Filed Pursuant to Rule 424(b)(4)

Registration No. 333-199896

PROSPECTUS

1,250,000 Shares of

Common Stock

We are an externally-managed real estate company formed to engage in the business of owning and leasing farmland located in major agricultural markets throughout the United States.

We are offering 1,250,000 shares of common stock, par value $0.001 per share, in this offering. Our common stock is traded on the NASDAQ Global Select Market under the symbol “LAND.” The closing price of our common stock on May 12, 2015, was $11.81 per share.

We believe that we qualify, and have elected to be taxed as, a real estate investment trust, or REIT, for federal income tax purposes. To assist us in complying with certain federal income tax requirements applicable to REITs, among other purposes, our charter contains certain restrictions relating to the ownership and transfer of our capital stock, including an ownership limit of 3.3% in value or number of shares, whichever is more restrictive, of the outstanding shares of our common stock by any person as further described under “Certain Provisions of Maryland Law and our Charter and Bylaws.”

We are an “emerging growth company” under applicable federal securities laws, and, as such, we are subject to reduced public company reporting requirements. Investing in shares of our common stock involves substantial risks that are described in the “Risk Factors” section beginning on page 20 of this prospectus.

| Per Share | Total | |||||||

| Public Offering Price |

$ | 11.40 | $ | 14,250,000 | ||||

| Underwriting Discount(1) |

$ | 0.57 | $ | 712,500 | ||||

| Proceeds, before expenses, to us |

$ | 10.83 | $ | 13,537,500 | ||||

| (1) | See “Underwriting” for information concerning certain expense reimbursement to the underwriters. |

We have granted the underwriters an option to purchase up to 187,500 additional shares of common stock from us at the public offering price, less the underwriting discount, within 30 days from the date of this prospectus to cover over-allotments, if any. If the underwriters exercise this option in full, the total public offering amount will be $16,387,500, the total underwriting discounts and commissions payable by us will be $819,375 and our total proceeds, before expenses, will be $15,568,125.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

We expect that delivery of the common stock will be made against payment for the common stock on or about May 15, 2015.

| Janney Montgomery Scott | Oppenheimer & Co. | JMP Securities | Ladenburg Thalmann | |||

| Maxim Group LLC | J.J.B. Hilliard, W.L. Lyons, LLC | |||||

The date of this prospectus is May 13, 2015

GLADSTONE LAND CORPORATION

| 1 | ||||

| 20 | ||||

| 43 | ||||

| 45 | ||||

| 46 | ||||

| 47 | ||||

| 48 | ||||

| 50 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

53 | |||

| 82 | ||||

| 88 | ||||

| 92 | ||||

| 101 | ||||

| 107 | ||||

| 110 | ||||

| Information Regarding the Board of Directors and Corporate Governance |

115 | |||

| 121 | ||||

| 122 | ||||

| 127 | ||||

| 130 | ||||

| 132 | ||||

| 133 | ||||

| Certain Provisions of Maryland Law and of our Charter and Bylaws |

139 | |||

| 144 | ||||

| Our Operating Partnership and the Operating Partnership Agreement |

145 | |||

| 148 | ||||

| Transfer, Dividend Paying and Dividend Reinvestment Agent and Registrar |

171 | |||

| 172 | ||||

| 177 | ||||

| 177 | ||||

| 177 | ||||

| 179 | ||||

| F-1 |

You should rely only upon the information contained and incorporated by reference in this prospectus and any free writing prospectus provided or approved by us. We have not, and the underwriters have not, authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely upon it. We are not, and the underwriters are not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of shares of our common stock. You should assume that the information appearing in the documents incorporated by reference in this prospectus is accurate only as of the respective dates of those documents or another date specified therein. Our business, financial condition and prospectus may have changed since such dates.

This summary highlights the material information in this prospectus. Because it is a summary, it may not contain all the information that you should consider before investing in our common stock. To fully understand this offering, you should carefully read this entire prospectus, including the more detailed information set forth under the caption “Risk Factors,” the historical and pro forma financial statements, including the related notes thereto, incorporated by reference into or appearing elsewhere in this prospectus, and any free writing prospectus provided or approved by us, and the information incorporated by reference in this prospectus, before investing in our common stock. Unless otherwise expressly stated or the context otherwise requires, all information presented in this prospectus assumes that the underwriters’ over-allotment option to purchase additional shares is not exercised.

Unless the context otherwise requires or indicates, each reference in this prospectus to (i) “we,” “our,” “us” and the “Company” means Gladstone Land Corporation, a Maryland corporation, and its consolidated subsidiaries, (ii) “Operating Partnership” means Gladstone Land Limited Partnership, a wholly-owned subsidiary of the Company and a Delaware limited partnership, (iii) “Adviser” means Gladstone Management Corporation, the external adviser of the Company and a Delaware corporation, and (iv) “Administrator” means Gladstone Administration, LLC, the external administrator to the Company and a Delaware limited liability company.

Gladstone Land Corporation

We are an externally-managed real estate investment trust (“REIT”) formed to engage in the business of owning and leasing farmland located in major agricultural markets throughout the United States. Our farmland is predominantly concentrated in locations where tenants are able to grow annual row crops such as berries, lettuce and melons, among others, which are planted and harvested annually or more frequently. We may also acquire property related to farming, such as storage facilities utilized for cooling crops, processing plants, packaging buildings and distribution centers. We completed our initial public offering on January 28, 2013, with a portfolio of 1,630 acres on 12 farms in California and Florida that were leased to 6 separate and unrelated corporate and independent farmer tenants. At that time, we also owned two cooling facilities and one facility utilized for storage and assembly of boxes for shipping produce (a “box barn”). As of the date of this prospectus, we owned 8,789 acres comprised of 34 farms: 15 in California, 10 in Florida, 4 in Michigan, 4 in Oregon and 1 in Arizona. We also own three cooling facilities and one box barn. These properties are currently leased to 29 separate and unrelated tenants that are either corporate or independent farmers. We also lease a small parcel on our 653-acre farm near Oxnard, California (“West Gonzales”), to an oil company.

Historically, our farmland has predominantly been concentrated in locations where tenants are able to grow annual row crops, such as certain types of berries and vegetable crops, which are planted and harvested annually or more frequently. However, during 2013, we began to diversify the variety of crops grown on our properties, and we now own several farms with more permanent crops, such as blueberries, as well as a couple of farms that grow grains, such as corn and beans. While our focus remains on annual row crops, in the future, we may acquire additional land with fruit or nut trees, bushes, wine berries and wine grapes, as well as land to grow grains. We may also acquire more property related to farming, such as storage facilities utilized for cooling crops, freezer buildings, box barns, silos, storage facilities, green houses, processing plants, packaging buildings and distribution centers.

1

The table below sets forth information regarding our portfolio of properties as of December 31, 2014, and properties acquired since that time, as noted in the table below:

| Property Name |

Location | Date Acquired |

Number of Farms |

Total Acres |

Farmable Acres |

Net

Cost Basis(1) |

Current Fair Value |

|||||||||||||||||

| San Andreas |

Watsonville, CA | 6/16/1997 | 1 | 307 | 238 | $ | 4,826,248 | $ | 11,344,000 | (3) | ||||||||||||||

| West Gonzales |

Oxnard, CA | 9/15/1998 | 1 | 653 | 502 | 12,406,298 | 49,900,000 | (4) | ||||||||||||||||

| West Beach |

Watsonville, CA | 1/3/2011 | 3 | 196 | 195 | 8,979,337 | 9,980,000 | (3) | ||||||||||||||||

| Dalton Lane |

Watsonville, CA | 7/7/2011 | 1 | 72 | 70 | 2,700,026 | 2,959,000 | (3) | ||||||||||||||||

| Keysville Road |

Plant City, FL | 10/26/2011 | 2 | 59 | 56 | 1,232,260 | 1,498,000 | (3) | ||||||||||||||||

| Colding Loop |

Wimauma, FL | 8/9/2012 | 1 | 219 | 181 | 3,925,704 | 4,300,000 | (4) | ||||||||||||||||

| Trapnell Road |

Plant City, FL | 9/12/2012 | 3 | 124 | 110 | 4,106,218 | 4,806,500 | (4) | ||||||||||||||||

