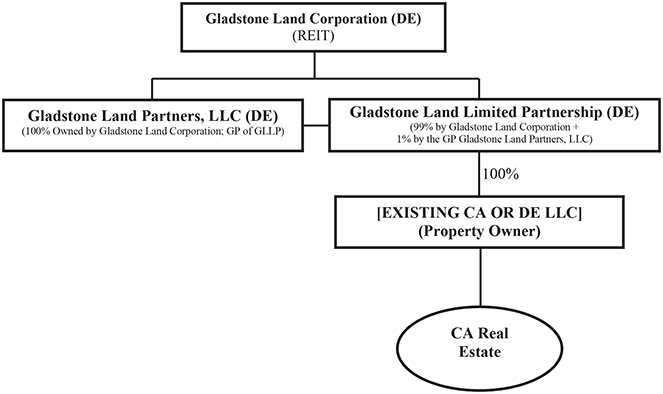

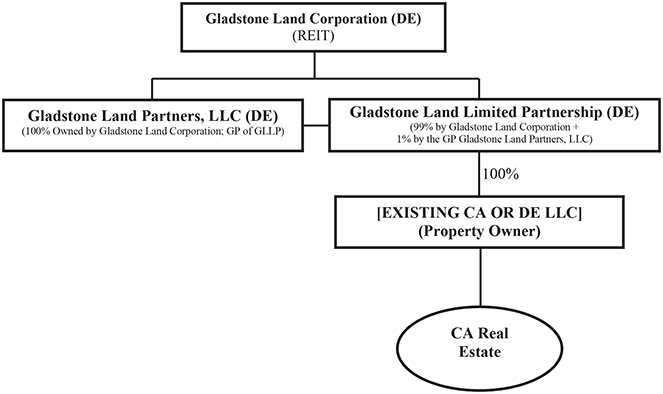

GLADSTONE LAND CORPORATION

EXISTING CALIFORNIA PROPERTY

OWNERSHIP STRUCTURE

Exhibit G

Loan Agreement

Gladstone 2020 Facility

Loan Nos. 196915, 198677 & 200539

105131550 0053564-00437

Exhibit 10.3

LOAN AGREEMENT

by and among

GLADSTONE LAND LIMITED PARTNERSHIP,

a Delaware limited partnership (“Borrower”)

GLADSTONE LAND CORPORATION,

a Maryland corporation (“Guarantor”)

and

METROPOLITAN LIFE INSURANCE COMPANY,

a New York corporation

(“Lender”)

Dated as of February ___, 2020

$150,000,000.00 Aggregate Facility

Loan No. 196915 - $25,000,000.00 (Note B)

Loan No. 198677 - $50,000,000.00 (Note D)

Loan No. 200539 - $75,000,000.00 (Note E)

1

Loan Agreement

Gladstone 2020 Facility

Loan Nos. 196915, 198677 & 200539

105131550 0053564-00437

LOAN AGREEMENT

THIS LOAN AGREEMENT (this “Agreement”), is made and entered into as of February ___, 2020, by and among GLADSTONE LAND LIMITED PARTNERSHIP, a Delaware limited partnership (“Borrower”), GLADSTONE LAND CORPORATION, a Maryland corporation (“Guarantor”), and METROPOLITAN LIFE INSURANCE COMPANY, a New York corporation (“Lender”).

W I T N E S S E T H:

WHEREAS, Borrower desires to obtain the Loan (as defined below) from Lender to refinance agricultural properties located in the States of California, Arizona and Michigan, and to provide funds for the subsequent purchase of additional farming properties, and Lender desires to make the Loan on the terms and conditions set forth herein and in the other Loan Documents. Capitalized terms used herein shall have the meanings assigned to them in Section 1 hereof.

NOW, THEREFORE, Borrower, Guarantor and Lender agree as follows:

| SECTION 1. | DEFINITIONS. |

For all purposes of this Agreement, except as otherwise expressly provided or unless the context otherwise requires:

“Affiliate” means any Person which, directly or indirectly, controls or is controlled by or is under common control with Borrower or Guarantor or which beneficially owns or holds or has the power to direct the voting power of five percent (5%) or more of any membership interest of Borrower or Guarantor or which has five percent (5%) or more of its Voting Interests (or in the case of a Person which is not a corporation, five percent (5%) or more of its equity interest) beneficially owned or held, directly or indirectly, by Borrower or Guarantor. For purposes of this definition, “control” means the power to direct the management and policies of a Person, directly or indirectly, whether through the ownership of voting securities, by contract or otherwise; and the terms “controlling” and “controlled” have meanings correlative to the foregoing. Notwithstanding the foregoing, or anything to the contrary herein, each of Gladstone Capital Corporation, Gladstone Commercial Corporation and Gladstone Investment Corporation, each a “Fund” and collectively the “Funds,” and any future fund advised by Gladstone Management Corporation, a Maryland corporation (the “Adviser”), or a sub-adviser thereof, and the subsidiaries of such Funds and future funds shall not be deemed to be Affiliates.

“Agreement” has the meaning specified in the first paragraph of this Agreement.

2

Loan Agreement

Gladstone 2020 Facility

Loan Nos. 196915, 198677 & 200539

105131550 0053564-00437

“Appraised Value” means the lesser of: (1) the amount for which a property is appraised by a third-party certified appraisal; or (2) Borrower’s cost to purchase a property, in either event, at the time it is pledged as Collateral. A certified appraisal of a property commissioned by Lender in form and substance satisfactory to Lender is required at the time any Collateral is pledged hereunder. Any appraisal of Collateral which is commissioned by a party other than Lender after the property has been accepted as Collateral may be provided to Lender for information purposes; provided however, Lender shall be under no obligation to review, rely upon or to otherwise use such an appraisal for any purpose. Borrower and Lender agree that the Appraised Value for the initial Collateral is as set forth on Exhibit A attached hereto. To the extent there are plantings on any Property that are covered by plant patents, the value of the patented plants shall be excluded from the Appraised Value.

“Articles and Bylaws” has the meaning specified in Section 4.25.

“Authorized Person” has the meaning specified in Section 3.3(j).

“Borrower” has the meaning specified in the first paragraph of this Agreement.

“Business Day” shall mean any day on which banks are required to be open to carry on their normal business in the State of New York.

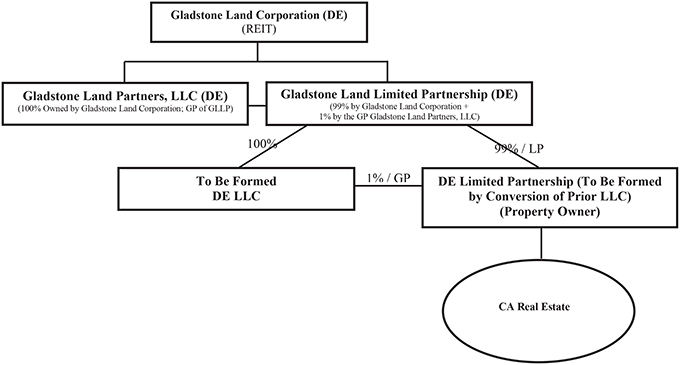

“California Entity Restructuring” has the meaning specified in Section 9.13.

“Closing Date” has the meaning specified in Section 2.2.

“Collateral” means the Real Property, all property and assets, and proceeds thereof, described in, subjected, or intended to be subjected, at any time to the Liens of any of the Collateral Documents, including any Future Property added pursuant to Section 3.1.

“Collateral Documents” has the meaning specified in Section 2.3.

“Consolidated Asset Value” means, as of the date of determination thereof, (i) the aggregate fair value of all properties and assets owned by Borrower, Guarantor and Property Owners, as reported in the MD&A section under the Net Asset Value disclosure in Guarantor’s quarterly filings with the Securities and Exchange Commission (“SEC”) (such as that found in Guarantor’s 10-Q for the Quarter Ended June 30, 2013), plus (ii) the amount of unrestricted cash, as reported on Guarantor’s Consolidated Balance Sheet filed with the SEC. In the absence of the Net Asset Value disclosure within Guarantor’s quarterly filing, or the absence of a quarterly filing, the aggregate fair value of assets shall be that as found in the most recent SEC filing, updated for any appraisals performed since the time of said filing. All such appraisals must have been performed by Lender-approved appraisers.

