Filed pursuant to Rule 433 Registration Statement No. 333-217042 A Farmland Real Estate Investment Trust $150,000,000 Series B Cumulative Redeemable Preferred Stock Offering FOR INTERNAL BROKER DEALER / RIA USE ONLY – NOAs of August 8, 2018

Filed pursuant to Rule 433 Registration Statement No. 333-217042 A Farmland Real Estate Investment Trust $150,000,000 Series B Cumulative Redeemable Preferred Stock Offering FOR INTERNAL BROKER DEALER / RIA USE ONLY – NOAs of August 8, 2018

Legal Disclaimers Estimates: This presentation contains industry and market data, forecasts, and projections that are based on internal data and estimates, independent industry publications, reports by market research firms, or other published independent sources. We believe these data to be reliable as of the date of this presentation, but there can be no assurance as to the accuracy or completeness of such information. We have not independently verified all market and industry data obtained from these third-party sources. Our internal data and estimates are based upon information obtained from trade and business organizations, other contacts in the markets in which we operate, and our management’s understanding of industry conditions. You should carefully consider the inherent risks and uncertainties associated with the market and other industry data contained in this presentation. Forward-Looking Statements: This presentation may include statements that constitute “forward-looking statements” within the meaning of the Securities Act of 1933 or the Securities Exchange Act of 1934. These forward-looking statements include comments with respect to our objectives and strategies and the results of our operations and our business. By their nature, these forward-looking statements involve numerous assumptions, uncertainties and opportunities, both general and specific. The risk exists that these statements may not be fulfilled. We caution readers of this presentation not to place undue reliance on these forward-looking statements, as a number of factors could cause future Company results to differ materially from these statements, including those factors listed under the caption, “Risk Factors,” in our Form 10-K and 10-Q filings and our registration statement, including our prospectus and prospectus supplement, as filed with the Securities and Exchange Commission (“SEC”), all of which can be found on our website, www.GladstoneLand.com,or the SEC website, www.SEC.gov. Any results or performance implied by forward-looking statements may be influenced in particular by factors such as fluctuations in interest rates and stock indices, the effects of competition in the areas in which we operate, and changes in economic, political, regulatory, and technological conditions. We caution that the foregoing list is not exhaustive. When relying on forward-looking statements to make decisions, investors should carefully consider the aforementioned factors as well as other uncertainties and events. The company has no duty to, and does not intend to, update or revise any forward-looking statements, except as required by law. Past or Present Performance Disclaimer: This presentation includes information regarding past or present performance of the company. Please note that past or present performance is not a guarantee of future performance or future results. 1

Risk Factors Please consult the prospectus supplement for this offering for a recitation of the risk factors of this offering. If any of the risks contained in or incorporated by reference into the prospectus supplement or the accompanying prospectus develop into actual events, our business, financial condition, liquidity, results of operations, FFO, adjusted funds from operations or our prospects could be materially and adversely affected, we may be unable to timely pay the dividends accrued on the Series B Preferred Stock (the “Shares”), the value of the Shares could decline and you may lose all or part of your investment. In addition, new risks may emerge at any time and we cannot predict such risks or estimate the extent to which they may affect our financial performance. Some statements in the prospectus supplement, including statements in the risk factors, constitute forward-looking statements. See the “Forward-Looking Statements” and “Risk Factors” sections in the prospectus supplement, the accompanying prospectus and in our regular filings with the SEC for additional risks which may affect us or the Shares. ? There will initially be no public market for the Shares as we do not intend to apply for quotation on NASDAQ until after the Termination Date, and even after listing, if achieved, a liquid secondary trading market may not develop and the features of the Shares may not provide you with favorable liquidity options. ? The Shares will not be rated. ? Dividend payments on the Shares are not guaranteed. ? We operate as a holding company dependent upon the asset and operations of our subsidiaries, and because of our structure, we may not be able to generate the funds necessary to make distributions on the Shares. ? We will be required to terminate this offering if both our Common Stock and our Series A Preferred Stock are no longer listed on NASDAQ or another national securities exchange. ? The ability to redeem shares of Shares may be limited.? The Shares will bear a risk of redemption by us. ? The cash distributions you receive may be less frequent or lower in amount than you expect. ? Upon the sale of any individual property, holders of Shares do not have a priority over holders of our common stock regarding return of capital. ? Your percentage of ownership may become diluted if we incur additional debt or issue new shares of stock or other securities, and incurrence of indebtedness and issuances of additional preferred stock or other securities by us may further subordinate the rights of the holders of our common stock and preferred stock. ? Our ability to pay dividends and/or redeem shares of Shares may be limited by Maryland law. ? Our charter contains restrictions upon ownership and transfer of the Shares, which may impair the ability of holders to acquire or dispose of the Shares. 2

Risk Factors (cont.) ? Holders of the Shares will be subject to inflation risk.? An investment in the Shares bears interest rate risk.? Holders of the Shares will bear reinvestment risk.? Holders of Shares will have extremely limited voting rights. ? Our management will have broad discretion in the use of the net proceeds from this offering and may allocate the net proceeds from this offering in ways that you and other stockholders may not approve. ? We may be unable to invest a significant portion of the net proceeds of this offering on acceptable terms. ? We are an “emerging growth company” and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make our Shares less attractive to investors. We elected to take advantage of the option to delay adoption of new or revised accounting standards until they are required to be adopted by private companies; consequently, our current and prior financial statements may not be comparable to those of other public companies. ? We have paid, may continue to pay, or may in the future pay, distributions from offering proceeds, borrowings or the sale of assets to the extent our cash flow from operations or earnings are not sufficient to fund declared distributions. Rates of distribution to holders of our common stock and preferred stock will not necessarily be indicative of our operating results. If we make distributions from sources other than our cash flows from operations or earnings, we will have fewer funds available for the acquisition of properties and your overall return may be reduced. ? If the properties we acquire or invest in do not produce the cash flow that we expect in order to meet our REIT minimum distribution requirement, we may decide to borrow funds to meet the REIT minimum distribution requirements, which could adversely affect our overall financial performance. ? Gladstone Securities, the dealer manager in this offering, is our affiliate, and we established the offering price and other terms for the Shares pursuant to discussions between us and our affiliated dealer manager; as a result, the actual value of your investment may be substantially less than what you pay. ? Payment of fees to our Adviser and its affiliates, including our affiliated dealer manager will reduce the cash available for investment and distribution and will increase the risk that you will not be able to recover the amount of your investment in our shares of Shares. ? If you fail to meet the fiduciary and other standards under ERISA or the Code as a result of an investment in this offering, you could be subject to liability and civil or criminal penalties. Gladstone Land Corporation (“LAND”) has filed a registration statement (including a prospectus) and a prospectus supplement with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement, the prospectus supplement and other documents that LAND has filed with the SEC for more complete information about LAND and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, Gladstone Securities, LAND’s dealer manager for this offering, will arrange to send you the prospectus and prospectus supplement if you request it by calling toll-free at (833) 849-5993. 3