| 38th Avenue |

Covert, MI | 4/5/2013 | 1 | 119 | 89 | 1,449,670 | 1,411,000 | (3) | ||||||||||||||||

| Sequoia Street |

Brooks, OR | 5/31/2013 | 1 | 218 | 206 | 3,521,564 | 3,135,000 | (3) | ||||||||||||||||

| Natividad Road |

Salinas, CA | 10/21/2013 | 1 | 166 | 166 | 7,398,003 | 7,607,000 | (3) | ||||||||||||||||

| 20th Avenue |

South Haven, MI | 11/5/2013 | 3 | 151 | 94 | 1,884,981 | 2,080,000 | (3) | ||||||||||||||||

| Broadway Road |

Moorpark, CA | 12/16/2013 | 1 | 60 | 60 | 2,935,348 | 3,403,000 | (3) | ||||||||||||||||

| Oregon Trail |

Echo, OR | 12/27/2013 | 1 | 1,895 | 1,640 | 13,993,009 | 14,301,000 | (3) | ||||||||||||||||

| East Shelton |

Willcox, AZ | 12/27/2013 | 1 | 1,761 | 1,320 | 7,760,059 | 7,900,000 | (4) | ||||||||||||||||

| Collins Road |

Clatskanie, OR | 5/30/2014 | 2 | 200 | 157 | 2,532,950 | 2,591,333 | (2) | ||||||||||||||||

| Spring Valley |

Watsonville, CA | 6/13/2014 | 1 | 145 | 110 | 5,882,738 | 5,900,000 | (2) | ||||||||||||||||

| McIntosh Road |

Dover, FL | 6/20/2014 | 2 | 94 | 78 | 2,553,874 | 2,666,000 | (2) | ||||||||||||||||

| Naumann Road |

Oxnard, CA | 7/23/2014 | 1 | 68 | 66 | 6,859,860 | 6,888,500 | (2) | ||||||||||||||||

| Sycamore Road |

Arvin, CA | 7/25/2014 | 1 | 326 | 322 | 5,939,522 | 5,800,000 | (2) | ||||||||||||||||

| Wauchula Road |

Duette, FL | 9/29/2014 | 1 | 808 | 590 | 13,772,371 | 13,765,000 | (2) | ||||||||||||||||

| Santa Clara Avenue |

Oxnard, CA | 10/29/2014 | 2 | 333 | 331 | 24,497,797 | 24,592,000 | (2) | ||||||||||||||||

| Dufau Road |

Oxnard, CA | 11/4/2014 | 1 | 65 | 64 | 6,099,925 | 6,125,600 | (2) | ||||||||||||||||

| Espinosa Road |

Salinas, CA | 1/5/2015 | 1 | 331 | 329 | 16,905,500 | 16,905,500 | (2) | ||||||||||||||||

| Parrish Road(5) |

Duette, FL | 3/10/2015 | 1 | 419 | 211 | 3,913,280 | 3,913,280 | (2) | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| 34 | 8,789 | 7,185 | $ | 166,076,542 | $ | 213,771,713 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| (1) | Consists of the initial acquisition price (including the costs allocated to both tangible and intangible assets, excluding those allocated to above- and below-market lease values), plus subsequent improvements and other capitalized costs associated with the properties, and adjusted for depreciation and amortization accumulated through December 31, 2014. As Espinosa Road and Parrish Road were both acquired subsequent to December 31, 2014, the net cost basis and current fair value for each is included as the purchase price. |

| (2) | Valued at the purchase price paid. |

| (3) | Represents values as determined by our internal valuation process. |

| (4) | Represents values based on third-party appraisals performed between January 2014 and October 2014. |

| (5) | Includes $700,000 of contingent consideration to be paid to the tenant for irrigation improvements made on the property by the tenant upon the approval by a local water management district of certain water permits. |

We generally lease our properties on a triple-net basis, an arrangement under which, in addition to rent, the tenant is required to pay the related taxes, insurance costs (including drought insurance if we were to acquire properties that depend upon rainwater for irrigation), maintenance and other operating costs. We may also sell farmland at certain times, such as when the land could be developed by others for urban or suburban uses. We do not currently intend to enter the business of growing, packing or marketing farmed products; however, if we do so in the future, we expect that we would conduct such business through a taxable REIT subsidiary (“TRS”).

To a lesser extent, we may provide senior secured first-lien mortgages to farmers for the purchase of farmland and farm-related properties. We expect that any mortgages we make would be secured by farming properties that have a successful history of crop production and profitable farming operations and that, over time,

2

such mortgages would not exceed 5.0% of the fair value of our total assets. Currently, we do not hold any mortgages, and we have not identified any properties for which to make loans secured by mortgages.

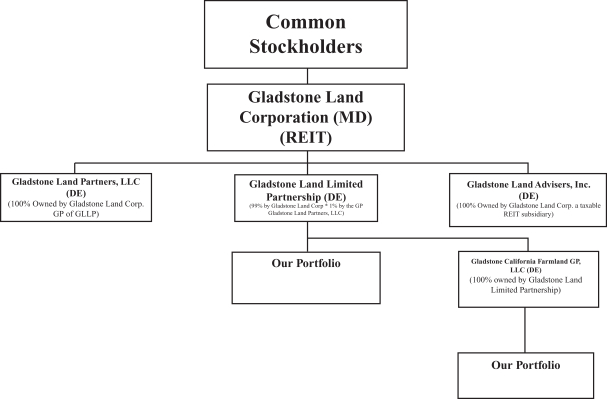

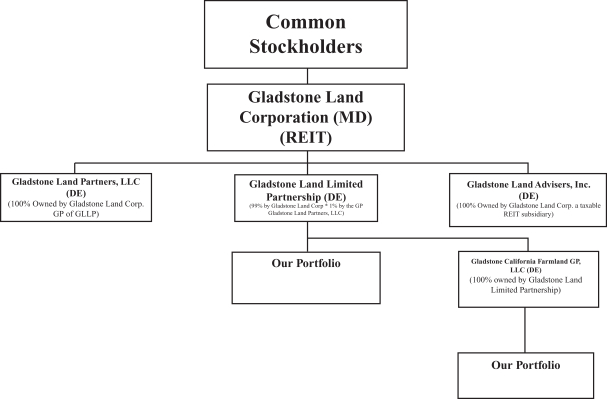

We conduct our business through an Umbrella Partnership Real Estate Investment Trust (“UPREIT”) structure in which our properties and the mortgage loans we make will be held directly or indirectly by Gladstone Land Limited Partnership (our “Operating Partnership”). We are the manager and 100% owner of Gladstone Land Partners, LLC (“Land Partners”), which is the sole general partner of our Operating Partnership, and we currently hold, directly and indirectly through Land Partners, 100% of its outstanding limited partnership units (“OP Units”). In the future, we may offer equity ownership in our Operating Partnership by issuing OP Units to farmland owners from time to time in consideration for acquiring their farms. Holders of OP Units in our Operating Partnership will be entitled to redeem these units for cash or, at our election, shares of our common stock on a one-for-one basis at any time after holding the OP Units for one year. Farmland owners who exchange their farms for OP Units may be able to do so in a tax-deferred exchange under U.S. federal income tax laws.

On September 3, 2014, we filed our 2013 federal income tax return, on which we elected to be taxed as a REIT for federal tax purposes beginning with the year ended December 31, 2013. As a REIT, we generally will not be subject to U.S. federal income tax if we distribute at least 90% of our taxable income to our stockholders and continue to meet certain other requirements. In addition, we have elected for Gladstone Land Advisers, Inc., a wholly-owned subsidiary of ours, to be taxed as a TRS. We may own or manage our assets and engage in other activities through Gladstone Land Advisors or another TRS we form or acquire when we deem it necessary or advisable. The taxable income generated by any TRS will be subject to regular corporate income tax. Currently, we do not conduct any operations through our TRS.

Subject to certain restrictions and limitations, and pursuant to contractual agreements, our business and real estate portfolio investments are managed by Gladstone Management Corporation (our “Adviser”), a Delaware corporation, a registered investment adviser with the Securities and Exchange Commission (the “SEC”) and an affiliate of ours. Administrative services are provided to us by Gladstone Administration, LLC (our “Administrator”), a Delaware limited liability company and an affiliate of ours. Our Adviser and our Administrator are owned and controlled by David Gladstone, our chief executive officer, president, chairman of our Board of Directors and our largest stockholder.

