Filed pursuant to Rule 433

Registration Statement No. 333-217042

GLADSTONE LAND

Company

and Offering Overview

A Gladstone Farmland Land Real Corporation Estate Investment Trust

$150,000,000 Series B Preferred Stock

A Publicly-Registered

Non-Traded REIT Preferred Offering

Risk Factors: An investment in shares of Gladstone Series B Preferred Stock involves a

high degree of risk. In consultation with your own financial and legal advisers, you should carefully consider, among other matters, the risk factors summarized on page 6 of this brochure and delineated in the “Risk

Factors”sectionsoftheprospectussupplementandinourmostrecentAnnualReportonForm10-Kand QuarterlyReportsonForm10-QandotherinformationwewillfilefromtimetotimewiththeSECbefore

decidingwhetheraninvestmentinsharesofGladstoneSeriesBPreferredStockissuitableforyou.

SPRING VALLEY ROAD, WATSONVILLE, CA

1

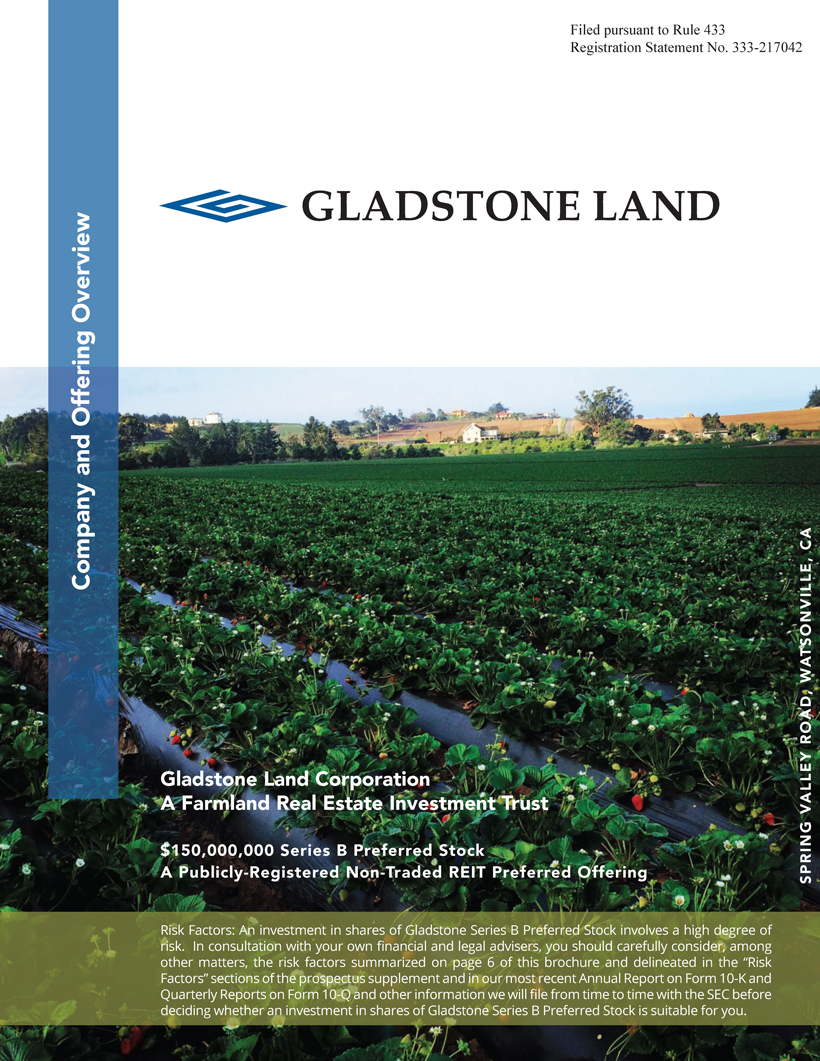

The Farmland Opportunity

Increasingglobaldemandfornaturalfoodshascontinuedtoleadto valuesacrossthemajorityoftheU.S.inrecentyears.Accordingto

averageperacrevaluesofU.S.croplandhavedoubledoverthepast tiongrowthisalsoamajordriverbehindtheoverallincreasedvalue

Nations,globalpopulationisexpectedtogrowby36%between2012and2050.2 Webelievethatpopulationgrowthand

therisingdemandfornaturalfoodswillresultinastrongincreaseindemandforourfarmsoverthelong-term,enabling ustoconsistentlyincreasetherentalratesonourfarms.Wealsoexpectthatthevaluesofourfarmlandwillincreaseat

ratesgreaterthanthatofinflation.Weintendtocontinuetomitigateanyinterestrateorinflationriskbyincludingannu-alescalationsandupwardmarket-rateadjustmentstorentalratesinourleases,whilecontinuingtoseekoutsuperior anddiversifiedcroplandacrosstheU.S.