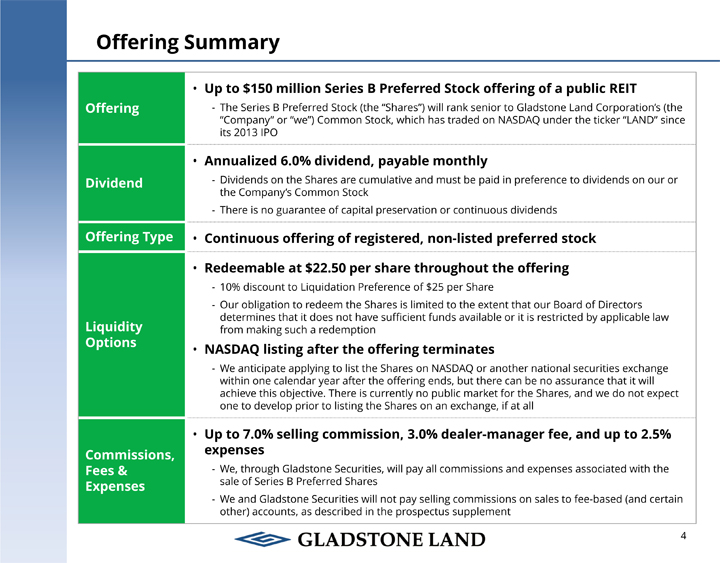

Offering Summary • Up to $150 million Series B Preferred Stock offering of a public REIT Offering - The Series B Preferred Stock (the “Shares”) will rank senior to Gladstone Land Corporation’s (the “Company” or “we”) Common Stock, which has traded on NASDAQ under the ticker “LAND” since its 2013 IPO • Annualized 6.0% dividend, payable monthly Dividend - Dividends on the Shares are cumulative and must be paid in preference to dividends on our or the Company’s Common Stock - There is no guarantee of capital preservation or continuous dividends Offering Type • Continuous offering of registered, non-listed preferred stock • Redeemable at $22.50 per share throughout the offering - 10% discount to Liquidation Preference of $25 per Share - Our obligation to redeem the Shares is limited to the extent that our Board of Directors determines that it does not have sufficient funds available or it is restricted by applicable law Liquidity from making such a redemption Options • NASDAQ listing after the offering terminates - We anticipate applying to list the Shares on NASDAQ or another national securities exchange within one calendar year after the offering ends, but there can be no assurance that it will achieve this objective. There is currently no public market for the Shares, and we do not expect one to develop prior to listing the Shares on an exchange, if at all • Up to 7.0% selling commission, 3.0% dealer-manager fee, and up to 2.5% Commissions, expenses Fees & - We, through Gladstone Securities, will pay all commissions and expenses associated with the Expenses sale of Series B Preferred Shares - We and Gladstone Securities will not pay selling commissions on sales to fee-based (and certain other) accounts, as described in the prospectus supplement 4

Investment Features • The Company already owns a portfolio of 79 farms with more than 67,000 acres Diversified across 9 states valued at approximately $560 million, as of June 30, 2018 Portfolio - Most farms have been farmed for decades, and all farms have their own water sources • The prices of produce crops have historically outpaced inflation, according to data from the U.S. Department of Labor1 Inflation - We primarily own farms that grow fresh produce crops, some nut orchards, and only a few that grow corn, wheat, or soy - Management seeks to structure leases with contractual rent escalators. There can be no guarantee that rental rates on lease renewals will continue to increase • The Company went public in 2013 and has been in business since 1997 Transparency - We file annual, quarterly, and periodic reports with the SEC - Because the Shares are not traded, it may be difficult to determine the value of your Shares or your return on investment • In 2017, the Company covered its preferred stock dividends by approximately 5x Dividend (i.e., earned $5 of AFFO to pay every $1 of preferred dividends) Coverage - The Company is unable to pay distributions to common stockholders unless it has paid dividends on all series of its preferred stock Notes: 1. Data from 1980-2017; source: https://www.bls.gov/cpi/ 5

Gladstone Land Overview farmers, Owns farmland primarily and onfarm a triple -related -net basis, facilities meaning leasedthe to farmer high-quality pays rent, insurance, maintenance, and taxes states, As of June valued 30, at 2018, approximately we own 79 $ farms 560 million. with 67,060 99.8%total of our acres acreage in 9 is currently leased vegetables, Primarily buys andfarmland nuts used to grow healthy foods, such as fruits, investment One of fouradvisor public companies with over managed $2.4 billion by an of SEC assets -registered under management and 67 professionals as of June 30, 2018 6

Three Areas of Farming Primary Focus: Fresh Produce The basic thesis is our belief that farmland growing fresh produce (e.g., fruits and vegetables) and permanent crops (e.g., nuts and blueberries) is a superior Secondary Focus: Nuts investment over land growing commodity crops (e.g., corn, wheat, and soy), due to: ?Higher profitability and rental income?Lower price volatility Tertiary Focus: Grains & Other Crops?Lower government dependency?Lower storage costs?Ground typically closer to major urban populations, thus higher development potential 7

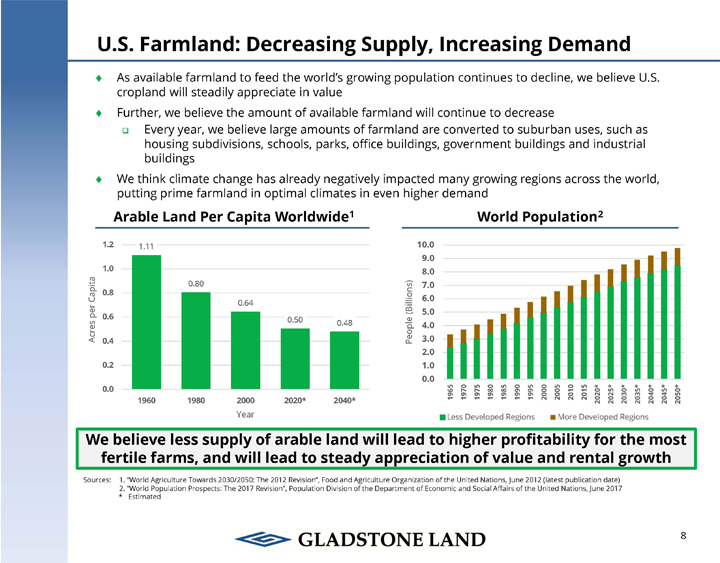

U.S. Farmland: Decreasing Supply, Increasing Demand ? As available farmland to feed the world’s growing population continues to decline, we believe U.S. cropland will steadily appreciate in value? Further, we believe the amount of available farmland will continue to decrease? Every year, we believe large amounts of farmland are converted to suburban uses, such as housing subdivisions, schools, parks, office buildings, government buildings and industrial buildings? We think climate change has already negatively impacted many growing regions across the world, putting prime farmland in optimal climates in even higher demand Arable Land Per Capita Worldwide1 World Population2 1.2 1.11 10.0 9.0 1.0 8.0 0.80 7.0 0.8 Capita 6.0 0.64 (Billions) per 5.0 0.6 0.50 0.48 4.0 Acres 0.4 People 3.0 2.0 0.2 1.0 0.0 0.0 1965 1970 1975 1980 1985 1990 1995 2000 2005 2010 2015 1960 1980 2000 2020* 2040* 2020* 2025* 2030* 2035* 2040* 2045* 2050* Year Less Developed Regions More Developed Regions We believe less supply of arable land will lead to higher profitability for the most fertile farms, and will lead to steady appreciation of value and rental growth Sources: 1. “World Agriculture Towards 2030/2050: The 2012 Revision”, Food and Agriculture Organization of the United Nations, June 2012 (latest publication date) 2. “World Population Prospects: The 2017 Revision”, Population Division of the Department of Economic and Social Affairs of the United Nations, June 2017 * Estimated 8