Our Investment Objectives and Our Strategy

Our principal business objective is to maximize stockholder returns through a combination of: (1) monthly cash distributions to our stockholders, which we hope to sustain and increase through long-term growth in cash flows from increased rents; (2) appreciation of our land; and (3) capital gains derived from the sale of our properties. Our primary strategy to achieve our business objective is to invest in high-quality farmland and diversify our current portfolio of primarily triple-net-leased farmland and properties related to farming operations. This strategy includes the following components:

| • | Owning Farms and Farm-Related Real Estate for Income. We own and intend to acquire farmland and lease it to corporate and independent farmers, including sellers who desire to continue farming the land after we acquire the property from them. We expect to hold acquired properties for many years and to generate stable and increasing rental income from leasing these properties. |

| • | Owning Farms and Farm-Related Real Estate for Appreciation. We intend to lease acquired properties over the long term. However, from time to time we may sell one or more properties if we believe it to be in the best interests of our stockholders. Potential purchasers may include real estate developers desiring to develop the property or financial purchasers seeking to acquire property for investment purposes. Accordingly, we will seek to acquire properties that we believe have potential for long-term appreciation in value. |

3

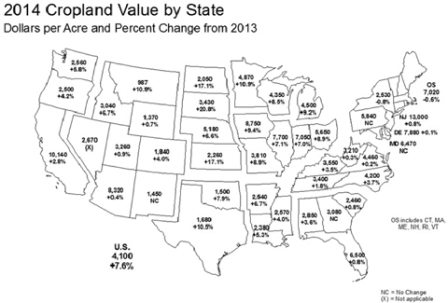

| • | Continue Expanding our Operations Geographically. While our properties are currently located in five states across the U.S., we expect that we will acquire properties in other farming locations in the future. We believe the Southeast and Mid-Atlantic regions of the United States, specifically states such as Georgia, North Carolina and New Jersey, offer attractive locations for expansion. We also expect to seek farmland acquisitions in the Midwest and may also expand into other areas in the United States. |

| • | Continue Expanding our Crop Varieties. Currently, the majority of tenants who farm our properties grow row crops dedicated to produce, such as lettuce and tomatoes, and berries, such as strawberries and raspberries. While we have begun expanding into longer-term crops, such as blueberries, as well as into grains, in the future, we will seek to continue expanding into other crops, such as commodity crops (e.g., wheat, rice and corn) and bush, tree and vine crops (e.g., fruits and nuts). |

| • | Using Leverage. To make more investments than would otherwise be possible, we intend to borrow through loans secured by long-term mortgages on our properties, and we may also borrow funds on a short-term basis or incur other indebtedness. |

| • | Owning Mortgages on Farms and Farm-Related Real Estate. In circumstances where our purchase of farms and farm-related properties is not feasible, we may provide the owner of the property with a mortgage loan secured by the property along with an option to sell the property to us in the future at a predetermined price. We do not expect that, over time, our mortgages held will exceed 5.0% of the fair value of our total assets. |

| • | Joint Ventures. Some of our investments may be made through joint ventures that would permit us to own interests in large properties without restricting the diversity of our portfolio. |

We expect that most of our future tenants will be medium-sized independent farming operations or large corporate farming operations that are unrelated to us. We intend to lease the majority of our properties under triple-net leases, an arrangement under which the tenant maintains the property while paying the related taxes, maintenance and insurance costs, as well as rent to us. We are actively seeking and evaluating other farm properties for potential purchase, although we are not currently a party to any binding purchase agreements to acquire any properties. All potential acquisitions will be subject to due diligence investigations, and there can be no assurance that we will be successful in identifying or acquiring any properties in the future.

Our Competitive Strengths

We believe that the following strengths differentiate us from our competitors:

| • | Innovative Business Strategy: First public company formed primarily to own and lease farmland with the goal of providing investors with steady income and capital appreciation, as well as a hedge against inflation. |

| • | Experienced Management Team: We are managed by an investment advisor registered with the SEC with over $1.8 billion of assets currently under management. Our management team has a successful track record of underwriting agricultural real estate and conducting extensive due diligence on the management teams, cash flows, financial statements and risk ratings of our respective tenants. In addition, our chief executive officer has unique industry knowledge as a former owner of Coastal Berry Company (from 1997-2004) — one of the largest integrated berry and vegetable growers, marketers, and shippers in California. |

| • | Focused Business Model: Our business model seeks to foster investment opportunities that are generated from our strategic relationships with agricultural real estate brokers and corporate and independent farmers. |

| • | Attractive Market Opportunities: We believe that attractive investment opportunities currently exist that will allow us to capitalize on investing in farmland that has demonstrated relatively steady appreciation in value and increases in rental rates with relatively low volatility. |

4

| • | Conservative Dual Underwriting Strategy: When underwriting a tenant’s farming operations and the real estate it occupies, we focus on the cash flow of the tenant and management of the farming operations as well as the intrinsic value of the property, including evaluation of access to water and other attributes. |

| • | Proven Ability to Execute Business Model: Since our initial public offering (our “IPO”) in January 2013, we have invested $126.7 million into the acquisition of 22 new farms, and an additional $3.9 million has been invested in the form of capital improvements on existing farms. |

| • | Distribution Stability: Since our IPO in January 2013 through April 2015, we have made 27 consecutive monthly distributions on our common stock. We currently pay monthly distributions (declared quarterly) to holders of shares of our common stock at a current rate of $0.04 per share. |

Properties Under Consideration

We currently have approximately 50 properties that are in various stages of our review process. During these review stages, we evaluate the properties to determine whether we believe they will meet our investment criteria, engage in preliminary discussions with some of the owners and, for certain of the properties, submit non-binding indications of interest or letters of intent. Generally, we do not commence the due diligence process during these review stages, nor do we agree upon price or terms relating to the potential acquisition of any of these properties. Therefore, we do not deem the acquisition of any property that we are considering in these review stages to be probable, and there can be no assurance that we will complete the acquisition of any property that we are currently evaluating.

Leases

We intend to own primarily single-tenant, agricultural real property. Generally, we will lease properties to tenants that our Adviser deems creditworthy under triple-net leases that will be full-recourse obligations of our tenants or their affiliates. Most of our agricultural leases have original terms ranging from 3 to 10 years for properties growing row crops and 5 to 15 years for properties growing permanent crops, often with options to extend the lease further. Rent is generally payable to us on either an annual or semi-annual basis, with one-half due at the beginning of the year and the other half due later in the year. Further, most of our leases contain provisions that provide for annual increases in the rental amounts payable by the tenants, often referred to as escalation clauses. The escalation clauses may specify fixed dollar amount or percentage increases each year, or it may be variable, based on standard cost of living or inflation indices. In addition, some leases that are longer-term in nature may require a regular survey of comparable land rents, with the rent owed per the lease being adjusted to reflect current market rents. We have not entered into any leases that include variable rent based on the success of the harvest each year; however, should we choose to do so, we would generally require the lease to include the guarantee of a minimum amount of rental income that satisfies our investment return criteria. Currently, our 34 farms are leased under original lease terms ranging from 1 to 15 years, with 21 farms leased on a pure triple-net basis, and 13 farms leased on a partial-net basis, with the landlord responsible for all or a portion of the related property taxes. However, due to follow-on leases we have executed on certain of our properties, two of our farms that are currently leased on a partial-net basis will convert to pure triple-net leases in November 2015.

While our Adviser seeks tenants it believes to be creditworthy, tenants are not required to meet any minimum rating established by an independent credit rating agency. Our Adviser’s standards for determining whether a particular tenant is creditworthy will vary in accordance with a variety of factors relating to specific prospective tenants. The creditworthiness of a tenant is determined on a tenant-by-tenant and case-by-case basis. We monitor our tenants’ credit quality on an ongoing basis by, among other things, periodically conducting site visits to the properties to ensure farming operations are taking place and to assess the general maintenance of the properties. To date, no changes to credit quality of our tenants have been identified, and all tenants continue to pay pursuant to the terms of their respective leases.

