Appendix A-1 Appendix A Insider Trading Policy For Gladstone Capital Corporation Gladstone Commercial Corporation Gladstone Investment Corporation Gladstone Land Corporation Gldastone Alternative Income Fund Gladstone Management Corporation Gladstone Administration LLC Gladstone Securities, LLC and their subsidiaries This Insider Trading Policy (the “Policy”) has been adopted to comply with Rules 17j-l under the Investment Company Act of 1940 (the “Investment Company Act”) and 204A under the Investment Advisers’ Act of 1940 (the “Advisers’ Act”) (the “Rules”). The Policy establishes standards and procedures designed to address conflicts of interest and detect and prevent abuse of fiduciary duty by persons with knowledge of the investments and investment intentions of Gladstone Management Corporation (the “Adviser”), Gladstone Administration LLC (the “Administrator”), Gladstone Securities, LLC, Gladstone Capital Corporation, Gladstone Commercial Corporation, Gladstone Investment Corporation, Gladstone Land Corporation, Gladstone Alternative Income Fund, their subsidiaries, and other funds managed and administered by the Adviser and the Administrator (collectively, the “Funds”). THIS POLICY WAS ORIGINALLY INCORPORATED BY REFERENCE INTO AND MADE A PART OF THE CODE OF ETHICS AND BUSINESS CONDUCT ADOPTED BY THE BOARDS OF DIRECTORS OF THE ADVISER AND THE FUNDS ON OCTOBER 11, 2005 (THE “CODE OF ETHICS”). ANY VIOLATION OF THIS POLICY IS SUBJECT TO SANCTIONS DESCRIBED IN THE CODE OF ETHICS. (a) General Policy (i) It is the policy of the Adviser, the Administrator and the Funds to oppose the unauthorized disclosure of any non-public information acquired in the workplace and the misuse of Material Non-public Information in securities trading. It is also the policy of the Adviser, the Administrator and the Funds to restrict trading of the Fund’s securities in a manner that minimizes the possibility of any unintentional violation of the securities laws. We have adopted several specific restrictions, outlined in this Policy, to effect the Company’s general policy.

Appendix A-2 (ii) This Policy acknowledges the general principles that officers, directors and employees of the Adviser, the Administrator, the Funds or any other company in a Control relationship to the Adviser, the Administrator or the Funds, referred to in this Policy as “Covered Persons,” (A) owe a fiduciary obligation to the Funds, the Administrator and the Adviser; (B) have the duty at all times to protect the interests of stockholders; (C) must conduct all personal securities transactions in such a manner as to avoid any actual or potential conflict of interest or abuse of an individual’s position of trust and responsibility; and (D) should not take inappropriate advantage of their positions in relation to the Funds, the Administrator or the Adviser. In recognition of the relationship between Covered Persons and members of their immediate family sharing a household with the Covered Person and entities whose investment decisions are influenced or controlled by such individuals, this Policy also applies to such persons, who are referred to in this Policy as “Insiders.” (iii) The Rules make it unlawful for Covered Persons to engage in conduct which is deceitful, fraudulent or manipulative, or which involves false or misleading statements, in connection with the purchase or sale of securities by an investment company. Accordingly, under the Rules and this Policy no Covered Person shall use any information concerning the investments or investment intentions of the Funds, or his or her ability to influence such investment intentions, for personal gain or in a manner detrimental to the interests of the Funds. In addition, the Rules and this Policy also contain additional restrictions for Covered Persons who are involved in or have access to information regarding securities recommendations made to the Funds, referred to in this Policy as Access Persons. (iv) Generally speaking, the restrictions in this Policy are time-based, to take account of events we know will occur on a regular basis, such as quarterly earnings releases, and circumstance-based, to address situations where information such as anticipated significant investment transactions, securities offerings, or any other such information that would likely affect the price of the Funds’ securities, is not yet known to the general public. (b) Definitions. For purposes of this Policy, (i) “Access Person” means any officer, employee director or managing director of the Adviser, the Administrator or the Funds, or any other company in a Control relationship to the Adviser, the Administrator or the Funds who is involved in or has access to information regarding securities recommendations made to the Funds. (ii) “Administrative Officer” means the CCO of the Relevant Fund, or, if the CCO of the Relevant Fund is not available, then the General Counsel of the Relevant Fund, or if the CCO and General Counsel of the Relevant Fund are not available, then the Chief Financial Officer of the Relevant Fund. Notwithstanding the foregoing, in the case of the pre-clearance of a Covered Transaction within the meaning of Section (b)(viii)(2) below, “Administrative Officer” means the CCO of the Adviser, or, if the CCO of the Adviser is not available, then the General Counsel of the Adviser, or if the CCO and General Counsel of the Adviser are not available, then the Chief Financial Officer of the Adviser.

Appendix A-3 (iii) “Beneficial Interest” means any interest by which a Covered Person or any member of his or her Immediate Family, can directly or indirectly derive a monetary benefit from the purchase, sale (or other acquisition or disposition) or ownership of a Security, except such interests as Clearing Officers (defined below) shall determine to be too remote for the purpose of this Policy. (A transaction in which a Covered Person acquires or disposes of a Security in which he or she has or thereby acquires a direct or indirect Beneficial Interest is sometimes referred to in this Code of Ethics as a “personal securities” transaction or as a transaction for the person’s “own account”). (iv) “CCO” means Chief Compliance Officer, as duly appointed. (v) “Control” means the power to exercise a controlling influence over the management or policies of a company (unless such power is solely the result of an official position with such company). Any person who owns beneficially, directly or through one or more controlled companies, more than 25% of the voting securities of a company shall be presumed to control such company. For purposes of this Policy, natural persons and portfolio companies of the Funds shall be presumed not to be controlled persons. (vi) “Covered Person” means any officer, director or employee of the Adviser, the Administrator, the Funds or any other company in a Control relationship to the Adviser, the Administrator or the Funds, but does not include portfolio companies of the Funds. (vii) “Covered Security” includes any Fund Securities and all debt obligations, stock and other instruments comprising the investments of the Funds, including any warrant or option to acquire or sell a security and financial futures contracts, but excludes securities issued by the U.S. government or its agencies, bankers’ acceptances, bank certificates of deposit, commercial paper and shares of a mutual Company. References to a “Covered Security” in this Policy shall include any warrant for, option in, or security convertible into that “Covered Security.” (viii) “Covered Transaction” means any of the following transactions: (1) A transaction in which such Covered Person knows or should know at the time of entering into the transaction that: (i) any of the Funds has engaged in a transaction in the same Security within the last 180 days, or is engaging in a transaction or is going to engage in a transaction in the same Security in the next 180 days; or (ii) the Adviser has within the last 180 days considered a transaction in the same Security for any of the Funds or is considering such a transaction in the Security or within the next 180 days is going to consider such a transaction in the Security; (2) a transaction that involves the direct or indirect acquisition of Securities in an initial public offering or Limited Offering of any issuer; or (3) a transaction in any Fund Security.

