could result in investment decisions that are not in the best interests of our stockholders. |

| |

• |

|

Our success will depend heavily on the performance of our Adviser. If our Adviser makes inadvisable investment or management decisions, our operations could be materially adversely impacted. |

7

The following diagram depicts our organizational structure.

Our Adviser

Our

business is managed by our Adviser, which is an affiliated registered investment adviser under the Advisers Act. Our Adviser is responsible for managing our business on a daily basis and for identifying and making acquisitions and dispositions that

it believes satisfies our investment criteria. Our Adviser does not directly acquire or lease real estate other than for its own use. Our Adviser does not and will not make loans to or investments in any company with which we have or intend to enter

into a lease, and we will not co-invest with our Adviser in any real estate transaction.

Each of our executive officers other than Lewis Parrish, our

chief financial officer, is also an officer of our Adviser and our Administrator. Each of our officers has significant experience in making investments in and lending to businesses of all sizes, including investing in real estate and making mortgage

loans. Including our officers, our Adviser and Administrator collectively employ over 60 professionals that are involved in structuring, arranging and managing investments on behalf of companies advised by our Adviser. We also rely on outside

professionals with agricultural experience that perform due diligence on the properties that we intend to acquire and lease. We are responsible for paying any fees charged by these outside professionals.

Under the terms of our amended and restated advisory agreement that went into effect on February 1, 2013, which we refer to as the Amended Advisory

Agreement, we pay an annual base management fee equal to a percentage of our adjusted stockholders’ equity, which is defined as our total stockholders’ equity at the end of each quarter less the recorded value of any preferred stock we may

issue. In 2014, we will pay a base management fee equal to 2.0% of our adjusted stockholders’ equity, which no longer excludes uninvested cash proceeds from the IPO.

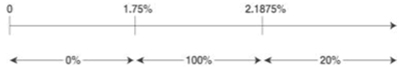

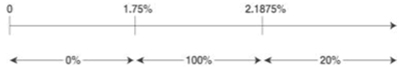

Under the terms of our Amended Advisory Agreement, we also pay an additional quarterly incentive fee based on our funds from operations, or FFO. For purposes

of calculating the incentive fee, our FFO before giving effect to any incentive fee, or our Pre-Incentive Fee FFO, will include any realized capital gains or losses, less any distributions paid on any preferred stock we may issue, but will not

include any unrealized capital gains or losses. The incentive fee will reward our Adviser if our Pre-Incentive Fee FFO for a particular calendar quarter exceeds a hurdle rate of 1.75%, or 7% annualized, of our total stockholders’ equity at the

end of the quarter.

8

We pay our Adviser an incentive fee with respect to our Pre-Incentive Fee FFO quarterly, as follows:

| |

• |

|

no incentive fee in any calendar quarter in which our Pre-Incentive Fee FFO does not exceed the hurdle rate of 1.75% (7% annualized); |

| |

• |

|

100% of the amount of the Pre-Incentive Fee FFO that exceeds the hurdle rate, but is less than 2.1875% in any calendar quarter (8.75% annualized); and |

| |

• |

|

20% of the amount of our Pre-Incentive Fee FFO that exceeds 2.1875% in any calendar quarter (8.75% annualized). |

Quarterly Incentive Fee Based on FFO

Pre-Incentive Fee FFO

(expressed as a percentage of total stockholders’ equity)

Percentage of Pre-Incentive Fee FFO allocated to the incentive fee

Our Administrator

Under the terms of the second amended

and restated administration agreement that went into effect on February 1, 2013, which we refer to as the Amended Administration Agreement, we pay for our allocable portion of the Administrator’s expenses incurred while performing services

to us, including, but not limited to, rent and the salaries and benefits expenses of our Administrator’s employees, including our chief financial officer, treasurer, chief compliance officer, general counsel and secretary (who also serves as

our Administrator’s president) and their respective staffs. From February 1, 2013, through June 30, 2014, our allocable portion of these expenses was derived by multiplying that portion of the Administrator’s expenses allocable

to all funds managed by the Adviser by the percentage of our total assets at the beginning of each quarter in comparison to the total assets of all funds managed by our Adviser.

As approved by our Board of Directors, effective July 1, 2014, our allocable portion of the Administrator’s expenses is now derived by multiplying

our Administrator’s total expenses by the approximate percentage of time the Administrator’s employees perform services for us in relation to their time spent performing services for all companies serviced by our Administrator under

similar contractual agreements.