3

Loan Agreement

Gladstone 2020 Facility

Loan Nos. 196915, 198677 & 200539

105131550 0053564-00437

“Consolidated Net Worth” means, as of the date of determination thereof, the aggregate amount of the Consolidated Asset Value less the Consolidated Total Debt of Borrower, Guarantor and its Subsidiaries in each case after eliminating inter-company loans.

“Consolidated Rental Revenue” means the quarter-to-date rental income of the operations of Borrower, Guarantor or its Subsidiaries, as reported in Guarantor’s Consolidated Statement of Operations filed with the SEC, multiplied by 4 (four). The quarter-to-date rental income will be adjusted for any properties acquired by Borrower, Guarantor or its Subsidiaries during the quarter so as to assume that the newly-acquired property was held for the full quarter.

“Consolidated Total Debt” means, as of the date of determination thereof, the sum of (1) liabilities for borrowed money, including all secured notes payable and all outstanding line of credit balances, (2) liabilities for deferred purchase price of property (excluding accounts payable arising in the ordinary course of business), and (3) without duplication, any guaranty with respect to liabilities of the type described in any of the clauses (1) and (2) hereof, as determined in accordance with GAAP for Borrower, Guarantor and its Subsidiaries, as reported on Guarantor’s Consolidated Balance Sheet most recently filed with the SEC.

“Contribution and Indemnity Agreement” has the meaning specified in Section 8.5.

“Corporate Documents” has the meaning specified in Section 4.25.

“Default Interest Rate” means the lesser of (a) sixteen percent (16%) per annum, and (b) the maximum interest rate provided by law.

“Disbursement” has the meaning specified in Section 3.

“ERISA” has the meaning specified in Section 4.14.

“Event of Default” has the meaning specified in Section 11.1.

“Executive Order” has the meaning specific in Section 4.21.

“Future Property” has the meaning specified in Section 3.1(a).

“Future Property Owner” has the meaning specified in Section 3.1(b).

“GAAP” means, as to a particular Person and at a particular time of determination, such accounting principles as, in the opinion of the independent public accountants regularly employed by such Person, conform at such time of determination to generally accepted accounting principles in the United States.

“General Partner” has the meaning specified in Section 4.25.

4

Loan Agreement

Gladstone 2020 Facility

Loan Nos. 196915, 198677 & 200539

105131550 0053564-00437

“Guarantor” means Gladstone Land Corporation, a Maryland corporation.

“Improvements” means the improvements located on the Real Property (specifically excluding, however, any irrigation equipment or facilities or other property owned by a tenant at the Property so long as such assets are not included in the Appraised Value of the related Collateral).

“Indebtedness” shall mean without duplication (1) all indebtedness or obligations for borrowed money or which have been incurred in connection with the acquisition of property or assets, (2) indebtedness or obligations secured by or constituting any Lien existing on property owned by the Person whose Indebtedness is being determined, whether or not the indebtedness or obligations secured thereby shall have been assumed, (3) guaranties and endorsements (other than endorsements for purposes of collection in the ordinary course of business), obligations to purchase goods or services for the purpose of supplying funds for the purchase or payment of, or measured by, indebtedness, liabilities or obligations of others and other contingent obligations in respect of, or to purchase or otherwise acquire or service, indebtedness, liabilities or obligations of others (whether or not representing money borrowed), (4) all liabilities, as reported in Guarantor’s consolidated financial statements filed with the SEC, in effect guaranteed by an agreement, whether or not contingent, to make a loan, advance or capital contribution to or other investment in a Person for the purpose of assuring or maintaining a minimum equity, asset base, working capital or other balance sheet condition for any date, or to provide funds for the payment of any liability, dividend or stock liquidation payment, or otherwise to supply funds to or in any manner invest in such Person for such purpose, and (5) any mandatory redeemable preferred stock or other equity (including preferred stock or other equity the only mandatory redemption payment with respect to which is at maturity) of any Obligor held by a Person other than such Obligor, at the higher of its voluntary or involuntary liquidation value. A renewal or extension of any Indebtedness without increase in the principal amount thereof shall not be deemed to be the incurrence of the Indebtedness so renewed or extended.

“Indemnity Agreement” has the meaning specified in Section 2.4.

“Key Principal” means either David Gladstone or Terry Brubaker or a successor approved by Lender.

“Land” means the real property subject to the Security Instruments, initially situated in Cochise County, Arizona; Kern, Santa Cruz and Ventura Counties, California; and Van Buren County, Michigan, and more particularly described in Exhibit B attached hereto, and such additional land as may be encumbered by any Security Instrument from time to time granted to secure the Loan.

“Lender” has the meaning specified in the first paragraph of this Agreement.

5

Loan Agreement

Gladstone 2020 Facility

Loan Nos. 196915, 198677 & 200539

105131550 0053564-00437

“Lien” means any mortgage, lien, pledge, security interest, encumbrance or charge of any kind, whether or not consensual, any conditional sale or other title retention agreement.

“LLC Agreement” has the meaning specified in Section 4.25.

“LLC Documents” has the meaning specified in Section 4.25.

“Loan” has the meaning specified in Section 2.2.

“Loan Documents” means the Notes executed concurrently herewith together with this Agreement, the other Collateral Documents, the Security Instruments and all other documents and instruments evidencing, securing or otherwise relating to the Loan including, without limitation, any Uniform Commercial Code financing statements.

“LP Agreement” has the meaning specified in Section 4.25(d).

“Material Adverse Effect” shall mean a material adverse effect on (a) the business, operations, properties, prospects or financial condition of any Obligor, or (b) the validity or enforceability of any of the Loan Documents.

“Note B” has the meaning specified in Section 2.1.

“Note D” has the meaning specified in Section 2.1.

“Note E” has the meaning specified in Section 2.1.

“Notes” means Note B, Note D and Note E, collectively, and each of the Notes may be referred to individually as a “Note”.

“Obligors” or “Obligor” means any or all of Guarantor, Borrower or Property Owners, collectively.

“OFAC” has the meaning specified in Section 4.21.

“Partial Release” has the meaning specified in Section 10.1.

“Partnership Documents” has the meaning specified in Section 4.25.

“Patent Payment” has the meaning specified in Section 10.2.

“Permitted Encumbrances” means the following:

(a) those Liens and Leases described on Exhibit D attached hereto;

6

Loan Agreement

Gladstone 2020 Facility

Loan Nos. 196915, 198677 & 200539

105131550 0053564-00437

(b) items set forth in Schedule B Part II of the title insurance policy or policies issued to Lender as of the Closing Date;

(c) liens in favor of Lender securing the Indebtedness;

(d) liens for taxes, assessments, levies or similar governmental charges not delinquent or otherwise being contested as permitted by the Security Instruments;

(e) Leases permitted under Section 4.10 below or otherwise in the Loan Documents; and

(f) liens that are being contested as permitted by the Security Instruments.

“Person” includes an individual, a corporation, a partnership, a limited liability company, a joint venture, a trust, an unincorporated organization or a government or any agency or political subdivision thereof.

“Plan” has the meaning specified in Section 4.14.

“Property Owners” means those wholly-owned subsidiaries of Borrower or Guarantor identified on Exhibit E attached hereto and incorporated herein, together with any other Subsidiaries of Borrower or Guarantor which own any Collateral now or in the future.

“Real Property” has the meaning specified in Section 2.3.

“Release Parcel” has the meaning specified in Section 10.1.

“Remaining Property” has the meaning specified in Section 10.1.

“Request” has the meaning specified in Section 10.1.

“Restricted Payments” means dividends paid on capital stock or distributions with respect to membership interest (in either cash or property), and purchases or redemptions of capital stock or membership interest.

“SDN List” has the meaning specified in Section 4.20.

“Security Instruments” has the meaning specified in Section 2.3.

“Subordinated Debt” means any debt owed to stockholders, subsidiaries or affiliates that is fully subordinated in right of payment and in respect of security in any respect to Debt evidence by the Notes and any of the other Loan Documents.

7

Loan Agreement

Gladstone 2020 Facility

Loan Nos. 196915, 198677 & 200539

105131550 0053564-00437

“Subsidiaries” means any Person at least a majority of whose outstanding stock or equity interest shall at the time be owned directly or indirectly by Borrower, Guarantor and/or one or more Subsidiaries of Borrower or Guarantor.

“Voting Interest”, as applied to the stock of any corporation, shall mean stock of any class or classes (however designated) having ordinary voting power for the election of a majority of the directors of such corporation other than stock having such power only by reason of the happening of a contingency.