5

Lease Expirations

Farm leases are often short-term in nature, so in any given year, we may have multiple leases up for renewal or extension. We had two agricultural leases that were originally due to expire in 2014, one on 196 acres of farmland (“West Beach”) and one on 307 acres of farmland (“San Andreas”), both near Watsonville, California. However, during the first half of 2014, we were able to re-lease both properties prior to their expirations and without any downtime. The two properties were re-leased for periods of nine and six years, respectively, at rental rates representing an average increase in minimum annualized straight-lined rental income of 26.0% over the previous leases. In aggregate, these properties accounted for approximately 6.3% of the total acreage owned as of December 31, 2014, and 13.4% of the total rental income recorded for the year ended December 31, 2014.

We have three agricultural leases due to expire in 2015: one on 72 acres of farmland near Watsonville, California (“Dalton Lane”), and two on 333 acres of farmland near Oxnard, California (“Santa Clara Avenue”). We have begun negotiations regarding lease renewals on both of these properties, and we anticipate being able to renew the leases prior to their respective expirations. In addition, given the current market conditions in the respective regions where these properties are located, we expect to be able to renew the leases at higher rental rates, compared to those of the existing leases. However, there can be no assurance that we will be able to renew the leases at a rate favorable to us, if at all, or be able to find a replacement tenant, if necessary.

In addition, we also have a surface area lease with an oil company on eight acres of West Gonzales that is renewed on an annual basis and continues for so long as the tenant continues to use its oil rights. We have received confirmation that the tenant intends to continue its lease for 2015. Under the terms of the lease, the amount of rent owed increases on an annual basis commensurate with the rental increases per the agricultural lease in place on West Gonzales. This lease accounted for approximately 0.4% of the rental income recorded during the year ended December 31, 2014.

Summary Risk Factors

An investment in shares of our common stock includes substantial risks. You should carefully consider the matters discussed in the “Risk Factors” section of this prospectus beginning on page 20 prior to deciding to invest in our common stock. Some of the risks include, but are not limited to:

| • | Our real estate portfolio is concentrated in a limited number of properties, which subjects us to an increased risk of significant loss if any property declines in value or if we are unable to lease a property. Currently, we own 34 farms, leased to 29 separate and unrelated tenants. We are actively seeking and evaluating other farm properties to potentially purchase with the net proceeds we will receive from this offering, although we have not yet entered into binding agreements to acquire these properties, and there is no guarantee that we will be able to acquire any of them. As a result, investors will be unable to evaluate the manner in which the net proceeds are invested and the economic merits of projects prior to investment. |

| • | As of December 31, 2014, one tenant, Dole Food Company (“Dole”) was responsible for approximately 30% of our annualized generally accepted accounting principles in the U.S. (“GAAP”), straight-line rental revenue. If Dole fails to make rental payments or elects to terminate its leases with us, it would have a material adverse effect on our financial performance and our ability to make distributions to our stockholders. |

| • | We use leverage through borrowings under mortgage loans on our properties, and potentially other indebtedness, which will result in risks, including restrictions on additional borrowings and payment of distributions and risk of loss of property securing a loan upon foreclosure. |

| • | We may fail to maintain our qualification as a REIT for federal income tax purposes. We would then be subject to corporate level taxation and we would not be required to pay any distributions to our stockholders. |

6

| • | The Company is considered an “emerging growth company” and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make our common stock less attractive to investors. |

| • | There was no active public market for our common stock prior to the IPO and the market price and trading volume of our common stock has been volatile at times following the IPO and may continue to be so following this offering, which may adversely impact the market for shares of our common stock and make it difficult to sell your shares. |

| • | We have paid, may continue to pay, or may in the future pay distributions from offering proceeds, borrowings or the sale of assets to the extent our cash flow from operations or earnings are not sufficient to fund declared distributions. Rates of distribution to you will not necessarily be indicative of our operating results. If we make distributions from sources other than our cash flows from operations or earnings, we will have fewer funds available for the acquisition of properties and your overall return may be reduced. |

| • | We currently lease many of our properties to medium-sized independent farming operations and agricultural businesses, which may have limited financial and personnel resources and, therefore, may be less stable than larger companies, which could impact our ability to generate rental revenue. |

| • | We are dependent upon our key management personnel for our future success, particularly David Gladstone and Terry Lee Brubaker. |

| • | Conflicts of interest exist between us, our Adviser, its officers and directors and their affiliates, which could result in investment decisions that are not in the best interests of our stockholders. |

| • | Our success will depend heavily on the performance and relationships of our Adviser. If our Adviser makes inadvisable investment or management decisions or is unable to source investments through their relationships and network, our operations could be materially adversely impacted. |

7

The following diagram depicts our organizational structure.

Our Adviser

Our business is externally managed by our Adviser, which was incorporated in 2002. The officers, directors and employees of our Adviser have significant experience in making investments in and lending to businesses of all sizes, including investing in real estate and making mortgage loans. We entered into an amended and restated Advisory Agreement with our Adviser (the “Amended Advisory Agreement”), under which our Adviser is responsible for managing our assets and liabilities, for operating our business on a day-to-day basis and for identifying, evaluating, negotiating and consummating investment transactions consistent with our investment policies as determined by our Board of Directors from time to time.

Each of our executive officers, other than Lewis Parrish, our chief financial officer, is also an officer of our Adviser and our Administrator. Each of our officers has significant experience in making investments in and lending to businesses of all sizes, including investing in real estate and making mortgage loans. Including our officers, our Adviser and Administrator collectively employ over 60 professionals that are involved in structuring, arranging and managing investments on behalf of companies advised by our Adviser. We also rely on outside professionals with agricultural experience that perform due diligence on the properties that we intend to acquire and lease. We are responsible for paying any fees charged by these outside professionals.

Our Adviser maintains an investment committee that will screen each of our investments. This investment committee is currently comprised of Messrs. Gladstone and Brubaker. We believe that the review process of our Adviser’s investment committee gives us a unique competitive advantage over other agricultural real estate companies because of the substantial experience that the members possess and their unique perspective in evaluating the blend of corporate credit, real estate and lease terms that collectively combine to provide an acceptable risk for our investments.

8

Our Adviser’s board of directors has empowered the investment committee to authorize and approve our investments, subject to the terms of the Amended Advisory Agreement. Before we acquire any property, the transaction will be reviewed by the investment committee to ensure that, in its view, the proposed transaction satisfies our investment criteria and is within our investment policies. Approval by the investment committee will generally be the final step in the property acquisition approval process, although the separate approval of our Board of Directors is required in certain circumstances.

Under the terms of our Amended Advisory Agreement that went into effect on February 1, 2013, we pay an annual base management fee equal to a percentage of our adjusted stockholders’ equity, which is defined as our total stockholders’ equity at the end of each quarter less the recorded value of any preferred stock we may issue and, for 2013 only, any uninvested cash proceeds from the IPO. For 2013, the base management fee was set at 1.0% of our adjusted stockholders’ equity; however, beginning January 1, 2014, we pay a base management fee equal to 2.0% of our adjusted stockholders’ equity, which no longer excludes uninvested cash proceeds from the IPO.

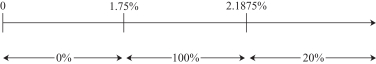

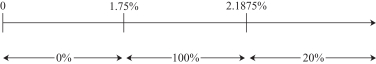

Pursuant to the Amended Advisory Agreement, we also pay an additional quarterly incentive fee based on our funds from operations (“FFO”). For purposes of calculating the incentive fee, our FFO before giving effect to any incentive fee (our “Pre-Incentive Fee FFO”) will include any realized capital gains or losses, less any distributions paid on any preferred stock we may issue, but will not include any unrealized capital gains or losses. The incentive fee will reward our Adviser if our Pre-Incentive Fee FFO for a particular calendar quarter exceeds a hurdle rate of 1.75%, or 7% annualized, of our total stockholders’ equity at the end of the quarter. We pay our Adviser an incentive fee with respect to our Pre-Incentive Fee FFO quarterly, as follows:

| • | no incentive fee in any calendar quarter in which our Pre-Incentive fee FFO does not exceed the hurdle rate of 1.75% (7% annualized); |

| • | 100% of the amount of the Pre-Incentive fee FFO that exceeds the hurdle rate, but is less than 2.1875% in any calendar quarter (8.75% annualized); and |

| • | 20% of the amount of our Pre-Incentive fee FFO that exceeds 2.1875% in any calendar quarter (8.75% annualized). |

Quarterly Incentive Fee Based on FFO

Pre-Incentive Fee FFO

(expressed as a percentage of adjusted stockholders’ equity)

Percentage of Pre-Incentive Fee FFO allocated to Incentive Fee

9

Our Administrator

Under the terms of the Amended Administration Agreement that went into effect on February 1, 2013, we pay for our allocable portion of the Administrator’s expenses incurred while performing services to us, including, but not limited to, rent and the salaries and benefits expenses of our Administrator’s employees, including our chief financial officer, treasurer, chief compliance officer, general counsel and secretary (who also serves as our Administrator’s president) and their respective staffs. From February 1, 2013, through June 30, 2014, our allocable portion of these expenses was generally derived by multiplying that portion of the Administrator’s expenses allocable to all funds serviced by the Administrator by the percentage of our total assets at the beginning of each quarter in comparison to the total assets of all funds managed by our Adviser.