Compensation of Our Adviser and Our Administrator

Set forth below is an estimate of all proposed compensation, fees, profits and other benefits, including reimbursement of out-of-pocket expenses that our

Adviser and our Administrator may receive in connection with this offering and our ongoing operations. We do not expect to make any payments to any other affiliates of our Adviser. For additional information with respect to the compensation of our

Adviser and our Administrator upon completion of this offering, see “Our Adviser and our Administrator – Amended Advisory Agreement – Compensation of our Adviser under the Amended Advisory Agreement” and “Our Adviser and our

Administrator – Amended Administration Agreement.”

9

|

|

|

|

|

| Type of Compensation

(Recipient) |

|

Description and Determination of Amount |

|

Estimated Amount |

|

|

Offering |

|

|

| Reimbursement of Offering Expenses (Adviser)(1) |

|

Offering expenses include all estimated expenses, other than underwriting discount, to be paid by us in connection with this offering, including our legal, accounting, printing, mailing and filing fees and other accountable offering

expenses. To the extent that our Adviser pays our offering expenses, we will reimburse our Adviser for these amounts. |

|

We anticipate paying for all offering costs incurred. |

|

|

|

|

|

Ongoing Operations |

|

|

| Annual Base Management Fee (Adviser) |

|

2.0% of our adjusted stockholders’ equity and our adjusted stockholders’ equity, measured at the end of each quarter and our adjusted stockholders’ equity, which does not exclude the uninvested cash proceeds of this

offering. |

|

Actual amount is dependent upon the amount of equity raised in this offering. |

|

|

|

| Quarterly Incentive Fee (2)(Adviser) |

|

We pay our Adviser an incentive fee with respect to our Pre-Incentive Fee FFO in each calendar quarter as follows:

• no incentive fee in

any calendar quarter in which our Pre-Incentive Fee FFO does not exceed the hurdle rate of 1.75% (7% annualized) of our adjusted stockholders’ equity at the end of the quarter; |

|

Actual amounts are dependent upon the amount of FFO we generate from time to time. |

|

|

• 100% of the amount of the Pre-Incentive Fee FFO that exceeds the hurdle rate, but is

less than 2.1875% of our adjusted stockholders’ equity at the end of any calendar quarter (8.75% annualized); and |

|

|

|

|

• 20% of the amount of our Pre-Incentive Fee FFO that exceeds 2.1875% of our adjusted

stockholders’ equity at the end of any calendar quarter (8.75% annualized). |

|

|

|

|

|

| Allocation of Administrator Overhead Expenses (3)(Administrator) |

|

We will pay our Administrator for our allocable portion of the Administrator’s overhead expenses in performing our obligations, including, but not limited to, our allocable portion of rent attributable to office space for

employees of the Administrator, and our allocable portion of the salaries and benefits expenses of our chief financial officer, treasurer, chief compliance officer, general counsel and secretary. Our allocable portion is derived by multiplying our

Administrator’s total expenses by the approximate percentage of time the Administrator’s employees perform services for us in relation to their time spent performing services for all companies serviced by our Administrator under similar

contractual agreements. |

|

Actual amounts will be dependent upon the expenses incurred by our Administrator and the percentage of time our Administrator’s employees spend on our maters in relation to their time spent on all companies serviced by our

Administrator. |

10

| (1) |

As of , 2014, we have incurred approximately

$ of expenses in connection with this offering. |

| (2) |

For purposes of calculating the incentive fee, our Pre-Incentive Fee FFO will include any realized capital gains or losses, less any dividends paid on our preferred stock, but Pre-Incentive Fee FFO will not include any

unrealized capital gains or losses. |

Examples of how the incentive fee would be calculated are as follows:

| |

• |

|

If our Pre-Incentive Fee FFO for a quarter were 1.75% or less of our adjusted stockholders’ equity, there would be no incentive fee because such FFO would not exceed the hurdle rate of 1.75%. |

| |

• |

|

In the event our Pre-Incentive Fee FFO for a quarter were equal to 2.00% of our adjusted stockholders’ equity, the incentive fee would be as follows: |

= 100% × (2.00% - 1.75%)

=

0.25% of adjusted stockholders’ equity

| |

• |

|

In the event our Pre-Incentive Fee FFO for a quarter were equal to 2.30% of our adjusted stockholders’ equity, the incentive fee would be as follows: |