All accounting terms used herein and not expressly defined in this Agreement shall have the meanings respectively given to them in accordance with GAAP as it exists at the date of applicability thereof.

| SECTION 2. | LOAN. |

2.1 Authorization. Borrower has duly authorized the delivery of the following promissory notes to Lender (collectively, the “Notes”): (i) that certain Amended and Restated Promissory Note (Note B – RELOC) in the principal amount of up to $25,000,000.00, as amended, modified, restated, extended or expanded from time to time (“Note B”), (ii) that certain Amended and Restated Promissory Note (Note D – RELOC) in the principal amount of up to $50,000,000.00, as amended, modified, restated, extended or expanded from time to time (“Note D”), and (iii) that certain Promissory Note (Note E) in the principal amount of up to $75,000,000.00, as amended, modified, restated, extended or expanded from time to time (“Note E”), each dated as of even date herewith and executed by Borrower to the order of Lender. The interest rates applicable to the balance under each Note (and the adjustment of such interest rates), the repayment terms and other terms applicable to the indebtedness evidenced by each Note are more particularly set forth in the respective Notes.

2.2 Loan; Closing. Borrower hereby agrees to borrow from Lender, and Lender, subject to the terms and conditions herein set forth and in the other Loan Documents, hereby agrees to lend to Borrower, the aggregate principal sum of up to One Hundred Fifty Million and 00/100 Dollars ($150,000,000.00) to be evidenced by the Notes and disbursed in accordance with this Agreement (the “Loan”). The date on which the initial Security Instruments are duly recorded in their respective jurisdictions, which shall be on or before February ___, 2020, shall be hereinafter referred to as the “Closing Date.”

2.3 Security. Payment of the Notes and performance of the obligations arising under this Agreement and the Loan shall be secured by (i) one or more Deeds of Trust, Security Agreement, Assignment of Rents and Leases and Fixture Filing, and (ii) one or more Mortgages, Security Agreement, Assignment of Rents and Leases and Fixture Filing (collectively, the “Security Instruments”) now or hereafter granted by any of the Property Owners with respect to, inter alia, the Land and the agricultural operations and related permanent plantings, irrigation

8

Loan Agreement

Gladstone 2020 Facility

Loan Nos. 196915, 198677 & 200539

105131550 0053564-00437

facilities and water rights located on the Land, and the rents, revenue and income derived therefrom, all as more particularly described in the Security Instruments (the “Real Property”), and such other documents and instruments as Lender shall reasonably request to further evidence or perfect its security interest in the Collateral. The Security Instruments, assignments, security and pledge agreements, guarantees and all of the other documents entered into now or in the future in connection with the Loan are collectively referred to herein as the “Collateral Documents.” Notwithstanding anything in this Agreement or any other Loan Documents to the contrary, Borrower is not granting any lien or security interest with respect to, and references to the Real Property shall not include, any crops and related plantings (including without limitation permanent plantings), irrigation facilities, water rights, or other property, rights or interests that are owned by tenants at the Property so long as such assets are not included in the Appraised Value of the related Collateral.

2.4 Guaranty and Pledge. Borrower’s obligations under the Notes, this Agreement and the other Loan Documents shall be guaranteed by (a) Guarantor pursuant to a Loan Guaranty Agreement dated as of even date herewith; (b) the Property Owners pursuant to certain Property Owner Guaranties dated as of even date herewith and the Security Instruments; and (c) any Future Property Owners pursuant to Loan Guaranty Agreements and Security Instruments, deliver in connection with the addition of Future Property to the Collateral. The Notes are also supported by a separate and independent Unsecured Indemnity Agreement by Borrower, Guarantor and the Property Owners (and any Future Property Owners, as applicable) in favor of Lender (the “Indemnity Agreement”).

2.5 Unused Commitment Fee. Borrower shall pay to Lender an unused commitment fee payable in arrears with each interest payment payable on an Interest Payment Date as more particularly provided in each of the Notes.

| SECTION 3. | DISBURSEMENTS OF LOAN. |

Subject to the satisfaction of all conditions precedent to closing, the proceeds of the Loan shall be disbursed as set forth in this Section 3. A disbursement of the Loan, whether under Note B, Note D or Note E, is herein referred to as a “Disbursement”.

3.1 Disbursements Under Note E. Note E will be disbursed in multiple Disbursements, only as follows:

Borrower may request a Disbursement in connection with the acquisition of additional agricultural properties in an aggregate amount not to exceed the face amount of Note E (i.e., $75,000,000.00) at any time after the Closing Date but no later than December 31, 2022, provided that each of the following conditions has been satisfied on or before the date of disbursement:

9

Loan Agreement

Gladstone 2020 Facility

Loan Nos. 196915, 198677 & 200539

105131550 0053564-00437

(a) The amount of each Disbursement will be based on and limited such that the amount disbursed under the Loan shall not exceed 60% of the aggregate Appraised Value of the Real Property and any new agricultural property accepted by Lender as Collateral for such Disbursement (the “Future Property”), as established by appraisals in form and substance acceptable to Lender in all respects, and otherwise limited as provided in this Section 3.1(b). In no event shall the total aggregate Disbursements under Note E exceed the lesser of Seventy-Five Million and 00/100 Dollars ($75,000,000.00) or sixty percent (60%) of the Appraised Value of the Collateral.

(b) The Disbursement shall be used solely to fund acquisitions or refinances of a Future Property and may not be used for any other purpose. The Future Property shall be acquired or owned by a Property Owner or a separate Subsidiary entity established as a single asset entity by Borrower or Guarantor for such purpose (the “Future Property Owner”). As a condition to any Disbursement for Future Property, such Future Property shall be subject to Lender’s review as to condition, quality, location, entitlement, improvement, water supplies and other characteristics in Lender’s sole and absolute discretion as Lender may apply in its customary underwriting and due diligence analysis.

(c) All of the Collateral shall be free of mechanics’ liens, judgments, and all other encumbrances, with the exception of the Security Instruments and any Permitted Encumbrances, and any leases of the Future Property shall be subject to Lender’s review and approval in accordance with Section 4.10, which approval shall require, at a minimum, that such leases shall be subordinate to the liens in favor of Lender. Lender shall be granted a first priority lien on the Future Property.

(d) Borrower, Property Owners and Guarantor shall execute and deliver to Lender, and shall cause the Future Property Owner to execute and deliver to Lender, such deeds of trust, security agreements, joinders (including to the Indemnity Agreement and the Contribution and Indemnity Agreement), reaffirmations, restated guaranties or amendments and such other documents as Lender may deem necessary to document the additional disbursement in a manner consistent with the balance of the Loan Documents and to encumber the Future Property with first liens and security interests for the benefit of Lender. Borrower and Guarantor shall also execute and deliver to Lender a Collateral Addition Addendum in the form attached hereto as Exhibit C. The Future Property Owner shall guaranty the Loan, jointly and severally with the other Property Owners, with regard to all of the obligations arising under the Loan, and Guarantor shall confirm that its guaranty shall continue to apply to the Loan as so disbursed and secured.

(e) Lender shall be provided with a mortgagee’s title insurance policy insuring Lender’s first priority lien in the Future Property subject only to such encumbrances as Lender may approve in its sole and absolute discretion. The amount of the title insurance insuring the existing Security Instruments and the new liens to be established in connection with the Disbursement shall be increased to the aggregate amount that will be available for Disbursements under the Notes following the addition of the Future Property as Collateral.

10

Loan Agreement

Gladstone 2020 Facility

Loan Nos. 196915, 198677 & 200539

105131550 0053564-00437

(f) No Event of Default under the Loan Agreement, the Notes, the Security Instruments, or any of the Loan Documents shall have occurred prior to or at the time such Disbursement is to be made, nor shall any event exist which with the giving of notice or the passage of time or both would constitute an Event of Default.

(g) The Property Owners are at the time of the Disbursement still the owners of the Real Property in the form existing as of the Closing Date, except to the extent of transfers otherwise permitted by Lender under the terms of the Loan Documents.

(h) Lender shall have received such additional information and documentation, in a form and substance satisfactory to Lender, as Lender may reasonably request, confirming compliance with any and all of the covenants, representations and warranties contained in the Notes, the Security Instruments and Loan Documents, including without limitation a debt allocation agreement among the Property Owners regarding their respective contributions for the indebtedness relating to the Loan.