Appendix A-4 (ix) “Fund Security” means any security issued by any of the Funds. References to a “Fund Security” in this Policy shall include any warrant for, option in, or security convertible into that “Fund Security.” (x) “Immediate Family” includes any children, stepchildren, grandchildren, parents, stepparents, grandparents, spouses, siblings, mothers-in-law, fathers-in-law, sons-in-law, daughters-in-law, brothers-in-law, or sisters-in-law, including adoptive relationships, who live in the same household. (xi) “Independent Officer” means an officer of the Relevant Fund other than the Administrative Officer who is not a party to the transaction or a relative of a party to the transaction. Notwithstanding the foregoing, in the case of the pre-clearance of a Covered Transaction within the meaning of Section (b)(viii)(2) below, “Independent Officer” means an officer of the Adviser other than the Administrative Officer who is not a party to the transaction or a relative of a party to the transaction. (xii) “Insiders” means Covered Persons, their Immediate Family and entities whose investment decisions are influenced or controlled by such individuals. (xiii) “Limited Offering” means an offering that is exempt from registration under Sections 4(2) or 4(6) of, or Regulation D under, the Securities Act of 1933. Limited Offerings may include, among other things, limited partnership or limited liability company interests, or other Securities purchased through private placements. (xiv) “Loan Officer” means an Access Person who is responsible for making decisions as to Securities to be bought or sold for the Funds’ portfolio. (xv) “Non-Access Person” means any employee of the Adviser, the Administrator, the Funds, or any other company in a Control relationship to the Adviser or the Funds, which employee is not an “Access Person.” (xvi) “Relevant Fund” means the Fund to which the relevant Covered Securities relate. (xvii) A “Security held or to be acquired” by the Funds means any Security which, within the most recent 180 days is or has been held by the Funds or is being or has been considered for purchase by the Funds. (xviii) A Security is “being considered for purchase or sale” from the time an amendment letter is signed by or on behalf of the Funds until the closing with respect to that Security is completed or aborted. (xix) “Security” means any note, stock, treasury stock, security future, bond, debenture, evidence of indebtedness, certificate of interest or participation in any profit-sharing agreement, collateral-trust certificate, preorganization certificate or subscription, transferable share, investment contract, voting-trust certificate, certificate of deposit for a security, fractional

Appendix A-5 undivided interest in oil, gas, or other mineral rights, any put, call, straddle, option, or privilege on any security (including a certificate of deposit) or on any group or index of securities (including any interest therein or based on the value thereof), or any put, call, straddle, option, or privilege entered into on a national securities exchange relating to foreign currency, or, in general, any interest or instrument commonly known as a “security”, or any certificate of interest or participation in, temporary or interim certificate for, receipt for, guarantee of, or warrant or right to subscribe to or purchase, any of the foregoing. (xx) “Trading Day” means a day on which the Nasdaq Global Market is open for trading. A Trading Day begins at the time trading begins on such day following the date of public disclosure of the financial results for that quarter. (c) Material Non-public Information. Material Non-public Information means any information that a reasonable investor would likely consider important in a decision to buy, hold or sell Covered Securities that has not already been disclosed generally to the public. Either positive or negative information may be material. (i) Materiality. While it may be difficult to determine whether particular information is material, there are various categories of information that are particularly sensitive and, as a general rule, should always be considered material. Examples of such information include, but are not limited to: (1) a Fund’s financial results, (2) known but unannounced large deviations in planned future earnings or losses, (3) execution or termination of significant investment transactions, (4) news of a pending or proposed merger or other acquisition, (5) changes in a Fund’s dividend rate or dividend policy, (6) news of the disposition, construction or acquisition of significant assets, (7) impending bankruptcy or financial liquidity problems, (8) significant developments involving corporate relationships, (9) new equity or debt offerings, (10) security buyback programs, (11) positive or negative developments in significant outstanding litigation, (12) significant litigation exposure due to actual or threatened litigation, (13) significant changes to existing debt facilities and (14) major changes in senior management. (ii) Non-public. Information about the Adviser, the Administrator and the Funds that is not yet in general circulation should be considered non-public. It is important to note that information is not necessarily public merely because it has been discussed in the press, which will sometimes report rumors. All information that a Covered Person learns about the Adviser, the Administrator or the Funds or their business plans in connection with his or her employment is non-public information unless you can point to its official release by the Adviser, the Administrator or the Funds in a press release, a filing with the Securities and Exchange Commission (the “SEC”) or a publicly available webcast or similar broadcast sponsored by the Adviser, the Administrator or the Funds. If you are considering engaging in a Covered Transaction and have any question as to whether information of which you are aware has been made public, contact the CCO of the Relevant Fund. (d) Specific Requirements for Trading in Fund Securities (i) Trading Window. Except as permitted in Section (e)(iii) of this Policy, Insiders may only conduct transactions involving the purchase or sale of a Fund Security during

Appendix A-6 the period commencing at the open of the market on the third Trading Day following the date of the Relevant Fund’s filing of its Form 10-Q or 10-K for the most recently completed fiscal period and continuing until the close of the market on the fifteenth (15th) calendar day prior to the last day of the fiscal quarter (the “Trading Window”), after which time the Trading Window will be closed until it re-opens on the third Trading Day following the date of filing of the Form 10-Q or 10-K for the subsequent period. Notwithstanding anything in this Policy to the contrary, in certain special circumstances involving a high level of market volatility, Insiders may conduct transactions involving the purchase or sale of a Fund Security outside the Trading Window, but not later than the last day of the fiscal quarter, provided that each such trade complies with the pre-clearance procedures outlined in Section (e)(i) of this Policy and is also approved in advance by the Relevant Fund’s Chief Executive Officer or President who is not placing the particular trade. In the event that the Insider and the Relevant Fund’s Chief Executive Officer and President are the same person, he or she must receive the approval of the Chief Operating Officer. In special circumstances, when insiders may have Material Non-public information, the CCO, General Counsel or the Chief Financial Officer of the Relevant Fund may, upon the concurrence of any two of such persons, close or open Trading Window or prevent a scheduled Trading Window from opening as originally scheduled. Upon determination that any such information no longer constitutes Material Non-public Information, the CCO, General Counsel or Chief Financial Officer of the Relevant Fund may, upon the concurrence of any two of such persons, re-open a Trading Window. (ii) Reserved. (iii) No Safe Harbor for Possession of Material Non-Public Information. Regardless of whether the Trading Window is open, the Funds and Insiders may not trade in Fund Securities while in possession of any Material Non-public Information (with the exception of trades pursuant to Rule 10b5-1 Trading Plans established in accordance with this Policy). Trading in Fund Securities during the Trading Window should not be considered a “safe harbor” from liability, and all Insiders should use good judgment at all times. (iv) Limit Orders. The prohibition against trading during the closed Trading Windows encompasses the fulfillment of “limit orders” (often referred to as “good until canceled orders”) by any broker with whom any such limit order is placed. Any unfilled limit orders in Fund Securities must be immediately canceled whenever (A) a Trading Window closes, including upon the imposition of a special circumstances closed Trading Window, or (B) the Insider comes into possession of Material Non-public Information. (v) Short Sales and Derivative Securities. No Insiders shall engage in a short sale of any Fund Security. A short sale is a sale of securities not owned by the seller or, if owned, not delivered against such sale within 20 days thereafter. In addition, trading in options to buy or sell Fund Securities (including put or call options), warrants, convertible securities, stock appreciation rights, or other similar rights with an exercise or conversion privilege at a price related to an equity security or with a value derived from the value of an equity security relating to a Fund Security (collectively, “Derivative Securities”), whether or not issued by the Funds, such as