We believe that population growth and the rising demand for natural foods will result in a strong increase in demand for our farms over the long-term,

“enabling us to consistently increase the rental rates on our farms.”

Farmland Growth vs. Population Growth

35.7 % Overall Growth2

10

People 7

&(Billions) 5

Hectares 3 0

2012

POPULATION LAND

1.USDA,EconomicResearchServiceusingdatafromUSDA,NationalAgriculturalStatisticsService(2017).LandValues:2017Summary

2.UnitedNations,DepartmentofEconomicandSocialAffairs, PopulationDivision(2007and2015).WorldPopulationProspects:The2017Revision

3.UnitedNations,FoodandAgricultureOrganizationoftheUnitedNations(2012).WorldAgricultureTowards2030/2050:The2012Revision,ESAWorkingPaperNo.12-03

2

2

Gladstone Land’s Investment Focus

We focus on acquiring high-value farmland that we lease to farmers, primarily on a triple-net lease basis. Our primary

focus is on annual fresh produce (fruits and vegetables), while our secondary focus is on permanent crops (such as blueberries, grapes and nuts).

FARM AND FARMER

CHARACTERISTICS

• On-site water sources

• High-value crops like fruits and vegetables

• Established rental markets with

abundance of strong operators

• Tenant farmers/operators with established histories and substantial farming resources • Family-owned farms where

sale-leaseback transactions free up capital for farmers, often to invest in and improve their operations

TRANSACTION STRUCTURES

• $2 million to $50 million transaction sizes • Favorable lease characteristics:

- Triple Net – we own the land, and the farmers/operators are required to pay taxes, insurance, maintenance and other operating costs—LeaseTerm– 5-10+ yeardurationwithbuilt-inrentescalationsandupwardmarketresets

DIVERSIFICATION1

• 72 farms in our portfolio • Farms located across nine states • Greater than 63,000 acres of land