(i) Concurrently with Borrower’s request for a Disbursement, Borrower shall furnish to Lender the following materials: (i) a copy of the purchase agreement for its acquisition of the Future Property and all relevant conveyance documents; (ii) a copy of any appraisal obtained by Borrower; (iii) a current title report for the Future Property; (iv) copies of any leases applicable to the Future Property, together with a subordination agreement and estoppel certificate from the related tenant in the form required by Lender; (v) copies of all organizational documents relating to the Future Property Owner; and (vi) copies of such additional documents and materials as Lender shall request.

(j) Written request for a Disbursement is received by Lender from an Authorized Person (defined below) at least thirty (30) days prior to the Business Day on which funds are desired, accompanied by all supporting data as may be necessary to confirm the satisfaction of all conditions to Disbursement. No more than six (6) Disbursements under Note E shall be permitted in any calendar year.

(k) Lender, at its option, and in its sole discretion, may reject the request for any Disbursement should it be determined by Lender, at its sole discretion, that Borrower, through its combination of water sources, does not possess or reasonably anticipate obtaining adequate supplies of irrigation water to sufficiently irrigate and maintain the agricultural operations to be conducted on the Collateral.

(l) Borrower shall pay all costs incurred by Lender, including title insurance premiums and endorsement costs, reasonable legal fees of outside counsel, escrow fees, environmental audits, appraisal costs, recording fees and any other third party costs relating to the review of the proposed Future Property or the confirmation of the status of the existing Collateral, the Disbursement and the satisfaction of the foregoing conditions.

11

Loan Agreement

Gladstone 2020 Facility

Loan Nos. 196915, 198677 & 200539

105131550 0053564-00437

(m) In the event of any optional or required prepayment of principal by Borrower under the Loan Documents, such prepayment shall (unless otherwise indicated by Borrower), in the absence of an Event of Default, be applied first to the outstanding principal balance, if any, of Note B and Note D and then to the outstanding principal balance of Note E. Any prepayment of the Loan at a time an Event of Default exists shall be applied to the Loan in such order as Lender directs.

3.2 Disbursements Under Note B and Note D.

(a) Disbursements. Borrower shall have the right from time to time, to request additional Disbursements under Note B or Note D, up to the face amount of such Note (i.e., $25,000,000.00 and $50,000,000.00, respectively), under the following conditions: (i) no Event of Default has occurred and is continuing and no event has occurred and is continuing which with the passing of time or giving of notice or both would become an Event of Default, and (ii) Disbursements shall be available so long as the combined outstanding principal balances of all Notes, plus the amount of the requested Disbursement do not exceed the lesser of (a) the aggregate face principal amounts of the Notes, and (b) the amount equal to 60% of the Appraised Value. Borrower may repay and reborrow such amounts as a revolving credit. Revolver draws and repayments shall be made not more than twice per calendar month per each type of transaction and written request for a Disbursement under Note B or Note D must be received by Lender no later than 12:00 p.m., Pacific Time, on the Business Day prior to the Business Day on which funds are desired. All draws and repayments will be by wire transfer and any draws shall be in amounts not less than One Hundred Thousand and 00/100 Dollars ($100,000.00) and in even increments of One Thousand and 00/100 Dollars ($1,000.00).

(b) Balance in Excess of Original Principal Amount. Notwithstanding anything contained herein to the contrary, in the event that (i) the aggregate outstanding unpaid principal amount of Note B at any time exceeds the amount of $25,000,000.00, (ii) the aggregate outstanding unpaid principal amount of Note D at any time exceeds the amount of $50,000,000.00, or (iii) the aggregate outstanding principal balance of all Notes exceeds the lesser of $150,000,000.00, or the amount equal to sixty percent (60%) of the Appraised Value of the Collateral, all Disbursements shall be suspended and Borrower shall immediately, without the requirement of any oral or written notice by Lender, prepay the principal of one or more of the Notes (including any Note with an outstanding unpaid principal amount exceeding the face amount of such Note) in an aggregate amount at least equal to such excess.

12

Loan Agreement

Gladstone 2020 Facility

Loan Nos. 196915, 198677 & 200539

105131550 0053564-00437

(c) Minimum Outstanding Balance. If the outstanding principal balance under Note B or Note D shall be an amount less than Fifty Thousand and 00/100 Dollars ($50,000.00) at any time, then the entire outstanding principal amount of such Note, together with accrued interest thereon at the Default Interest Rate, shall, ten (10) Business Days after receipt of written notice from Lender, immediately become due and payable without demand, and Borrower’s right to draw upon such Note shall terminate and Lender’s obligation to fund future Disbursements under such Note shall cease.

(d) Use of Funds for Acquisition, Refinance or Working Capital. Subject to availability as set forth above, Disbursements under Note B or Note D may be used for working capital purposes or may also be used to fund the acquisition or refinance of additional agricultural properties. Any additional agricultural property so acquired or refinanced may be added to the Collateral for the loan as a Future Property so long as all requirements for Future Property set forth in Section 3.1 with respect to Disbursements for the acquisition or refinance of Future Property under Note E are satisfied, as determined by Lender in its discretion.

3.3 Authorized Persons. The request by an Authorized Person (as defined herein) for a Disbursement shall constitute a representation and warranty by Borrower to Lender as of that date that all of the conditions herein have been satisfied, and that Borrower is in full compliance with all of the covenants, representations and warranties contained in this Agreement and the Loan Documents. Disbursements must be requested in writing, by telephone, facsimile transmission or otherwise on behalf of an Authorized Person of Borrower. Borrower recognizes and agrees that Lender cannot effectively determine whether a specific request purportedly made by or on behalf of Borrower is actually authorized or authentic. As it is in Borrower’s best interest that Lender disburse funds in response to these forms of request, Borrower assumes all risks regarding the validity, authenticity and due authorization of any request purporting to be made by or on behalf of Borrower. Borrower promises to repay any sums, with interest, that are disbursed by Lender pursuant to any request which Lender in good faith believes to be authorized. For purposes of this Agreement, an “Authorized Person” means any individual who is designated by Borrower as having authority to request disbursements under Note B, Note D, Note E and this Agreement, whether such designation is made in a limited liability company resolution provided to Lender or in any other written notice to Lender, and any individual who is so designated shall remain an Authorized Person until Lender receives written notice to the contrary. As of the date hereof, the following persons are Authorized Persons, acting together, are authorized to request Disbursements under the Notes and this Agreement on behalf of Borrower:

Terry Brubaker

David Gladstone

Jay Beckhorn

Lewis Parrish

13

Loan Agreement

Gladstone 2020 Facility

Loan Nos. 196915, 198677 & 200539

105131550 0053564-00437

| SECTION 4. | REPRESENTATIONS AND WARRANTIES. |

Borrower represents and warrants that:

4.1 Financial Statements. Lender has been furnished with copies of consolidated balance sheets of Obligors as of September 30, 2019, and for each of the years December 31, 2013 through December 31, 2018, and related statements of cash flows and consolidated statements of operations, statements of stockholder’s equity, and statements of cash flows of the Obligors for the fiscal years ended on said dates. Such financial statements, including the related schedules and notes, are complete and correct in all material respects and fairly present (a) the financial condition of the Obligors as at the respective dates of said balance sheets and (b) the results of the operations and changes in financial position of the Obligors for the fiscal years ended on said dates, all in conformity with generally accepted accounting principles applied on a consistent basis (except as otherwise stated therein or in the notes thereto) throughout the periods involved.

4.2 No Material Adverse Effect. There has been no Material Adverse Effect as to any of the Obligors subsequent to December 31, 2019.

4.3 Liens. Exhibit D attached hereto correctly sets forth all Liens securing Indebtedness for money borrowed by any Obligors existing on the date hereof, other than liens granted to Lender.

4.4 Licenses. Each Obligor possesses and shall continue to possess all trademarks, trade names, copyrights, patents, governmental licenses, franchises, certificates, consents, permits and approvals necessary to enable them to carry on their business in all material respects as now conducted, to own and operate the properties material to their business as now owned and operated, and needed in connection with the construction, use, operation and occupancy of the Improvements as the same have been constructed and are presently being used and occupied (including the use of personal property thereon), without known conflict with the rights of others. All such trademarks, trade names, copyrights, patents, licenses, franchises, certificates, consents, permits and approvals which are material to the operations of each Obligor, taken as a whole, are valid and subsisting.