Appendix A-7 exchange-traded options, are prohibited. Short sales and Derivative Security trading are prohibited by this Policy even when the Trading Window is open. (vi) Other Prohibited Activities. In addition, no Covered Person shall, directly or indirectly in connection with the purchase or sale of a “security held or to be acquired” (as defined in Section (b)(xvii) of this Policy) by the Funds: (a) employ any device, scheme or artifice to defraud the Funds; or (b) make to the Funds or the Adviser any untrue statement of a material fact or omit to state to any of the foregoing a material fact necessary in order to make the statements made, in light of the circumstances under which they are made, not misleading; or (c) engage in any act, practice, or course of business which operates or would operate as a fraud or deceit upon the Funds; or (d) engage in any manipulative practice with respect to the Funds. In addition, no Fund shall, directly or indirectly in connection with the purchase or sale of its securities: (a) employ any device, scheme or artifice to defraud; or (b) make any untrue statement of a material fact or omit to state to any of the foregoing a material fact necessary in order to make the statements made, in light of the circumstances under which they are made, not misleading; or (c) engage in any act, practice, or course of business which operates or would operate as a fraud or deceit upon any person. (e) Pre-Clearance of Covered Transactions (i) Pre-Clearance of Transactions in Fund Securities. Except for transactions that are exempted under Section (e)(iii) below, all Covered Persons must obtain pre- clearance for any transactions in Fund Securities using the following procedures: (1) From Whom Obtained. Before any Insider engages in any transaction in Fund Securities, the relevant Covered Person must pre-clear the proposed transaction with the Administrative Officer (the CCO of the Relevant Fund, or, if the CCO of the Relevant Fund is not available, then the General Counsel of the Relevant Fund, or if the CCO and General Counsel of the Relevant Fund are not available, then the Chief Financial Officer of the Relevant Fund). Until the Administrative Officer provides pre-clearance for the proposed transaction, such Insider shall not execute the proposed transaction. The Administrative Officer may consult management and counsel in reviewing and pre-clearing transactions, although the primary responsibility to assess whether a proposed transaction complies with this Policy and applicable law will lie with the Covered Person. (2) Pre-clearance Period. The Covered Person will have until the end of fourteen (14) calendar days following the day pre-clearance is received, or until such earlier time that the Trading Window closes or the Insider comes into possession of Material Non-Public Information, to execute the transaction. If for any reason the transaction is not completed within this period of time, pre-clearance must be re-obtained from the Administrative Officer. Execution of a trade shall include the actual sale or purchase, rather than simply placing of an order to do so. (3) Form. To initiate pre-clearance, you must contact the Administrative Officer in person, by phone, or email. After discussing the proposed trade, pre- clearance can be obtained by (i) completing and signing Schedule B, and obtaining the approval

Appendix A-8 and signature of the Administrative Officer; or (ii) responding affirmatively to an email sent by the Administrative Officer containing all the required information of Schedule B and receiving a reply email from the Administrative Officer indicating such approval. Schedule B may be amended from time to time by the CCO of the Relevant Fund, with the permission of the Chairman of the Ethics Committee of the Relevant Fund. The Administrative Officer is the CCO of the Relevant Fund, or, if the CCO is not available, then the General Counsel of the Relevant Fund, or if the CCO and General Counsel are not available, then the CFO of the Relevant Fund. (4) Filing. A copy of all completed pre-clearance forms, with all required signatures (or, as applicable, email correspondence), shall be retained by the CCO of the Relevant Fund. (5) Insider’s Responsibility. Notwithstanding the foregoing, even if a proposed trade is pre-cleared, the Insider is prohibited from trading any Fund Securities while in possession of Material Non-public Information. (ii) Pre-Clearance of Non-Fund Securities Covered Transactions. With the exception of transactions in Fund Securities (covered in Section (e)(i) above) and transactions that are exempted under Section (e)(iii) below, Insiders proposing to engage in Covered Transactions must obtain pre-clearance of such Covered Transaction using the following procedures: (1) From Whom Obtained. Pre-clearance must be obtained from the Administrative Officer and one Independent Officer. (2) Pre-clearance Period. In the case of a proposed Covered Transaction, if the relevant Covered Person receives pre-clearance, the Insider will have until the end of fourteen (14) calendar days following the day pre-clearance is received to execute the transaction. If for any reason the transaction is not completed within this period of time, pre- clearance must be re-obtained before the transaction can be executed. (3) Form. Pre-clearance must be obtained in writing by completing and signing the “Request for Permission to Engage in a Non-Fund Securities Covered Transaction” form attached hereto as Schedule A, which form shall set forth the details of the proposed transaction, and obtaining the signatures of the Administrative Officer and one Independent Officer. Schedule A may be amended from time to time by the CCO of the Relevant Fund, with the permission of the Chairman of the Ethics Committee of the Relevant Fund. (4) Filing. A copy of all completed pre-clearance forms, with all required signatures, shall be retained by the CCO of the Relevant Fund. (5) Factors to be Considered in Pre-clearance of Non-Fund Securities Covered Transactions. The persons responsible for pre-clearance may refuse to grant pre-clearance of a Covered Transaction in their absolute discretion. Generally, such persons will consider the following factors in determining whether or not to clear a Covered Transaction: (1) whether the Insider is in possession of Material Non-Public Information, (2) whether the amount or nature of the transaction or person making it is likely to affect the price or market for the

Appendix A-9 Security; (3) whether the individual making the proposed purchase or sale is likely to benefit from purchases or sales being made or being considered by the Funds; (4) whether the Security proposed to be purchased or sold is one that would qualify for purchase or sale by the Funds; (5) whether the transaction is non-volitional on the part of the individual, such as receipt of a stock dividend, bequest or inheritance; (6) whether potential harm to the Funds from the transaction is remote; (7) whether the transaction would be likely to affect a highly institutional market; and (8) whether the transaction is related economically to Securities being considered for purchase or sale (as defined in Section (b)(xviii) of this Policy) by the Funds. (iii) Exemptions From Pre-Clearance Requirements The following transactions are exempt from the pre-clearance provisions of this Policy: (1) Not Controlled Securities. Purchases, sales or other acquisitions or dispositions of Securities for an account over which the Insider has no direct influence or Control and does not exercise indirect influence or Control; (2) Involuntary Transactions. Involuntary purchases or sales made by an Insider; (3) DRPs. Purchases which are part of an automatic dividend reinvestment plan; (4) Rights Offerings. Purchases or other acquisitions or dispositions resulting from the exercise of rights acquired from an issuer as part of a pro rata distribution to all holders of a class of Securities of such issuer and the sale of such rights; and (5) Rule 10b5-1 Plans. a. Trades Pursuant to Trading Plan Exempted from Compliance with Trading Windows and Pre-clearance Requirements. A transaction in Fund Securities in accordance with a trading plan adopted in accordance with the SEC’s Rule 10b5-1(c) and this Section (e)(iii)(5) (the “Trading Plan”) shall not be required to be effected during an open Trading Window nor shall it require pre-clearance, even though such transaction takes place during a closed Trading Window or while the Insider was aware of Material Non-public Information. b. Adoption and Approval of Trading Plan. The Trading Plan must be adopted during (i) an open Trading Window and (ii) at a time when such Insider is not in possession of Material Non-public Information. Each Trading Plan must be pre-approved by the Administrative Officer to confirm compliance with this Policy and applicable securities laws, and such approval is subject to the sole discretion of the Administrative Officer. Approval of a Trading Plan shall not be deemed a representation by the Adviser, Administrator or the applicable Fund that such plan complies with Rule 10b5-1, nor an assumption by the Adviser, Administrator or the applicable Fund of any liability or responsibility to the individual or any other party if the plan does not comply with Rule 10b5-1. The initial trades under such Trading Plan