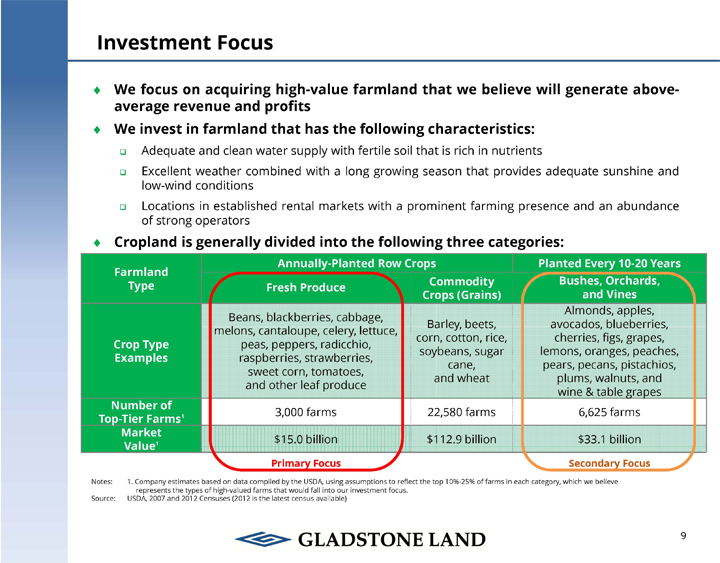

Investment Focus ? We focus on acquiring high-value farmland that we believe will generate above-average revenue and profits? We invest in farmland that has the following characteristics: ? Adequate and clean water supply with fertile soil that is rich in nutrients ? Excellent weather combined with a long growing season that provides adequate sunshine and low-wind conditions? Locations in established rental markets with a prominent farming presence and an abundance of strong operators ? Cropland is generally divided into the following three categories: Annually-Planted Row Crops Planted Every 10-20 Years Farmland Type Commodity Bushes, Orchards, Fresh Produce Crops (Grains) and Vines Almonds, apples, Beans, blackberries, cabbage, Barley, beets, avocados, blueberries, melons, cantaloupe, celery, lettuce, corn, cotton, rice, cherries, figs, grapes, Crop Type peas, peppers, radicchio, soybeans, sugar lemons, oranges, peaches, Examples raspberries, strawberries, cane, pears, pecans, pistachios, sweet corn, tomatoes, and wheat plums, walnuts, and and other leaf produce wine & table grapes Number of 1 3,000 farms 22,580 farms 6,625 farms Top-Tier Farms Market 1 $15.0 billion $112.9 billion $33.1 billion Value Primary Focus Secondary Focus Notes: 1. Company estimates based on data compiled by the USDA, using assumptions to reflect the top 10%-25% of farms in each category, which we believe represents the types of high-valued farms that would fall into our investment focus. Source: USDA, 2007 and 2012 Censuses (2012 is the latest census available) 9

Investment Focus (continued) ? While we invest in farmland growing a variety of crop types, our primary focusisfarmlandgrowing freshproduce ? We view this type of farmland as the most productive (in terms of revenue per acre), the most profitable for farmers, and earns the highest rents for landlords. ? We believe fresh produce has lower risks than commodity crops ? Water Access: Commodity crops usually depend solely on rain for water, whereas fresh produce crops are irrigated from farm wells and county-supplied water, and all our farms have their own water supply. ? Price Volatility: Commodity crops typically depend on foreign market prices that make them volatile, whereas fresh produce grown and consumed in the U.S. is more insulated. ? Government Dependency: Commodity crops often depend on government subsidies and tariffs for protection that are subject to change. ? Storage Costs: There is added cost to dry and store commodity crops, whereas fresh produce is consumed within days. ? Rents: Based on our experience, we believe fresh produce farmland has higher rental rates than commodity crop farmland, even though we believe commodity crops carry higher risks. 10

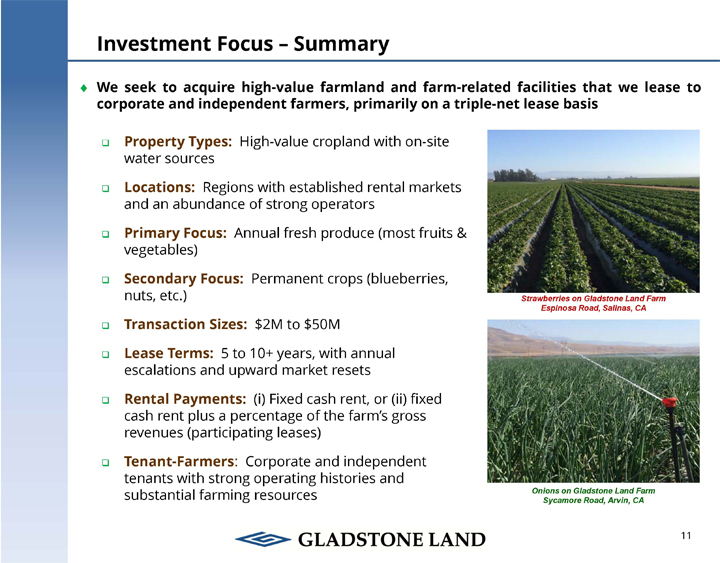

Investment Focus – Summary ? We seek to acquire high-value farmland and farm-related facilities that we lease to corporate and independent farmers, primarily on a triple-net lease basis ? Property Types: High-value cropland with on-site water sources? Locations: Regions with established rental markets and an abundance of strong operators? Primary Focus: Annual fresh produce (most fruits & vegetables)? Secondary Focus: Permanent crops (blueberries, nuts, etc.) Strawberries on Gladstone Land Farm Espinosa Road, Salinas, CA ? Transaction Sizes: $2M to $50M ? Lease Terms: 5 to 10+ years, with annual escalations and upward market resets? Rental Payments: (i) Fixed cash rent, or (ii) fixed cash rent plus a percentage of the farm’s gross revenues (participating leases)? Tenant-Farmers: Corporate and independent tenants with strong operating histories and substantial farming resources Onions on Gladstone Land Farm Sycamore Road, Arvin, CA 11