4.5 Litigation. There are no actions, suits or proceedings (whether or not purportedly on behalf of any Obligor or any of its members) pending or, to the knowledge of any Obligor, threatened in writing against any Obligor or any of its members or any Obligor’s property, assets, or business, including, without limitation, the Real Property, the Improvements, the personal property thereon, or any interest in Obligor or any guarantor of the Loan at law or in equity or before or by any federal, state, municipal or other governmental department, commission, board, bureau, agency or instrumentality, domestic or foreign, or before any arbitrator of any kind, which involve any of the transactions herein contemplated or the

14

Loan Agreement

Gladstone 2020 Facility

Loan Nos. 196915, 198677 & 200539

105131550 0053564-00437

possibility of any Material Adverse Effect; and neither Obligors nor any of their members, to the best of Obligor’s knowledge, is in default or violation of any law or any rule, regulation, judgment, order, writ, injunction, decree or award of any court, arbitrator or federal, state, municipal or other governmental department, commission, board, bureau, agency or instrumentality, domestic or foreign, which default or violation might have a Material Adverse Effect unless sufficient funds have been reserved to pay, in the event of an adverse judgment, all damages claimed thereunder as reflected in Guarantor’s financial statements.

4.6 Land Use Litigation. There are no pending or, to the knowledge of any Obligor, threatened proceedings or actions to revoke, attack, challenge the validity of, rescind or modify the zoning of the Land, the subdivision of the Land or any building, construction or other permits heretofore issued with respect thereto, or asserting such zoning, subdivision or permits do not permit the use and operation of the Real Property. During the term of the Loan, Obligors shall promptly furnish Lender written notice of any litigation affecting or relating to any Obligor or the Real Property.

4.7 Condemnation. Obligors have not received notice from any governmental or quasi-governmental body or agency or from any person or entity with respect to (and Obligors do not know of) any actual or threatened taking of the Land or any portion thereof, for any public or quasi-public purpose by the exercise of the right of condemnation or eminent domain.

4.8 Availability of Utilities. All utility services necessary and sufficient for the Land and the Real Property, and the operation thereof for their intended purposes are available at the boundaries of (or otherwise supplied to through appurtenant, recorded insured easements) the Land, including, without limitation, water, storm and sanitary sewer facilities, electric and telephone facilities, as and where applicable.

4.9 Access. All portions of the Real Property have dedicated legal access to public roads, either directly or across other portions of the Real Property or via recorded appurtenant, insured easements. The existing access between the Improvements (and every part thereof) and public roads is sufficient to comply with all presently existing laws, ordinances, regulations, agreements and restrictions affecting the Real Property or Improvements and for the present use of the Real Property and Improvements.

4.10 Leases; Contracts. There are no outstanding leases, franchise contracts, management contracts, service contracts, construction contracts, marketing contracts or other contracts, licenses or permits, whether oral or written, that cannot be terminated by Obligor upon thirty (30) days’ notice or less or that are material to or included in the Appraised Value (other than other Permitted Encumbrances), affecting the Land or the Real Property or the use thereof, arising by, through or under an Obligor except as disclosed on Exhibit D attached hereto. Obligors will not enter into any lease or other agreement affecting any portion of the Real Property without first obtaining Lender’s written consent, other than year-to-year leases for

15

Loan Agreement

Gladstone 2020 Facility

Loan Nos. 196915, 198677 & 200539

105131550 0053564-00437

farming purposes (which do not require Lender’s consent), and any such lease or other agreement shall be subordinate, and at Lender’s election, expressly subordinate to the lien of Lender’s Security Instruments except as otherwise permitted in such Security Instrument. If Lender fails to approve or disapprove a proposed lease in writing (including its reasons for disapproval, if applicable) within fifteen (15) Business Days after receipt of a written request for lease approval from Borrower (such request to include all information requested by Lender in connection with such lease), Lender shall be deemed to have approved such lease.

4.11 No Burdensome Provisions. None of the Obligors are a party to any agreement or instrument or subject to any charter or other corporate or legislative restriction or any judgment, order, writ, injunction, decree, award, rule or regulation which materially and adversely affects or in the future may materially and adversely affect the business, operations, properties, assets, prospects or condition, financial or other, of any Obligor, taken as a whole.

4.12 Compliance with Other Instruments. None of the Obligors are in default in the performance, observance or fulfillment of any of the obligations, covenants or conditions contained in any bond, debenture, note or other evidence of Indebtedness of any Obligor or contained in any instrument under or pursuant to which any thereof has been issued or made and delivered except as disclosed to Lender in writing or as reflected in Guarantor’s financial statements. Neither the execution and delivery of this Agreement and the Loan Documents by Obligors, the consummation by Obligors of the transactions herein and therein contemplated, nor compliance by Obligors with the terms, conditions and provisions hereof and thereof and of the Notes will violate any provision of law or rule or regulation thereunder or any order, injunction or decree of any court or other governmental body to which any Obligor is a party or by which any term thereof is bound or conflict with or result in a breach of any of the terms, conditions or provisions of the articles of incorporation, corporate charter or bylaws of Obligors or of any agreement or instrument to which any Obligor is a party or by which any Obligor is bound, or constitute a default thereunder, or result in the creation or imposition of any Lien of any nature whatsoever upon any of the properties or assets of any Obligor (other than the Liens created by the Collateral Documents). No consent of the members of any Obligor is required for the execution, delivery and performance of this Agreement, the Loan Documents or the Notes by Obligors other than those delivered to Lender prior to the Closing, if any.

4.13 Disclosure. Neither this Agreement, the Loan Documents nor any of the Exhibits hereto, nor any certificate or other data furnished to Lender in writing by or on behalf of Obligors in connection with the transactions contemplated by this Agreement contains any untrue statement of a material fact or omits a material fact necessary to make the statements contained herein or therein not misleading. To the best knowledge of each Obligor, there is no fact which materially and adversely affects or in the future may materially and adversely affect the business, operations, properties, assets, prospects or condition, financial or other, of any Obligor, taken as a whole, which has not been disclosed to Lender in writing.

16

Loan Agreement

Gladstone 2020 Facility

Loan Nos. 196915, 198677 & 200539

105131550 0053564-00437

4.14 ERISA. Each of the Obligors represents, warrants and covenants that it is acting on its own behalf and that as of the date hereof, it is not an employee benefit plan as defined in Section 3(3) of the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), which is subject to Title I of ERISA, nor a plan as defined in Section 4975(e)(1) of the Internal Revenue Code of 1986, as amended, each of the foregoing hereinafter referred to collectively as a “Plan”, and the assets of the Obligors do not constitute “plan assets” of one or more such Plans within the meaning of Department of Labor Regulation Section 2510.3-101. Each of the Obligors also represents, warrants and covenants that it will not be reconstituted as a Plan or as an entity whose assets constitute “plan assets.”

4.15 Tax Liability. Obligors have filed all tax returns (or extensions) which are required to be filed and have paid all taxes which have become due pursuant to such returns and all other taxes, assessments, fees and other governmental charges upon Obligors and upon their properties, assets, income and franchises which have become due and payable by Obligors except those wherein the amount, applicability or validity are being contested by Obligors by appropriate proceedings in good faith and in respect of which adequate reserves have been established.

4.16 Governmental Action. No action of, or filing with, any governmental or public body or authority is required to authorize, or is otherwise required in connection with, the execution, delivery and performance by Obligors of this Agreement, the Loan Documents or the Notes (other than recordation of the Security Instruments in the Office of the Recorder or other applicable land records office for the County in which such property is located, and the filing of financing statements with respect to the Collateral in the Office of the Secretary of State in which the Obligors and affiliated party are domiciled, all of which will have been duly recorded or filed on or prior to the Closing Date).

4.17 Hazardous Waste. Neither the Real Property nor any portion thereof nor any other property owned or controlled at any time by any Obligor has been or will be used by Obligors or, to the best of Obligors’ knowledge, any tenant of the Real Property or any portion thereof for the production, release, storage, handling or disposal of hazardous or toxic wastes or materials other than those pesticides, herbicides, fertilizers, fuels and other agricultural and commercial chemicals customarily used in agricultural and commercial operations of the type currently conducted by Obligors or their farm tenants on the Real Property all of which have been and will be used in accordance with all applicable laws and regulations.