As approved by our Board of Directors, effective July 1, 2014, our allocable portion of the Administrator’s expenses is now generally derived by multiplying our Administrator’s total expenses by the approximate percentage of time the Administrator’s employees perform services for us in relation to their time spent performing services for all companies serviced by our Administrator under similar contractual agreements. This change in methodology resulted in an increase in the fee we paid to our Administrator of approximately 137% for the six months ended December 31, 2014, as compared to the first six months of the fiscal year. Management believes that the new methodology of allocating the Administrator’s total expenses by approximate percentages of time services were performed more accurately approximates the fees incurred for the actual services performed. While this change in methodology resulted in an increase in the fee paid to our Administrator for the six months ended December 31, 2014, we are not currently able to determine whether the change in methodology will result in an increase or decrease for the upcoming fiscal year.

10

Compensation of Our Adviser and Our Administrator

Set forth below is an estimate of all proposed compensation, fees, profits and other benefits, including reimbursement of out-of-pocket expenses that our Adviser and our Administrator may receive in connection with this offering and our ongoing operations. We do not expect to make any payments to any other affiliates of our Adviser. For additional information with respect to the compensation of our Adviser and our Administrator upon completion of this offering, see “Our Adviser and our Administrator — Amended Advisory Agreement — Compensation of our Adviser under the Amended Advisory Agreement” and “Our Adviser and our Administrator — Amended Administration Agreement.”

| Type of Compensation (Recipient) |

Description and Determination of Amount |

Estimated Amount | ||

| Offering |

||||

| Reimbursement of Offering Expenses (Adviser)(1) | Offering expenses include all estimated expenses, other than underwriting discount, to be paid by us in connection with this offering, including our legal, accounting, printing, mailing and filing fees and other accountable offering expenses. To the extent that our Adviser pays our offering expenses, we will reimburse our Adviser for these amounts. | We anticipate paying for all offering costs incurred. | ||

| Ongoing Operations |

||||

| Annual Base Management Fee (Adviser) | 2.0% of our adjusted stockholders’ equity and our adjusted stockholders’ equity, measured at the end of each quarter and our adjusted stockholders’ equity, which does not exclude the uninvested cash proceeds of this offering. | Actual amount is dependent upon the amount of equity raised in this offering. | ||

| Quarterly Incentive Fee (Adviser)(2) | We pay our Adviser an incentive fee with respect to our Pre-Incentive Fee FFO in each calendar quarter as follows:

• no incentive fee in any calendar quarter in which our Pre-Incentive Fee FFO does not exceed the hurdle rate of 1.75% (7% annualized) of our adjusted stockholders’ equity at the end of the quarter;

• 100% of the amount of the Pre-Incentive Fee FFO that exceeds the hurdle rate, but is less than 2.1875% of our adjusted stockholders’ equity at the end of any calendar quarter (8.75% annualized); and

• 20% of the amount of our Pre-Incentive Fee FFO that exceeds 2.1875% of our adjusted stockholders’ equity at the end of any calendar quarter (8.75% annualized).

|

Actual amounts are dependent upon the amount of FFO we generate from time to time. | ||

11

| Type of Compensation (Recipient) |

Description and Determination of Amount |

Estimated Amount | ||

| Allocation of Administrator Overhead Expenses (Administrator)(3) | We will pay our Administrator for our allocable portion of the Administrator’s overhead expenses in performing our obligations, including, but not limited to, our allocable portion of rent attributable to office space for employees of the Administrator, and our allocable portion of the salaries and benefits expenses of our chief financial officer, treasurer, chief compliance officer, general counsel and secretary. Our allocable portion is derived by multiplying our Administrator’s total expenses by the approximate percentage of time the Administrator’s employees perform services for us in relation to their time spent performing services for all companies serviced by our Administrator under similar contractual agreements. | Actual amounts will be dependent upon the expenses incurred by our Administrator and the percentage of time our Administrator’s employees spend on our maters in relation to their time spent on all companies serviced by our Administrator. |

| (1) | As of March 31, 2015, we have incurred approximately $165,000 of expenses in connection with this offering. |

| (2) | For purposes of calculating the incentive fee, our Pre-Incentive Fee FFO will include any realized capital gains or losses, less any dividends paid on our preferred stock, but Pre-Incentive Fee FFO will not include any unrealized capital gains or losses. |

Examples of how the incentive fee would be calculated are as follows:

| • | If our Pre-Incentive Fee FFO for a quarter were 1.75% or less of our adjusted stockholders’ equity, there would be no incentive fee because such FFO would not exceed the hurdle rate of 1.75%. |

| • | In the event our Pre-Incentive Fee FFO for a quarter were equal to 2.00% of our adjusted stockholders’ equity, the incentive fee would be as follows: |

= 100% × (2.00% - 1.75%)

= 0.25% of adjusted stockholders’ equity

| • | In the event our Pre-Incentive Fee FFO for a quarter were equal to 2.30% of our adjusted stockholders’ equity, the incentive fee would be as follows: |

= (100% × (“catch-up”: 2.1875% - 1.75%)) + (20% × (2.30% - 2.1875%))

= (100% × 0.4375%) + (20% × 0.1125%)

= 0.4375% + 0.0225%

= 0.46% of our adjusted stockholders’ equity

| (3) | Our Administrator is 100% owned by Gladstone Holding Corporation, which is also the 100% owner of our Adviser. |

Our Other Affiliates and Potential Conflicts of Interest

Gladstone Commercial Corporation. Each of our directors and each of our executive officers, other than Lewis Parrish, our chief financial officer and assistant treasurer, is also an executive officer or director of

12

Gladstone Commercial Corporation (“Gladstone Commercial”), a publicly held REIT whose common stock is traded on the NASDAQ Global Select Market under the trading symbol “GOOD.” Gladstone Commercial invests in and owns net leased industrial, commercial and retail real property and selectively makes long-term industrial and commercial mortgage loans. Gladstone Commercial does not invest in or own agricultural real estate or make loans secured by agricultural real estate and, therefore, Gladstone Commercial will not compete with us for investment opportunities.

Gladstone Capital Corporation. Each of our directors and each of our executive officers, other than Messrs. Beckhorn and Parrish, is also an executive officer or director of Gladstone Capital Corporation (“Gladstone Capital”), a publicly held closed-end management investment company whose common stock is traded on the NASDAQ Global Market under the trading symbol “GLAD.” Gladstone Capital makes loans to and investments in small and medium-sized businesses. It does not buy or lease real estate and does not lend to agricultural enterprises and, therefore, Gladstone Capital will not compete with us for investment opportunities. Gladstone Capital will not make loans to or investments in any company with which we have or intend to enter into a lease.

Gladstone Investment Corporation. Each of our directors and each of our executive officers, other than Messrs. Beckhorn and Parrish, is also executive an officer or director of Gladstone Investment Corporation (“Gladstone Investment”), a publicly held closed-end management investment company whose common stock is traded on the NASDAQ Global Market under the trading symbol “GAIN.” Gladstone Investment makes loans to and investments in small and medium-sized businesses in connection with buyouts and other recapitalizations. It does not buy or lease real estate and does not lend to agricultural enterprises and, therefore, Gladstone Investment will not compete with us for investment opportunities. Gladstone Investment will not make loans to or investments in any company with which we have or intend to enter into a lease.

We do not presently intend to co-invest with Gladstone Capital, Gladstone Commercial or Gladstone Investment in any business. However, in the future it may be advisable for us to co-invest with one of these companies. If we decide to change our policy on co-investments with affiliates, we will seek approval of this decision from our independent directors.