Appendix A-10 shall not be permitted until at least thirty calendar days have passed following the establishment of the Trading Plan. c. Amendment of Trading Plan. An Insider may amend or replace his or her Trading Plan only during periods when trading is permitted in accordance with this Policy, and the relevant Covered Person must submit any proposed amendment or replacement of a Trading Plan to the Administrative Officer for approval prior to adoption. The relevant Covered Person must provide notice to the Administrative Officer prior to an Insider terminating a Trading Plan. d. Form. Pre-clearance of a Trading Plan must be obtained in writing by (i) completing and signing the “Request for Permission to Establish Rule 10b5-1 Trading Plan” form attached hereto as Schedule C, and (ii) obtaining the signature of the Administrative Officer. Schedule C may be amended from time to time by the CCO of the Relevant Fund, with the permission of the Chairman of the Ethics Committee of the Relevant Fund. e. Filing. A copy of all completed pre-clearance forms, with all required signatures, shall be retained by the CCO of the Relevant Fund. (f) Reporting Requirements. (i) Access Persons. (1) Holdings Reports. a. Initial Holdings Report. Within ten (10) days of becoming an Access Person, each Access Person shall make a written report to the CCO of the Relevant Fund of all Securities in which such Access Person holds a direct or indirect Beneficial Interest. Access Persons need not report any such Securities that are exempt under subsection (i)(1)(d) of this Section (f). The initial holdings report shall be made on the form provided for such purpose by the CCO of the Relevant Fund. Each initial holdings report must be current as of a date no more than forty-five (45) days prior to the date that the reporting person became an Access Person. b. Annual Holdings Reports. No later than February 13th of each year, each Access Person shall make a written report to the CCO of the Relevant Fund of all Securities in which such Access Person holds a direct or indirect Beneficial Interest. Access Persons need not report any such Securities that are exempt under subsection (i)(1)(d) of this Section (f). The annual holdings report shall be made on the form provided for such purpose by the CCO of the Relevant Fund. Each annual holdings report must be current as of a date no later than December 31st of the prior year. c. Contents of Holdings Reports. Holdings reports must contain, at a minimum, the following information with respect to each Security: (i) the title and type of each Security for which an Access Person holds a direct or indirect Beneficial Interest; (ii) for publicly traded Securities, the ticker symbol or CUSIP number for each such Security; (iii) the

Appendix A-11 principal amount of each Security; (iv) the name of any broker, dealer or bank with whom you, or any members of your Immediate Family, maintain an account in which any Securities are held for your direct or indirect benefit; and (v) the date of submission of the report. d. Exemptions from Holdings Reports. The following Securities are not required to be included in holdings reports made by Access Persons: i. Securities held in accounts over which an Access Person has no direct or indirect influence or control; ii. Direct obligations of the Government of the United States; iii. Bankers’ acceptances, bank certificates of deposit, commercial paper and high quality short-term debt instruments, including repurchase agreements; and iv. Shares issued by open-end funds. (2) Transaction Reports. a. Quarterly Report. Within thirty (30) days of the end of each calendar quarter, each Access Person must submit a quarterly report to the CCO of the Relevant Fund, on the form provided for such purpose by the CCO of the Relevant Fund, of all transactions during the calendar quarter in any Securities in which such Access Person has any direct or indirect Beneficial Interest. b. Contents of Transaction Reports. Quarterly Transaction Reports must contain, at a minimum, the following information with respect to each transaction in a Security: (i) the title and type of each Security involved; (ii) for publicly traded Securities, the ticker symbol or CUSIP number for each such Security; (iii) the number of shares, interest rate, and maturity date and principal amount, as applicable, of each Security involved; (iv) the price of the Security at which the transaction was effected; (v) the name of any broker, dealer or bank through which the transaction was effected; and (vi) the date of submission of the report. c. Exemptions from Transaction Reports. The following transactions are not required to be included in Quarterly transactions reports of Access Persons: i. Transactions in Securities over which an Access Person has no direct or indirect influence or control; ii. Transactions in Direct obligations of the Government of the United States; iii. Transactions in Bankers’ acceptances, bank certificates of deposit, commercial paper and high

Appendix A-12 quality short-term debt instruments, including repurchase agreements; iv. Transactions in shares issued by open-end funds; and v. Transactions which are part of an automatic dividend reinvestment plan. (ii) Non-Access Persons. (1) Annual Transactions Report. Within 10 days of the end of each calendar year, each Non-Access Person shall make a written report to the CCO of the Relevant Fund of all transactions by which they acquired or disposed of a direct or indirect Beneficial Interest in any Covered Security. (2) Form. Each annual report shall be provided on the form “Annual Securities Transactions Confidential Report of Non-Access Persons” form attached hereto as Schedule D, which form shall set forth the information regarding each transaction requested in the form. Schedule D may be amended from time to time by the CCO of the Relevant Fund, who shall promptly provide any form so amended to all Non-Access Persons. (3) Filing. A copy of all reports submitted pursuant to this Section (f), with all required signatures, shall be retained by the CCO of the Relevant Fund. (iii) Disclaimer. Any report made by an Access Person or Non-Access Person under this Section (e) may contain a statement that the report is not to be construed as an admission that the person making it has or had any direct or indirect Beneficial Interest in any Security or Covered Security to which the report relates. (iv) Responsibility to Report. It is the responsibility of all Covered Persons to take the initiative to provide each report required to be made by them under this Policy. Any effort by the Adviser, the Administrator or the Funds to facilitate the reporting process does not change or alter that responsibility. (g) Confidentiality of Transactions Until disclosed in a public report to stockholders or to the SEC in the normal course, all information concerning Securities being considered for purchase or sale (as defined in Section (b)(xv) of this Policy) by the Funds shall be kept confidential by all Access Persons and disclosed by them only on a “need to know” basis. It shall be the responsibility of the CCO to report any inadequacy found by him or her to the Board of Directors of the Company or any committee appointed by the Board of Directors to deal with such information. (h) Sanctions

Appendix A-13 Any violation of this Policy shall be subject to the imposition of such sanctions by the Funds or the Adviser as may be deemed appropriate under the circumstances to achieve the purposes of the Rules and this Policy, which may include suspension or termination of employment, a letter of censure or restitution of an amount equal to the difference between the price paid or received by the Funds and the more advantageous price paid or received by the offending person. Sanctions for violation of this Policy by a director of the Funds will be determined by a majority vote of the independent directors of the applicable Fund. (i) Administration and Construction (i) Administration. The administration of this Policy shall be the responsibility of the CCO of the Adviser and the Funds. (ii) Duties. The duties of the CCO under this Policy include: (1) continuous maintenance of a current list of the names of all Access and Non-Access Persons, with an appropriate description of their title or employment; (2) providing each Covered Person a copy of this Policy and informing them of their duties and obligations hereunder, and assuring that Covered Persons are familiar with applicable requirements of this Appendix; (3) supervising the implementation of this Policy and its enforcement by the Adviser, the Administrator and the Funds; (4) maintaining or supervising the maintenance of all records and reports required by this Policy; (5) preparing listings of all transactions effected by any Access Person within thirty (30) days of the date on which the same security was held, purchased or sold by any of the Funds; (6) issuing either personally or with the assistance of counsel, as may be appropriate, any interpretation of this Policy which may appear consistent with the objectives of the Rules and this Policy; (7) conducting of such inspections or investigations, including scrutiny of the listings referred to in the preceding subparagraph, as shall reasonably be required to detect and report, with recommendations, any apparent violations of this Policy to the Board of Directors of the Funds or any Committee appointed by them to deal with such information; and (8) submitting a quarterly report to the directors of the Funds containing a description of any (i) violation and the sanction imposed; (ii) transactions which suggest the possibility of a violation of interpretations issued by the CCO of the Relevant Fund; and (iii) any other significant information concerning the appropriateness of this Policy. (j) Required Records. The CCO shall maintain and cause to be maintained in an easily accessible place, the following records: (i) Code of Ethics and Policies. Copies of the Code of Ethics into which this Policy has been incorporated, this Policy, and any other codes of ethics or insider trading policies adopted pursuant to the Rules (“Rule 17 and Rule 204A Codes”) which have been in effect during the past five (5) years; (ii) Violations. A record of any violation of any such Rule 17 and Rule 204A Codes and of any action taken as a result of such violation;