• More than 39 different crop types farmed by 49 unrelated farmer tenants

EXISTING STATES

CROP TYPES & # OF FARMS

1. As of September 30, 2017

3

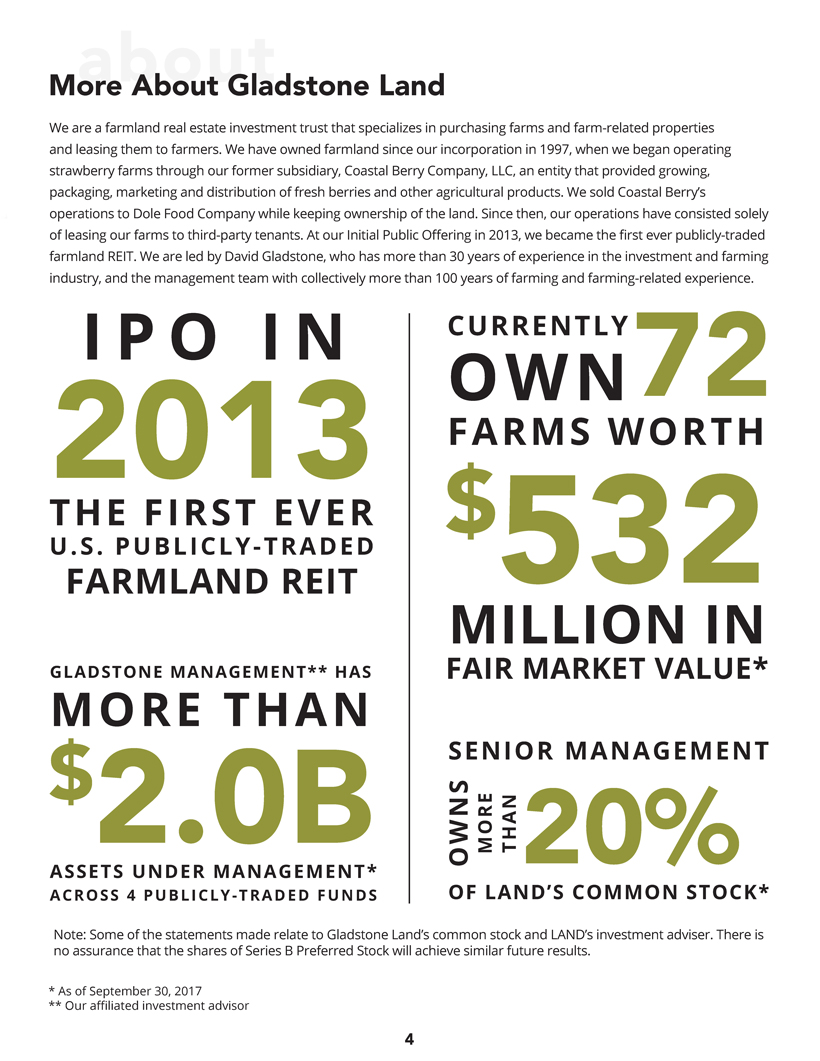

More About Gladstone Land

Weareafarmlandrealestateinvestmenttrustthatspecializesinpurchasingfarmsandfarm-relatedproperties

andleasingthemtofarmers.Wehaveownedfarmlandsinceourincorporationin1997,whenwebeganoperating strawberryfarmsthroughourformersubsidiary,CoastalBerryCompany,LLC,anentitythatprovidedgrowing,

packaging,marketinganddistributionoffreshberriesandotheragriculturalproducts.WesoldCoastalBerry’s operationstoDoleFoodCompanywhilekeepingownershipoftheland.Sincethen,ouroperationshaveconsistedsolely

ofleasingourfarmstothird-partytenants.AtourInitialPublicOfferingin2013,webecamethefirsteverpublicly-traded farmlandREIT.WeareledbyDavidGladstone,whohasmorethan30yearsofexperienceintheinvestmentandfarming

industry,andthemanagementteamwithcollectivelymorethan100yearsoffarmingandfarming-relatedexperience.

2013 IPO IN

THE FIRST EVER

U.S. PUBLICLY-TRADED

FARMLAND REIT

GLADSTONE MANAGEMENT** HAS

MORE THAN

$2.0B

ASSETS UNDER MANAGEMENT*

ACROSS 4 PUBLICLY-TRADED FUNDS

CURRENTLY

OWN

FARMS WORTH

$532

MILLION IN

FAIR MARKET VALUE*

SENIOR MANAGEMENT

OWNSMORETHAN 20%

OF LAND’S COMMON STOCK*

Note:SomeofthestatementsmaderelatetoGladstoneLand’scommonstockandLAND’sinvestmentadviser.Thereis

noassurancethatthesharesofSeriesBPreferredStockwillachievesimilarfutureresults.

* As of September 30, 2017

** Our affiliated investment advisor

4

Offering Summary

GladstoneLandCorporation’sSeriesBPreferredStockOffering isdesignedwiththegoalsofpotentiallyproviding investorswithsteadyincomeandpreservationofcapital.1

Therecanbenoassurancethatwewillachievethese objectives.

SHARES

SeriesBCumulativeRedeemablePreferredStock(“Shares”).TheShareswillrankseniortoGladstoneLand’sCommonStock

andonparitywithitsSeriesAPreferredStockwithrespecttopaymentofdividendsanddistributionofamountsonliquidation, dissolutionandwindingup.

SHARE PRICE &

DIVIDEND RATE

$25.00perSharewithaminimuminitialinvestmentof$25,000.Nominimumforqualifiedretirementaccounts.

6.0%annualizeddividend,or$1.50perShareperyearannualized,intendedtobepaidmonthlyin12distributionsof$0.125per Sharepermonth. 1

DividendsontheSeriesBSharesarecumulativeandmustbepaidinpreferencetodividendsoncommonstock.

SIZE

$150million

TERM

Theearlieroffive(5)yearsfromtheoffering’sinitialprospectusfilingorthesaleofall6,000,000Sharesbeingoffered.