= (100% × (“catch-up”: 2.1875% - 1.75%)) + (20% × (2.30% - 2.1875%))

= (100% × 0.4375%) + (20% × 0.1125%)

= 0.4375% + 0.0225%

= 0.46% of

our adjusted stockholders’ equity

| (3) |

Our Administrator is 100% owned by Gladstone Holding Corporation, which is also the 100% owner of our Adviser. |

Our Other Affiliates and Potential Conflicts of Interest

Gladstone Commercial Corporation. Each of our directors and each of our executive officers other than Lewis Parrish, our chief financial officer, is

also an executive officer or director of Gladstone Commercial Corporation, or Gladstone Commercial, a publicly held REIT whose common stock is traded on the NASDAQ Global Select Market under the trading symbol “GOOD.” Gladstone Commercial

invests in and owns net leased industrial, commercial and retail real property and selectively makes long-term industrial and commercial mortgage loans. Gladstone Commercial does not invest in or own agricultural real estate or make loans secured by

agricultural real estate and, therefore, Gladstone Commercial will not compete with us for investment opportunities.

Gladstone Capital

Corporation. Each of our directors and each of our executive officers, other than Mr. Parrish, is also an executive officer or director of Gladstone Capital Corporation, or Gladstone Capital, a publicly held closed-end management investment

company whose common stock is traded on the NASDAQ Global Market under the trading symbol “GLAD.” Gladstone Capital makes loans to and investments in small and medium-sized businesses. It does not buy or lease real estate and does not lend

to agricultural enterprises and, therefore, Gladstone Capital will not compete with us for investment opportunities. Gladstone Capital will not make loans to or investments in any company with which we have or intend to enter into a lease.

Gladstone Investment Corporation. Each of our directors and each of our executive officers, other than Mr. Parrish, is also executive an officer

or director of Gladstone Investment Corporation, or Gladstone Investment, a publicly held closed-end management investment company whose common stock is traded on the NASDAQ Global Market under the trading symbol “GAIN.” Gladstone

Investment makes loans to and investments in small and medium-sized businesses in connection with buyouts and other recapitalizations. It does not buy or lease real estate and does not lend to agricultural enterprises and, therefore, Gladstone

Investment will not compete with us for investment opportunities. Gladstone Investment will not make loans to or investments in any company with which we have or intend to enter into a lease.

We do not presently intend to co-invest with Gladstone Capital, Gladstone Commercial or Gladstone Investment in any business. However, in the future it may be

advisable for us to co-invest with one of these companies. If we decide to change our policy on co-investments with affiliates, we will seek approval of this decision from our independent directors.

11

Each of our executive officers other than Mr. Parrish, is also an officer and director of our Adviser,

Gladstone Capital, Gladstone Commercial and Gladstone Investment. Our Adviser and its affiliates, including our officers, may have conflicts of interest in the course of performing their duties for us. These conflicts may include:

| |

• |

|

Our Adviser may realize substantial compensation on account of its activities on our behalf; |

| |

• |

|

Our agreements with our Adviser are not arm’s-length agreements; |

| |

• |

|

We may experience competition with our affiliates for financing transactions; and |

| |

• |

|

Our Adviser and other affiliates could compete for the time and services of our officers and directors. |

Our Tax Status

We believe that we qualify, and have

elected to be treated as a REIT under the federal income tax laws beginning with our taxable year ended December 31, 2013. We believe that, beginning with such taxable year, we have been organized and have operated in such a manner as to

qualify for taxation as a REIT under the Internal Revenue Code of 1986, as amended, or the Code, and we intend to continue to operate in such a manner. No assurances can be given that our beliefs or expectations will be fulfilled, however, since

qualification as a REIT depends on our ability to satisfy numerous asset, income, stock ownership and distribution tests described below, the satisfaction of which depends, in part, on our operating results.

The sections of the Code relating to qualification, operation and taxation as a REIT are highly technical and complex. The following discussion sets forth only

the material aspects of those sections. This summary is qualified in its entirety by the applicable Code provisions and the related Treasury Regulations and administrative and judicial interpretations thereof.