4.18 Separate Property. The Real Property is taxed and billed separately from real property not subject to the Security Instruments.

4.19 No Affiliation. No director, officer, partner, manager, stockholder or member of any Obligor is an officer or director of Lender or is a relative of an officer or director of Lender within the following categories: a son, daughter or descendant of either; a stepson, stepdaughter, stepfather, stepmother; father, mother or ancestor of either, or a spouse. It is expressly understood that for the purpose of determining any of the foregoing relationships, a legally adopted child of a person is considered a child of such person by blood.

17

Loan Agreement

Gladstone 2020 Facility

Loan Nos. 196915, 198677 & 200539

105131550 0053564-00437

4.20 No Foreign Person. Neither any Obligor nor any member or partner of Obligor is, and no legal or beneficial interest in a shareholder of any Obligor is or will be held, directly or indirectly, by, a “foreign person” under the International Foreign Investment Survey Act of 1976, the Agricultural Foreign Investment Disclosure Act of 1978, the Foreign Investments in Real Property Tax Act of 1980, the amendments of such Acts or regulations promulgated pursuant to such Acts. Obligors, and all persons holding directly or indirectly any beneficial interest in Obligors, have complied with all filing and reporting requirements of such Acts. Neither any Obligor, nor any actual or beneficial owner of any Obligor, nor any intended recipient of the loan appears on the Specially Designated Nationals and Blocked Persons List (the “SDN List”) as published by the Department of the Treasury of the United States, Office of Foreign Assets Control.

4.21 Office of Foreign Asset Control. Each Obligor represents and warrants that neither such Obligor nor any of its respective Affiliates is a Prohibited Person and Obligors and all of their respective Affiliates are in full compliance with all applicable orders, rules, regulations and recommendations of The Office of Foreign Assets Control of the U.S. Department of the Treasury. At all times throughout the term of the Loan, Borrower, Guarantor and all of their respective Subsidiaries shall: (i) not be a Prohibited Person (defined below); and (ii) be in full compliance with all applicable orders, rules, regulations and recommendations of The Office of Foreign Assets Control (“OFAC”) of the U.S. Department of the Treasury.

The term “Prohibited Person” shall mean any person or entity:

(a) listed in the Annex to, or otherwise subject to the provisions of, the Executive Order No. 13224 on Terrorist Financing, effective September 24, 2001, and relating to Blocking Property and Prohibiting Transactions With Persons Who Commit, Threaten to Commit, or Support Terrorism (the “Executive Order”);

(b) that is owned or controlled by, or acting for or on behalf of, any person or entity that is listed to the Annex to, or is otherwise subject to the provisions of, the Executive order.

(c) with whom Lender is prohibited from dealing or otherwise engaging in any transaction by any terrorism or money laundering law, including the Executive Order;

(d) who commits, threatens or conspires to commit or supports “terrorism” as defined in the Executive Order;

18

Loan Agreement

Gladstone 2020 Facility

Loan Nos. 196915, 198677 & 200539

105131550 0053564-00437

(e) that is named as a “specially designated national and blocked person” on the most current list published by the U.S. Treasury Department Office of Foreign Assets Control at its official website, www.ustreas.gov/offices/enforcement/ofac, or at any replacement website or other replacement official publication of such list; or

(f) who is an Affiliate of or affiliated with a person or entity listed above.

4.22 Intentionally deleted.

4.23 Affiliate Debt. As of the Closing Date, the only Indebtedness outstanding among Borrower, Guarantor, Property Owners or their respective Subsidiaries is as set forth in Exhibit F attached hereto.

4.24 Limitation on Representations and Warranties. Notwithstanding anything herein to the contrary, none of the representations or warranties in Section 4.21 shall apply to any shareholder of Guarantor holding less than 25% of the total outstanding stock of Guarantor or limited partner of Borrower holding less than 25% of the total outstanding partnership interests in Borrower, and no other representation or warranty in this Section 4 shall apply to any shareholder of Guarantor or limited partner of Borrower.

4.25 Organization. Guarantor, as Manager of Gladstone Land Partners, LLC, a Delaware limited liability company (“General Partner”), the General Partner of Borrower, and Borrower hereby unconditionally warrant and represent to Lender the following as of the date hereof:

(a) Borrower is a limited partnership, duly organized, validly existing and in good standing under the laws of the State of Delaware. All certificates, licenses, permits and other approvals required to be obtained by Borrower in connection with its existence as a limited partnership or in order to engage in the business in which it is presently engaged or in which it contemplates engaging have been duly obtained and, if required, filed, and are in full force and effect and true and complete copies of each have been delivered to Lender. No proceeding or action is pending, planned or threatened for the dissolution, termination or annulment of Borrower. The execution and delivery of each document to be executed by General Partner in connection with the Loan has been duly authorized by all necessary action of the partners of Borrower. The sole general partner of Borrower is General Partner.

(b) General Partner is a limited liability company, duly organized, validly existing and in good standing under the laws of the State of Delaware. No proceeding or action is pending, planned or threatened for the dissolution, termination or annulment of General Partner. The execution and delivery of each document to be executed by General Partner as the general partner of Borrower in connection with the Loan has been duly authorized by all necessary action of the members of General Partner. The sole manager of General Partner is Guarantor.

19

Loan Agreement

Gladstone 2020 Facility

Loan Nos. 196915, 198677 & 200539

105131550 0053564-00437

(c) Guarantor is a corporation, duly organized, validly existing and in good standing under the laws of the State of Maryland. No proceeding or action is pending, planned or threatened for the dissolution, termination or annulment of Guarantor. The execution and delivery of each document to be executed by Guarantor as the manager of General Partner in connection with the Loan has been duly authorized by all necessary action of the directors of Guarantor.

(d) A true and complete copy of Borrower’s Agreement of Limited Partnership dated December 31, 2003 (the “LP Agreement”) and any and all amendments thereto (such LP Agreement and amendments thereto are herein together called the “Partnership Documents”) have been furnished to Lender. The Partnership Documents are duly and validly executed and delivered and are in full force and effect and binding upon and enforceable against Borrower in accordance with their respective terms.

(e) A true and complete copy of General Partner’s Operating Agreement dated December 31, 2003 (the “LLC Agreement”) and any and all amendments thereto (such LLC Agreement and amendments thereto are herein together called the “LLC Documents”) have been furnished to Lender. The LLC Documents are duly and validly executed and delivered and are in full force and effect and binding upon and enforceable against General Partner in accordance with their respective terms.

(f) A true and complete copy of Guarantor’s Articles of Incorporation and Bylaws (the “Articles and Bylaws”) and any and all amendments thereto (such Articles and Bylaws and amendments thereto are herein together called the “Corporate Documents”) have been furnished to Lender. The Corporate Documents are duly and validly executed and delivered and are in full force and effect and binding upon and enforceable against Guarantor in accordance with their respective terms.

(g) All information, reports, papers and data given to Lender by or on behalf of Borrower, General Partner or Guarantor with respect to the Loan are accurate, complete and correct in all material respects and do not omit any fact necessary to prevent the facts contained therein from being materially misleading. Guarantor acknowledges that Lender is relying upon the truth and accuracy of the statements set forth herein in electing to make the Loan to Borrower.

4.26 Business of Borrower; Fee Title to Real Property. The sole business of the Borrower and its affiliates on the Real Property is the direct or indirect ownership and management of the Real Property and the Improvements together with certain other properties of like kind and nature. As of the date hereof, Borrower or a wholly owned subsidiary of Borrower

20

Loan Agreement

Gladstone 2020 Facility

Loan Nos. 196915, 198677 & 200539

105131550 0053564-00437

is well seized of an indefeasible estate in fee simple in the Real Property and the Improvements as to their related parcels, subject only to those matters set forth in the mortgagee policy or policies of title insurance to be approved by Lender and issued by Chicago Title Insurance Company or those matters disclosed or permitted under the Loan Documents.

4.27 Insolvency. No Obligor is insolvent or bankrupt, or will become insolvent or bankrupt as a result of the making of the Loan or any of the various transactions entered into in connection herewith, and there has been (i) no assignment made for the benefit of the creditors of any of them, (ii) no appointment of a receiver of any of them or for the properties of any of them, or (iii) any bankruptcy, reorganization, or liquidation proceeding instituted by or against any of them.