COMMISSIONS, FEES, AND EXPENSES

Sellingcommissionsupto7.0%,dealermanagerfeesof3.0%,andestimatedofferingexpensesof2.5%ofgrossproceeds.Wewill

notpaysellingcommissionsonsalestofee-based(andcertainother)a plement.

DEALER MANAGER

GladstoneSecurities,LLC

Investmen Featur s

Diversified Portfolio Inflation Public Listing Redemption Feature Transparency

9stateswithcurrentfairvalueofapproximately Wealreadyownaportfolioof72farmsthatcompriseapproximately63,000acresoflandacross $532million,asofSeptember30,2017.

Thepricesofproducecropshavehistoricallyoutpacedinflation.2 Weprimarilyownfarms thatgrowproducecrops.

escalators.Wehaveaveragedovera9.0%increaseinrentalratesonallleaserenewalssinceour Also,weseektostructureourleaseswithbuilt-incontractualrent IPOinJanuary2013.3

withinonecalendaryearaftertheofferingends,buttherecanbenoassurancethatwewill WeanticipateapplyingtolisttheSharesonNASDAQoranothernationalsecuritiesexchange

publicmarkettodeveloppriortolistingtheSharesonanexchange,ifatall. achievethisobjective.ThereiscurrentlynopublicmarketfortheShares,andwedonotexpecta perShare. Eachinvestormayannuallyrequestredemptionofalloraportionofhis/herSharesat

Theannualpoolwewillmakeavailableforsatisfyingredemptionsislimitedto5% $23.50 ThisredemptioncapmaylimityourabilitytoredeemsomeoranyofyourShares. ofthetotalnumberofSharessoldinthatyearfromJanuarytoNovembermultipliedby$25. thesymbol“LAND”.

WhiletheSharesarenotlistedonanyexchange,ourCommonStockislistedonNASDAQunder Assuch,wefileannual,quarterly,andperiodicreportswiththeSEC.Because oninvestment. theSharesarenottraded,itmaybedifficult todeterminethevalueoftheSharesoryourreturn

There is no guarantee of capital preservation or continuous dividends.

Bureau

of Labor Statistics, United States Department of Labor, CPI Detailed Report, Data for 1985-2016

There can be no guarantee that rental rates on lease renewals will

continue to increase.

5

GLADSTONE SECURITIES

Dealer Manager (Member

FINRA/SIPC) 1521 Westbranch Drive, Suite 100 McLean, VA 22102 Investors: Contact your financial advisor Finance Professionals: Call (703) 287-5900 or toll-free (833)

849-5993 www.gladstoneofferings.com

RISKFACTORS

Pleaseconsulttheprospectussupplementforthisofferingfora recitationoftheriskfactorsofthisoffering.Ifanyoftheriskscontained

inorincorporatedbyreferenceintotheprospectussupplementorthe accompanyingprospectusdevelopintoactualevents,ourbusiness, financialcondition,liquidity,resultsofoperations,FFO,adjustedfunds fromoperationsorourprospectscouldbemateriallyandadversely

affected,wemaybeunabletotimelypaythedividendsaccruedonthe SeriesBPreferredStock,thevalueoftheSeriesBPreferredStockcould declineandyoumayloseallorpartofyourinvestment.Inaddition, newrisksmayemergeatanytimeandwecannotpredictsuchrisksor

estimatetheextenttowhichtheymayaffectourfinancialperformance. Somestatementsintheprospectussupplement,includingstatementsin

theriskfactors,constituteforward-lookingstatements.Seethe“Forward-LookingStatements”and“RiskFactors”sectionsintheprospectus supplement,theaccompanyingprospectusandinourregularfilings

withtheSECforadditionalriskswhichmayaffectusorthesharesofour SeriesBPreferredStock(the“Shares”).

•TherewillinitiallybenopublicmarketfortheSharesaswedonot intendtoapplyforquotationonNASDAQuntilaftertheTermination

Date,andevenafterlisting,ifachieved,aliquidsecondarytrading marketmaynotdevelopandthefeaturesoftheSharesmaynotprovide youwithfavorableliquidityoptions.

•TheShareswillnotberated.

•DividendpaymentsontheSeriesBPreferredStockarenotguaranteed. •Weoperateasaholdingcompanydependentupontheassetand

operationsofoursubsidiaries,andbecauseofourstructure,wemay notbeabletogeneratethefundsnecessarytomakedistributionson theShares.