Each of our executive officers, other than Messrs. Beckhorn and Parrish, is also an officer and director of our Adviser, Gladstone Capital, Gladstone Commercial and Gladstone Investment. Our Adviser and its affiliates, including our officers, may have conflicts of interest in the course of performing their duties for us. These conflicts may include:

| • | Our Adviser may realize substantial compensation on account of its activities on our behalf; |

| • | Our agreements with our Adviser are not arm’s-length agreements; |

| • | We may experience competition with our affiliates for financing transactions; and |

| • | Our Adviser and other affiliates could compete for the time and services of our officers and directors. |

Our Tax Status

We have operated and intend to continue to operate in a manner that will allow us to qualify as a REIT under the Internal Revenue Code of 1986, as amended (the “Code”). On September 3, 2014, we filed our 2013 federal income tax return, on which we elected to be taxed as a REIT for federal income tax purposes beginning with our tax year ended December 31, 2013. Our qualification as a REIT depends on our ability to satisfy numerous asset, income, stock ownership and distribution tests described below, the satisfaction of which depends, in part, on our operating results.

13

The sections of the Code relating to qualification, operation and taxation as a REIT are highly technical and complex. The following discussion sets forth only the material aspects of those sections. This summary is qualified in its entirety by the applicable Code provisions and the related Treasury Regulations and administrative and judicial interpretations thereof.

As a REIT, we generally will not be subject to federal income tax on the taxable income that we distribute to our stockholders because we will be entitled to a deduction for dividends that we pay. The benefit of that tax treatment is that it avoids the “double taxation,” or taxation at both the corporate and stockholder levels, that generally results from owning stock in a corporation. In general, income generated by a REIT is taxed only at the stockholder level if such income is distributed by the REIT to its stockholders. We will be subject to federal tax, however, in the following circumstances:

| • | We are subject to the corporate federal income tax on any REIT taxable income, including net capital gain, that we do not distribute to our stockholders during, or within a specified time period after, the calendar year in which the income is earned. |

| • | We may be subject to the corporate “alternative minimum tax” on any items of tax preference, including any deductions of net operating losses. |

| • | We are subject to tax, at the highest corporate rate, on: |

| • | net income from the sale or other disposition of property acquired through foreclosure (“foreclosure property”), as described under “Material U.S. Federal Income Tax Considerations — Gross Income Tests — Foreclosure Property,” that we hold primarily for sale to customers in the ordinary course of business, and |

| • | other nonqualifying income from foreclosure property. |

| • | We are subject to a 100% tax on net income from sales or other dispositions of property, other than foreclosure property, that we hold primarily for sale to customers in the ordinary course of business. |

| • | If we fail to satisfy one or both of the 75% gross income test or the 95% gross income test, as described under “Material U.S. Federal Income Tax Considerations — Gross Income Tests,” but nonetheless maintain our qualification as a REIT because we meet certain other requirements, we will be subject to a 100% tax on: |

| • | the greater of the amount by which we fail the 75% gross income test or the 95% gross income test, in either case, multiplied by |

| • | a fraction intended to reflect our profitability. |

| • | If we fail to distribute during a calendar year at least the sum of: (1) 85% of our REIT ordinary income for the year, (2) 95% of our REIT capital gain net income for the year, and (3) any undistributed taxable income required to be distributed from earlier periods, then we will be subject to a 4% nondeductible excise tax on the excess of the required distribution over the amount we actually distributed. |

| • | If we fail any of the asset tests, other than a de minimis failure of the 5% asset test, the 10% vote test or the 10% value test, as described under “Material U.S. Federal Income Tax Considerations — Asset Tests,” as long as (1) the failure was due to reasonable cause and not to willful neglect, (2) we file a description of each asset that caused such failure with the IRS, and (3) we dispose of the assets causing the failure or otherwise comply with the asset tests within six months after the last day of the quarter in which we identify such failure, we will pay a tax equal to the greater of $50,000 or the highest federal corporate income tax rate (currently 35%) multiplied by the net income from the nonqualifying assets during the period in which we failed to satisfy the asset tests. |

14

| • | If we fail to satisfy one or more requirements for REIT qualification, other than the gross income tests and the asset tests, and such failure is due to reasonable cause and not to willful neglect, we will be required to pay a penalty of $50,000 for each such failure. |

| • | We will be subject to a 100% excise tax on transactions with a taxable REIT subsidiary that are not conducted on an arm’s-length basis. |

| • | If we acquire any asset from a C corporation, or a corporation that generally is subject to full corporate-level tax, in a merger or other transaction in which we acquire a basis in the asset that is determined by reference either to the C corporation’s basis in the asset or to another asset, we will pay tax at the highest corporate rate applicable if we recognize gain on the sale or disposition of the asset during the 10-year period after we acquire the asset. The amount of gain on which we will pay tax generally is the lesser of: |

| • | the amount of gain that we recognize at the time of the sale or disposition, and |

| • | the amount of gain that we would have recognized if we had sold the asset at the time we acquired it. |

| • | The earnings of our taxable REIT subsidiaries are subject to federal corporate income tax. |

In addition, we may be subject to a variety of taxes, including payroll taxes and state, local and foreign income, property and other taxes on our assets and operations. We also could be subject to tax in situations and on transactions not presently contemplated.

To maintain our qualification as a REIT, we must meet a number of organizational and operational requirements, including a requirement that we annually distribute at least 90% of our net income, excluding net capital gains, to our stockholders. As a REIT, we generally will not be subject to U.S. federal income tax on our net income that we distribute to our stockholders. If we fail to qualify as a REIT in any taxable year, we will be subject to U.S. federal income tax at regular corporate rates. Even if we qualify for taxation as a REIT, we may be subject to some U.S. federal, state and local taxes on our income or property, and the net income of any of our subsidiaries that qualifies as a TRS will be subject to taxation at normal corporate rates. In addition, we will be subject to regular corporate income tax for the taxable years ending prior to our qualification as a REIT. See “Material U.S. Federal Income Tax Considerations.”

It is also possible that the federal income tax laws or regulations governing REITs or the administrative interpretations of those laws or regulations might change in the future in a manner that might make it difficult or impossible for us to continue to qualify as a REIT.

Corporate Information

We were originally incorporated in California on June 14, 1997, but were subsequently re-incorporated in Delaware on May 25, 2004, and finally re-incorporated in Maryland on March 24, 2011. We have elected to be taxed as a real estate investment trust beginning with our tax year ended December 31, 2013. Our executive offices are located at 1521 Westbranch Drive, Suite 100, McLean, Virginia 22102. Our telephone number at our executive offices is (703) 287-5800 and our corporate website is www.GladstoneLand.com. However, the information located on, or accessible from, our website is not, and shall not be deemed to be, a part of this prospectus, any accompanying prospectus supplement or any free writing prospectus or incorporated into any other filings that we make with the SEC.

15

The Offering

| Issuer |

Gladstone Land Corporation |

| Common stock offered by us |

1,250,000 shares (or 1,437,500 shares of common stock if the underwriters exercise their overallotment option in full) |

| Common stock outstanding prior to this offering |

7,753,717 shares(1) |

| Common stock to be outstanding after this offering |

9,003,717 shares(2) |

| Use of proceeds |

We estimate that our net proceeds from this offering will be approximately $13.3 million (or approximately $15.3 million if the underwriters exercise their over-allotment option in full) after deducting the underwriting discounts and commissions and other estimated offering expenses payable by us. We intend to use the proceeds from this offering to fund future property acquisitions, repay debt and for other general corporate purposes. See “Use of Proceeds.” |

| Dividends and Distributions |

We declare quarterly and pay monthly cash distributions to holders of our common stock at the current rate of $0.04 per share. Distributions are authorized and paid at the discretion of our Board of Directors and are based upon the circumstances at the time of declaration. |

| Restriction on ownership |

To assist us in maintaining our qualification as a REIT for federal income tax purposes, among other purposes, ownership, actual or constructive, by any person of more than 3.3% in value of shares of our capital stock or 3.3% in value or number (whichever is more restrictive) of shares of our common stock is restricted by our charter. This restriction may be waived by our Board of Directors in its sole and absolute discretion, prospectively or retroactively, upon the satisfaction of certain conditions. See “Certain Provisions of Maryland Law and of our Charter and Bylaws.” |

| Risk factors |

An investment in shares of our common stock involves substantial risks, and prospective investors should carefully consider the matters discussed in the “Risk Factors” sections in this prospectus. |

| NASDAQ symbol |

“LAND” |

For additional information regarding stock, see “Description of Our Capital Stock.”