4.28 Condition of Real Property. There has been no damage or destruction to any part of the Real Property, Improvements or personal property thereon by fire or other casualty that has not heretofore been repaired. There are presently no existing defects on the Improvements or such personal property and no repairs or alterations thereof or modifications thereto are reasonably necessary or appropriate except for normal and routine maintenance. The Improvements and all of such personal property are in good condition and working order (subject to reasonable wear and tear and normal and routine maintenance requirements) and the Real Property and Improvements and the present use thereof comply, in all material respects, with all (a) applicable legal and, where any Obligor or an Affiliate is a party to a contract, contractual requirements (including, without limitation, any leases) with regard to the use, occupancy and construction thereof, including, without limitation, any zoning, subdivision, environmental, air quality, flood hazard, fire safety, planning, handicapped facilities, building and other governmental laws, ordinances, codes, regulations, orders and requirements of any governmental agency, (b) building, occupancy and other permits, licenses and other approvals, and (c) declarations, conditions, easements, rights-of-way, covenants and restrictions of record. To Borrower’s actual knowledge, there are no violations or alleged or asserted violations of law, municipal ordinances, public or private contracts, declarations, covenants, conditions, or restrictions of record, or other requirements with respect to the Real Property or Improvements, or any part thereof. The zoning of the Real Property and the right and ability to use or operate the Improvements are not in any way dependent upon or related to any real estate other than the Real Property except as may be reflected in items set for in Schedule B Part II of the title insurance policies issued or to be issues to Lender in connection with the Security Instruments.

21

Loan Agreement

Gladstone 2020 Facility

Loan Nos. 196915, 198677 & 200539

105131550 0053564-00437

4.29 Intentionally Deleted.

4.30 Utilities. All utility and water delivery services necessary for the operation of the Real Property for its intended purposes are available at the boundaries of the Real Property.

4.31 Real Estate Taxes. There are no delinquent real estate or other taxes or assessments on or against the Real Property, Improvements or Personal Property, or any part thereof. Copies of the current general real estate tax bills with respect to the Real Property and Improvements have been delivered to Lender. Said bills cover the whole of the Real Property and Improvements and do not cover or apply to any other property. The various parcels comprising the Real Property are separately assessed for real estate tax purposes. There are no special assessments against the Real Property or Improvements other than as reflected in the Lender’s mortgage title policy or policies insuring the Security Instruments, and to Borrower’s knowledge there is no pending or contemplated action pursuant to which any special assessment may be levied against the Real Property or Improvements.

4.32 Business Purpose. The Loan is made solely for business purposes and not for personal, family, or household purposes, and the proceeds shall be used solely for the purpose of carrying on the Borrower’s business.

4.33 Authorization. The Loan Documents have been duly and validly authorized, executed, and delivered by each Obligor or such other person or entity, as the case may be, and are in full force and effect and binding upon and enforceable against such Obligor or such other person or entity in accordance with their respective terms. No default exists under the Loan Documents and no act has occurred and no condition exists which, with the giving of notice or passage of time, or both, could constitute a default under the Loan Documents.

4.34 Survival. All representations and warranties contained herein shall survive the disbursement and closing of the Loan without limit.

| SECTION 5. | CONDITIONS PRECEDENT. |

5.1 Conditions Precedent to Closing. Lender’s obligations hereunder shall be subject to the conditions precedent that Lender has received on or before the Closing Date in form and substance satisfactory to Lender’s counsel, such assurances and evidence as Lender may require of the performance by Obligors of all its agreements to be performed hereunder, to the accuracy of its representations and warranties herein contained, and to the satisfaction, prior to the Closing Date or concurrently therewith, of the following further conditions:

(a) Legality. Lender shall be satisfied that the Notes being issued to it on the Closing Date shall qualify on the Closing Date as a legal investment for life insurance companies under the New York Insurance Law (without resort to any provision of such law, such as Section 1405(a)(8) thereof, permitting limited investments by Lender without restriction as to the character of the particular investment) and such purchase shall not subject Lender to any penalty or other onerous condition under or pursuant to any applicable law or governmental regulation; and Lender shall have received such certificates or other evidence as Lender may reasonably request to establish compliance with this condition.

22

Loan Agreement

Gladstone 2020 Facility

Loan Nos. 196915, 198677 & 200539

105131550 0053564-00437

(b) Proceedings. All proceedings to be taken in connection with the transactions contemplated by this Agreement and the Loan Documents, and all documents incidental thereto, shall be satisfactory in form and substance to Lender; and Lender shall have received copies of all documents which Lender may reasonably request in connection with said transactions and copies of the records of all corporate proceedings in connection therewith in form and substance satisfactory to Lender. Lender shall have received evidence of due formation, existence and authorization of this transaction by Borrower, Guarantor and Property Owners together with evidence of the authority of each signatory hereto.

(c) Representations True; No Default. The representations and warranties of Obligors in this Agreement and in the Loan Documents shall be true on and as of the Closing Date with the same effect as though such representations and warranties had been made on and as of the Closing Date; on the Closing Date no event which is, or with notice or lapse of time or both would be, an Event of Default shall have occurred and be continuing.

(d) Loan Documents. Lender shall have received on the Closing Date fully executed original counterparts of each of the Loan Documents including all necessary consents.

(e) Environmental Audit Results. The results of any environmental audit of the Real Property required by Lender, and any remedial action required to be taken by Borrower as a result of such audit, are complete and satisfactory to Lender.

(f) UCC Search. Current Uniform Commercial Code searches made in the Office of the Delaware Secretary of State on Borrower and the Property Owners, showing no filings relating to the Real Property, Borrower or Property Owners other than those made hereunder and Permitted Encumbrances, and showing no other filing which is objectionable to Lender.

(g) Title Requirements. Lender shall be furnished on the Closing Date with an ALTA loan policy (2006 Lender’s Policy Form) of title insurance with respect to the Security Instruments, issued to Lender by a title insurance company acceptable to Lender in the amount of the Loan insuring such Security Instrument, as of the date of the disbursement of the Loan, to be a first and prior lien upon the Land, containing such endorsements and such co-insurance or re-insurance as Lender may request, and showing title to be subject to no matters other than Permitted Encumbrances and those which may otherwise be approved, in writing, by Lender.

(h) Opinion of Borrower Counsel. Lender shall have received on the Closing Date from third-party legal counsel for Borrower and Guarantor, a favorable opinion as to such matters incident to the transactions contemplated by this Agreement in form and substance acceptable to Lender.

23

Loan Agreement

Gladstone 2020 Facility

Loan Nos. 196915, 198677 & 200539

105131550 0053564-00437

(i) Other Closing Matters. Lender shall have received such other documentation, assurances, certifications, estoppels and other materials confirming the satisfaction of all closing requirements set forth in the applications for the Loan submitted by Borrower and the terms of Lender’s approval of such applications, as well as the satisfaction of all closing conditions set forth in Lender’s instructions to the escrow agent handling the closing of the Loan.

| SECTION 6. | FINANCIAL STATEMENTS; COMPLIANCE CERTIFICATES; ADDITIONAL INFORMATION; AND INSPECTION. |

6.1 Financial Statements and Reports. From and after the date hereof and so long as Lender (or a nominee designated by Lender) shall hold the Notes, Borrower shall deliver to Lender:

(a) as soon as practicable after the end of each fiscal year, and in any event within 120 days after the end of each fiscal year, the annual certified financial statements and related consolidated statements of earnings, equity and cash flows of Borrower and Subsidiaries conducting business in the agricultural industry, and Guarantor as of the end of and for such year, setting forth in each case in comparative form the corresponding figures of the previous fiscal year, all in reasonable detail, prepared in conformity with generally accepted accounting principles applied on a basis consistent with that of previous years (except as otherwise stated therein or in the notes thereto) certified by Borrower, stating that such financial statements present fairly the consolidated financial condition and results of operations and cash flows of Borrower and related entities and Guarantor in accordance with generally accepted accounting principles consistently applied (except for changes with which such accountants concur); with all such financial statements and related reports audited by an independent third party certified public accountant;

(b) immediately upon a responsible manager, partner or officer of any Borrower becoming aware of the existence of a condition, event or act which constitutes an Event of Default or an event of default under any other evidence of Indebtedness of any Borrower including, without limitation, an event which, with notice or lapse of time or both, would constitute such an Event of Default or event of default, a written notice specifying the nature and period of existence thereof and what action such Borrower, as the case may be, is taking or proposes to take with respect thereto; and

(c) such other information as to the business and properties of Borrower, including consolidating financial statements of Borrower, Property Owners and Guarantor, and financial statements and other reports filed with any governmental department, bureau, commission or agency, as Lender may from time to time reasonably request.