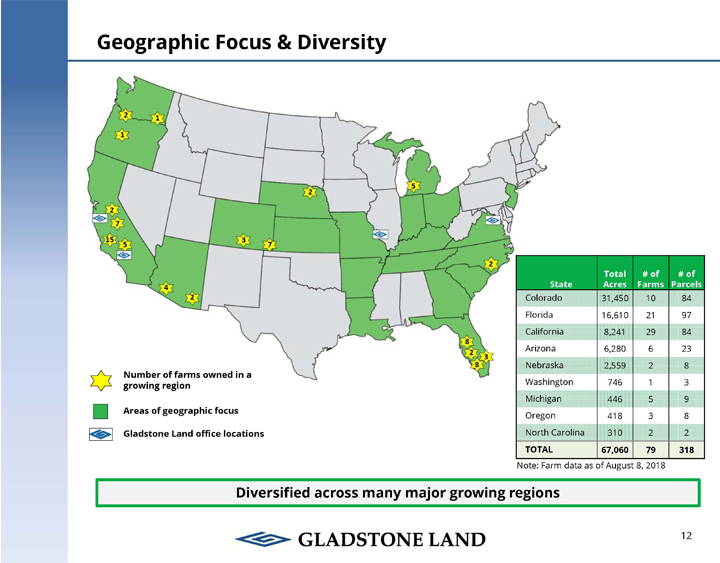

Geographic Focus & Diversity Total # of # of State Acres Farms Parcels Colorado 31,450 10 84 Florida 16,610 21 97 California 8,241 29 84 Arizona 6,280 6 23 Number of farms owned in a Nebraska 2,559 2 8 # Washington 746 1 3 growing region Michigan 446 5 9 Areas of geographic focus Oregon 418 3 8 Gladstone Land office locations North Carolina 310 2 2 TOTAL 67,060 79 318 Note: Farm data as of August 8, 2018 Diversified across many major growing regions 12

Selected Properties Palm City, Florida Oxnard, California Watsonville, California Snap Peas Strawberries Raspberries Coalinga, California Arvin, California Okeechobee, Florida Pistachios Almond Trees Cabbage 13

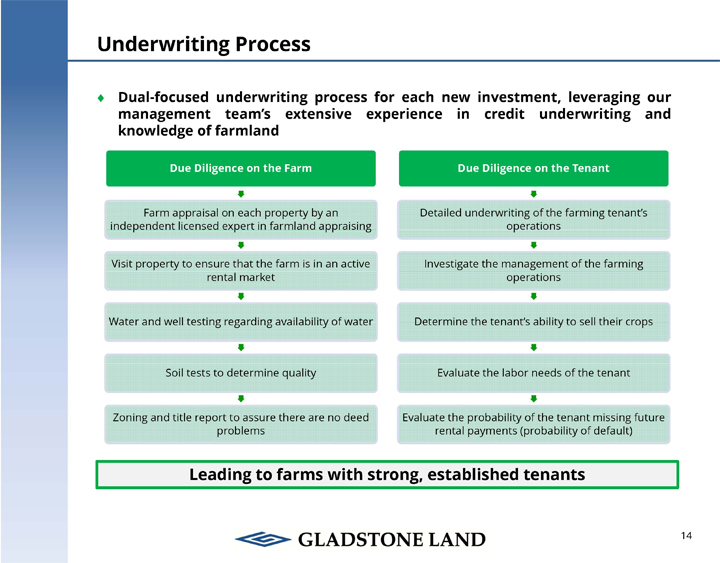

Underwriting Process ? Dual-focused underwriting process for each new investment, leveraging our management team’s extensive experience in credit underwriting and knowledge of farmland Due Diligence on the Farm Due Diligence on the Tenant Farm appraisal on each property by an Detailed underwriting of the farming tenant’s independent licensed expert in farmland appraising operations Visit property to ensure that the farm is in an active Investigate the management of the farming rental market operations Water and well testing regarding availability of water Determine the tenant’s ability to sell their crops Soil tests to determine quality Evaluate the labor needs of the tenant Zoning and title report to assure there are no deed Evaluate the probability of the tenant missing future problems rental payments (probability of default) Leading to farms with strong, established tenants 14

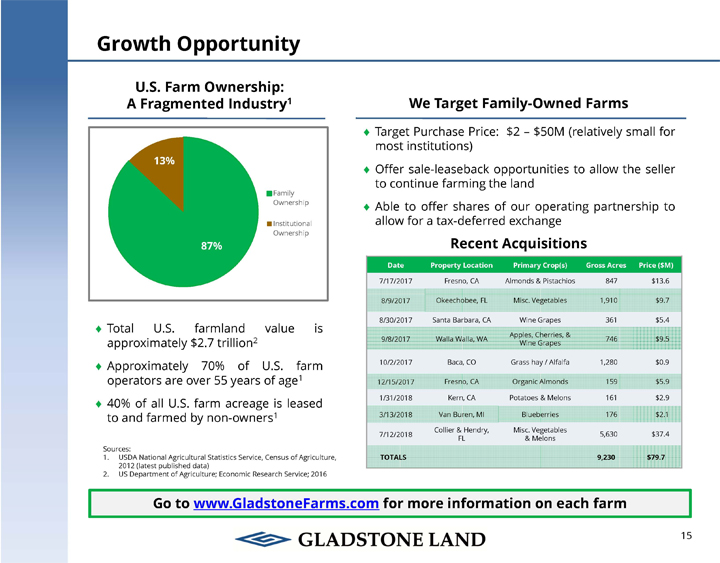

Growth Opportunity U.S. Farm Ownership: A Fragmented Industry1 We Target Family-Owned Farms ? Target Purchase Price: $2 – $50M (relatively small for most institutions) 13% ? Offer sale-leaseback opportunities to allow the seller to continue farming the land Family Ownership? Able to offer shares of our operating partnership to Institutional allow for a tax-deferred exchange Ownership 87% Recent Acquisitions Date Property Location Primary Crop(s) Gross Acres Price ($M) 7/17/2017 Fresno, CA Almonds & Pistachios 847 $13.6 8/9/2017 Okeechobee, FL Misc. Vegetables 1,910 $9.7 8/30/2017 Santa Barbara, CA Wine Grapes 361 $5.4 ? Total U.S. farmland value is Apples, Cherries, & 2 9/8/2017 Walla Walla, WA 746 $9.5 approximately $2.7 trillion Wine Grapes ? Approximately 70% of U.S. farm 10/2/2017 Baca, CO Grass hay / Alfalfa 1,280 $0.9 operators are over 55 years of age1 12/15/2017 Fresno, CA Organic Almonds 159 $5.9? 40% of all U.S. farm acreage is leased 1/31/2018 Kern, CA Potatoes & Melons 161 $2.9 to and farmed by non-owners1 3/13/2018 Van Buren, MI Blueberries 176 $2.1 Collier & Hendry, Misc. Vegetables 7/12/2018 5,630 $37.4 FL & Melons Sources: 1. USDA National Agricultural Statistics Service, Census of Agriculture, TOTALS 9,230 $79.7 2012 (latest published data) 2. US Department of Agriculture; Economic Research Service; 2016 Go to www.GladstoneFarms.com for more information on each farm 15