•Wewillberequiredtoterminatethisofferingifbothourcommonstock andtheSeriesAPreferredStockarenolongerlistedonNASDAQor anothernationalsecuritiesexchange.

•TheabilitytoredeemsharesofSharesmaybelimited. •TheShareswillbearariskofredemptionbyus. •Thecashdistributionsyoureceivemaybelessfrequentorlowerin

amountthanyouexpect.

•Uponthesaleofanyindividualproperty,holdersofSharesdonothave apriorityoverholdersofourcommonstockregardingreturnofcapital.

•Yourpercentageofownershipmaybecomedilutedifweincur additionaldebtorissuenewsharesofstockorothersecurities,and incurrenceofindebtednessandissuancesofadditionalpreferredstock orothersecuritiesbyusmayfurthersubordinatetherightsofthe

holdersofourcommonstockandpreferredstock.

•Ourabilitytopaydividendsand/orredeemsharesofSharesmaybe limitedbyMarylandlaw.

•Ourchartercontainsrestrictionsuponownershipandtransferofthe Shares,whichmayimpairtheabilityofholderstoacquireordisposeof theShares.

•HoldersoftheShareswillbesubjecttoinflationrisk. •AninvestmentintheSharesbearsinterestraterisk. •HoldersoftheShareswillbearreinvestmentrisk.

•HoldersofShareswillhaveextremelylimitedvotingrights. •Ourmanagementwillhavebroaddiscretionintheuseofthenet proceedsfromthisofferingandmayallocatethenetproceedsfromthis offeringinwaysthatyouandotherstockholdersmaynotapprove.

•Wemaybeunabletoinvestasignificantportionofthenetproceedsof thisofferingonacceptableterms.

•Wearean“emerginggrowthcompany”andwecannotbecertainif thereduceddisclosurerequirementsapplicabletoemerginggrowth

companieswillmakeourShareslessattractivetoinvestors.Weelected totakeadvantageoftheoptiontodelayadoptionofneworrevised accountingstandardsuntiltheyarerequiredtobeadoptedbyprivate companies;consequently,ourcurrentandpriorfinancialstatements

maynotbecomparabletothoseofotherpubliccompanies. •Wehavepaid,maycontinuetopay,ormayinthefuturepay, distributionsfromofferingproceeds,borrowingsorthesaleofassetsto theextentourcashflowfromoperationsorearningsarenotsufficient

tofunddeclareddistributions.Ratesofdistributiontoholdersofour commonstockandpreferredstockwillnotnecessarilybeindicativeof ouroperatingresults.Ifwemakedistributionsfromsourcesotherthan ourcashflowsfromoperationsorearnings,wewillhavefewerfunds

availablefortheacquisitionofpropertiesandyouroverallreturnmay bereduced.

•Ifthepropertiesweacquireorinvestindonotproducethecash

flowthatweexpectinordertomeetourREITminimumdistribution requirement,wemaydecidetoborrowfundstomeettheREIT minimumdistributionrequirements,whichcouldadverselyaffectour overallfinancialperformance.

•GladstoneSecurities,thedealermanagerinthisoffering,isouraffiliate, andweestablishedtheofferingpriceandothertermsfortheShares pursuanttodiscussionsbetweenusandouraffiliated

dealermanager; asaresult,theactualvalueofyourinvestmentmaybesubstantiallyless thanwhatyoupay.

•PaymentoffeestoourAdviseranditsaffiliates,includingouraffiliated dealermanagerwillreducethecashavailableforinvestmentand

distributionandwillincreasetheriskthatyouwillnotbeabletorecover theamountofyourinvestmentinoursharesofShares.

•IfyoufailtomeetthefiduciaryandotherstandardsunderERISAorthe Codeasaresultofaninvestmentinthisoffering,youcouldbesubject

toliabilityandcivilorcriminalpenalties.

Gladstone Land Corporation (“LAND”) has filed a registration statement (including a prospectus) and a prospectus

supplement with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement, the prospectus supplement and other documents that LAND has filed with the SEC for more

complete information about LAND and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, Gladstone Securities, LAND’s dealer manager for this offering, will arrange to send you

the prospectus and prospectus supplement if you request it by calling toll-free at (833) 849-5993.

6