| (1) | The common stock outstanding is as of May 8, 2015. |

| (2) | Assumes that the underwriters do not exercise the overallotment option. If the underwriters exercise the overallotment option in full, 9,191,217 shares of common stock will be outstanding upon completion of this offering. |

16

Summary Selected Consolidated Financial and Operating Data

You should read the summary financial information below in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the financial statements, notes thereto and other financial information incorporated by reference into or included elsewhere in this prospectus. The summary of consolidated financial data as of December 31, 2014, 2013, 2012, 2011 and 2010 are derived from audited and, where noted, unaudited consolidated financial statements incorporated by reference into or included elsewhere in this prospectus and from internal records. Our historical results of operations are not necessarily indicative of results of operations that should be expected in any future periods, and our results for any interim period are not necessarily indicative of the results that may be expected for a full fiscal year.

| As of and For the Years Ended December 31, | ||||||||||||||||||||

| 2014 | 2013 | 2012 | 2011 | 2010 | ||||||||||||||||

| Operating Data: |

||||||||||||||||||||

| Total operating revenues |

$ | 7,184,922 | $ | 4,038,138 | $ | 3,390,594 | $ | 2,964,082 | $ | 2,418,111 | ||||||||||

| Operating income |

$ | 1,599,972 | $ | 1,357,453 | $ | 1,901,615 | $ | 1,282,828 | $ | 1,564,581 | ||||||||||

| Net (loss) income before income taxes |

$ | (98,631 | ) | $ | 295,047 | $ | 900,692 | $ | 13,730 | $ | 877,127 | |||||||||

| Net (loss) income |

$ | (125,133 | ) | $ | (1,224,683 | ) | $ | 600,373 | $ | 6,219 | $ | 560,523 | ||||||||

| Funds from operations(1)(6) |

$ | 1,610,511 | $ | (502,228 | ) | $ | 1,074,853 | $ | 511,787 | $ | 877,767 | |||||||||

| Adjusted funds from operations(2)(6) |

$ | 3,126,433 | $ | 1,193,931 | $ | 1,291,337 | $ | 1,050,694 | $ | 1,204,545 | ||||||||||

| Share and Per-Share Data: |

||||||||||||||||||||

| Weighted average common shares outstanding — basic and diluted |

6,852,917 | 6,214,557 | 2,750,000 | 2,750,000 | 2,750,000 | |||||||||||||||

| (Loss) earnings per weighted average common share — basic and diluted |

$ | (0.02 | ) | $ | (0.20 | ) | $ | 0.22 | $ | 0.00 | $ | 0.20 | ||||||||

| Funds from operations — basic and diluted(1)(6) |

$ | 0.24 | $ | (0.08 | ) | $ | 0.39 | $ | 0.19 | $ | 0.32 | |||||||||

| Adjusted funds from operations — basic and diluted(2)(6) |

$ | 0.46 | $ | 0.19 | $ | 0.47 | $ | 0.38 | $ | 0.44 | ||||||||||

| Distributions per common share |

$ | 0.36 | $ | 1.49 | $ | — | $ | 0.37 | $ | — | ||||||||||

| Balance Sheet Data: |

||||||||||||||||||||

| Real estate and lease intangibles, net(3) |

$ | 145,257,763 | $ | 75,622,247 | $ | 37,351,944 | $ | 30,326,780 | $ | 17,760,574 | ||||||||||

| Total assets |

$ | 151,702,624 | $ | 93,673,464 | $ | 40,985,848 | $ | 32,768,277 | $ | 29,034,484 | ||||||||||

| Aggregate borrowings(4) |

$ | 86,417,361 | $ | 43,154,165 | $ | 30,817,880 | $ | 24,133,000 | $ | 19,755,621 | ||||||||||

| Total stockholders’ equity |

$ | 59,969,328 | $ | 48,511,992 | $ | 8,136,726 | $ | 7,536,353 | $ | 8,547,633 | ||||||||||

| Total common shares outstanding |

7,753,717 | 6,530,264 | 2,750,000 | 2,750,000 | 2,750,000 | |||||||||||||||

| Supplemental Data: |

||||||||||||||||||||

| Cash flows from operations |

$ | 3,543,622 | $ | (460,353 | ) | $ | 1,137,777 | $ | 1,898,093 | $ | 665,261 | |||||||||

| Number of farms owned(6) |

32 | 21 | 12 | 8 | 2 | |||||||||||||||

| Gross acreage owned(6) |

8,039 | 6,000 | 1,630 | 1,287 | 960 | |||||||||||||||

| Occupancy rate(6) |

100 | % | 100 | % | 100 | % | 100 | % | 100 | % | ||||||||||

| Fair value of farmland portfolio(5)(6) |

$ | 192,952,933 | $ | 115,977,120 | $ | 75,459,000 | $ | 66,080,073 | $ | 53,600,000 | ||||||||||

| Net asset value per share(5)(6) |

$ | 13.94 | $ | 13.51 | $ | 16.82 | $ | 15.74 | $ | 15.99 | ||||||||||

17

| (1) | Funds from operations is a term developed by the National Association of Real Estate Investment Trusts and is defined below. |

| (2) | Adjusted funds from operations is defined below. |

| (3) | Consists of the initial acquisition price (including the costs allocated to both tangible and intangible assets, excluding those allocated to above- and below-market lease values), plus subsequent improvements and other capitalized costs associated with the properties, and adjusted for depreciation and amortization accumulated through December 31, 2014. |

| (4) | Representative of all borrowings of the Company, including mortgage notes payable, bonds payable and borrowings under lines of credit. |

| (5) | As presented in Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Net Asset Value.” |

| (6) | Unaudited. |

The National Association of Real Estate Investment Trusts (“NAREIT”) developed funds from operations (“FFO”) as a relative non-GAAP supplemental measure of operating performance of an equity REIT to recognize that income-producing real estate historically has not depreciated on the same basis determined under GAAP. FFO, as defined by NAREIT, is net income (computed in accordance with GAAP), excluding gains or losses from sales of property and impairment losses on property, plus depreciation and amortization of real estate assets, and after adjustments for unconsolidated partnerships and joint ventures. We further present adjusted fund from operations (“AFFO”) as an additional non-GAAP financial measure, as we believe AFFO to be a more useful supplemental metric for investors to use in assessing our operational performance on a more sustainable basis than FFO.

We calculate AFFO by adjusting FFO for the following items:

| • | A net adjustment for the straight-lining of rents. This adjustment removes the straight-lining of rental income and also includes the removal of amortization related to above- and below-market lease values and to leasehold improvements, resulting in rental income reflected on a cash basis. |

| • | Plus acquisition-related expenses. Acquisition-related expenses are incurred for investment purposes and do not correlate with the operations of our existing portfolio. Further, due to the inconsistency in which these costs are incurred and how they are treated for accounting purposes, we believe the exclusion of these expenses improves comparability of our results on a period-to-period basis. |

| • | Plus income tax provision. We have elected to be treated as a REIT for federal tax purposes beginning with our taxable year ended December 31, 2013. As a REIT, we generally will not be subject to federal income taxes on amounts distributed to our stockholders, provided we meet certain conditions. As such, we believe it is beneficial for investors to view our results of operations excluding the impact of income taxes. |

| • | Plus amortization of deferred financing costs. The amortization of costs incurred to obtain financing is excluded from AFFO, as it is a non-cash expense item. |

| • | Adjustments for other one-time charges. We will adjust for certain non-recurring charges and receipts and will explain such adjustments accordingly. |

FFO and AFFO do not represent cash flows from operating activities in accordance with GAAP, which, unlike FFO and AFFO, generally reflects all cash effects of transactions and other events in the determination of net income, and should not be considered an alternative to net income as an indication of our performance or to cash flows from operations as a measure of liquidity or ability to make distributions. Comparisons of FFO and AFFO, using the NAREIT definition for FFO and the definition above for AFFO, to similarly-titled measures for other REITs may not necessarily be meaningful due to possible differences in the definitions used by such REITs.