24

Loan Agreement

Gladstone 2020 Facility

Loan Nos. 196915, 198677 & 200539

105131550 0053564-00437

6.2 Inspection. From and after the date hereof and so long as Lender (or a nominee designated by Lender) shall hold the Notes, upon reasonable prior notice to Borrower, Lender shall have the right (i) to visit and inspect, at Lender’s expense, any of the properties, all at such reasonable times and as often as Lender may reasonably request, of Property Owners or Borrower (including any property not owned by Borrower but upon which any security for the Loan may be located), to examine its books of account and to discuss the affairs, finances and accounts of Obligors with its and their members, officers and managers and independent public accountants, and (ii) to contact such third parties doing business with Borrower, and to engage in other auditing procedures as Lender deem reasonable to ensure the validity of Lender’s security interests or the accuracy of Obligors’ representations, warranties and certifications. In connection with such inspections, Lender and Lender’s engineers, contractors and other representatives shall have the right to perform such environmental audits and other environmental examinations of the Real Property as Lender deems necessary or advisable from time to time after reasonable prior notice to Borrower.

6.3 Water Adequacy. Within thirty (30) days of Lender’s request (but not more than once a year unless an Event of Default exists), Borrower shall deliver to Lender such information as may be requested by Lender to demonstrate the sources and amount of water supply available to each parcel of the Land during the coming crop year, including the number of irrigated acres, the confirmed supply available and the per acre foot cost of such supply.

| SECTION 7. | AFFIRMATIVE COVENANTS. |

Borrower covenants and agrees that so long as any of the Notes shall be outstanding:

7.1 To Pay Indebtedness. Borrower will punctually pay or cause to be paid the principal and interest (and prepayment premium, if any) to become due in respect of the Notes according to the terms thereof and hereof (inclusive of any other permitted payments of which Borrower has notified Lender).

7.2 Maintenance of Borrower Office. Borrower will maintain an office at 1521 Westbranch Drive, Suite 100, McLean, Virginia 22102 (or such other place in the United States of America as Borrower may designate in writing to the holder of the Notes).

7.3 To Keep Books. Obligors will keep proper books of record and account in accordance with generally accepted accounting principles.

7.4 Payment of Taxes; Corporate Existence; Maintenance of Properties. Obligors shall:

(a) pay and discharge promptly all taxes, assessments and governmental charges or levies imposed upon it, its income or profits or its property before the same shall become in default, as well as all lawful claims and liabilities of any kind (including claims and liabilities for labor, materials and supplies) which, if unpaid, might by law become a Lien upon its property, subject to the right to contest certain claims as provided in the Security Instruments;

25

Loan Agreement

Gladstone 2020 Facility

Loan Nos. 196915, 198677 & 200539

105131550 0053564-00437

(b) do all things necessary to preserve and keep in full force and effect its corporate existence, rights (charter and statutory) and franchises (or cure any noncompliance within a reasonable period after learning of the same, not to exceed 30 days); and

(c) maintain and keep all its properties used or useful in the conduct of its business in good condition, repair and working order, reasonable and ordinary wear and tear excepted, and supplied with all necessary equipment and make all necessary repairs, renewals, replacements, betterments and improvements thereof, all as may be necessary so that the business carried on in connection therewith may be conducted at all times in a reasonable and lawful manner.

7.5 To Insure. Obligors shall (in addition to the insurance required to be maintained pursuant to the Security Instruments):

(a) keep all of its insurable properties owned by it insured against all risks usually insured against by persons operating like properties in the same geographical areas where the properties are located, all in amounts sufficient to prevent Obligor from becoming a coinsurer within the terms of the policies in question, but in any event as to any improvements located thereon in amounts not less than eighty percent (80%) of the then full replacement value thereof;

(b) maintain public liability insurance against claims for personal injury, death or property damage suffered by others upon or in or about any premises occupied by it or occurring as a result of its maintenance or operation of any airplanes, automobiles, trucks or other vehicles or other facilities (including, but not limited to, any machinery used therein or thereon) or as the result of the use of products sold by it or services rendered by it;

(c) maintain such other types of insurance with respect to its business as is usually carried by persons of comparable size engaged in the same or similar business and similarly situated; and

(d) maintain all such worker’s compensation or similar insurance as may be required under the laws of any State or jurisdiction in which it may be engaged in business.

All insurance for which provision has been made in Section 7.5 shall be maintained in at least such amounts as such insurance is usually carried by persons of comparable size engaged in the same or a similar business and similarly situated; and all insurance herein provided for shall be effected under a valid and enforceable policy or policies issued by insurers of recognized responsibility, except that Obligor may effect worker’s compensation or other similar insurance in respect of operations in any State or other jurisdiction either through an insurance fund operated by such State or other jurisdiction or by causing to be maintained a system or systems of self-insurance which are in accord with applicable laws.

26

Loan Agreement

Gladstone 2020 Facility

Loan Nos. 196915, 198677 & 200539

105131550 0053564-00437

7.6 Continued Operations. Property Owners or their tenants, as applicable, shall continue, in at least substantially the same manner and degree as present (subject to customary crop rotations and changes in customary practice in the geographic area of the applicable Property), and subject to the addition of Future Properties, their agricultural operations on the Property. Obligors acknowledge that such continued operations constitute a significant inducement to Lender to make the Loan.

7.7 Notice of Change of Status. Borrower agrees that it shall promptly notify Lender of the following:

(a) if any assets of any Obligor are surrendered in satisfaction of a debt or obligation pursuant to the enforcement thereof;

(b) if any Obligor is dissolved or any trust comprising Obligor is revoked or amended;

(c) if the lease for any land currently leased by any Obligor expires or is terminated; or

(d) upon the commencement of any litigation, including any arbitration or mediation, and of any proceedings before any governmental agency which could materially and adversely affect the Real Property, Borrower, Guarantor or Lender.

| SECTION 8. | SUBSTANTIAL BENEFITS; CONSEQUENCES OF LOAN STRUCTURE. |

8.1 Borrower and Guarantor understand and agree that:

(a) unless and to the extent otherwise released by Lender in writing, the Collateral pledged by the Property Owners will secure the entire amount of the Loan under the Notes and the other Loan Documents;

(b) an Event of Default by any or all of the Property Owners under the Security Instruments or any of the Collateral Documents or other loan documents evidencing or securing any portion of the Loan will also constitute an Event of Default under the entire Loan and all other Notes and other Loan Documents executed or delivered to evidence or secure the Loan or any portion thereof;

27

Loan Agreement

Gladstone 2020 Facility

Loan Nos. 196915, 198677 & 200539

105131550 0053564-00437

(c) except as otherwise stated in Section 10, Obligors will not be entitled to the release of Lender’s security interest in any portion of the Collateral until the entire Loan has been paid in full;

(d) a result of the structure of the Loan is that all of the Collateral, regardless of the form by which it is encumbered or the ownership, shall now be security for the repayment of all of the Notes, and shall be available to satisfy the obligations incurred in connection with the entire Loan and each Note; and

(e) a default by any Obligor under any Note or the Loan Documents could result in the judicial or nonjudicial sale of some or all the Collateral for the Loan, and the application of the proceeds from such sale to complete or only partial satisfaction of the joint and several obligations of the Obligors under any of the Notes or Loan Documents.

8.2 Due to the business relationships among the Obligors there is a community of interests among the Obligors such that the benefits of the Loan and each of the Notes evidencing the Loan flowing to one Obligor also benefits the other Obligors. The benefit of the Loan to each of the Obligors constitutes the reasonably equivalent value of the aggregate transfers made and the aggregate obligations incurred by each of the Obligors in connection with the Loan.

8.3 The proceeds of the Loan will be used:

(a) to finance the Collateral; and

(b) to provide working capital and financing or refinancing funds relating to the purchase or refinance of additional Real Property by Borrower or its Subsidiaries.

8.4 After diligent inquiry, Borrower has determined:

(a) the interest rate and repayment terms of the Loan are more favorable than those any could have obtained without the pledge of Obligors’ ownership interests in the Real Property as collateral for the Loan and the joint and several liability of the Obligors;