As a REIT, we generally will not be subject to federal income tax on the taxable income that we distribute to our stockholders because we will be entitled to a

deduction for dividends that we pay. The benefit of that tax treatment is that it avoids the “double taxation,” or taxation at both the corporate and stockholder levels, that generally results from owning stock in a corporation. In

general, income generated by a REIT is taxed only at the stockholder level if such income is distributed by the REIT to its stockholders. We will be subject to federal tax, however, in the following circumstances:

| |

• |

|

We are subject to the corporate federal income tax on any REIT taxable income, including net capital gain, that we do not distribute to our stockholders during, or within a specified time period after, the calendar year

in which the income is earned. |

| |

• |

|

We may be subject to the corporate “alternative minimum tax” on any items of tax preference, including any deductions of net operating losses. |

| |

• |

|

We are subject to tax, at the highest corporate rate, on: |

| |

• |

|

net income from the sale or other disposition of property acquired through foreclosure (“foreclosure property”), as described under “Material U.S. Federal Income Tax Considerations — Gross Income

Tests — Foreclosure Property,” that we hold primarily for sale to customers in the ordinary course of business, and |

| |

• |

|

other non-qualifying income from foreclosure property. |

| |

• |

|

We are subject to a 100% tax on net income from sales or other dispositions of property, other than foreclosure property, that we hold primarily for sale to customers in the ordinary course of business.

|

| |

• |

|

If we fail to satisfy one or both of the 75% gross income test or the 95% gross income test, as described under “Material U.S. Federal Income Tax Considerations — Gross Income Tests,” but nonetheless

maintain our qualification as a REIT because we meet certain other requirements, we will be subject to a 100% tax on: |

| |

• |

|

the greater of the amount by which we fail the 75% gross income test or the 95% gross income test, in either case, multiplied by |

| |

• |

|

a fraction intended to reflect our profitability. |

12

| |

• |

|

If we fail to distribute during a calendar year at least the sum of: (1) 85% of our REIT ordinary income for the year, (2) 95% of our REIT capital gain net income for the year, and (3) any undistributed

taxable income required to be distributed from earlier periods, then we will be subject to a 4% nondeductible excise tax on the excess of the required distribution over the amount we actually distributed. |

| |

• |

|

If we fail any of the asset tests, other than a de minimis failure of the 5% asset test, the 10% vote test or the 10% value test, as described under “Material U.S. Federal Income Tax Considerations — Asset

Tests,” as long as (1) the failure was due to reasonable cause and not to willful neglect, (2) we file a description of each asset that caused such failure with the IRS, and (3) we dispose of the assets causing the failure or

otherwise comply with the asset tests within six months after the last day of the quarter in which we identify such failure, we will pay a tax equal to the greater of $50,000 or the highest federal corporate income tax rate (currently 35%)

multiplied by the net income from the nonqualifying assets during the period in which we failed to satisfy the asset tests. |

| |

• |

|

If we fail to satisfy one or more requirements for REIT qualification, other than the gross income tests and the asset tests, and such failure is due to reasonable cause and not to willful neglect, we will be required

to pay a penalty of $50,000 for each such failure. |

| |

• |

|

We will be subject to a 100% excise tax on transactions with a taxable REIT subsidiary that are not conducted on an arm’s-length basis. |

| |

• |

|

If we acquire any asset from a C corporation, or a corporation that generally is subject to full corporate-level tax, in a merger or other transaction in which we acquire a basis in the asset that is determined by

reference either to the C corporation’s basis in the asset or to another asset, we will pay tax at the highest corporate rate applicable if we recognize gain on the sale or disposition of the asset during the 10-year period after we acquire the

asset. The amount of gain on which we will pay tax generally is the lesser of: |

| |

• |

|

the amount of gain that we recognize at the time of the sale or disposition, and |

| |

• |

|

the amount of gain that we would have recognized if we had sold the asset at the time we acquired it. |

| |

• |

|

The earnings of our taxable REIT subsidiaries are subject to federal corporate income tax. |

In addition, we

may be subject to a variety of taxes, including payroll taxes and state, local and foreign income, property and other taxes on our assets and operations. We also could be subject to tax in situations and on transactions not presently contemplated.

To maintain our qualification as a REIT, we must meet a number of organizational and operational requirements, including a requirement that we annually

distribute at least 90% of our net income, excluding net capital gains, to our stockholders. As a REIT, we generally will not be subject to U.S. federal income tax on our net income that we distribute to our stockholders. If we fail to qualify

as a REIT in any taxable year, we will be subject to U.S. federal income tax at regular corporate rates. Even if we qualify for taxation as a REIT, we may be subject to some U.S. federal, state and local taxes on our income or property,

and the net income of any of our subsidiaries that qualifies as a TRS will be subject to taxation at normal corporate rates. In addition, we will be subject to regular corporate income tax for the taxable years ending prior to our qualification as a

REIT. See “Material U.S. Federal Income Tax Considerations.”