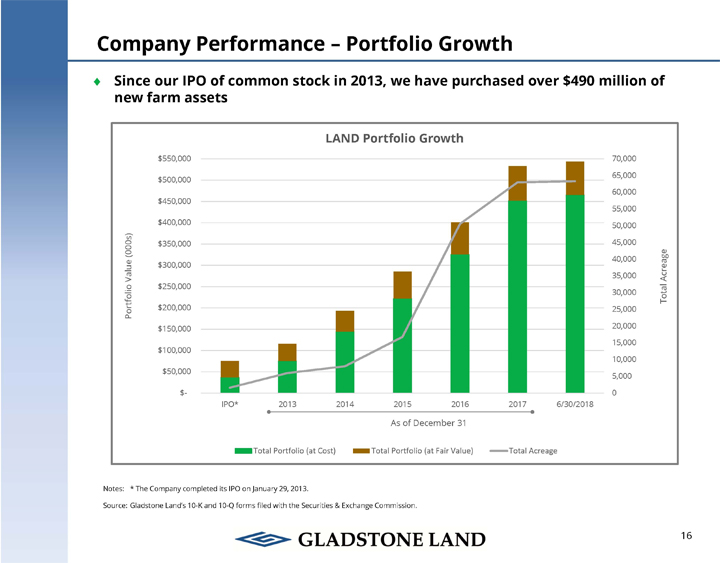

Company Performance – Portfolio Growth ? Since our IPO of common stock in 2013, we have purchased over $490 million of new farm assets LAND Portfolio Growth $550,000 70,000 65,000 $500,000 60,000 $450,000 55,000 $400,000 50,000 (000s) $350,000 45,000 $300,000 40,000 Value 35,000 Acreage $250,000 30,000 Total Portfolio $200,000 25,000 $150,000 20,000 15,000 $100,000 10,000 $50,000 5,000 $- 0 IPO* 2013 2014 2015 2016 2017 6/30/2018 As of December 31 Total Portfolio (at Cost) Total Portfolio (at Fair Value) Total Acreage Notes: * The Company completed its IPO on January 29, 2013. Source: Gladstone Land’s 10-K and 10-Q forms filed with the Securities & Exchange Commission. 16

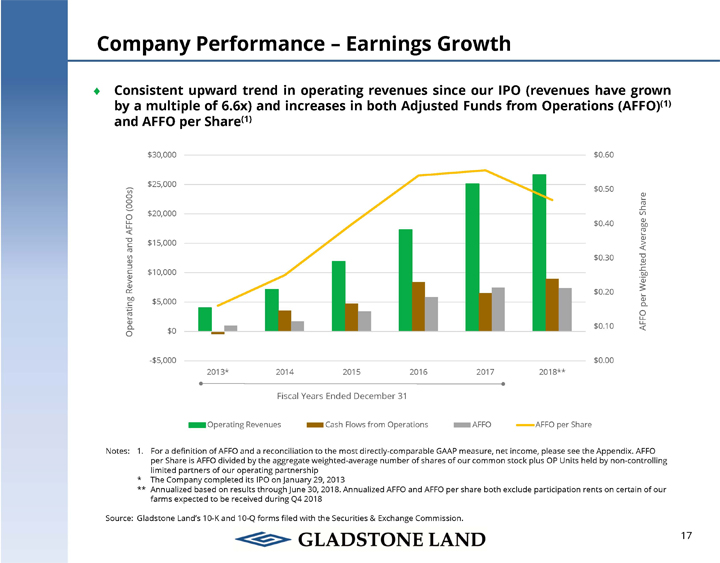

Company Performance – Earnings Growth ? Consistent upward trend in operating revenues since our IPO (revenues have grown by a multiple of 6.6x) and increases in both Adjusted Funds from Operations (AFFO)(1) and AFFO per Share(1) $30,000 $0.60 $25,000 (000s) $0.50 $20,000 Share AFFO $0.40 and $15,000 Average $0.30 $10,000 Weighted Revenues $0.20 $5,000 per $0.10 AFFO Operating $0 -$5,000 $0.00 2013* 2014 2015 2016 2017 2018** Fiscal Years Ended December 31 Operating Revenues Cash Flows from Operations AFFO AFFO per Share Notes: 1. For a definition of AFFO and a reconciliation to the most directly-comparable GAAP measure, net income, please see the Appendix. AFFO per Share is AFFO divided by the aggregate weighted-average number of shares of our common stock plus OP Units held by non-controlling limited partners of our operating partnership * The Company completed its IPO on January 29, 2013 ** Annualized based on results through June 30, 2018. Annualized AFFO and AFFO per share both exclude participation rents on certain of our farms expected to be received during Q4 2018 Source: Gladstone Land’s 10-K and 10-Q forms filed with the Securities & Exchange Commission. 17

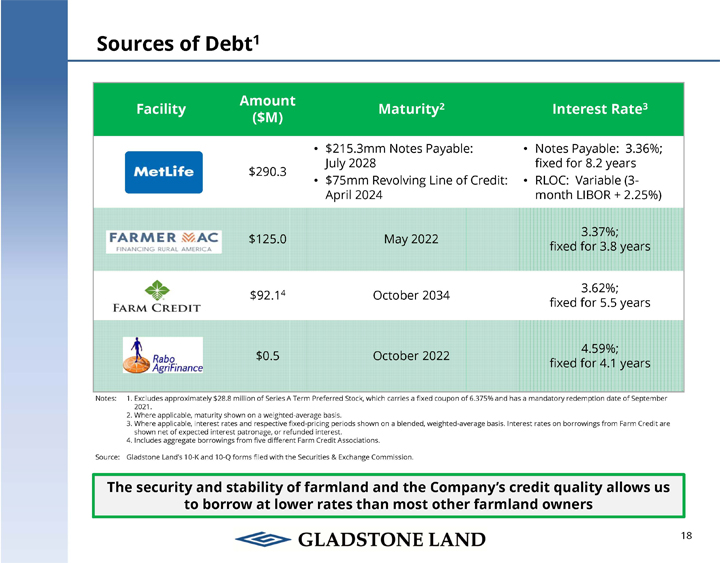

Sources of Debt1 Amount 2 3 Facility Maturity Interest Rate ($M) • $215.3mm Notes Payable: • Notes Payable: 3.36%; July 2028 fixed for 8.2 years $290.3 • $75mm Revolving Line of Credit: • RLOC: Variable (3-April 2024 month LIBOR + 2.25%) 3.37%; $125.0 May 2022 fixed for 3.8 years 4 3.62%; $92.1 October 2034 fixed for 5.5 years 4.59%; $0.5 October 2022 fixed for 4.1 years Notes: 1. Excludes approximately $28.8 million of Series A Term Preferred Stock, which carries a fixed coupon of 6.375% and has a mandatory redemption date of September 2021. 2. Where applicable, maturity shown on a weighted-average basis. 3. Where applicable, interest rates and respective fixed-pricing periods shown on a blended, weighted-average basis. Interest rates on borrowings from Farm Credit are shown net of expected interest patronage, or refunded interest. 4. Includes aggregate borrowings from five different Farm Credit Associations. Source: Gladstone Land’s 10-K and 10-Q forms filed with the Securities & Exchange Commission. The security and stability of farmland and the Company’s credit quality allows us to borrow at lower rates than most other farmland owners 18