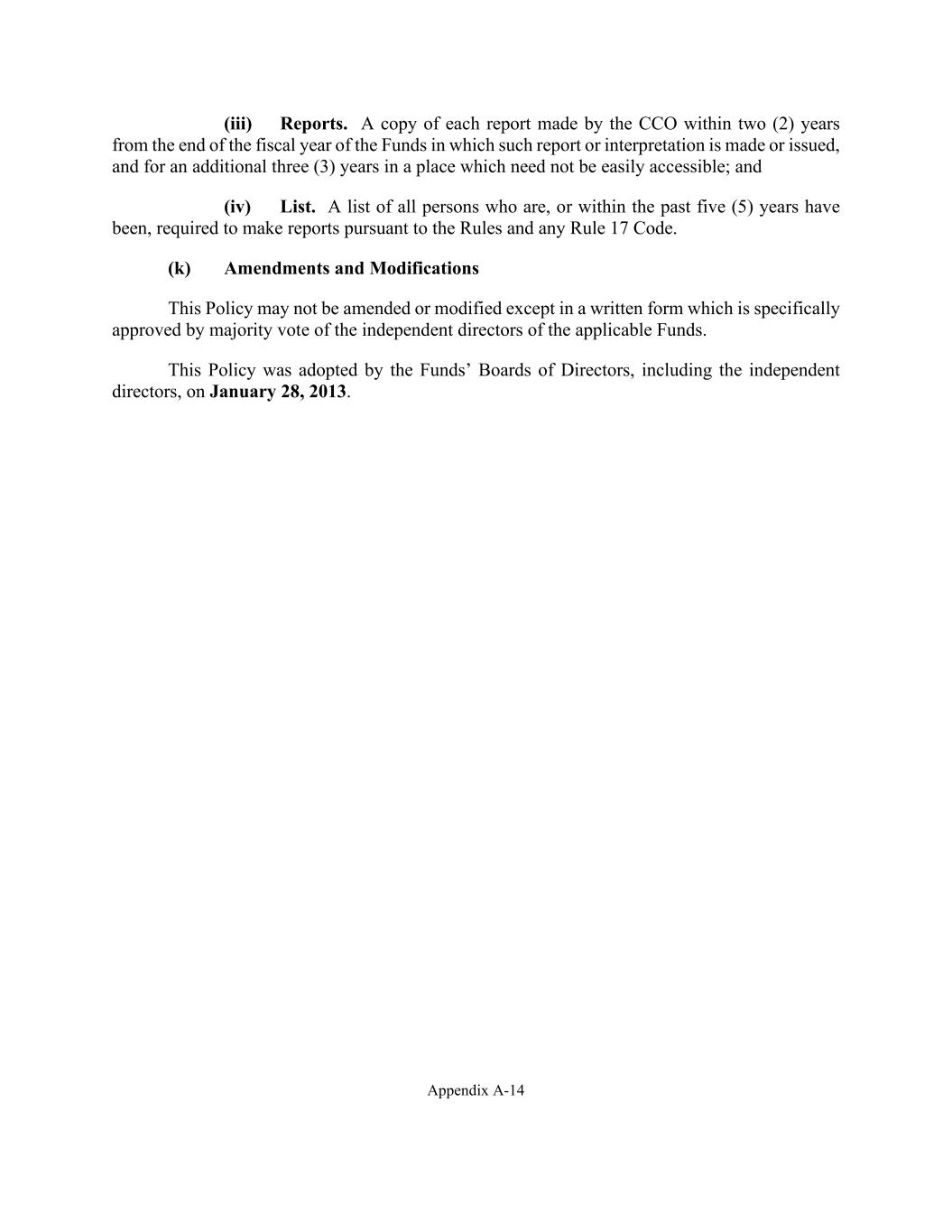

Appendix A-14 (iii) Reports. A copy of each report made by the CCO within two (2) years from the end of the fiscal year of the Funds in which such report or interpretation is made or issued, and for an additional three (3) years in a place which need not be easily accessible; and (iv) List. A list of all persons who are, or within the past five (5) years have been, required to make reports pursuant to the Rules and any Rule 17 Code. (k) Amendments and Modifications This Policy may not be amended or modified except in a written form which is specifically approved by majority vote of the independent directors of the applicable Funds. This Policy was adopted by the Funds’ Boards of Directors, including the independent directors, on January 28, 2013.

Request to Engage in a Non-Fund Securities Covered Transaction Appendix A - 14 Updated March 17, 2020 SCHEDULE A REQUEST FOR PERMISSION TO ENGAGE IN A NON-FUND SECURITIES COVERED TRANSACTION I hereby request permission to effect a transaction in securities as indicated below for my own account or other account in which I have a beneficial interest or legal title. I acknowledge that if I am granted pre-clearance for my Transaction Request, I will have until the end of fourteen (14) calendar days following the day pre-clearance is received to execute the transaction. I also acknowledge that, if for any reason the transaction is not completed within this period of time, pre-clearance must be re-obtained before the transaction can be executed. (Use approximate dates and amounts of proposed transactions.) PURCHASES AND ACQUISITIONS Date IPO or Limited Offering? No. of Shares or Principal Amount Name and Trading Symbol of Security Unit Price Total Price Brokerage Firm SALES AND OTHER DISPOSITIONS Name: Request Date: Signature: Permission Granted Permission Denied Signature: (Administrative Officer) Date: Signature: Date: (Independent Officer or President/CEO)