It is also possible that the federal income tax laws or regulations governing

REITs or the administrative interpretations of those laws or regulations might change in the future in a manner that might make it difficult or impossible for us to continue to qualify as a REIT.

Corporate Information

We were originally incorporated in

California on June 14, 1997 and have elected to be taxed as a real estate investment trust beginning with our tax year ended December 31, 2013. We were subsequently re-incorporated in Delaware on May 25, 2004 and finally

re-incorporated in Maryland on March 24, 2011. Our executive offices are located at 1521 Westbranch Drive, Suite 100, McLean, Virginia 22102. Our telephone number at our executive offices is (703) 287-5800 and our corporate website is

www.GladstoneLand.com. However, the information located on, or accessible from, our website is not, and shall not be deemed to be, a part of this prospectus, any accompanying prospectus supplement or any free writing prospectus or incorporated into

any other filings that we make with the SEC.

13

The Offering

|

|

|

| Issuer |

|

Gladstone Land Corporation |

|

|

| Common stock offered by us |

|

shares (or shares of common stock if

the underwriters exercise their overallotment option in full) |

|

|

| Common stock outstanding prior to this offering |

|

7,753,717 shares |

|

|

| Common stock to be outstanding after this offering |

|

shares |

|

|

| Use of proceeds |

|

We estimate that our net proceeds from this offering will be approximately (or approximately

if the underwriters exercise their over-allotment option in full) after deducting the underwriting discounts and commissions and

other estimated offering expenses payable by us. We intend to use the proceeds from this offering to fund pending and future property acquisitions, including those described under “Our Investment Pipeline,” repay debt and for other general

corporate purposes. See “Use of Proceeds.” |

|

|

| Dividends and Distributions |

|

We declare quarterly and pay monthly cash distributions to holders of our common stock at the current rate of $0.03 per share. Distributions are authorized and paid at the discretion of our Board of Directors and are based upon the

circumstances at the time of declaration. |

|

|

| Restriction on ownership |

|

To assist us in maintaining our qualification as a REIT for federal income tax purposes, among other purposes, ownership, actual or constructive, by any person of more than 3.3% in value of shares of our capital stock or 3.3% in

value or number (whichever is more restrictive) of shares of our common stock is restricted by our charter. This restriction may be waived by our Board of Directors in its sole and absolute discretion, prospectively or retroactively, upon the

satisfaction of certain conditions. See “Certain Provisions of Maryland Law and of our Charter and Bylaws.” |

|

|

| Risk factors |

|

An investment in shares of our common stock involves substantial risks, and prospective investors should carefully consider the matters discussed in the “Risk Factors” sections in this prospectus. |

|

|

| NASDAQ symbol |

|

“LAND” |

For additional information regarding stock, see “Description of Our Capital Stock.”

14

Summary Selected Consolidated Financial and Operating Data

You should read the summary financial information below in conjunction with “Management’s Discussion and Analysis of Financial Condition and

Results of Operations” and the financial statements, notes thereto and other financial information incorporated by reference into or included elsewhere in this prospectus. The summary of consolidated financial data as of December 31, 2013,

and December 31, 2012, and for the years ended December 31, 2013, and December 31, 2012, are derived from audited financial statements incorporated by reference into or included elsewhere in this prospectus. We have derived the

following summary of our balance sheet data as of September 30, 2014, and statement of operations data for the nine months ended September 30, 2014, and September 30, 2013, from our unaudited financial statements incorporated by

reference into or appearing later in this prospectus.

The unaudited financial data include, in the opinion of our management, all adjustments, consisting

only of normal recurring adjustments that are necessary for a fair presentation of our financial position and results of operations for these periods. Our historical results of operations are not necessarily indicative of results of operations that

should be expected in any future periods, and our results for any interim period are not necessarily indicative of the results that may be expected for a full fiscal year.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