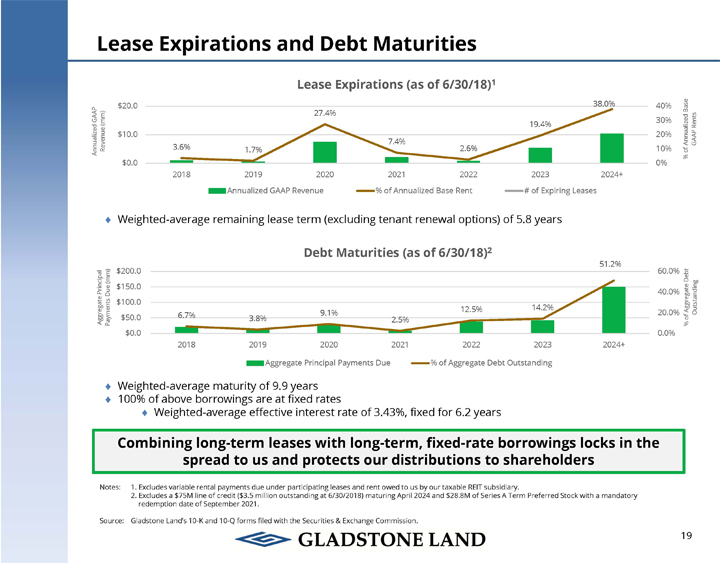

Lease Expirations and Debt Maturities Lease Expirations (as of 6/30/18)1 38.0% $20.0 40% Base GAAP 27.4% (mm) 30% 19.4% Rents $10.0 20% 7.4% Annualized GAAP Revenue 3.6% 1.7% 2.6% 10% Annualized $0.0 0% 2018 2019 2020 2021 2022 2023 2024+ Annualized GAAP Revenue % of Annualized Base Rent # of Expiring Leases ? Weighted-average remaining lease term (excluding tenant renewal options) of 5.8 years Debt Maturities (as of 6/30/18)2 51.2% (mm) $200.0 60.0% Debt $150.0 Principal Due 40.0% $100.0 12.5% 14.2% Aggregate $50.0 6.7% 3.8% 9.1% 20.0% Outstanding Aggregate Payments 2.5% $0.0 0.0% 2018 2019 2020 2021 2022 2023 2024+ Aggregate Principal Payments Due % of Aggregate Debt Outstanding ? Weighted-average maturity of 9.9 years? 100% of above borrowings are at fixed rates ? Weighted-average effective interest rate of 3.43%, fixed for 6.2 years Combining long-term leases with long-term, fixed-rate borrowings locks in the spread to us and protects our distributions to shareholders Notes: 1. Excludes variable rental payments due under participating leases and rent owed to us by our taxable REIT subsidiary. 2. Excludes a $75M line of credit ($3.5 million outstanding at 6/30/2018) maturing April 2024 and $28.8M of Series A Term Preferred Stock with a mandatory redemption date of September 2021. Source: Gladstone Land’s 10-K and 10-Q forms filed with the Securities & Exchange Commission. 19

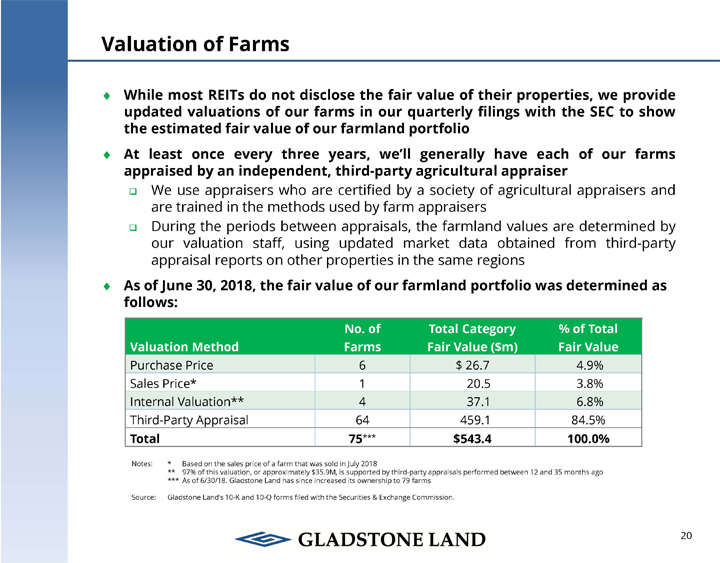

Valuation of Farms ? While most REITs do not disclose the fair value of their properties, we provide updated valuations of our farms in our quarterly filings with the SEC to show the estimated fair value of our farmland portfolio? At least once every three years, we’ll generally have each of our farms appraised by an independent, third-party agricultural appraiser ? We use appraisers who are certified by a society of agricultural appraisers and are trained in the methods used by farm appraisers? During the periods between appraisals, the farmland values are determined by our valuation staff, using updated market data obtained from third-party appraisal reports on other properties in the same regions ? As of June 30, 2018, the fair value of our farmland portfolio was determined as follows: No. of Total Category % of Total Valuation Method Farms Fair Value ($m) Fair Value Purchase Price 6 $ 26.7 4.9% Sales Price* 1 20.5 3.8% Internal Valuation** 4 37.1 6.8% Third-Party Appraisal 64 459.1 84.5% Total 75*** $543.4 100.0% Notes: * Based on the sales price of a farm that was sold in July 2018 ** 97% of this valuation, or approximately $35.9M, is supported by third-party appraisals performed between 12 and 35 months ago *** As of 6/30/18. Gladstone Land has since increased its ownership to 79 farms Source: Gladstone Land’s 10-K and 10-Q forms filed with the Securities & Exchange Commission. 20

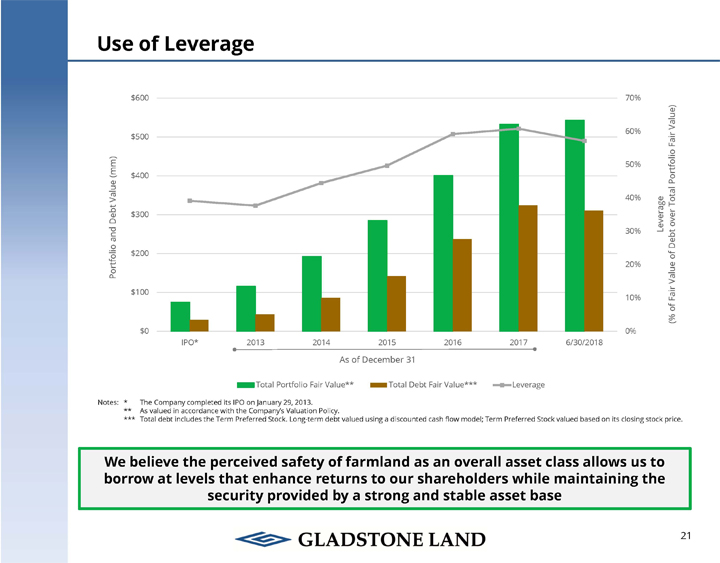

Use of Leverage $600 70% 60%Value) $500 Fair (mm) 50% $400 Portfolio Value 40% Total Debt $300 Leverageover and 30% Debt $200 of Portfolio 20% Value $100 10% Fair $0 0% IPO* 2013 2014 2015 2016 2017 6/30/2018 As of December 31 Total Portfolio Fair Value** Total Debt Fair Value*** Leverage Notes: * The Company completed its IPO on January 29, 2013. ** As valued in accordance with the Company’s Valuation Policy. *** Total debt includes the Term Preferred Stock. Long-term debt valued using a discounted cash flow model; Term Preferred Stock valued based on its closing stock price. We believe the perceived safety of farmland as an overall asset class allows us to borrow at levels that enhance returns to our shareholders while maintaining the security provided by a strong and stable asset base 21