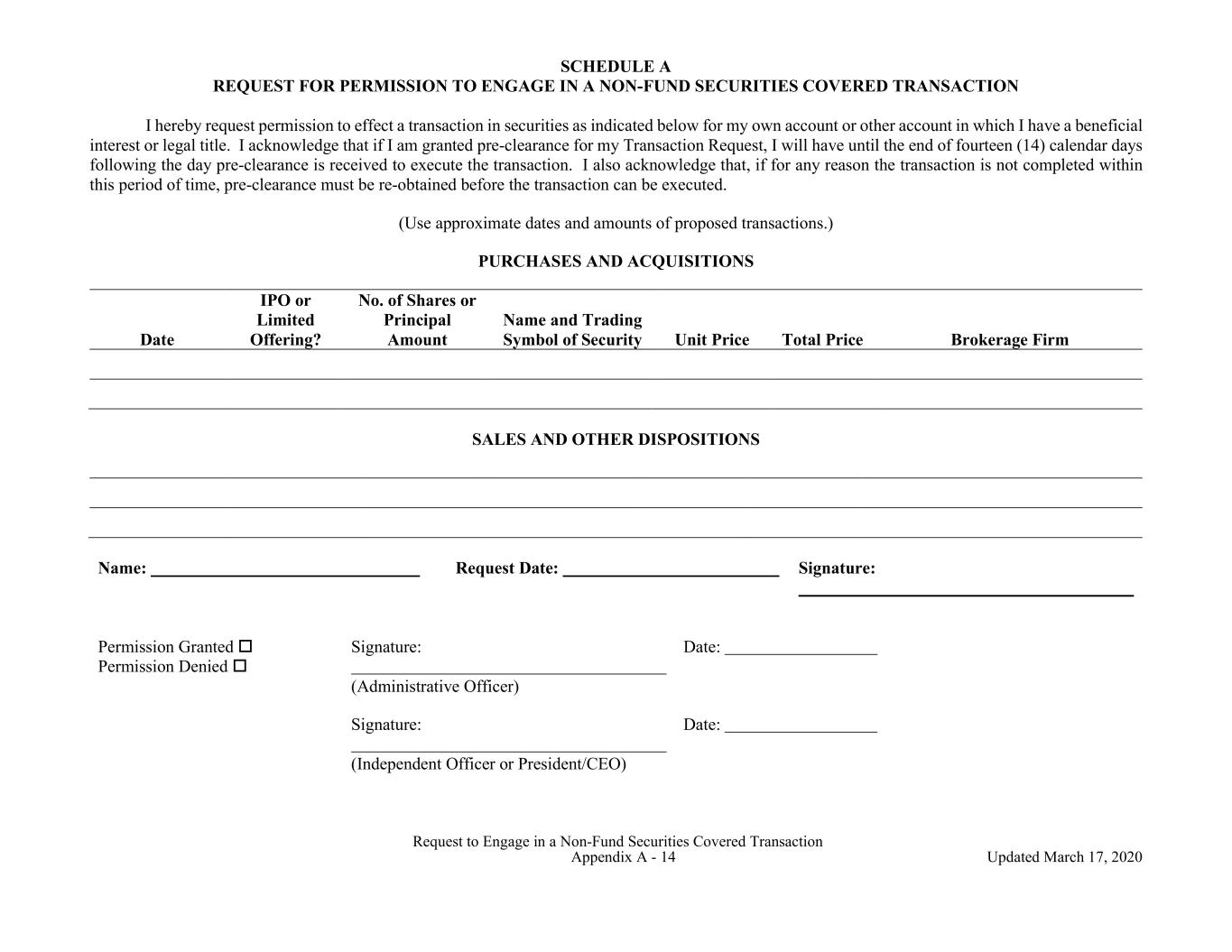

Request for Pre-Clearance and Certification in Connection with a Transaction in Fund Securities Appendix A – 15 SCHEDULE B REQUEST FOR PRE-CLEARANCE AND CERTIFICATION IN CONNECTION WITH A TRANSACTION IN FUND SECURITIES Instructions: To initiate pre-clearance, you must contact the Administrative Officer in person, by phone, or email. After discussing the proposed trade, pre-clearance can be obtained by (1) completing and signing this Schedule B, and obtaining the approval and signature of the Administrative Officer; or (2) responding affirmatively to an email sent by the Administrative Officer containing all the required information of this Schedule B and receiving a reply email from the Administrative Officer indicating such approval. The Administrative Officer is the CCO of the Relevant Fund, or, if the CCO is not available, then the General Counsel of the Relevant Fund, or if the CCO and General Counsel are not available, then the CFO of the Relevant Fund. Capitalized terms used in this Schedule B have the meanings given them in the Insider Trading Policy as adopted by the Boards of Directors of the Funds on January 28, 2013 (the “Policy”). REQUEST FOR PRE-CLEARANCE I hereby request permission to effect a transaction in Fund Securities as indicated below for my own account or other account in which I have a beneficial interest or legal title. Requestor’s name: _________________________________ Transaction type (Buy or Sell):______________ Proposed order date: ___________________ Approximate number of shares (if debt securities, principal dollar amount) of trade: __________ Name and trading symbol of Fund Security: ____________________________________ CERTIFICATION Pursuant to the Policy, and in connection with the above request for pre-clearance (the “Transaction Request”), I, __________________, hereby certify that I am not in possession of any Material Non-public Information, as defined in the Policy. I further certify I have read and understand the Insider Trading Policy as adopted by the Boards of Directors of the Funds and am personally responsible for abiding by all the policies and procedures contained within the Policy and aware of the consequences of failing to do so. Signature: __________________________ Date: ______________________

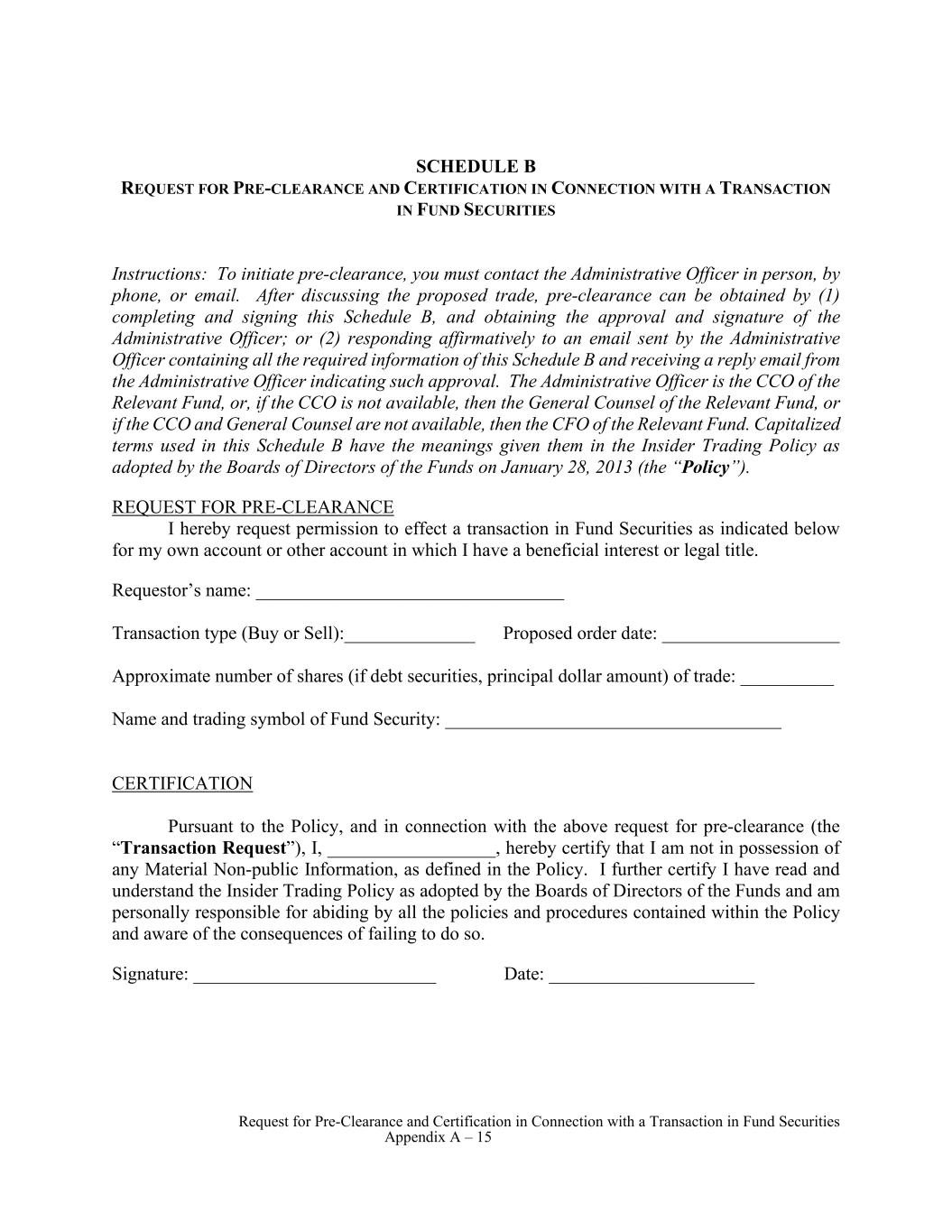

Request for Pre-Clearance and Certification in Connection with a Transaction in Fund Securities PRE-CLEARANCE CONSIDERATIONS AND DECISION 1) Is the Fund involved in a stock offering (overnight, ATM, etc.)? If yes, consider whether requestor is an Affiliated Purchaser under Regulation M and precluded from trading in securities of Fund during offering period. 2) Is the trader currently subject to any lockup agreements resulting from recent stock offerings for this fund? Confirm with legal and compliance. If yes, determine if proposed trade is not allowed during the proposed trade period. Pre-clearance Granted Pre-clearance Denied Administrative Officer Signature: _____________________ Pre-clearance Granted/Denied Date: ___________________