18

AFFO available to common stockholders is AFFO, adjusted to subtract distributions made to holders of preferred stock, if applicable. We believe that net income available to common stockholders is the most directly comparable GAAP measure to AFFO available to common stockholders.

Basic adjusted funds from operations (“Basic AFFO”) per share and diluted adjusted funds from operations (“Diluted AFFO”) per share are AFFO available to common stockholders divided by the number of weighted average shares of common stock outstanding and AFFO available to common stockholders divided by the number of weighted average shares of common stock outstanding on a diluted basis, respectively, during a period. We believe that AFFO available to common stockholders, Basic AFFO per share and Diluted AFFO per share are useful to investors because they provide investors with a further context for evaluating our AFFO results in the same manner that investors use net income and earnings per share (“EPS”) in evaluating net income available to common stockholders. In addition, because many REITs provide AFFO available to common stockholders, Basic AFFO and Diluted AFFO per share information to the investment community, we believe these are useful supplemental measures when comparing us to other REITs. We believe that net income is the most directly-comparable GAAP measure to AFFO, basic EPS is the most directly-comparable GAAP measure to Basic AFFO per share, and diluted EPS is the most directly-comparable GAAP measure to Diluted AFFO per share.

The following table provides a reconciliation of our FFO and AFFO for the fiscal years ended December 31, 2014, 2013, 2012, 2011 and 2010 to the most directly-comparable GAAP measure, net income, and a computation of basic and diluted AFFO per weighted average share of common stock:

| For the Years Ended | ||||||||||||||||||||

| 2014 | 2013 | 2012 | 2011 | 2010 | ||||||||||||||||

| Net (loss) income available to common stockholders |

$ | (125,133 | ) | $ | (1,224,683 | ) | $ | 600,373 | $ | 6,219 | $ | 560,523 | ||||||||

| Plus: Real estate and intangible depreciation and amortization |

1,735,644 | 722,455 | 474,480 | 505,568 | 317,244 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| FFO available to common stockholders |

1,610,511 | (502,228 | ) | 1,074,853 | 511,787 | 877,767 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net adjustment for straight-lining of rents |

1,089,057 | (7,320 | ) | (296,801 | ) | 441,539 | — | |||||||||||||

| Plus: Acquisition-related expenses |

520,352 | 153,725 | 153,494 | 63,489 | — | |||||||||||||||

| Plus: Income tax provision |

26,502 | 1,519,730 | 300,319 | 7,511 | 316,604 | |||||||||||||||

| Plus: Amortization of deferred financing costs |

53,286 | 30,024 | 59,472 | 26,368 | 10,174 | |||||||||||||||

| (Minus) plus: Other one-time (receipts) charges, net(1) |

(173,275 | ) | — | — | — | — | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| AFFO available to common stockholders |

$ | 3,126,433 | $ | 1,193,931 | $ | 1,291,337 | $ | 1,050,694 | $ | 1,204,545 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Weighted average common shares outstanding — basic & diluted |

6,852,917 | 6,214,557 | 2,750,000 | 2,750,000 | 2,750,000 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| FFO per weighted average common share — basic and diluted |

$ | 0.24 | $ | (0.08 | ) | $ | 0.39 | $ | 0.19 | $ | 0.32 | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| AFFO per weighted average common share — basic and diluted |

$ | 0.46 | $ | 0.19 | $ | 0.47 | $ | 0.38 | $ | 0.44 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (1) | Includes the addition of $89,688 of repairs incurred as a result of the fire on the cooler on West Gonzales that were expensed during the year ended December 31, 2014, netted against the property and casualty recovery, net, of $262,963 recorded during the year ended December 31, 2014. |

19

Your investment in shares of our common stock involves substantial risks. In consultation with your own financial and legal advisers, you should carefully consider, among other matters, the factors set forth below before deciding whether an investment in shares of our common stock is suitable for you. If any of the risks contained in or incorporated by reference into this prospectus develop into actual events, our business, financial condition, liquidity, results of operations, FFO, our ability to make cash distributions to holders of our common stock and prospects could be materially and adversely affected, the market price of our common stock could decline and you may lose all or part of your investment. In addition, new risks may emerge at any time and we cannot predict such risks or estimate the extent to which they may affect our financial performance. Some statements in this prospectus, including statements in the following risk factors, constitute forward-looking statements. See the “Forward-Looking Statements” section in this prospectus.

Risks Relating To Our Business

Two of our current properties are leased to the same tenant, Dole, and if Dole is no longer able to make rental payments or chooses to terminate its leases prior to or upon their expiration, it could have a material adverse effect on our financial performance and our ability to make distributions to our stockholders.

Two of our 30 current leases, representing approximately 30% of our annualized, straight-line rental revenue as of December 31, 2014, are with Dole and expire in 2020. If Dole fails to make rental payments, elects to terminate its leases prior to or upon their expiration or does not renew its lease, and we cannot re-lease the land on satisfactory terms, or if Dole were to experience financial problems or declare bankruptcy, it could have a material adverse effect on our financial performance and our ability to make dividend payments to our stockholders.

Our real estate portfolio is concentrated in a limited number of properties and states, which subjects us to an increased risk of significant loss if any property declines in value, if we are unable to lease a property or adverse weather, economic or regulatory changes or developments in the markets in which our properties are located.

As of the date of this prospectus, we owned 34 farms located in 5 different states across the U.S. that are leased to 29 separate and unrelated independent and corporate farmers. One consequence of a limited number of investments is that the aggregate returns we realize may be substantially adversely affected by the unfavorable performance of a small number of leases or a significant decline in the value of any single property. In addition, while we do not intend to invest more than 25% of our total assets in a particular property at the time of investment, it is possible that, as the values of our properties change, one property may comprise up to half the value of our total assets. Lack of diversification and investment concentration will increase the potential that a single underperforming investment could have a material adverse effect on our cash flows and the price we could realize from the sale of our properties. Since our current real estate profile is concentrated across only five states, we are also currently subject to the any adverse change in the political or regulatory climate in those states or specific counties where our properties are located that could adversely affect our real estate portfolio and our ability to lease properties. Finally, the geographic concentration of our portfolio could cause us to be more susceptible to adverse weather, economic or regulatory changes or developments in the markets in which our properties are located than if we owned a more geographically-diverse portfolio, which could materially and adversely affect the value of our farms and our ability to lease our farms on favorable terms or at all.

We may not be successful in identifying and consummating additional suitable acquisitions that meet our investment criteria, which may impede our growth and negatively affect our results of operations.

We continue to actively seek and evaluate other farm properties for potential purchase, but there is no guarantee that we will be able to continue to find and acquire properties that meet our investment criteria. We expect that many of our future tenants will be independent farming operations, about which there is generally

20

little or no publicly available operating and financial information. As a result, we will rely on our Adviser to perform due diligence investigations of these tenants, their operations and their prospects. We may not learn all of the material information we need to know regarding these businesses through our investigations. As a result, it is possible that we could lease properties to tenants or make mortgage loans to borrowers that ultimately are unable to pay rent or interest to us, which could adversely impact the amount available for distributions.

We currently lease many of our properties to medium-sized, independent farming operations and agricultural businesses, which may have limited financial and personnel resources and, therefore, may be less stable than larger companies, which could impact our ability to generate rental revenue.

We expect to lease many of our properties to medium-sized farming operations and related agricultural businesses, which will expose us to a number of unique risks related to these entities. For example, medium-sized agricultural businesses may be more likely than larger farming operations to have difficulty making lease payments when they experience adverse events. They also tend to experience significant fluctuations in their operating results and to be more vulnerable to competitors’ actions and market conditions, as well as general economic downturns. In addition, our target tenants may face intense competition, including competition from companies with greater financial resources, which could lead to price pressure on crops that could lower our tenants’ income.

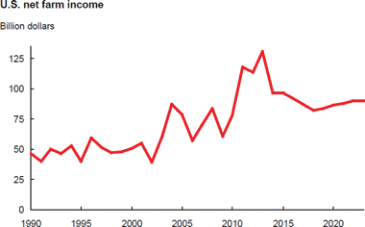

Furthermore, the success of a medium-sized business may also depend on the management talents and efforts of one or a small group of persons. The death, disability or resignation of one or more of these persons could have a material adverse impact on our tenant and, in turn, on us.