Gladstone Land: Executive Management David Gladstone – Chairman & CEO • Chairman and CEO since inception • Former owner of Coastal Berry, one of the largest strawberry farm operations in CA (1997-2004) • Former Chairman of American Capital (NASDAQ: ACAS) (1997-2001) • Former Chairman and CEO of Allied Capital Corporation (NYSE: ALD) (1974-1997) • Over 30 years of experience in the farming industry Terry Lee Brubaker – Vice Chairman & COO • Vice Chairman and COO since 2004 • Founded Heads Up Systems in 1999 • Vice President of the paper group for the American Forest & Paper Association (1996-1999) Lewis Parrish – CFO • CFO since July 2014 • Over 12 years of public accounting and industry experience • Licensed CPA in the Commonwealth of Virginia Jay Beckhorn – Treasurer • Treasurer since January 2015 • Former Senior Vice President with Sunrise Senior Living (2000-2008) • Over 25 years of experience in securing debt financing for real estate properties John Kent – Managing Director (Capital Markets) • Joined Gladstone Management in 2017 • Formerly in investment banking in UBS, Nomura and Macquarie • Over 18 years experience in public and private capital markets Experienced management that owns over 18% of our common stock 22

Gladstone Land: Deal Team Bill Reiman – Managing Director (West Coast) • Fifth-generation farmer focused on coastal California • Built and managed a $25M strawberry and raspberry farming operation • Recent Chairman of California Strawberry Commission Ventura County Agriculture Association Bill Frisbie – Managing Director (East Coast) • Joined Gladstone Management in 2006; helped take Gladstone Land public in 2013 • Responsible for sourcing and executing farmland acquisitions across the U.S., with focus on the east coast • Current Chairman of the NCREIF Farmland Index Bill Hughes – Managing Director (Midwest) • Fourth-generation farmer focused on the Midwest • 13 years of experience in agricultural investing with U.S. Trust’s Specialty Investments group • Current President of U.S. Agri-Services Group Tony Marci – Managing Director (West Coast) • Joined Gladstone Land in 2018 • Focused on farmland acquisitions and managing existing properties • Served for several years on the board of directors of the California Strawberry Commission Deal team with strong farm operating background and investment-oriented focus 23

Why Invest in Gladstone Land’s Series B Preferred Stock Goal to Provide Cash ?Our goal is a cash distribution rate per share of $0.125 per month, or $1.50 Returns per year and is paid in preference to the common stock distributions ?Management has more than 100 combined years of industry experience and Management Team owns more than 17% of our common stock & Ownership ?Management has owned farms since 1997 ?Strong relationships with farmland brokers and corporate & independent Sourcing Advantage farmers, leading to an advantage with sourcing properties and finding quality tenants Acquisition ?Can pay cash or offer tax-free exchanges with shares of our operating Flexibility partnership Macroeconomic ?With global population increasing and demand for food rising, farmland is Trends expected to become more valuable ?Owning stock in Gladstone Land provides investors with diversification Diversified Portfolio across 18 distinct growing regions; approx. 40 crop types; and 53 different, unrelated tenants 24

Appendix 25

Adjusted Funds from Operations (AFFO) ? Funds From Operations (FFO): The National Association of Real Estate Investment Trusts (NAREIT) developed FFO as a relative non-GAAP supplemental measure of operating performance of an equity REIT in order to recognize that income-producing real estate historically has not depreciated on the basis determined under GAAP. FFO, as defined by NAREIT, is net income (computed in accordance with GAAP), excluding gains (or losses) from sales of property and impairment losses on property, plus depreciation and amortization of real estate assets, and after adjustments for unconsolidated partnerships and joint ventures. The Company believes that FFO provides investors with an additional context for evaluating its financial performance and as a supplemental measure to compare it to other REITs; however, comparisons of the Company’s FFO to the FFO of other REITs may not necessarily be meaningful due to potential differences in the application of the NAREIT definition used by such other REITs. ? Core FFO (CFFO): CFFO is FFO, adjusted for items that are not indicative of the results provided by the Company’s operating portfolio and affect the comparability of the Company’s period-over-period performance. These items include certain non-recurring items, such as acquisition-related expenses, income tax provisions and property and casualty losses or recoveries. Although the Company’s calculation of CFFO differs from NAREIT’s definition of FFO and may not be comparable to that of other REITs, the Company believes it is a meaningful supplemental measure of its sustainable operating performance. Accordingly, CFFO should be considered a supplement to net income computed in accordance with GAAP as a measure of our performance. For a full explanation of the adjustments made to arrive at CFFO, please read the Company’s most recent Form 10-Q or Form 10-K, as appropriate, as filed with the SEC. ? Adjusted FFO (AFFO): AFFO is CFFO, adjusted for certain non-cash items, such as the straight-lining of rents and amortizations into rental income (resulting in cash rent being recognized ratably over the period in which the cash rent is earned). Although the Company’s calculation of AFFO differs from NAREIT’s definition of FFO and may not be comparable to that of other REITs, the Company believes it is a meaningful supplemental measure of its sustainable operating performance on a cash basis. Accordingly, AFFO should be considered a supplement to net income computed in accordance with GAAP as a measure of our performance. For a full explanation of the adjustments made to arrive at AFFO, please read the Company’s most recent Form 10-Q or Form 10-K, as appropriate, as filed with the SEC. The Company’s presentation of FFO, as defined by NAREIT, or CFFO or AFFO, as defined above, does not represent cash flows from operating activities determined in accordance with GAAP and should not be considered an alternative to net income as an indication of its performance or to cash flow from operations as a measure of liquidity or ability to make distributions. 26