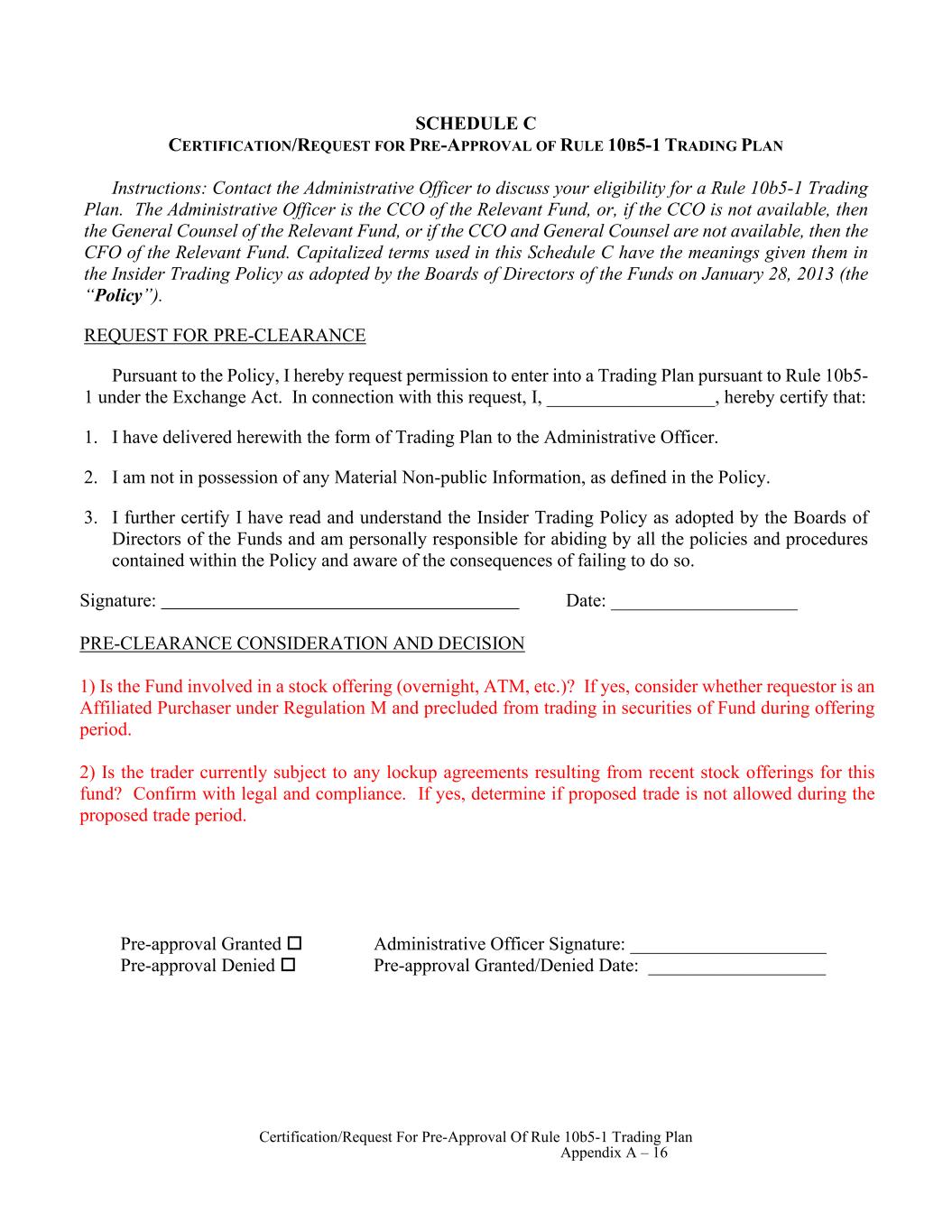

Certification/Request For Pre-Approval Of Rule 10b5-1 Trading Plan Appendix A – 16 SCHEDULE C CERTIFICATION/REQUEST FOR PRE-APPROVAL OF RULE 10B5-1 TRADING PLAN Instructions: Contact the Administrative Officer to discuss your eligibility for a Rule 10b5-1 Trading Plan. The Administrative Officer is the CCO of the Relevant Fund, or, if the CCO is not available, then the General Counsel of the Relevant Fund, or if the CCO and General Counsel are not available, then the CFO of the Relevant Fund. Capitalized terms used in this Schedule C have the meanings given them in the Insider Trading Policy as adopted by the Boards of Directors of the Funds on January 28, 2013 (the “Policy”). REQUEST FOR PRE-CLEARANCE Pursuant to the Policy, I hereby request permission to enter into a Trading Plan pursuant to Rule 10b5- 1 under the Exchange Act. In connection with this request, I, __________________, hereby certify that: 1. I have delivered herewith the form of Trading Plan to the Administrative Officer. 2. I am not in possession of any Material Non-public Information, as defined in the Policy. 3. I further certify I have read and understand the Insider Trading Policy as adopted by the Boards of Directors of the Funds and am personally responsible for abiding by all the policies and procedures contained within the Policy and aware of the consequences of failing to do so. Signature: Date: ____________________ PRE-CLEARANCE CONSIDERATION AND DECISION 1) Is the Fund involved in a stock offering (overnight, ATM, etc.)? If yes, consider whether requestor is an Affiliated Purchaser under Regulation M and precluded from trading in securities of Fund during offering period. 2) Is the trader currently subject to any lockup agreements resulting from recent stock offerings for this fund? Confirm with legal and compliance. If yes, determine if proposed trade is not allowed during the proposed trade period. Pre-approval Granted Pre-approval Denied Administrative Officer Signature: _____________________ Pre-approval Granted/Denied Date: ___________________