As of and For the Nine |

|

|

As of and For the Years |

|

| |

|

Months Ended September 30, |

|

|

Ended December 31, |

|

| |

|

2014 |

|

|

2013 |

|

|

2013 |

|

|

2012 |

|

|

|

|

|

|

| Balance Sheet Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total real estate, net(1) |

|

$ |

113,945,180 |

|

|

$ |

42,069,990 |

|

|

$ |

75,622,247 |

|

|

$ |

37,351,944 |

|

| Total assets |

|

|

120,621,425 |

|

|

|

85,701,381 |

|

|

|

93,673,464 |

|

|

|

40,985,848 |

|

| Total borrowings |

|

|

57,345,598 |

|

|

|

29,589,165 |

|

|

|

43,154,165 |

|

|

|

30,817,880 |

|

| Total liabilities |

|

|

60,831,732 |

|

|

|

31,376,192 |

|

|

|

45,161,472 |

|

|

|

32,849,122 |

|

| Total stockholders’ equity |

|

|

59,789,693 |

|

|

|

54,325,189 |

|

|

|

48,511,992 |

|

|

|

8,136,726 |

|

|

|

|

|

|

| Operating Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Rental revenue |

|

|

4,828,033 |

|

|

|

2,860,435 |

|

|

|

4,027,687 |

|

|

|

3,390,594 |

|

| Operating income |

|

|

1,054,243 |

|

|

|

1,063,517 |

|

|

|

1,357,453 |

|

|

|

1,901,615 |

|

| Net (loss) income available to common stockholders |

|

|

(179,803 |

) |

|

|

82,633 |

|

|

|

(1,224,683 |

) |

|

|

600,373 |

|

| FFO available to common stockholders(2) |

|

|

885,966 |

|

|

|

591,743 |

|

|

|

(502,228 |

) |

|

|

1,074,853 |

|

| AFFO available to common stockholders(3) |

|

|

2,088,565 |

|

|

|

824,196 |

|

|

|

1,193,931 |

|

|

|

1,390,146 |

|

|

|

|

|

|

| Other Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Farms owned |

|

|

29 |

|

|

|

14 |

|

|

|

21 |

|

|

|

12 |

|

| Acres owned |

|

|

7,641 |

|

|

|

1,967 |

|

|

|

6,000 |

|

|

|

1,630 |

|

| Occupancy rate |

|

|

100.0 |

% |

|

|

100.0 |

% |

|

|

100.0 |

% |

|

|

100.0 |

% |

| |

(1) |

Consists of the initial acquisition price or properties acquired (including the costs allocated to both tangible and intangible assets), plus subsequent improvements and other capitalized costs associated with the

properties, and adjusted for accumulated depreciation and amortization. |

| |

(2) |

FFO is a term approved by the National Association of Real Estate Investment Trusts, or NAREIT. NAREIT developed FFO as a relative non-GAAP supplement measure of operating performance of an equity REIT to recognize that

income-producing real estate historically has not depreciated on the same basis determined under GAAP. We calculate FFO in accordance with NAREIT’s definition, which is net income (computed in accordance with GAAP), excluding gains or losses

from sales of property and impairment losses on property, plus depreciation and amortization of real estate assets, and after adjustments for unconsolidated partnerships and joint ventures. |

| |

(3) |

Adjusted FFO, or AFFO, is calculated by adjusting FFO for the following items: |

| |

• |

|

A net adjustment for the straight-lining of rents. This adjustment includes the removal of amortization related to above- and below-market lease values and to leasehold improvements, resulting in rental income

being reflected on a cash basis. |

| |

• |

|

Plus acquisition-related expenses. Acquisition-related expenses are incurred for investment purposes and do not correlate with the operations of our existing portfolio. Further, due to the inconsistency in which

these costs are incurred and how they are treated for accounting purposes, we believe the exclusion of these expenses improves comparability of our results on a period-by-period basis. |

| |

• |

|

Plus income tax provision. We have elected to be treated as a REIT for federal tax purposes beginning with our taxable year ended December 31, 2013. As a REIT, we generally will not be subject to federal

income taxes on amounts distributed to our stockholders, provided we meet certain conditions. As such, we believe it is beneficial for investors to view our results of operations excluding the impact of income taxes. |

15

| |

• |

|

Plus amortization of deferred financing costs. The amortization of costs incurred to obtain financing is excluded from AFFO. |

| |

• |

|

Adjustments for other one-time charges. Certain non-recurring charges and receipts will be adjusted for and explained accordingly. |

FFO and AFFO do not represent cash flows from operating activities in accordance with GAAP, which, unlike FFO and AFFO, generally reflects all cash effects of

transactions and other events in the determination of net income, and should not be considered an alternative to net income as an indication of our performance or to cash flows from operations as a measure of liquidity or ability to make

distributions. Comparisons of FFO and AFFO, using the NAREIT definition for FFO and the definition above for AFFO, to similarly-titled measures for other REITs may not necessarily be meaningful due to possible differences in the definitions used by

such REITs.