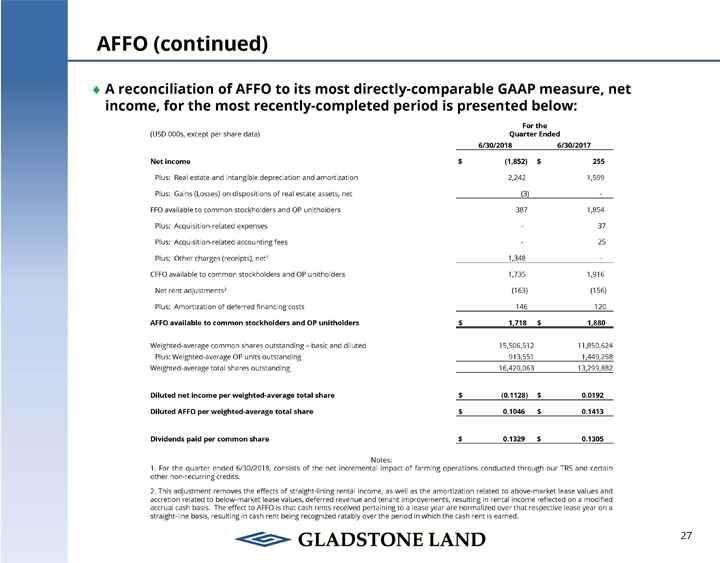

AFFO (continued) ?A reconciliation of AFFO to its most directly-comparable GAAP measure, net income, for the most recently-completed period is presented below: For the (USD 000s, except per share data) Quarter Ended 6/30/2018 6/30/2017 Net income $ (1,852) $ 255 Plus: Real estate and intangible depreciation and amortization 2,242 1,599 Plus: Gains (Losses) on dispositions of real estate assets, net (3) -FFO available to common stockholders and OP unitholders 387 1,854 Plus: Acquisition-related expenses - 37 Plus: Acquisition-related accounting fees - 25 Plus: Other charges (receipts), net1 1,348 -CFFO available to common stockholders and OP unitholders 1,735 1,916 Net rent adjustments2 (163) (156) Plus: Amortization of deferred financing costs 146 120 AFFO available to common stockholders and OP unitholders $ 1,718 $ 1,880 Weighted-average common shares outstanding – basic and diluted 15,506,512 11,850,624 Plus: Weighted-average OP units outstanding 913,551 1,449,258 Weighted-average total shares outstanding 16,420,063 13,299,882 Diluted net income per weighted-average total share $ (0.1128) $ 0.0192 Diluted AFFO per weighted-average total share $ 0.1046 $ 0.1413 Dividends paid per common share $ 0.1329 $ 0.1305 Notes: 1. For the quarter ended 6/30/2018, consists of the net incremental impact of farming operations conducted through our TRS and certain other non-recurring credits. 2. This adjustment removes the effects of straight-lining rental income, as well as the amortization related to above-market lease values and accretion related to below-market lease values, deferred revenue and tenant improvements, resulting in rental income reflected on a modified accrual cash basis. The effect to AFFO is that cash rents received pertaining to a lease year are normalized over that respective lease year on a straight-line basis, resulting in cash rent being recognized ratably over the period in which the cash rent is earned. 27

Net Asset Value (NAV) ? NetAssetValue (NAV): Pursuant to a valuation policy approved by our board of directors, our valuation team, with oversight from the chief valuation officer, provides recommendations of value for our properties to our board of directors, who then review and approve the fair values of our properties. Per our valuation policy, our valuations are derived based on either the purchase price of the property; values as determined by an independent, third-party appraiser; or through an internal valuation process, which process is, in turn, based on values as determined by independent, third-party appraisers. In any case, we intend to have each property valued by an independent, third-party appraiser at least once every three years, or more frequently in some instances. Various methodologies are used, both by the appraisers and in our internal valuations, to determine the fair value of our real estate on an “As Is” basis, including the sales comparison, income capitalization (or a discounted cash flow analysis) and cost approaches of valuation. NAV is a non-GAAP, supplemental measure of financial position of an equity REIT and is calculated as total equity, adjusted for the increase or decrease in fair value of our real estate assets and encumbrances relative to their respective costs bases. Further, we calculate NAV per share by dividing NAV by our total shares outstanding. ? Comparison of estimated NAV and estimated NAV per share to similarly-titled measures for other REITs may not necessarily be meaningful due to possible differences in the calculation or application of the definition of NAV used by such REITs. In addition, the trading price of our common shares may differ significantly from our most recent estimated NAV per share calculation. The Company’s independent auditors have neither audited nor reviewed our calculation of NAV or NAV per share. For a full explanation of our valuation policy, please read the Company’s most recent Form 10-Q or Form 10-K, as appropriate, as filed with the SEC. 28

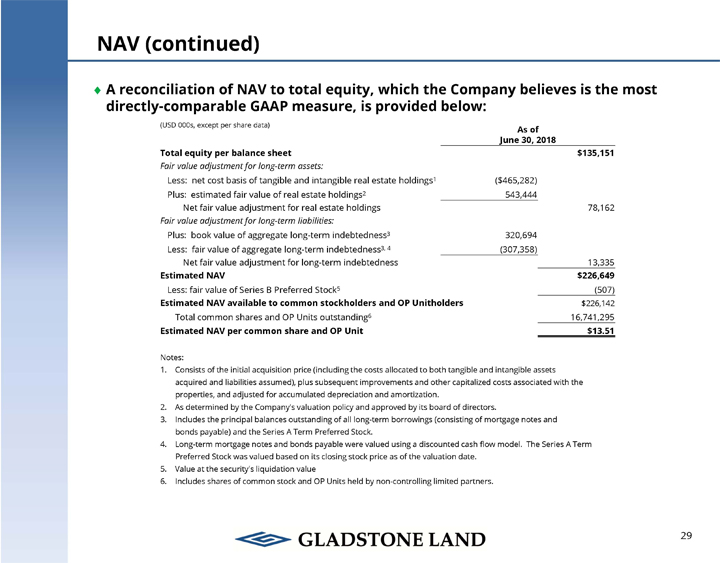

NAV (continued) ?A reconciliation of NAV to total equity, which the Company believes is the most directly-comparable GAAP measure, is provided below: (USD 000s, except per share data) As of June 30, 2018 Total equity per balance sheet $135,151 Fair value adjustment for long-term assets: Less: net cost basis of tangible and intangible real estate holdings1 ($465,282) Plus: estimated fair value of real estate holdings2 543,444 Net fair value adjustment for real estate holdings 78,162 Fair value adjustment for long-term liabilities: Plus: book value of aggregate long-term indebtedness3 320,694 Less: fair value of aggregate long-term indebtedness3, 4 (307,358) Net fair value adjustment for long-term indebtedness 13,335 Estimated NAV $226,649 Less: fair value of Series B Preferred Stock5 (507) Estimated NAV available to common stockholders and OP Unitholders $226,142 Total common shares and OP Units outstanding6 16,741,295 Estimated NAV per common share and OP Unit $13.51 Notes: 1. Consists of the initial acquisition price (including the costs allocated to both tangible and intangible assets acquired and liabilities assumed), plus subsequent improvements and other capitalized costs associated with the properties, and adjusted for accumulated depreciation and amortization. 2. As determined by the Company’s valuation policy and approved by its board of directors. 3. Includes the principal balances outstanding of all long-term borrowings (consisting of mortgage notes and bonds payable) and the Series A Term Preferred Stock. 4. Long-term mortgage notes and bonds payable were valued using a discounted cash flow model. The Series A Term Preferred Stock was valued based on its closing stock price as of the valuation date. 5. Value at the security’s liquidation value 6. Includes shares of common stock and OP Units held by non-controlling limited partners. 29