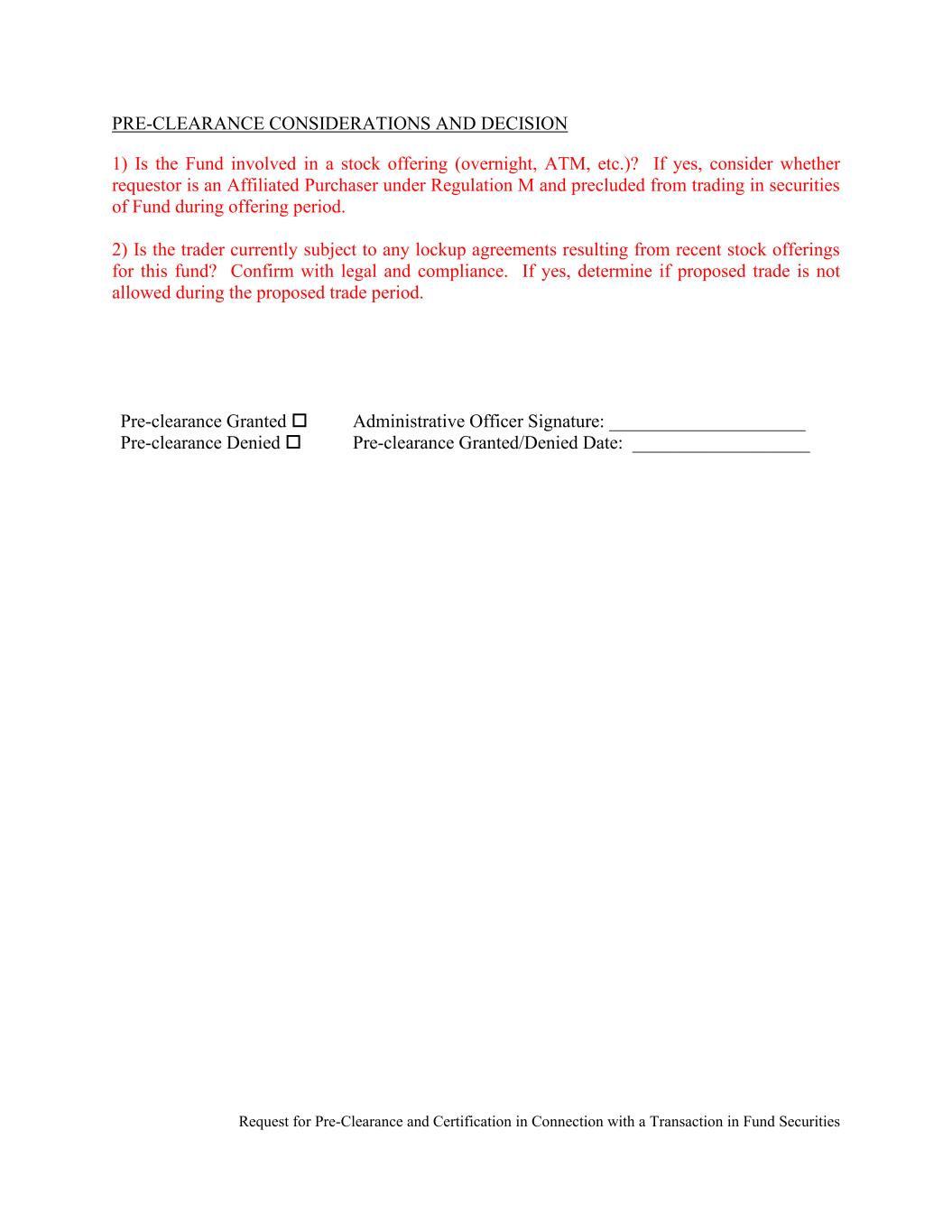

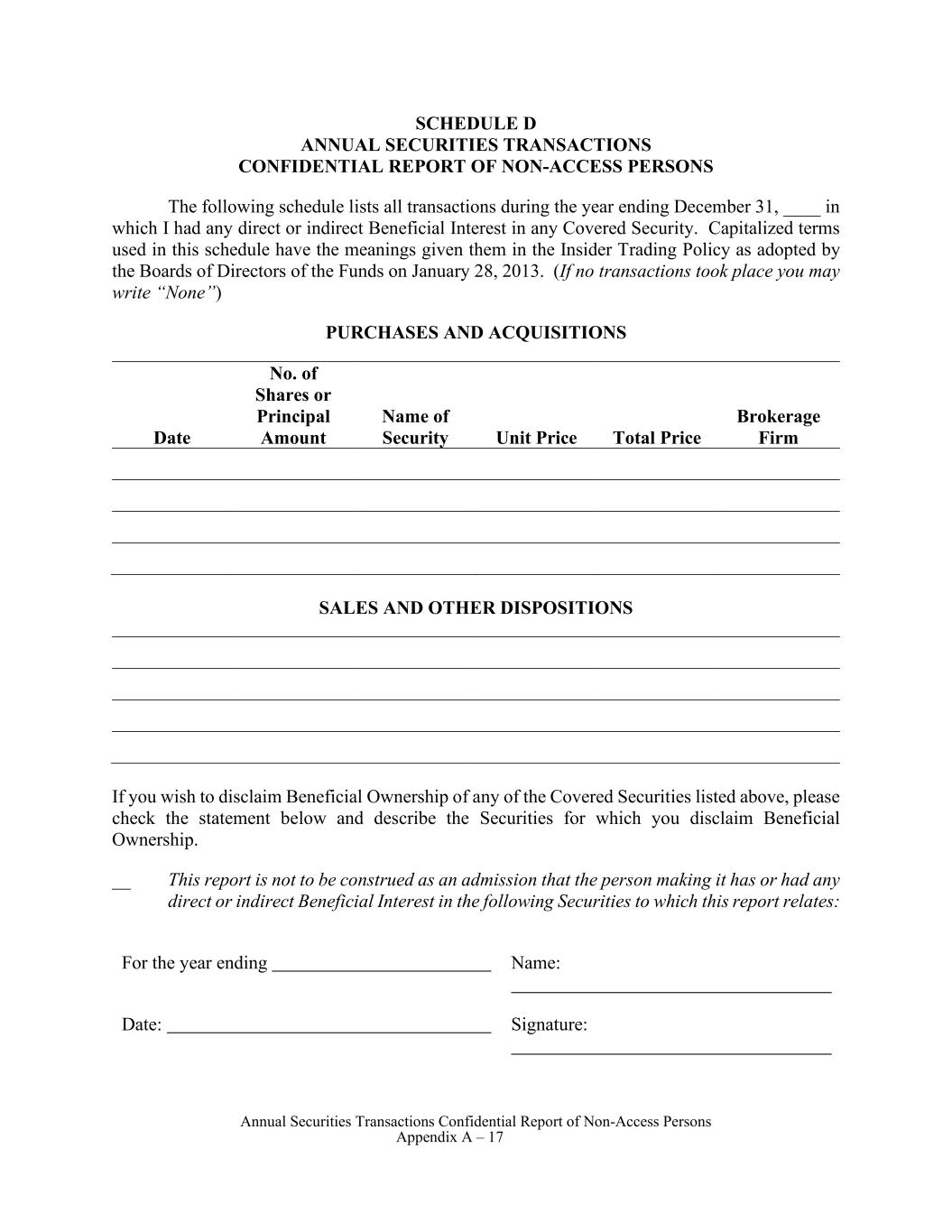

Annual Securities Transactions Confidential Report of Non-Access Persons Appendix A – 17 SCHEDULE D ANNUAL SECURITIES TRANSACTIONS CONFIDENTIAL REPORT OF NON-ACCESS PERSONS The following schedule lists all transactions during the year ending December 31, ____ in which I had any direct or indirect Beneficial Interest in any Covered Security. Capitalized terms used in this schedule have the meanings given them in the Insider Trading Policy as adopted by the Boards of Directors of the Funds on January 28, 2013. (If no transactions took place you may write “None”) PURCHASES AND ACQUISITIONS Date No. of Shares or Principal Amount Name of Security Unit Price Total Price Brokerage Firm SALES AND OTHER DISPOSITIONS If you wish to disclaim Beneficial Ownership of any of the Covered Securities listed above, please check the statement below and describe the Securities for which you disclaim Beneficial Ownership. __ This report is not to be construed as an admission that the person making it has or had any direct or indirect Beneficial Interest in the following Securities to which this report relates: For the year ending Name: Date: Signature:

Annual Securities Transactions Confidential Report of Non-Access Persons Appendix A – 17