FFO and AFFO available to common stockholders is FFO and AFFO, respectively, adjusted to subtract distributions made to holders of preferred

stock, if applicable. We believe that net income available to common stockholders is the most directly comparable GAAP measure to both FFO and AFFO available to common stockholders.

Basic funds from operations per share, or Basic FFO per share, and basic adjusted funds from operations per share, or Basic AFFO per share, are FFO and AFFO,

respectively, available to common stockholders divided by the number of weighted average shares of common stock outstanding during a period. Diluted funds from operations per share, or Diluted FFO per share, and diluted adjusted funds from

operations per share, or Diluted AFFO per share, are FFO and AFFO, respectively, available to common stockholders divided by the number of weighted average shares of common stock outstanding on a diluted basis during a period. We believe that FFO

and AFFO available to common stockholders, Basic FFO and Basic AFFO per share, and Diluted FFO and Diluted AFFO per share are useful to investors because they provide investors with a further context for evaluating our FFO and AFFO results in the

same manner that investors use net income and earnings per share, or EPS, in evaluating net income available to common stockholders. In addition, because many REITs provide FFO and AFFO available to common stockholders, Basic FFO and AFFO and

Diluted FFO, and AFFO per share information to the investment community, we believe these are useful supplemental measures when comparing us to other REITs. We believe that net income is the most directly comparable GAAP measure to each FFO and

AFFO, basic EPS is the most directly comparable GAAP measure to each Basic FFO and Basic AFFO per share, and diluted EPS is the most directly-comparable GAAP measure to Diluted FFO and Diluted AFFO per share.

The following table provides a reconciliation of our FFO and AFFO to the most directly comparable GAAP measure, net (loss) income, and a computation of basic

and diluted net (loss) income, FFO and AFFO per weighted average share of common stock.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the Nine Months Ended September 30, |

|

|

For the Years Ended December 31, |

|

| |

|

2014 |

|

|

2013 |

|

|

2013 |

|

|

2012 |

|

| Net (loss) income available to common stockholders |

|

$ |

(179,803 |

) |

|

$ |

82,633 |

|

|

$ |

(1,224,683 |

) |

|

$ |

600,373 |

|

| Plus: Real estate and intangible depreciation and amortization |

|

|

1,065,769 |

|

|

|

509,110 |

|

|

|

722,455 |

|

|

|

474,480 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| FFO available to common stockholders |

|

|

885,966 |

|

|

|

591,743 |

|

|

|

(502,228 |

) |

|

|

1,074,853 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net adjustment for straight-lining of rents |

|

|

793,644 |

|

|

|

(62,462 |

) |

|

|

(7,320 |

) |

|

|

(197,992 |

) |

| Plus: Acquisition-related expenses |

|

|

334,886 |

|

|

|

81,107 |

|

|

|

153,725 |

|

|

|

153,494 |

|

| Plus: Income tax provision |

|

|

20,103 |

|

|

|

191,433 |

|

|

|

1,519,730 |

|

|

|

300,319 |

|

| Plus: Amortization of deferred financing costs |

|

|

35,648 |

|

|

|

22,375 |

|

|

|

30,024 |

|

|

|

59,472 |

|

| Plus: Other one-time charges, net(i) |

|

|

18,318 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| AFFO available to common stockholders |

|

$ |

2,088,565 |

|

|

$ |

824,196 |

|

|

$ |

1,193,931 |

|

|

$ |

1,390,146 |

|

|

|

|

|

|

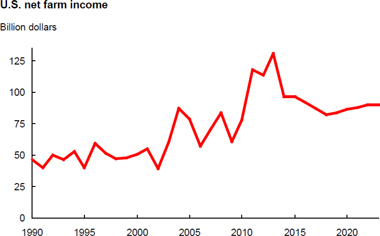

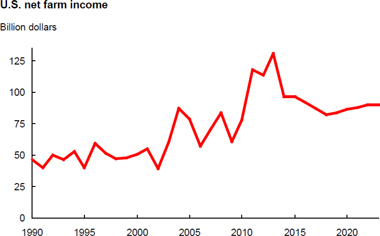

|

|